A Sacramento California Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after a Specified Time is a legally binding estate planning tool designed to provide long-term financial security for the trust or (also known as the granter or settler) and their designated beneficiaries. This type of trust ensures that the trust or's assets are protected, managed, and distributed according to their wishes, while allowing them to receive income from the trust at a later date. Keywords: Sacramento California, irrevocable trust, future benefit, trust or, income payable, specified time, estate planning, legal protection, assets, beneficiaries. There are various types of Sacramento California Irrevocable Trusts with Income Payable to Trust or after a Specified Time, each serving unique purposes based on the specific needs and goals of the trust or. Some notable types include: 1. Sacramento California Irrevocable Life Insurance Trust (IIT): This trust allows the trust or to remove their life insurance policies from their estate, minimizing costs and potential estate tax burdens while providing income to the trust or during their lifetime. 2. Sacramento California Qualified Personnel Residence Trust (PRT): This trust enables the trust or to transfer ownership of their primary residence or vacation home into the trust, allowing them to live in the property for a specified period while preserving its value for future beneficiaries. Upon expiration, the property is transferred to the beneficiaries. 3. Sacramento California Dynasty Trust: Ideal for those seeking to preserve wealth for multiple generations, this trust allows the trust or's assets to be held in perpetuity, minimizing estate taxes and providing income to the trust or before distribution to future beneficiaries. 4. Sacramento California Charitable Remainder Trust (CRT): Designed for philanthropic individuals, this trust allows the trust or to donate assets to a charitable organization while retaining the right to receive income from the trust for a specific period. Upon termination, the remaining assets are transferred to the designated charity. 5. Sacramento California Granter Retained Income Trust (GRIT): With a GRIT, the trust or transfers income-producing assets to the trust while retaining the right to receive income for a specified time. Afterward, the assets are transferred to the beneficiaries, usually family members, potentially minimizing estate taxes. Overall, a Sacramento California Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after a Specified Time offers effective asset protection, estate tax planning, and the ability to distribute income to the trust or while ensuring their assets pass seamlessly to designated beneficiaries. It is crucial to consult with an experienced estate planning attorney to determine the best type of trust that aligns with individual goals and objectives.

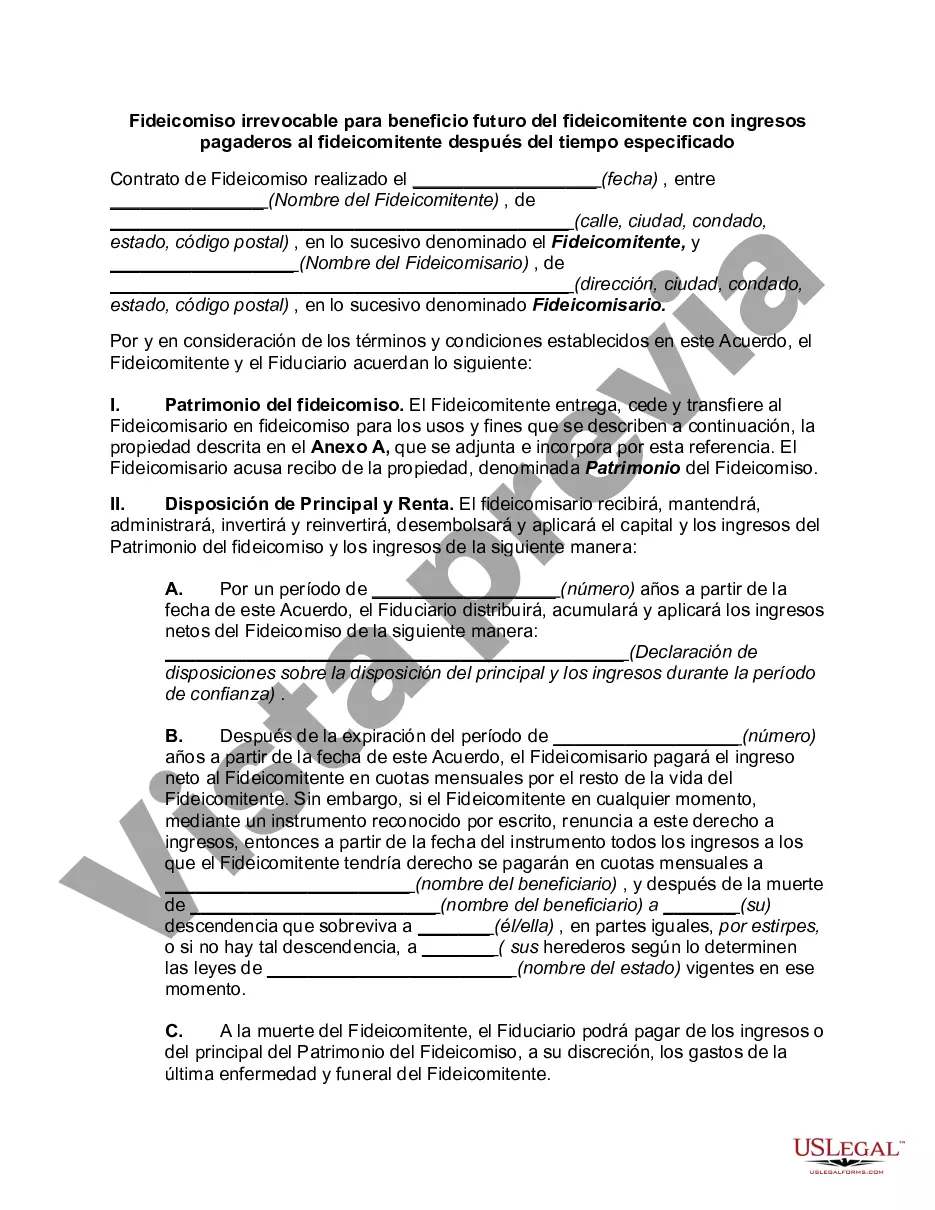

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Sacramento California Fideicomiso irrevocable para beneficio futuro del fideicomitente con ingresos pagaderos al fideicomitente después del tiempo especificado - Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

How to fill out Sacramento California Fideicomiso Irrevocable Para Beneficio Futuro Del Fideicomitente Con Ingresos Pagaderos Al Fideicomitente Después Del Tiempo Especificado?

Are you looking to quickly draft a legally-binding Sacramento Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time or maybe any other document to take control of your own or corporate affairs? You can select one of the two options: contact a legal advisor to write a legal document for you or draft it completely on your own. The good news is, there's a third option - US Legal Forms. It will help you get neatly written legal documents without having to pay unreasonable fees for legal services.

US Legal Forms provides a huge catalog of over 85,000 state-compliant document templates, including Sacramento Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time and form packages. We offer documents for a myriad of use cases: from divorce papers to real estate document templates. We've been on the market for over 25 years and gained a rock-solid reputation among our customers. Here's how you can become one of them and obtain the necessary document without extra troubles.

- To start with, carefully verify if the Sacramento Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time is adapted to your state's or county's laws.

- If the document includes a desciption, make sure to check what it's intended for.

- Start the searching process again if the form isn’t what you were seeking by using the search bar in the header.

- Choose the plan that best fits your needs and proceed to the payment.

- Select the file format you would like to get your document in and download it.

- Print it out, complete it, and sign on the dotted line.

If you've already registered an account, you can easily log in to it, locate the Sacramento Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time template, and download it. To re-download the form, just go to the My Forms tab.

It's effortless to find and download legal forms if you use our catalog. Additionally, the documents we provide are reviewed by law professionals, which gives you greater peace of mind when writing legal affairs. Try US Legal Forms now and see for yourself!