A Harris Texas Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is a type of trust established under Texas law that offers several benefits and protections for the trust or (also known as the granter or settler). This specific type of trust is designed to allow the trust or to set aside assets for the future benefit of either themselves or a named beneficiary, while also ensuring a steady stream of income payable to the trust or after a specified period of time. One of the primary features of the Harris Texas Irrevocable Trust for Future Benefit of Trust or is its irrevocability. Once the trust has been established and the assets have been transferred into it, the trust or relinquishes control over the assets, allowing them to be managed by a trustee appointed by the trust or. This irrevocable nature ensures that the assets are protected from creditors and other potential claims. The income payable to the trust or after a specified time provides a valuable source of income, typically used to support the trust or during retirement years or any other defined period. By designating an income stream, the trust or can ensure a stable financial future while also preserving the trust's principal for the future beneficiary. Different types of Harris Texas Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time can include: 1. Harris Texas Irrevocable Income Trust: This type of trust focuses primarily on providing the trust or with a reliable source of income during a specific period, such as retirement. The assets held in the trust are managed by a trustee, who will distribute income to the trust or as agreed upon in the trust document. 2. Harris Texas Dynasty Trust: A dynasty trust is designed to provide benefits for multiple generations. While the trust or may not be the primary beneficiary, they can benefit from receiving income payments for a specified time before the trust assets are passed on to subsequent beneficiaries. 3. Harris Texas Charitable Remainder Trust: This type of trust allows the trust or to transfer assets into the trust, receive income from those assets for a specified period, and then have the remaining trust assets distributed to a chosen charitable organization upon termination. 4. Harris Texas Qualified Personnel Residence Trust (PRT): A PRT is primarily used to transfer ownership of a primary residence or vacation home into the trust to pass it on to a designated beneficiary while allowing the trust or to continue residing in the property for a specified period and receiving income. In conclusion, a Harris Texas Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time offers a secure and flexible means for individuals to protect assets, ensure a stable income stream, and plan for the future benefit of themselves or their chosen beneficiaries. The different types of trusts within this category cater to specific needs and goals, allowing the trust or to tailor their estate plan accordingly.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Fideicomiso irrevocable para beneficio futuro del fideicomitente con ingresos pagaderos al fideicomitente después del tiempo especificado - Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

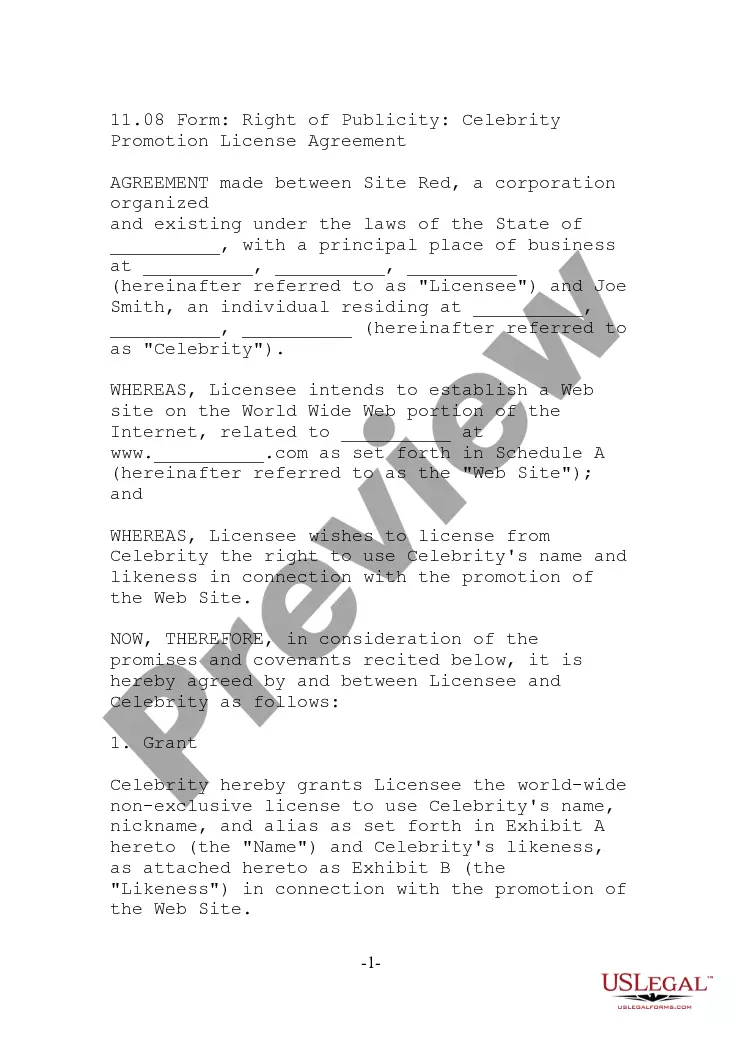

Description

How to fill out Harris Texas Fideicomiso Irrevocable Para Beneficio Futuro Del Fideicomitente Con Ingresos Pagaderos Al Fideicomitente Después Del Tiempo Especificado?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Harris Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business scenarios. All the forms can be used many times: once you obtain a sample, it remains available in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Harris Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Harris Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time:

- Analyze the page content to make sure you found the correct sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document once you find the right one.

- Choose one of the subscription plans and log in or sign up for an account.

- Decide how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!