A Dallas Texas Joint Trust with Income Payable to Trustees During Joint Lives is a specific type of trust arrangement that is commonly used in estate planning. This trust allows individuals, referred to as trustees, in Dallas Texas to combine their assets into a joint trust, from which they receive income during their joint lives. This arrangement provides various benefits, including ensuring financial security for the trustees and potentially reducing tax liabilities. The main purpose of a Dallas Texas Joint Trust with Income Payable to Trustees During Joint Lives is to allow trustees to pool their assets and establish a source of income that they can rely on during their lifetimes. This income can be derived from various sources, such as rental properties, investments, or business ventures, depending on the assets held within the trust. By creating this type of trust in Dallas Texas, the trustees ensure that they have a steady stream of income throughout their joint lives. This can be particularly advantageous for retired individuals or couples who no longer generates active income through work. The income generated from the trust can be used to cover living expenses, medical costs, travel, or any other financial obligations. Furthermore, a Dallas Texas Joint Trust with Income Payable to Trustees During Joint Lives offers potential tax advantages. By structuring the trust properly, trustees may be able to minimize estate taxes and potentially reduce the overall tax burden on the trust assets. Consultation with a professional estate planning attorney in Dallas Texas is essential to ensure the trust is set up correctly to maximize these benefits. It's worth noting that there isn't a specific name for different types of Dallas Texas Joint Trusts with Income Payable to Trustees During Joint Lives, as this trust arrangement is often tailored to the unique circumstances and goals of the trustees. The terms and specific provisions of the trust, including the distribution of income and assets, are typically customized to meet the trustees' specific needs. In summary, a Dallas Texas Joint Trust with Income Payable to Trustees During Joint Lives is an estate planning tool that allows trustees in Dallas Texas to create a joint trust and receive income from the trust assets during their lifetimes. This arrangement offers financial security and potential tax advantages. If properly structured and customized, it can be an effective method for managing and distributing assets while ensuring the trustees' financial well-being.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Fideicomiso conjunto con ingresos pagaderos a los fideicomitentes durante la vida conjunta - Joint Trust with Income Payable to Trustors During Joint Lives

Description

How to fill out Dallas Texas Fideicomiso Conjunto Con Ingresos Pagaderos A Los Fideicomitentes Durante La Vida Conjunta?

