Chicago, Illinois Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time: Understanding the Basics In Chicago, Illinois, an irrevocable trust for the future benefit of the trust or, with income payable to the trust or after a specified time, is a legal arrangement that offers unique advantages and financial opportunities. This trust structure allows individuals in the Chicago area to protect and preserve their assets for the benefit of themselves or their chosen beneficiaries. An irrevocable trust is a powerful tool for estate planning purposes. It is designed to help individuals safeguard their assets, provide for their future needs, and ensure their wealth is distributed according to their wishes. Unlike a revocable trust, which can be modified or terminated at any time, an irrevocable trust cannot be altered once it is created, making it a reliable asset protection strategy. The primary feature of an irrevocable trust for future benefit in Chicago, Illinois, is that the trust or will receive income payments after a specified time. This aspect allows the trust or to plan for their future financial needs while also ensuring an uninterrupted stream of income during the designated period. Different Types of Chicago, Illinois Irrevocable Trusts for Future Benefit of Trust or with Income Payable to Trust or after Specified Time: 1. Chicago, Illinois Charitable Remainder Trust: This type of irrevocable trust allows the trust or to donate assets to charity while retaining the right to receive income payments for a predetermined period. At the end of the specified time, the remaining assets are transferred to the designated charitable organization(s). 2. Chicago, Illinois Qualified Personnel Residence Trust: This trust enables the trust or to transfer ownership of their primary residence or a vacation home to the trust. The trust or retains the right to live in the property for a fixed period while receiving income payments. After the specified time, the property is transferred to the chosen beneficiaries, potentially minimizing estate taxes. 3. Chicago, Illinois Granter Retained Annuity Trust: This trust structure allows the trust or to transfer appreciating assets, such as stocks or real estate, into the trust while retaining an annuity payment for a defined period. At the end of the term, the remaining assets pass on to the designated beneficiaries, often with substantial tax benefits. 4. Chicago, Illinois Life Insurance Trust: This type of irrevocable trust allows the trust or to transfer life insurance policies into the trust, ensuring that the death benefit is received by the chosen beneficiaries while also providing income payments to the trust or during their lifetime. Creating an irrevocable trust for the future benefit of the trust or with income payable to the trust or after a specified time in Chicago, Illinois, requires professional assistance from estate planning attorneys well-versed in local laws and regulations. Such professionals can offer guidance on structuring the trust to align with individual goals, while also maximizing the benefits and minimizing potential tax implications. In conclusion, an irrevocable trust for the future benefit of the trust or with income payable to the trust or after a specified time is a powerful estate planning tool available to individuals in Chicago, Illinois. By understanding the different types and working with experienced professionals, individuals can tailor these trusts to align with their unique financial objectives and ensure the sustainable growth and distribution of their assets according to their wishes.

