The Alameda California Revocable Trust for Lifetime Benefit of Trust or for Lifetime Benefit of Surviving Spouse after Death of Trust or's with Annuity is a legal arrangement designed to protect assets and provide financial security for both the trust or (the person creating the trust) and their surviving spouse. This type of trust combines the benefits of a revocable trust, which allows the trust or to make changes or revoke the trust during their lifetime, and an annuity, which guarantees a steady stream of income. The primary purpose of this trust is to ensure that the trust or's assets are managed and distributed according to their wishes while they are alive, and to provide ongoing support and financial stability for their surviving spouse after their death. It allows the trust or to maintain control over their assets and make changes as needed, while also securing a regular income stream for their spouse. One of the key advantages of the Alameda California Revocable Trust for Lifetime Benefit of Trust or for Lifetime Benefit of Surviving Spouse after Death of Trust or's with Annuity is that it avoids probate, the lengthy and expensive process of distributing assets through the courts. By placing their assets within the trust, the trust or can ensure a smooth and efficient transfer of assets to their surviving spouse without court intervention. There are different types of Alameda California Revocable Trust for Lifetime Benefit of Trust or for Lifetime Benefit of Surviving Spouse after Death of Trust or's with Annuity, including the following: 1. Revocable Living Trust: This is the most common type of trust and allows the trust or to retain full control over the assets placed in the trust during their lifetime. They can make changes, add or remove assets, or even revoke the trust entirely. 2. Irrevocable Living Trust: Unlike the revocable trust, an irrevocable trust cannot be changed or revoked once it is established. The trust or permanently transfers their assets into the trust, providing long-term benefits and asset protection. 3. Testamentary Trust: This type of trust is established within a will and only takes effect after the trust or's death. It can be used to provide ongoing support and financial security to the surviving spouse. In conclusion, the Alameda California Revocable Trust for Lifetime Benefit of Trust or for Lifetime Benefit of Surviving Spouse after Death of Trust or's with Annuity offers a comprehensive solution for managing assets, ensuring financial stability, and providing for a surviving spouse. It combines the flexibility of a revocable trust with the security of an annuity to create a tailored estate planning strategy that meets the specific needs and goals of the trust or and their spouse.

