Bronx New York Joint Trust with Income Payable to Trustees During Joint Lives is a legal arrangement designed to provide financial security and estate planning benefits to individuals living in the Bronx, New York. This trust is created by two individuals, often spouses, who wish to protect their assets, ensure a steady income stream, and preserve wealth for their beneficiaries. The primary feature of this joint trust is the regular income generated and payable to the trustees (those who create the trust) during their joint lives. This income can be derived from various sources, such as interest, dividends, or rental payments from real estate properties held within the trust. The trustees can enjoy the benefits of this income while they are both alive, promoting financial stability and comfort throughout their lives. Additionally, the Bronx New York Joint Trust provides several advantages, including asset protection from creditors, avoidance of probate, and potential tax benefits. By placing assets into the trust, these assets are shielded from potential claims or judgments made against the individual trustees. Moreover, upon the death of either trust or, the assets held within the trust can pass directly to the beneficiary without going through the lengthy and costly probate process. There may be different types of Bronx New York Joint Trusts with Income Payable to Trustees During Joint Lives, catering to various estate planning needs. Some examples include: 1. Revocable Joint Trust: This type of trust allows the trustees to make changes, amend, or revoke the trust agreement during their joint lives. They have full control over the assets placed in the trust and can modify the terms as needed. 2. Irrevocable Joint Trust: In contrast to the revocable trust, an irrevocable joint trust cannot be altered or revoked once established. It provides enhanced asset protection benefits and may offer potential tax advantages, but it requires careful consideration before creating, as it limits the trustees' control over the assets. 3. Income-Only Joint Trust: This variation of the joint trust focuses solely on generating income during the trustees' joint lives, without addressing the distribution of the principal or assets to beneficiaries. It ensures a steady stream of income while preserving the wealth for future generations. 4. Charitable Joint Trust: This type of trust signifies the intention of the trustees to support charitable causes during their joint lives. It includes provisions for regular charitable donations or distributions, ensuring both financial security and philanthropic contributions. Creating a Bronx New York Joint Trust with Income Payable to Trustees During Joint Lives requires the assistance of an experienced estate planning attorney who can tailor the trust to meet individual needs, consider tax implications, and adhere to New York state laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bronx New York Fideicomiso conjunto con ingresos pagaderos a los fideicomitentes durante la vida conjunta - Joint Trust with Income Payable to Trustors During Joint Lives

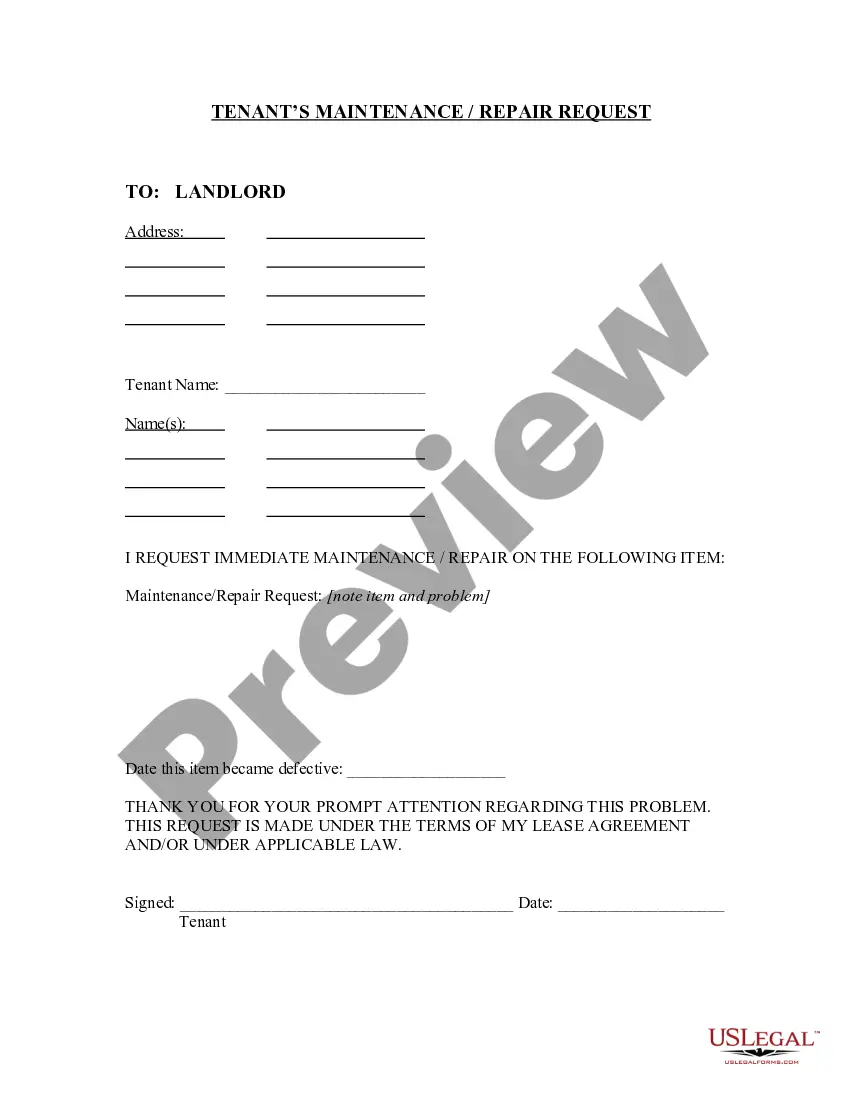

Description

How to fill out Bronx New York Fideicomiso Conjunto Con Ingresos Pagaderos A Los Fideicomitentes Durante La Vida Conjunta?

A document routine always goes along with any legal activity you make. Staring a business, applying or accepting a job offer, transferring ownership, and many other life situations demand you prepare formal paperwork that varies throughout the country. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal templates. Here, you can easily locate and download a document for any personal or business objective utilized in your region, including the Bronx Joint Trust with Income Payable to Trustors During Joint Lives.

Locating templates on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Bronx Joint Trust with Income Payable to Trustors During Joint Lives will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this quick guideline to get the Bronx Joint Trust with Income Payable to Trustors During Joint Lives:

- Make sure you have opened the right page with your localised form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the template corresponds to your needs.

- Search for another document using the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the appropriate subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Bronx Joint Trust with Income Payable to Trustors During Joint Lives on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal paperwork. All the templates available in our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!