The Cook Illinois Qualified Personnel Residence Trust One Term Holder (PTR) is a specialized legal instrument designed to help individuals or families protect and manage their primary residence for estate planning purposes. This trust has gained popularity in Illinois due to its flexibility and potential tax benefits. A Cook Illinois PTR allows the granter (i.e., the person creating the trust) to transfer the ownership of their primary residence to a trust, while still retaining the right to live in the property for a specified term. During this term, which is typically a fixed number of years, the granter can continue to enjoy their home, pay property taxes, and maintain the property. However, the granter must give up ownership rights over the residence during this term. One main advantage of the Cook Illinois PTR is that it provides potential estate tax savings. By transferring the residence to the trust, the value of the property is removed from the granter's taxable estate, potentially resulting in lower estate tax liabilities upon their passing. This can be particularly beneficial for individuals with a high net worth who wish to minimize estate taxes for the benefit of their heirs. There are different types of Cook Illinois Spurs available, depending on specific needs and goals: 1. Granter Retained Income Trust (GRIT): This type of PTR enables the granter to retain the right to receive income from the property during the trust term. The income received can help supplement the granter's expenses during that period. 2. Granter Retained Annuity Trust (GREAT): With a GREAT, the granter retains the right to receive a fixed annuity payment from the trust for the trust term. This annuity is typically a percentage of the original property value. 3. Granter Retained Unit rust (GUT): In contrast to a GREAT, a GUT allows the granter to receive a variable annuity payment based on a fixed percentage of the trust's value, which is revalued annually. This type of PTR can be advantageous in a high-appreciation property scenario. It's important to note that the specific terms, conditions, and tax implications of a Cook Illinois PTR can vary based on individual circumstances. Seeking advice from an experienced estate planning attorney or financial professional is crucial to ensure optimal results and compliance with applicable laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Titular calificado de fideicomiso de residencia personal de un plazo - Qualified Personal Residence Trust One Term Holder

Description

How to fill out Cook Illinois Titular Calificado De Fideicomiso De Residencia Personal De Un Plazo?

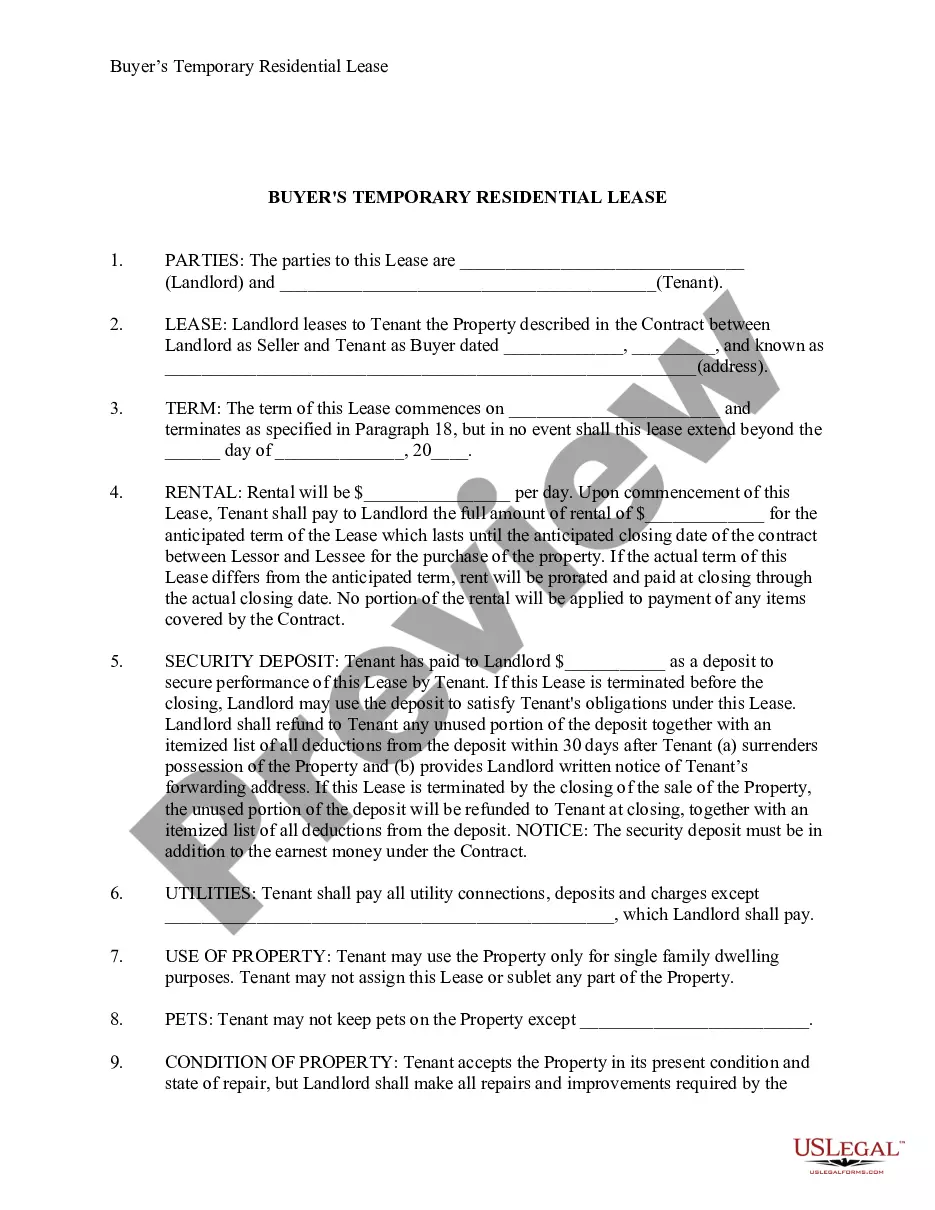

If you need to find a reliable legal form provider to obtain the Cook Qualified Personal Residence Trust One Term Holder, look no further than US Legal Forms. No matter if you need to launch your LLC business or manage your asset distribution, we got you covered. You don't need to be knowledgeable about in law to find and download the needed form.

- You can browse from more than 85,000 forms arranged by state/county and situation.

- The self-explanatory interface, number of supporting materials, and dedicated support team make it easy to locate and complete different documents.

- US Legal Forms is a trusted service providing legal forms to millions of customers since 1997.

You can simply select to search or browse Cook Qualified Personal Residence Trust One Term Holder, either by a keyword or by the state/county the document is created for. After finding the required form, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's easy to start! Simply locate the Cook Qualified Personal Residence Trust One Term Holder template and check the form's preview and description (if available). If you're comfortable with the template’s terminology, go ahead and hit Buy now. Create an account and select a subscription plan. The template will be instantly available for download once the payment is processed. Now you can complete the form.

Handling your law-related matters doesn’t have to be expensive or time-consuming. US Legal Forms is here to demonstrate it. Our extensive collection of legal forms makes this experience less costly and more affordable. Set up your first company, organize your advance care planning, draft a real estate contract, or execute the Cook Qualified Personal Residence Trust One Term Holder - all from the comfort of your home.

Sign up for US Legal Forms now!