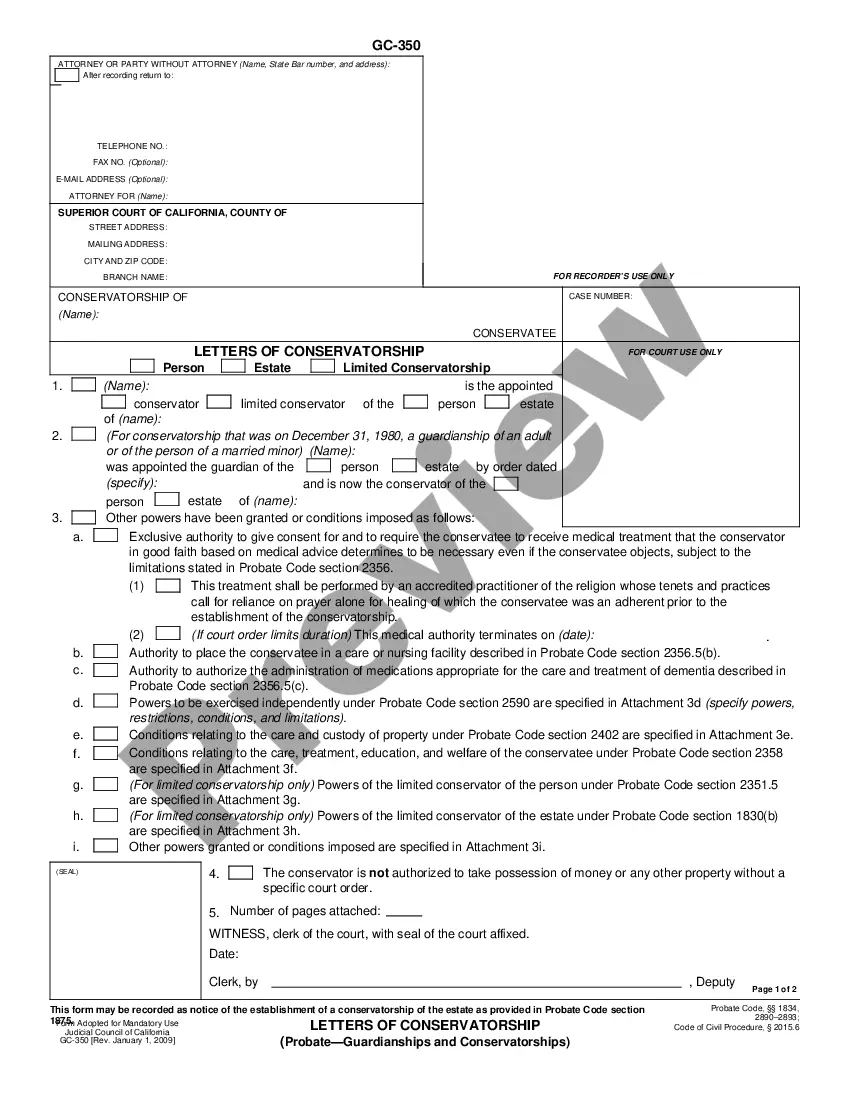

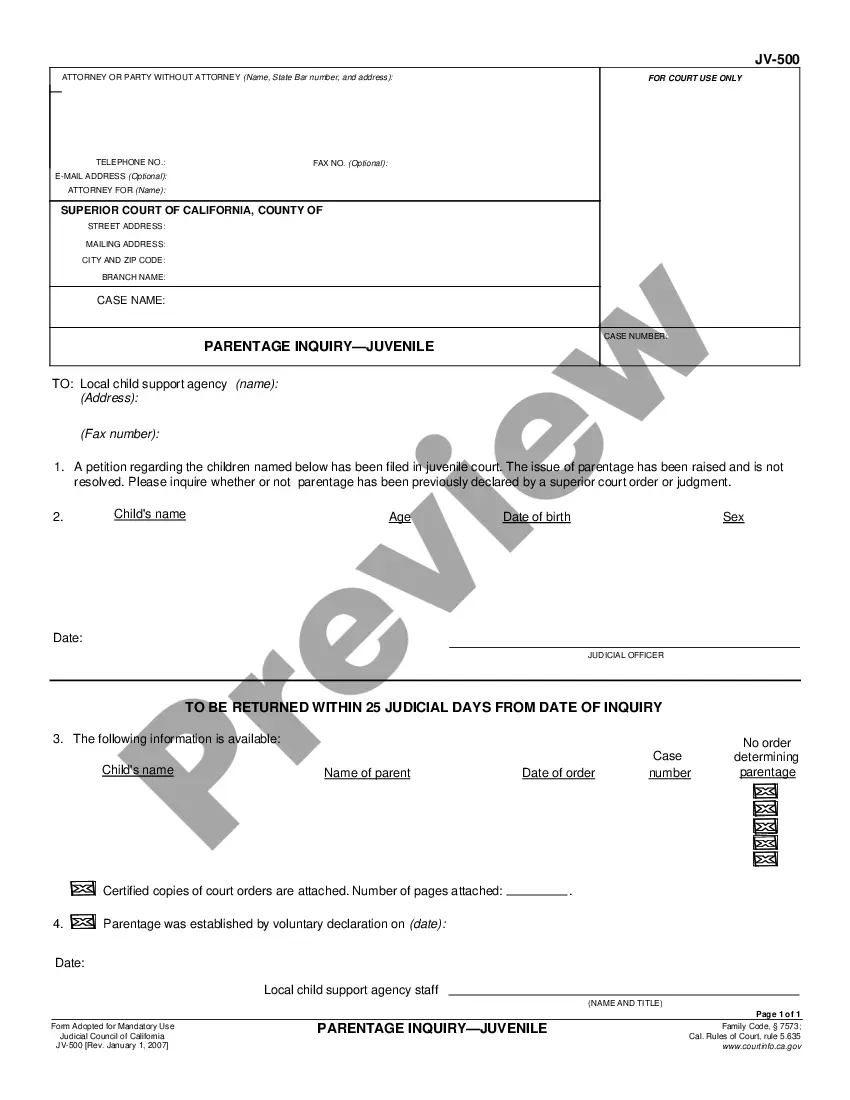

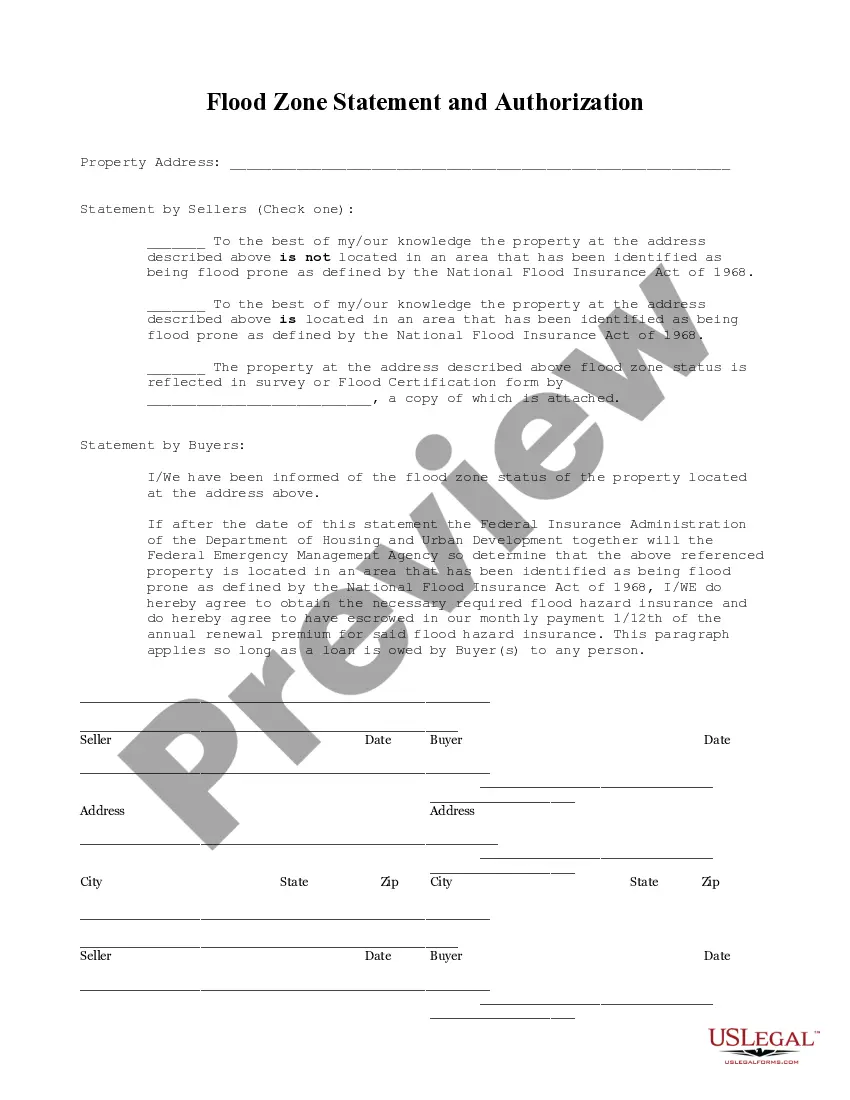

Preparing legal documentation can be difficult. In addition, if you decide to ask a legal professional to draft a commercial agreement, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Dallas Joint Trust with Income Payable to Trustors During Joint Lives, it may cost you a fortune. So what is the best way to save time and money and draw up legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is the most extensive online collection of state-specific legal documents, providing users with the up-to-date and professionally verified forms for any use case collected all in one place. Therefore, if you need the current version of the Dallas Joint Trust with Income Payable to Trustors During Joint Lives, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Dallas Joint Trust with Income Payable to Trustors During Joint Lives:

- Glance through the page and verify there is a sample for your area.

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - look for the correct one in the header.

- Click Buy Now once you find the needed sample and choose the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a transaction with a credit card or via PayPal.

- Choose the file format for your Dallas Joint Trust with Income Payable to Trustors During Joint Lives and save it.

Once done, you can print it out and complete it on paper or import the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Give it a try now!

Form popularity

FAQ

El Beneficiario: El beneficiario o fideicomisario es quien recibe los beneficios derivados de la ejecucion del contrato de fiducia; el fideicomisario puede ser el mismo fideicomitente y/o una o varias personas diferentes al fideicomitente.

El fideicomisario es el heredero que va a recibir los bienes de la herencia por parte del fiduciario y no por el testador/fideicomitente. El fideicomisario es la persona que va a poder disponer de manera libre de los bienes de la herencia.

