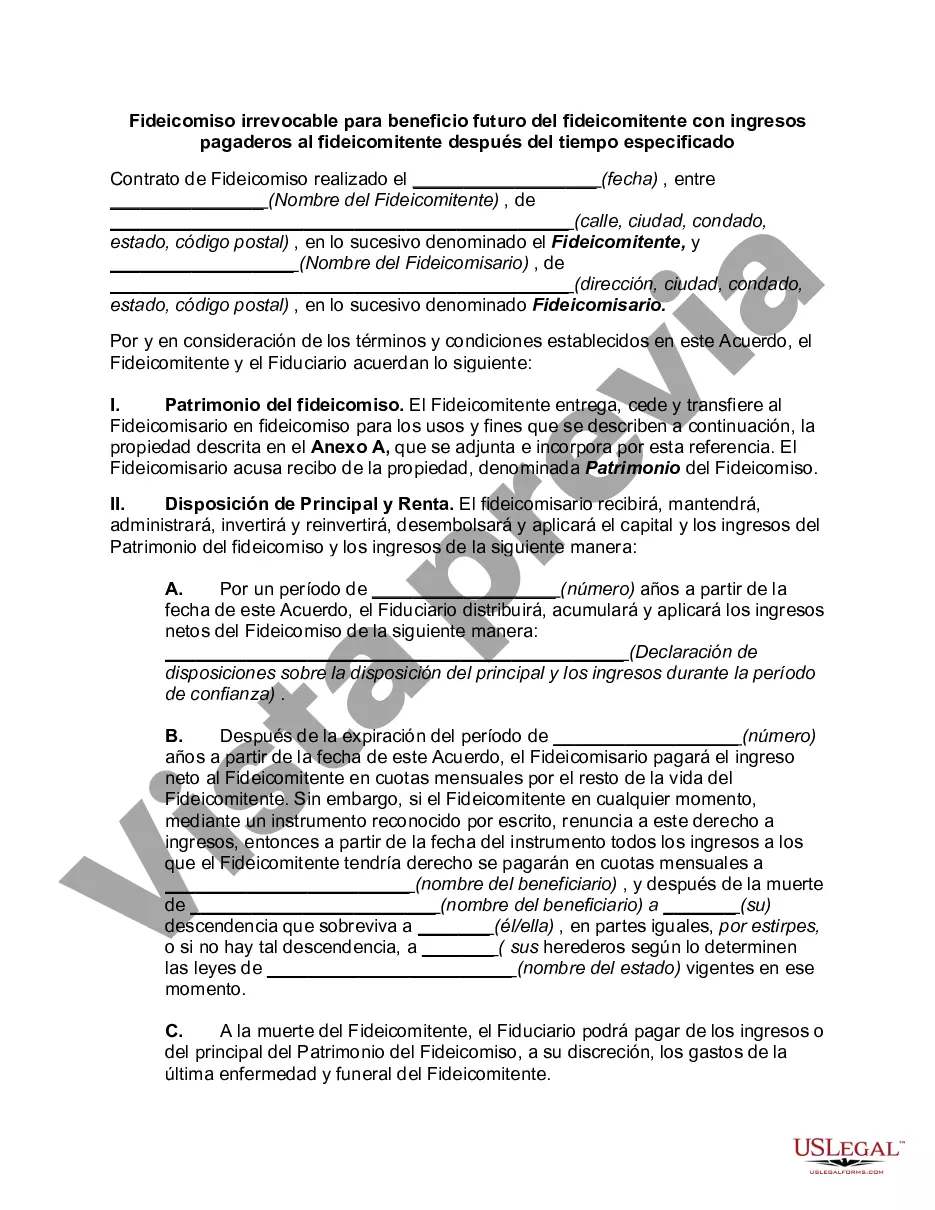

The Bexar Texas Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is a legal arrangement in which the trust or transfers their assets to the trustee for the benefit of themselves or other designated beneficiaries at a later specified time. This type of trust offers various advantages and is popular for individuals seeking long-term financial planning and asset retention. The primary purpose of the Bexar Texas Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is to facilitate asset preservation, minimize estate taxes, and provide for the financial security of the trust or other beneficiaries. This type of trust offers considerable protection for the assets held within it, as they are deemed to be separate from the trust or's personal estate. One variant of the Bexar Texas Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is the Granter Retained Income Trust (GRIT). In this trust, the trust or retains the income generated by the trust assets for a specific period, after which the income is then payable to the trust or other beneficiaries. This type of trust allows the trust or to retain a level of control and enjoy the trust's income while ensuring the designated beneficiaries receive the remaining assets at the specified time. Another type of trust that falls under the Bexar Texas Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is the Qualified Personnel Residence Trust (PRT). This trust allows the trust or to transfer their personal residence or vacation home into the trust while retaining the right to reside in it for a defined period. After this time, the property is then distributed to the beneficiaries of the trust. The Bexar Texas Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time provides substantial benefits such as asset protection, estate tax minimization, and long-term financial planning. By creating this type of trust, individuals can ensure their assets are preserved, their beneficiaries are provided for, and their financial goals are achieved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bexar Texas Fideicomiso irrevocable para beneficio futuro del fideicomitente con ingresos pagaderos al fideicomitente después del tiempo especificado - Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

How to fill out Bexar Texas Fideicomiso Irrevocable Para Beneficio Futuro Del Fideicomitente Con Ingresos Pagaderos Al Fideicomitente Después Del Tiempo Especificado?

Do you need to quickly create a legally-binding Bexar Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time or probably any other document to handle your own or business affairs? You can select one of the two options: hire a professional to write a legal paper for you or create it entirely on your own. Luckily, there's a third solution - US Legal Forms. It will help you get neatly written legal paperwork without having to pay sky-high fees for legal services.

US Legal Forms offers a huge catalog of over 85,000 state-compliant document templates, including Bexar Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time and form packages. We provide documents for an array of life circumstances: from divorce paperwork to real estate document templates. We've been out there for more than 25 years and got a rock-solid reputation among our clients. Here's how you can become one of them and obtain the necessary template without extra hassles.

- To start with, carefully verify if the Bexar Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time is tailored to your state's or county's regulations.

- In case the document includes a desciption, make sure to check what it's suitable for.

- Start the searching process over if the form isn’t what you were hoping to find by using the search box in the header.

- Choose the subscription that best fits your needs and move forward to the payment.

- Choose the file format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, find the Bexar Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time template, and download it. To re-download the form, simply go to the My Forms tab.

It's easy to find and download legal forms if you use our services. Moreover, the paperwork we provide are updated by industry experts, which gives you greater confidence when writing legal matters. Try US Legal Forms now and see for yourself!