The Hillsborough Florida Revocable Trust for Lifetime Benefit of Trust or for Lifetime Benefit of Surviving Spouse after Death of Trust or's with Annuity is a legal arrangement designed to provide financial security and asset distribution for individuals and their spouses in Hillsborough County, Florida. This type of trust allows the trust or (the person creating the trust) to transfer their assets into the trust while retaining control and benefiting from them during their lifetime. Keywords: Hillsborough Florida, Revocable Trust, Lifetime Benefit, Trust or, Surviving Spouse, Death, Annuity, Financial Security, Asset Distribution. There are two main types of Hillsborough Florida Revocable Trust for Lifetime Benefit of Trust or for Lifetime Benefit of Surviving Spouse after Death of Trust or's with Annuity: 1. A Revocable Living Trust: This type of trust is created during the lifetime of the trust or and allows them to maintain full control and benefit from their assets while alive. The trust or can make changes or revoke the trust at any time, ensuring flexibility and adaptability as their circumstances change. After the trust or's death, the trust assets are transferred to the surviving spouse, providing them with continued financial support and security. 2. An Irrevocable Living Trust: Unlike the revocable trust, this type of trust cannot be altered or revoked once it is established. It provides a more secure and protected way of transferring assets to the surviving spouse after the trust or's death. The trust or relinquishes control over the assets, but they may still receive income from an annuity or other sources during their lifetime. This trust helps in preserving assets and mitigating tax implications, ultimately benefiting the surviving spouse. In conclusion, the Hillsborough Florida Revocable Trust for Lifetime Benefit of Trust or for Lifetime Benefit of Surviving Spouse after Death of Trust or's with Annuity is a powerful legal instrument that ensures financial security and peace of mind for individuals and their spouses in Hillsborough County, Florida. It offers flexibility, control, and various options to protect assets and provide for loved ones even after the trust or's passing.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hillsborough Florida Fideicomiso revocable para el beneficio de por vida del fideicomitente para el beneficio de por vida del cónyuge sobreviviente después de la muerte del fideicomitente con anualidad - Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity

Description

How to fill out Hillsborough Florida Fideicomiso Revocable Para El Beneficio De Por Vida Del Fideicomitente Para El Beneficio De Por Vida Del Cónyuge Sobreviviente Después De La Muerte Del Fideicomitente Con Anualidad?

Laws and regulations in every sphere differ around the country. If you're not a lawyer, it's easy to get lost in a variety of norms when it comes to drafting legal documents. To avoid expensive legal assistance when preparing the Hillsborough Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity, you need a verified template valid for your region. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal forms. It's a great solution for professionals and individuals looking for do-it-yourself templates for different life and business situations. All the forms can be used many times: once you purchase a sample, it remains accessible in your profile for subsequent use. Thus, if you have an account with a valid subscription, you can simply log in and re-download the Hillsborough Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Hillsborough Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity:

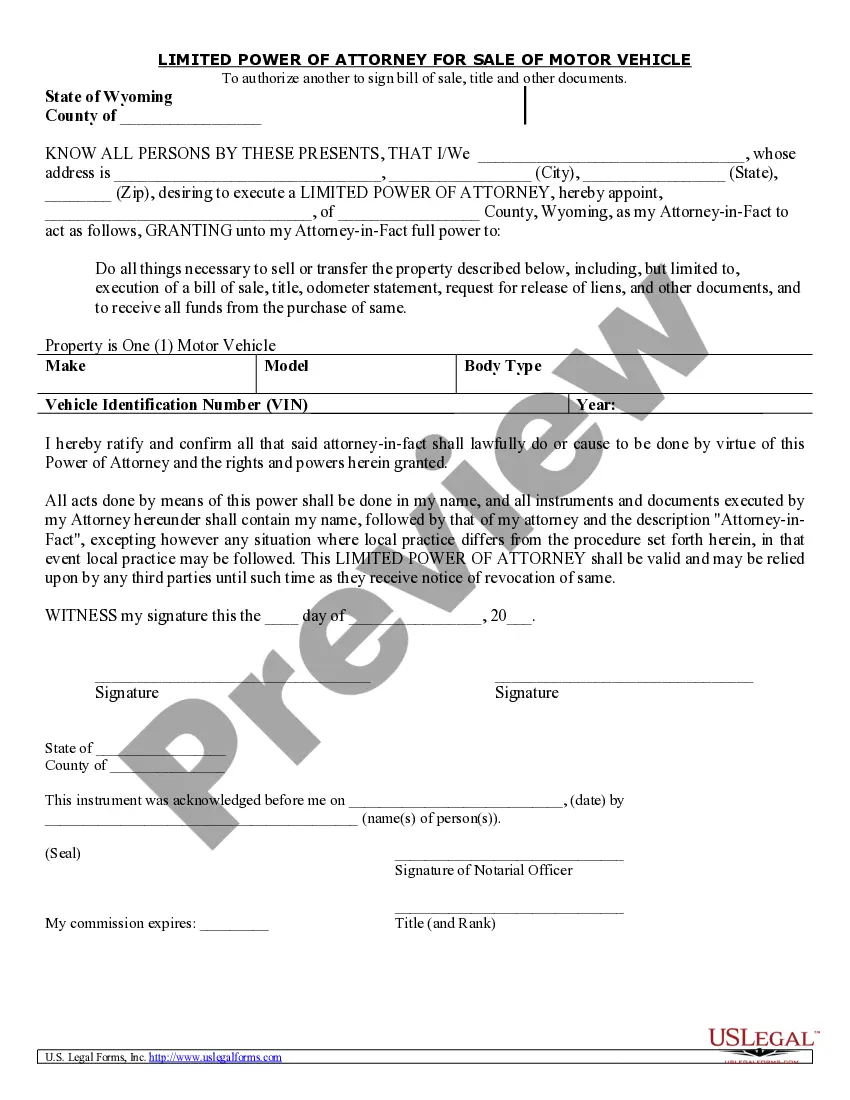

- Take a look at the page content to ensure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the template when you find the right one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!