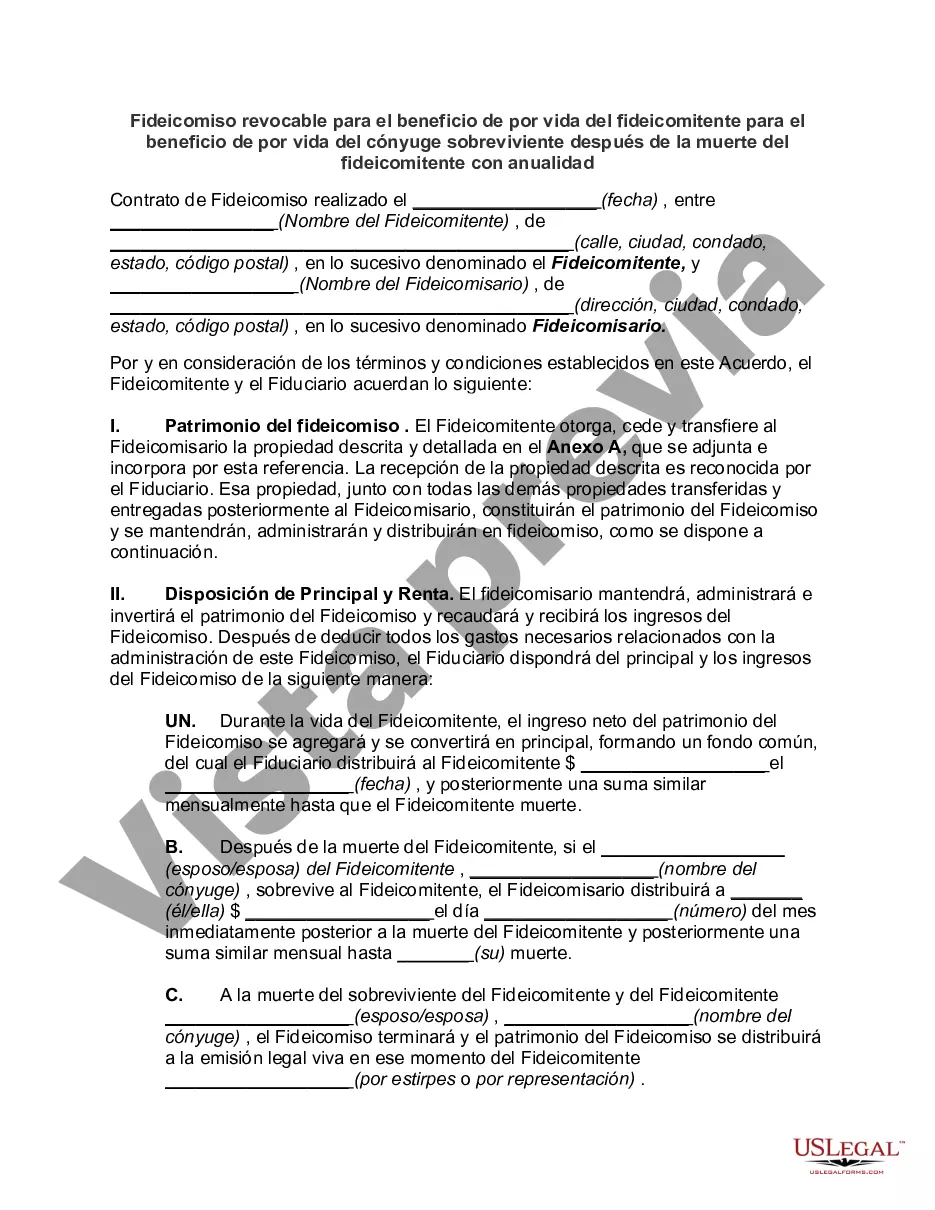

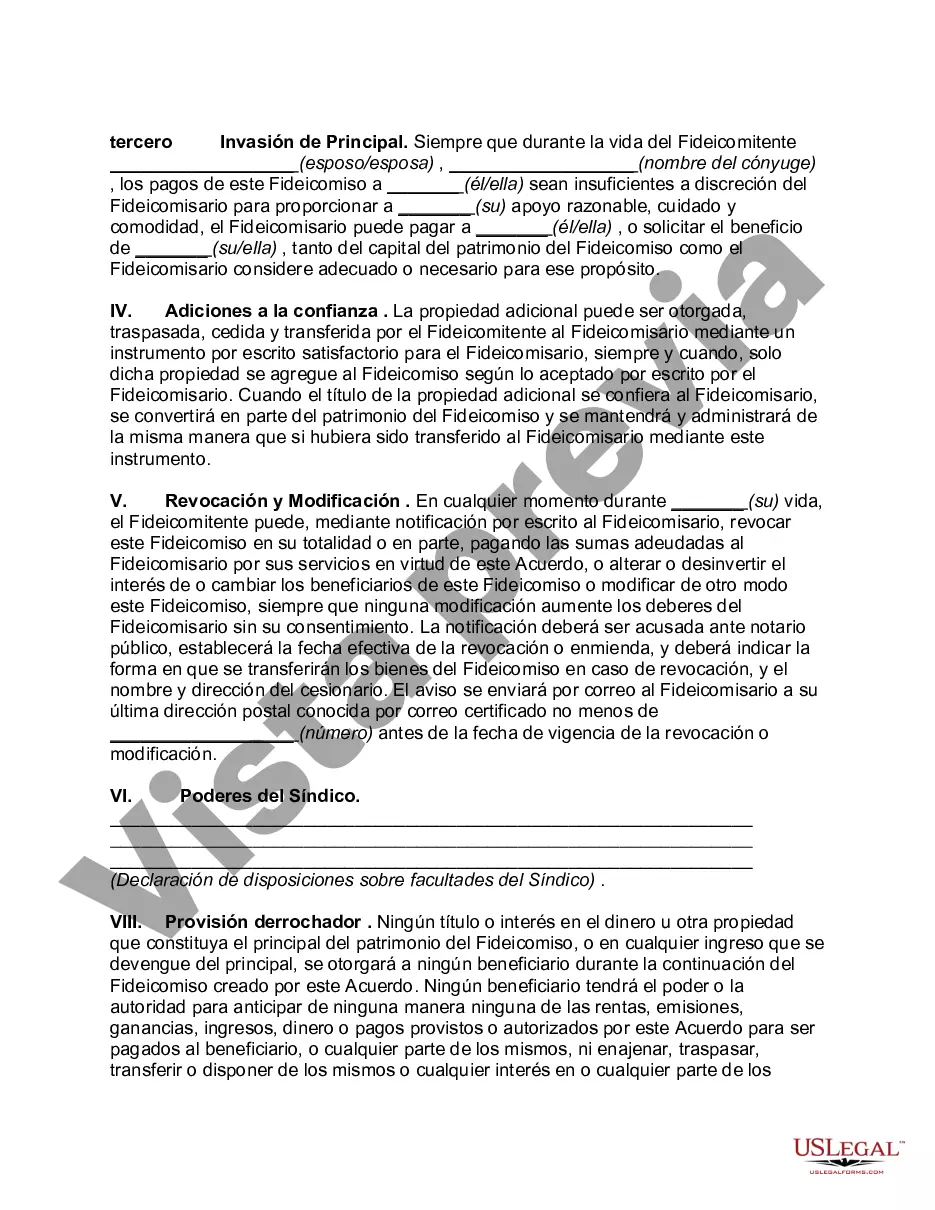

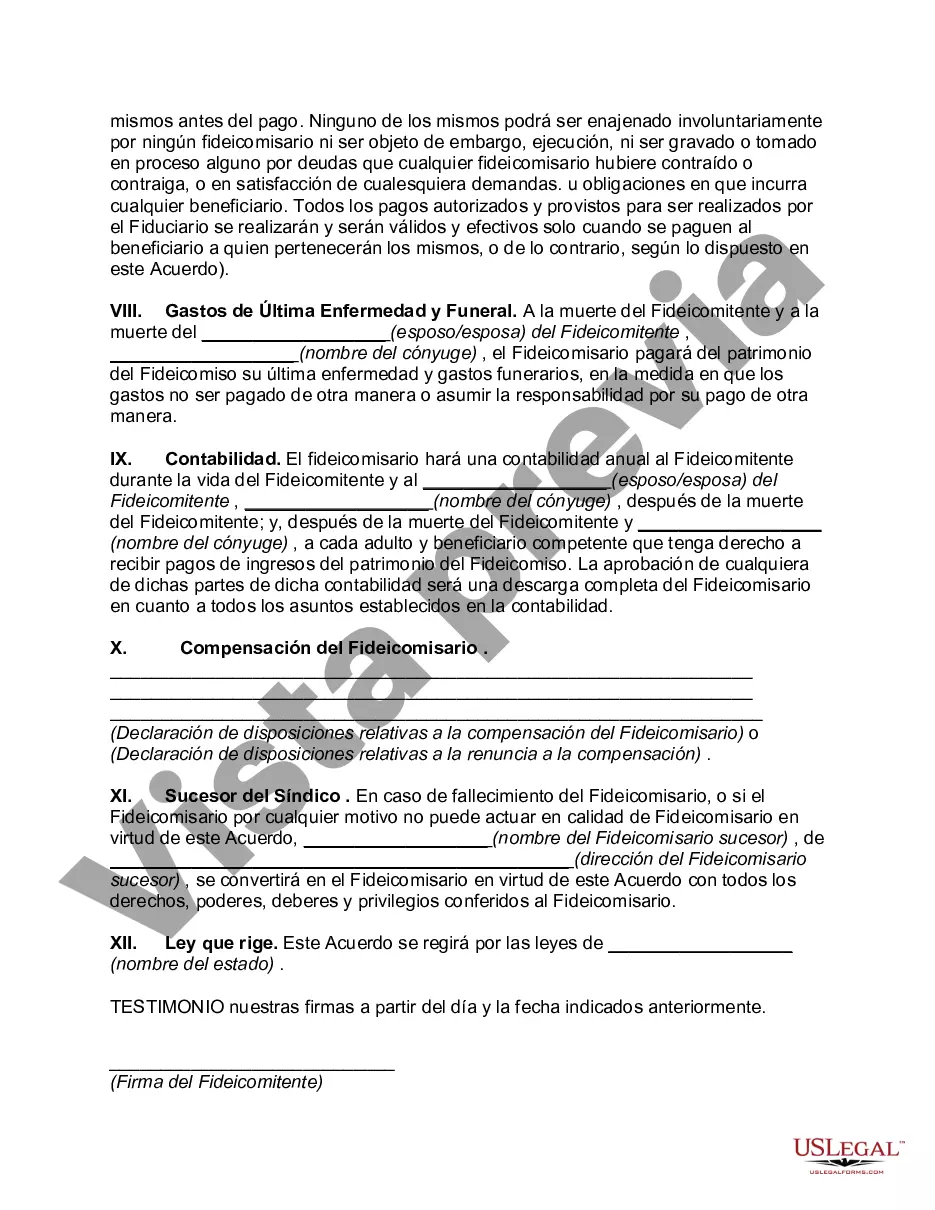

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Alameda California Fideicomiso revocable para el beneficio de por vida del fideicomitente para el beneficio de por vida del cónyuge sobreviviente después de la muerte del fideicomitente con anualidad - Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity

Description

How to fill out Alameda California Fideicomiso Revocable Para El Beneficio De Por Vida Del Fideicomitente Para El Beneficio De Por Vida Del Cónyuge Sobreviviente Después De La Muerte Del Fideicomitente Con Anualidad?

Preparing paperwork for the business or personal demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's important to consider all federal and state regulations of the particular area. However, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to draft Alameda Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity without professional help.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Alameda Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity by yourself, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal documents that are professionally verified, so you can be certain of their validity when picking a sample for your county. Earlier subscribed users only need to log in to their accounts to save the necessary form.

If you still don't have a subscription, follow the step-by-step guideline below to get the Alameda Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity:

- Look through the page you've opened and verify if it has the document you require.

- To do so, use the form description and preview if these options are presented.

- To locate the one that meets your needs, use the search tab in the page header.

- Recheck that the template complies with juridical standards and click Buy Now.

- Choose the subscription plan, then sign in or create an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly get verified legal forms for any situation with just a few clicks!