A Travis Texas Revocable Trust for Lifetime Benefit of Trust or for Lifetime Benefit of Surviving Spouse after Death of Trust or's with Annuity is a specific type of revocable trust created under Texas law. This type of trust is designed to provide financial security and support to the trust or (the person creating the trust) during their lifetime and ensure that their surviving spouse continues to receive financial benefits after the trust or's passing. The main purpose of this type of revocable trust is to establish a structure that allows the trust or to maintain control over their assets and provide for their surviving spouse's financial needs. By creating this trust, the trust or can ensure that their assets are managed and distributed according to their wishes, while also providing ongoing income for themselves and their spouse. There may be different variations or types of Travis Texas Revocable Trust for Lifetime Benefit of Trust or for Lifetime Benefit of Surviving Spouse after Death of Trust or's with Annuity, each with its own unique features or provisions. Some possible variations of this type of trust could include: 1. Irrevocable Travis Texas Revocable Trust: This variation of the trust is designed to be non-amendable or non-revocable after its creation. Once the trust is established, the trust or cannot make any changes or modifications to its terms. 2. Testamentary Travis Texas Revocable Trust: This type of trust is created within the trust or's will and only takes effect after the trust or's death. It allows for greater flexibility and control over the distribution of assets and annuity payments to the surviving spouse. 3. Granter Retained Income Trust (GRIT): A GRIT is a variation of the revocable trust where the trust or retains the right to receive income generated by the trust during their lifetime. The surviving spouse may also receive income or benefit from the trust after the trust or's passing. 4. Charitable Remainder Annuity Trust (CAT): This type of trust allows the trust or to donate assets to a charitable organization while retaining the right to receive a fixed annuity payment for their lifetime. After the trust or's death, the surviving spouse may also receive annuity payments. Overall, a Travis Texas Revocable Trust for Lifetime Benefit of Trust or for Lifetime Benefit of Surviving Spouse after Death of Trust or's with Annuity allows individuals to consolidate control over their assets, plan for their ongoing financial security, and ensure that their surviving spouse is provided for after their passing. It offers flexibility in terms of asset distribution, income generation, and may have various other provisions depending on the specific type of trust.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Fideicomiso revocable para el beneficio de por vida del fideicomitente para el beneficio de por vida del cónyuge sobreviviente después de la muerte del fideicomitente con anualidad - Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity

Description

How to fill out Travis Texas Fideicomiso Revocable Para El Beneficio De Por Vida Del Fideicomitente Para El Beneficio De Por Vida Del Cónyuge Sobreviviente Después De La Muerte Del Fideicomitente Con Anualidad?

A document routine always accompanies any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and lots of other life situations require you prepare formal documentation that varies throughout the country. That's why having it all collected in one place is so beneficial.

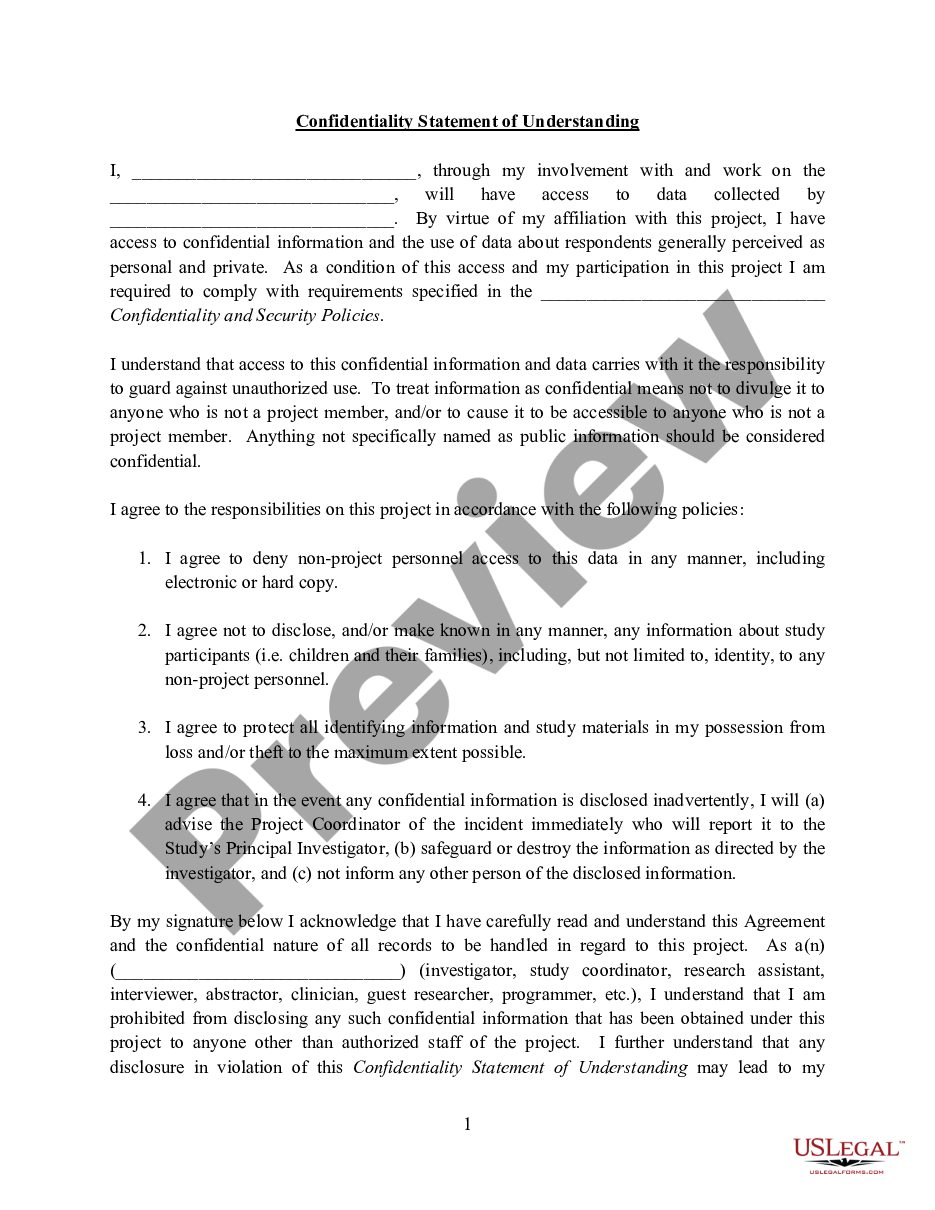

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily find and download a document for any individual or business purpose utilized in your region, including the Travis Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity.

Locating forms on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Travis Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this simple guideline to get the Travis Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity:

- Ensure you have opened the correct page with your local form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document via the search option in case the sample doesn't fit you.

- Click Buy Now once you locate the required template.

- Select the suitable subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Travis Revocable Trust for Lifetime Benefit of Trustor for Lifetime Benefit of Surviving Spouse after Death of Trustor's with Annuity on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!