A Wake North Carolina Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time is a legal arrangement that provides various advantages and protections for the granter (also known as the trust or). This specialized trust structure allows the granter to create a fund that will benefit them at a specified time in the future, while also providing them with a regular income during that time. The Wake North Carolina Irrevocable Trust for Future Benefit of Trust or with Income Payable to Trust or after Specified Time can be further categorized into different types based on specific purposes and features. Some of these types include: 1. Charitable Remainder Trust: This type of trust allows the granter to receive regular income from the trust during their lifetime, with the remaining trust assets passing to a designated charity or charities upon their death or at the end of a specified time period. 2. Generation-Skipping Trust: This trust is specifically designed to benefit future generations, typically grandchildren or great-grandchildren, while also ensuring that the granter's children receive their fair share. By "skipping" a generation, the trust helps reduce estate taxes that would otherwise be applied. 3. Qualified Personnel Residence Trust: This trust enables the granter to transfer their primary residence or vacation home to the trust while retaining the right to continue living in it for a defined period. The trust offers potential estate tax savings by removing the property's value from the granter's estate. 4. Medicaid Trust: Also known as an irrevocable income-only trust, this type of trust assists individuals in protecting their assets from being counted for Medicaid eligibility purposes. The trust's income is payable to the granter while ensuring that the principal assets are preserved for the granter's beneficiaries. 5. Life Insurance Trust: This irrevocable trust holds one or more life insurance policies, with the proceeds ultimately distributed to the trust's beneficiaries. It ensures that the insurance proceeds are outside the granter's taxable estate and provides potential estate tax savings. These different types of Wake North Carolina Irrevocable Trusts for Future Benefit of Trust or with Income Payable to Trust or after Specified Time offer a range of benefits and solutions tailored to the granter's unique goals and circumstances. It is crucial to consult with an experienced estate planning attorney to determine the most suitable trust structure based on individual needs and objectives.

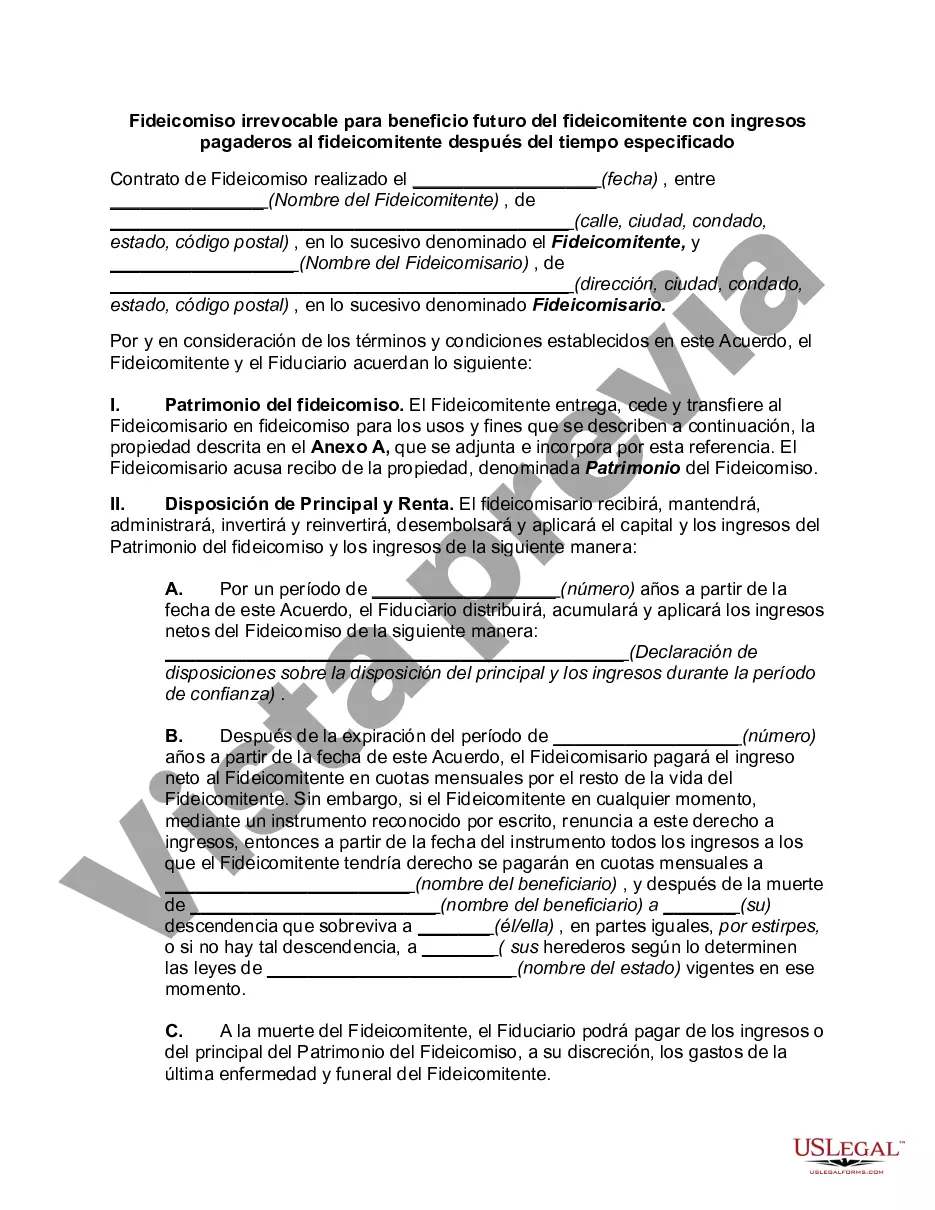

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wake North Carolina Fideicomiso irrevocable para beneficio futuro del fideicomitente con ingresos pagaderos al fideicomitente después del tiempo especificado - Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time

Description

How to fill out Wake North Carolina Fideicomiso Irrevocable Para Beneficio Futuro Del Fideicomitente Con Ingresos Pagaderos Al Fideicomitente Después Del Tiempo Especificado?

Laws and regulations in every area differ around the country. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Wake Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal forms. It's an excellent solution for professionals and individuals looking for do-it-yourself templates for various life and business occasions. All the documents can be used multiple times: once you purchase a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can just log in and re-download the Wake Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time from the My Forms tab.

For new users, it's necessary to make some more steps to obtain the Wake Irrevocable Trust for Future Benefit of Trustor with Income Payable to Trustor after Specified Time:

- Examine the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template when you find the proper one.

- Choose one of the subscription plans and log in or sign up for an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!