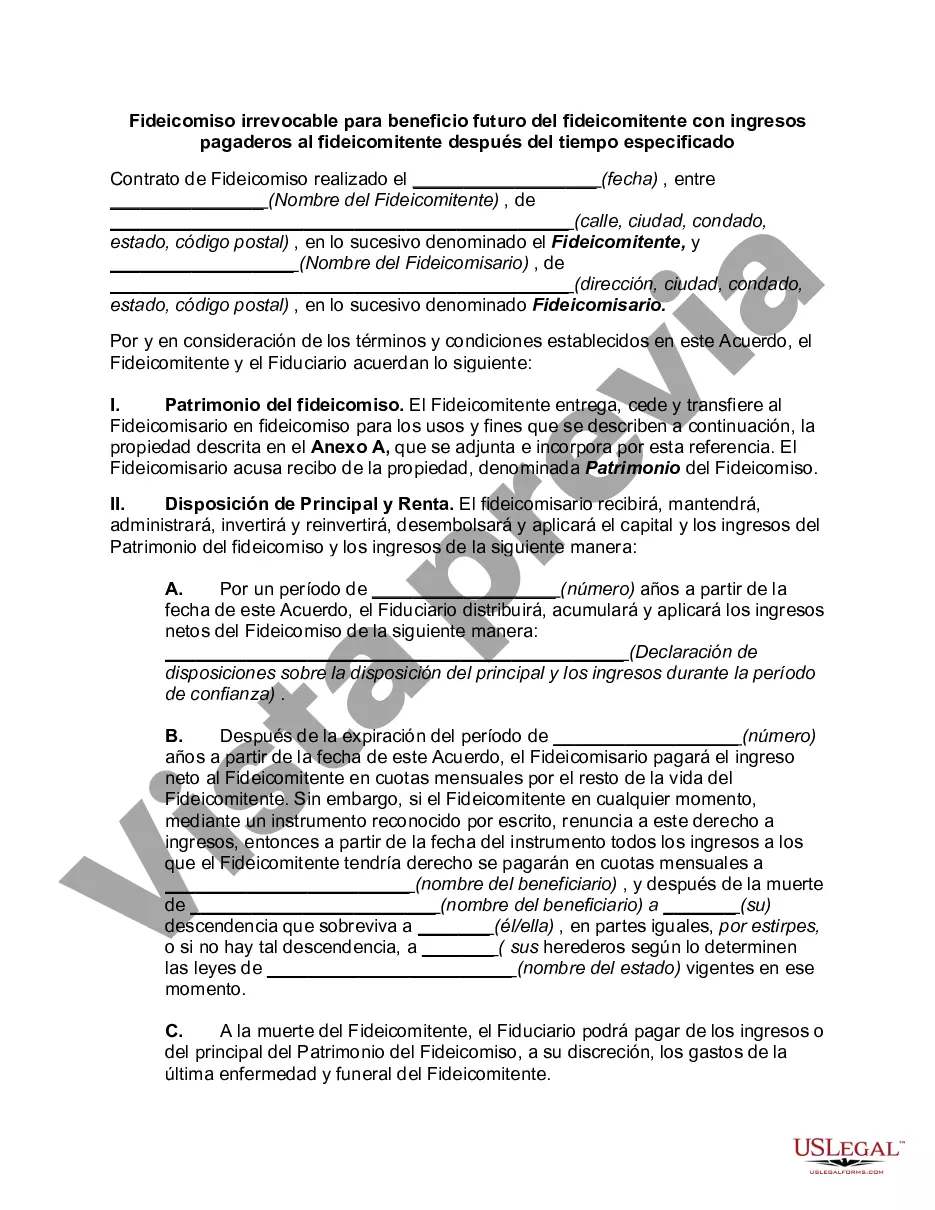

Los Angeles, California boasts an array of estate planning options, including the highly beneficial and versatile Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time. This specific type of trust offers individuals a strategic and advantageous way to manage their assets while ensuring long-term financial security. The Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time allows the trust or to transfer their assets to a trustee, who manages and administers the trust on behalf of the beneficiaries. Unlike a revocable trust, an irrevocable trust cannot be modified or terminated without the consent of all parties involved, providing a strong sense of security for the trust or. The primary advantage of this type of trust is the ability for the trust or to receive income from the trust after a specified period or event. This income can be structured in various ways, including regular payments or lump-sum distributions, depending on the preferences and needs of the trust or. By stipulating a specific time or event for the income to begin, the trust or can effectively plan for their financial future and ensure a steady stream of income when needed. For individuals in Los Angeles, California, considering the Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time, it is essential to understand the different types available: 1. Fixed-Term Trust: In this type of irrevocable trust, the trust or designates a specific period after which the income will commence. For example, the trust or may choose to receive income from the trust starting 10 years after the creation of the trust. This type offers predictability and allows for effective long-term financial planning. 2. Event-Based Trust: With an event-based trust, the trust or specifies a particular event that triggers the commencement of income payments. For instance, the trust or may set the income to begin upon retirement, the birth of a child, or any other significant life event. This type of trust provides flexibility and accommodates individual circumstances. 3. Conditional Trust: A conditional trust allows the trust or to determine specific conditions for the income to start. For instance, the trust or may state that income becomes payable once they reach a particular age, achieve a specific financial goal, or any other condition they deem appropriate. This type of trust gives the trust or control over when the income should commence based on their unique circumstances and objectives. In conclusion, the Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time offers a valuable estate planning tool for individuals in Los Angeles, California. By considering the different types available, individuals can tailor their trust to meet their specific financial goals and ensure a steady income stream in the future. It is advisable to consult with a knowledgeable estate planning attorney to navigate the complexities and make informed decisions regarding this type of trust.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Los Angeles California Fideicomiso irrevocable para beneficio futuro del fideicomitente con ingresos pagaderos al fideicomitente después del tiempo especificado - Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

How to fill out Los Angeles California Fideicomiso Irrevocable Para Beneficio Futuro Del Fideicomitente Con Ingresos Pagaderos Al Fideicomitente Después Del Tiempo Especificado?

If you need to find a reliable legal form supplier to get the Los Angeles Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time, look no further than US Legal Forms. Whether you need to launch your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to find and download the appropriate form.

- You can search from more than 85,000 forms arranged by state/county and case.

- The intuitive interface, number of supporting resources, and dedicated support team make it simple to locate and execute various documents.

- US Legal Forms is a trusted service providing legal forms to millions of users since 1997.

You can simply select to search or browse Los Angeles Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time, either by a keyword or by the state/county the document is intended for. After locating needed form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's simple to start! Simply find the Los Angeles Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time template and check the form's preview and short introductory information (if available). If you're confident about the template’s terminology, go ahead and click Buy now. Create an account and choose a subscription plan. The template will be immediately ready for download once the payment is completed. Now you can execute the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to demonstrate it. Our rich variety of legal forms makes these tasks less costly and more reasonably priced. Create your first company, organize your advance care planning, draft a real estate contract, or complete the Los Angeles Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time - all from the convenience of your home.

Join US Legal Forms now!