A Houston Texas Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is a legal arrangement that offers various benefits to the trust or while ensuring the preservation and management of assets for the future. This type of trust provides a strategic approach to wealth management, asset protection, and estate planning. The primary purpose of an Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is to protect the trust or's assets from potential creditors, ensure smooth transfer of wealth to beneficiaries, minimize estate taxes, and provide a steady stream of income for the trust or after a specified time. Importantly, this trust is irrevocable, meaning that once established, it cannot be modified or terminated without the agreement of all parties involved. There are several types of Houston Texas Irrevocable Trusts for Future Benefit of Trust or with Income Payable to Trust or after Specified Time, each designed to cater to specific needs and circumstances. These include: 1. Revocable Living Trust: This trust provides flexibility and control over assets during the trust or's lifetime, allowing the trust or to amend or revoke the trust as per their discretion. It converts into an irrevocable trust upon the trust or's death. 2. Life Insurance Trust: This type of trust owns life insurance policies, ensuring that the proceeds are not subject to estate taxes upon the trust or's death. The trust or designates beneficiaries who receive the income after a specified time, offering financial security to loved ones. 3. Charitable Remainder Trust: This trust allows for a charitable donation while still providing income for the trust or after a specified time. The trust or receives an income stream during their lifetime, and upon their passing, the remaining assets are distributed to the designated charitable organization. 4. Qualified Personnel Residence Trust: This trust enables the trust or to transfer their primary residence or vacation home to the trust while retaining the right to live in it for a specified period. It provides estate tax benefits while preserving the trust or's right to use the property. 5. Dynasty Trust: Created to benefit multiple generations, a dynasty trust allows for the tax-efficient transfer of wealth across several generations. The trust provides income for the trust or after a specified time, while preserving assets from estate taxes and potential creditor claims. Establishing a Houston Texas Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time requires careful consideration, professional counsel, and a clear understanding of one's financial goals. This type of trust can provide invaluable asset protection, tax advantages, and a steady income stream for the trust or, ensuring the continued well-being of their loved ones and the preservation of their wealth.

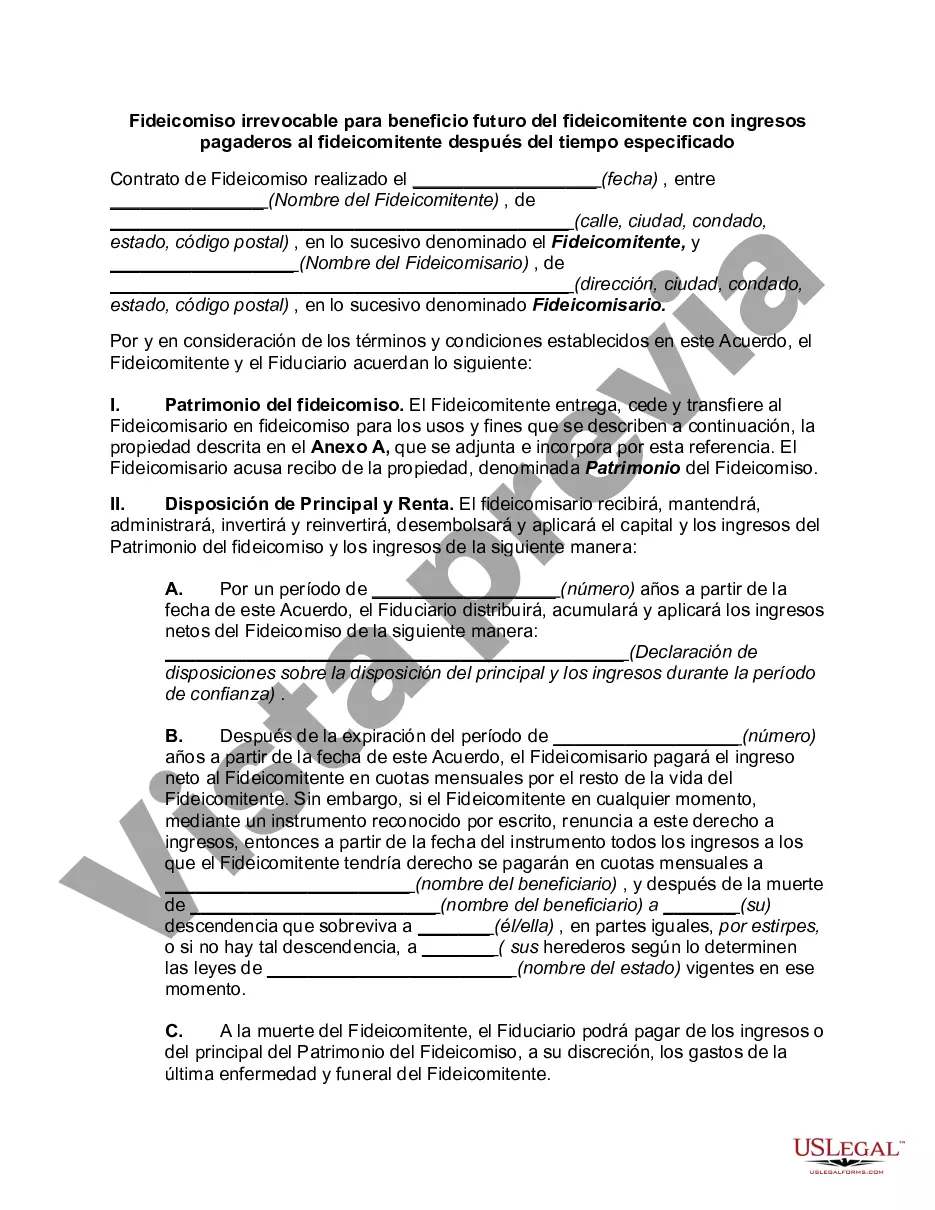

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Fideicomiso irrevocable para beneficio futuro del fideicomitente con ingresos pagaderos al fideicomitente después del tiempo especificado - Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

How to fill out Houston Texas Fideicomiso Irrevocable Para Beneficio Futuro Del Fideicomitente Con Ingresos Pagaderos Al Fideicomitente Después Del Tiempo Especificado?

Draftwing paperwork, like Houston Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time, to take care of your legal matters is a tough and time-consumming task. Many situations require an attorney’s participation, which also makes this task not really affordable. Nevertheless, you can get your legal affairs into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website features over 85,000 legal documents intended for different scenarios and life circumstances. We ensure each form is compliant with the laws of each state, so you don’t have to worry about potential legal issues compliance-wise.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Houston Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time form. Simply log in to your account, download the template, and customize it to your requirements. Have you lost your form? No worries. You can get it in the My Forms tab in your account - on desktop or mobile.

The onboarding flow of new users is just as simple! Here’s what you need to do before downloading Houston Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time:

- Ensure that your form is compliant with your state/county since the rules for writing legal papers may vary from one state another.

- Discover more information about the form by previewing it or going through a brief description. If the Houston Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time isn’t something you were looking for, then use the header to find another one.

- Sign in or create an account to start using our service and download the document.

- Everything looks great on your side? Click the Buy now button and choose the subscription option.

- Pick the payment gateway and enter your payment information.

- Your form is good to go. You can go ahead and download it.

It’s easy to find and buy the needed document with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our extensive collection. Subscribe to it now if you want to check what other benefits you can get with US Legal Forms!