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

FIDEICOMITENTE: Persona fisica o moral que constituye un fideicomiso para destinar ciertos bienes o derechos a la realizacion de un fin licito y determinado y encarga dicha realizacion a una Institucion de Credito. FIDUCIARIO: Es la persona encargada por el fideicomitente de realizar el fin del fideicomiso.

Cuando se habla del fideicomiso, es necesario distinguir al menos las tres partes principales que componen esta figura mercantil: el fiduciante, el fiduciario y el fideicomisario. Fiduciante.Fiduciario.Fideicomisario.

¿Quien puede fungir como fideicomitente en un contrato de fideicomiso? Toda persona, fisica o moral, con capacidad o autorizacion legal para disponer de los bienes y derechos objeto del fideicomiso. Esto no excluye a las personas incapaces, quienes siempre podran actuar a traves de su representante legal.

FIDEICOMITENTE: Persona fisica o moral que constituye un fideicomiso para destinar ciertos bienes o derechos a la realizacion de un fin licito y determinado y encarga dicha realizacion a una Institucion de Credito. FIDUCIARIO: Es la persona encargada por el fideicomitente de realizar el fin del fideicomiso.

Los fideicomisos le permiten al otorgante controlar las propiedades, aun despues de su muerte. Los fideicomisos proporcionan privacidadson contratos discretos entre dos partes que raramente son partes del registro publico. Los fideicomisos pueden funcionar para eliminar la necesidad de tutores.

Las partes principales que intervienen usualmente en un Fideicomiso son 3: Fideicomitente, Fiduciario y Fideicomisario, como comentamos, eventualmente en algunos Fideicomisos pueden participar partes adicionales como Fideicomitentes A, Fideicomitentes B, Fideicomitentes C, etc., Fideicomisario en Primer Lugar,

Los fideicomisos son sujetos en el Impuesto a las Ganancias, segun lo dispuesto por el art. 73 inciso a), apartado 6 de la ley, debiendo tributar el impuesto a la tasa actual del 30%. Es decir que tienen el mismo tratamiento que los demas sujetos mencionados en el art. 73 (SA, SRL, etc.)