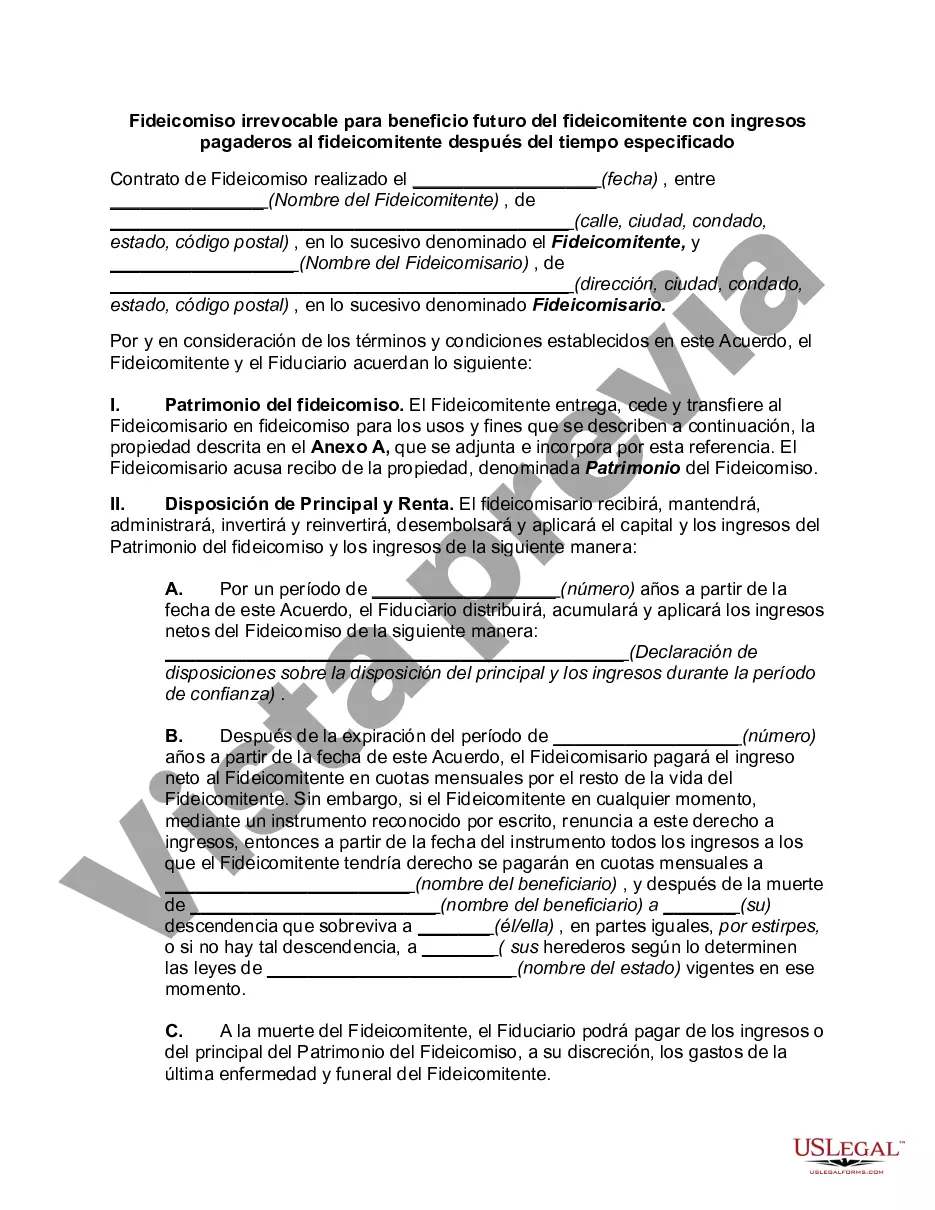

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Fideicomiso irrevocable para beneficio futuro del fideicomitente con ingresos pagaderos al fideicomitente después del tiempo especificado - Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

How to fill out Chicago Illinois Fideicomiso Irrevocable Para Beneficio Futuro Del Fideicomitente Con Ingresos Pagaderos Al Fideicomitente Después Del Tiempo Especificado?

Dealing with legal forms is a necessity in today's world. However, you don't always need to look for qualified assistance to draft some of them from the ground up, including Chicago Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in various categories varying from living wills to real estate paperwork to divorce papers. All forms are arranged based on their valid state, making the searching experience less challenging. You can also find detailed materials and guides on the website to make any tasks related to document completion simple.

Here's how you can find and download Chicago Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time.

- Take a look at the document's preview and outline (if provided) to get a basic information on what you’ll get after downloading the document.

- Ensure that the document of your choosing is adapted to your state/county/area since state laws can impact the legality of some documents.

- Check the related forms or start the search over to find the right document.

- Hit Buy now and register your account. If you already have an existing one, choose to log in.

- Pick the pricing {plan, then a needed payment gateway, and purchase Chicago Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time.

- Choose to save the form template in any available format.

- Go to the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the needed Chicago Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time, log in to your account, and download it. Of course, our platform can’t take the place of a legal professional completely. If you have to deal with an exceptionally difficult case, we advise using the services of a lawyer to check your document before signing and submitting it.

With over 25 years on the market, US Legal Forms became a go-to provider for many different legal forms for millions of users. Join them today and get your state-compliant paperwork effortlessly!