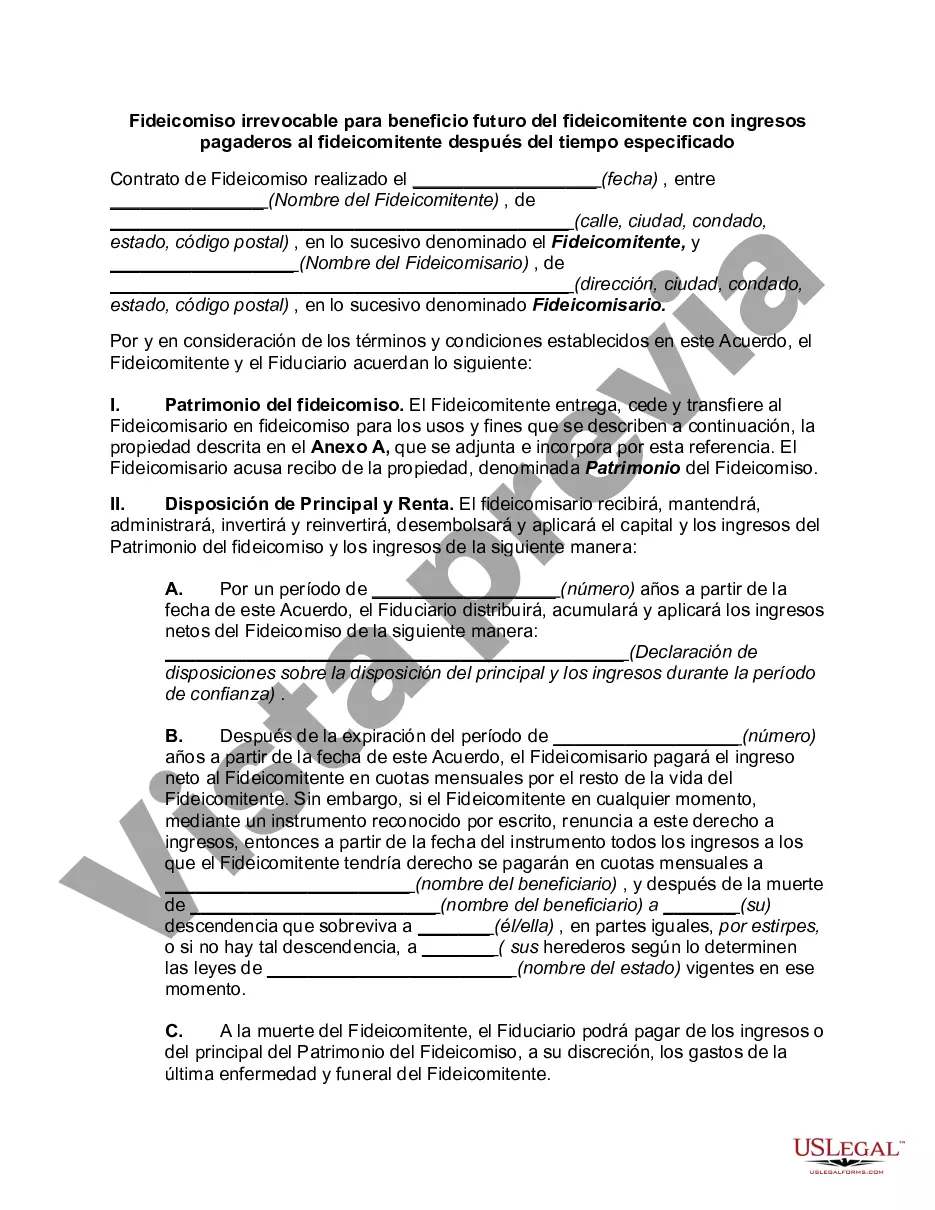

The Bronx, New York, Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is a legal instrument designed to protect the assets and wealth of individuals in the Bronx, New York, by providing them with financial security and future benefits. This type of trust, commonly known as an "irrevocable trust," offers several variations to suit the specific needs and goals of the Trust or. 1. Income Only Trust: This type of trust allows the Trust or to receive regular income generated by the trust's assets while ensuring the preservation of the principal for future beneficiaries. 2. Charitable Remainder Trust: Trustees who wish to contribute to charitable causes can establish a Charitable Remainder Trust, which enables them to receive income for a specified period while also supporting their chosen charitable organizations. After the specified time, the remaining assets are transferred to the charitable beneficiaries. 3. Special Needs Trust: Individuals with special needs can set up a Special Needs Trust to ensure continued financial assistance without jeopardizing their eligibility for government benefits. This trust allows the Trust or to provide for the supplemental needs of the beneficiary, maintaining their quality of life. 4. Spendthrift Trust: With a Spendthrift Trust, the Trust or can ensure that their assets are protected from creditors and irresponsible spending by the beneficiaries. This type of trust restricts the beneficiary's access to principal assets, ensuring its preservation for the future. 5. Life Insurance Trust: Trustees can establish a Life Insurance Trust specifically to hold life insurance policies and manage the proceeds for the benefit of their chosen beneficiaries, ensuring tax advantages and efficient distribution upon their passing. Irrevocable trusts provide numerous advantages, including asset protection, estate tax minimization, and ensuring a legacy for future generations. They require careful planning, legal guidance, and consideration of the Trust or's specific circumstances, making it crucial to consult with experienced professionals in estate planning and trust administration. By setting up a Bronx, New York, Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after a Specified Time, individuals can secure their financial future while also providing for their loved ones and philanthropic causes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bronx New York Fideicomiso irrevocable para beneficio futuro del fideicomitente con ingresos pagaderos al fideicomitente después del tiempo especificado - Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

How to fill out Bronx New York Fideicomiso Irrevocable Para Beneficio Futuro Del Fideicomitente Con Ingresos Pagaderos Al Fideicomitente Después Del Tiempo Especificado?

Draftwing paperwork, like Bronx Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time, to take care of your legal affairs is a difficult and time-consumming process. Many cases require an attorney’s involvement, which also makes this task expensive. Nevertheless, you can consider your legal affairs into your own hands and deal with them yourself. US Legal Forms is here to save the day. Our website features more than 85,000 legal documents crafted for different scenarios and life circumstances. We ensure each document is in adherence with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already aware of our services and have a subscription with US, you know how effortless it is to get the Bronx Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time form. Simply log in to your account, download the template, and personalize it to your needs. Have you lost your document? Don’t worry. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new customers is just as straightforward! Here’s what you need to do before getting Bronx Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time:

- Ensure that your form is specific to your state/county since the rules for creating legal papers may differ from one state another.

- Find out more about the form by previewing it or going through a quick intro. If the Bronx Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time isn’t something you were looking for, then use the header to find another one.

- Log in or create an account to begin utilizing our service and get the document.

- Everything looks good on your end? Click the Buy now button and choose the subscription plan.

- Select the payment gateway and type in your payment information.

- Your template is good to go. You can try and download it.

It’s easy to locate and purchase the appropriate template with US Legal Forms. Thousands of businesses and individuals are already taking advantage of our extensive collection. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!