Allegheny Pennsylvania Revocable Trust for Lifetime Benefit of Trust or, Lifetime Benefit of Surviving Spouse after Trust or's Death with Trusts for Children is a type of trust arrangement commonly used in estate planning. This particular trust is designed to provide ongoing financial support and protection for the individuals involved, including the trust or (the person who creates the trust), their surviving spouse, and their children. The Allegheny Pennsylvania Revocable Trust for Lifetime Benefit of Trust or, Lifetime Benefit of Surviving Spouse after Trust or's Death with Trusts for Children allows the trust or to maintain control over their assets during their lifetime while also ensuring that their surviving spouse and children are well taken care of after their passing. By establishing this type of trust, the trust or can: 1. Maintain Control: The trust or retains the ability to manage and access their assets during their lifetime. 2. Lifetime Benefit for Trust or: The trust or can receive income from the trust assets during their lifetime, providing ongoing financial support. 3. Lifetime Benefit for Surviving Spouse: After the trust or's death, the surviving spouse continues to receive income from the trust, ensuring their financial security. 4. Trusts for Children: The trust also includes provisions for creating separate trusts for each child, allowing for their ongoing financial support and protection. These separate trusts can be customized to meet the specific needs and circumstances of each individual child. It is important to note that there may be variations or subtypes of the Allegheny Pennsylvania Revocable Trust for Lifetime Benefit of Trust or, Lifetime Benefit of Surviving Spouse after Trust or's Death with Trusts for Children, based on specific requirements or preferences. Examples may include: — Charitable Trust: This subtype includes provisions for charitable giving, allowing the trust or to support their favorite causes or organizations. — Special Needs Trust: If one or more of the children has special needs or disabilities, a special needs trust can be established within the overall trust structure. This ensures that the child's eligibility for government benefits is not compromised while also providing them with additional financial support. — Education Trust: For families that prioritize education, this subtype can allocate funds specifically for education-related expenses, such as tuition, books, and fees. — Asset Protection Trust: In situations where asset protection is a concern, the trust can be structured to shield the assets from potential creditors, lawsuits, or other financial risks. The Allegheny Pennsylvania Revocable Trust for Lifetime Benefit of Trust or, Lifetime Benefit of Surviving Spouse after Trust or's Death with Trusts for Children offers a comprehensive solution for estate planning that addresses the specific needs of the trust or, surviving spouse, and children. These trusts provide flexibility, control, and financial security, ensuring the continued well-being of the family for generations to come.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Fideicomiso revocable para el beneficio de por vida del fideicomitente, beneficio de por vida del cónyuge sobreviviente después de la muerte del fideicomitente con fideicomisos para niños - Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children

Description

How to fill out Allegheny Pennsylvania Fideicomiso Revocable Para El Beneficio De Por Vida Del Fideicomitente, Beneficio De Por Vida Del Cónyuge Sobreviviente Después De La Muerte Del Fideicomitente Con Fideicomisos Para Niños?

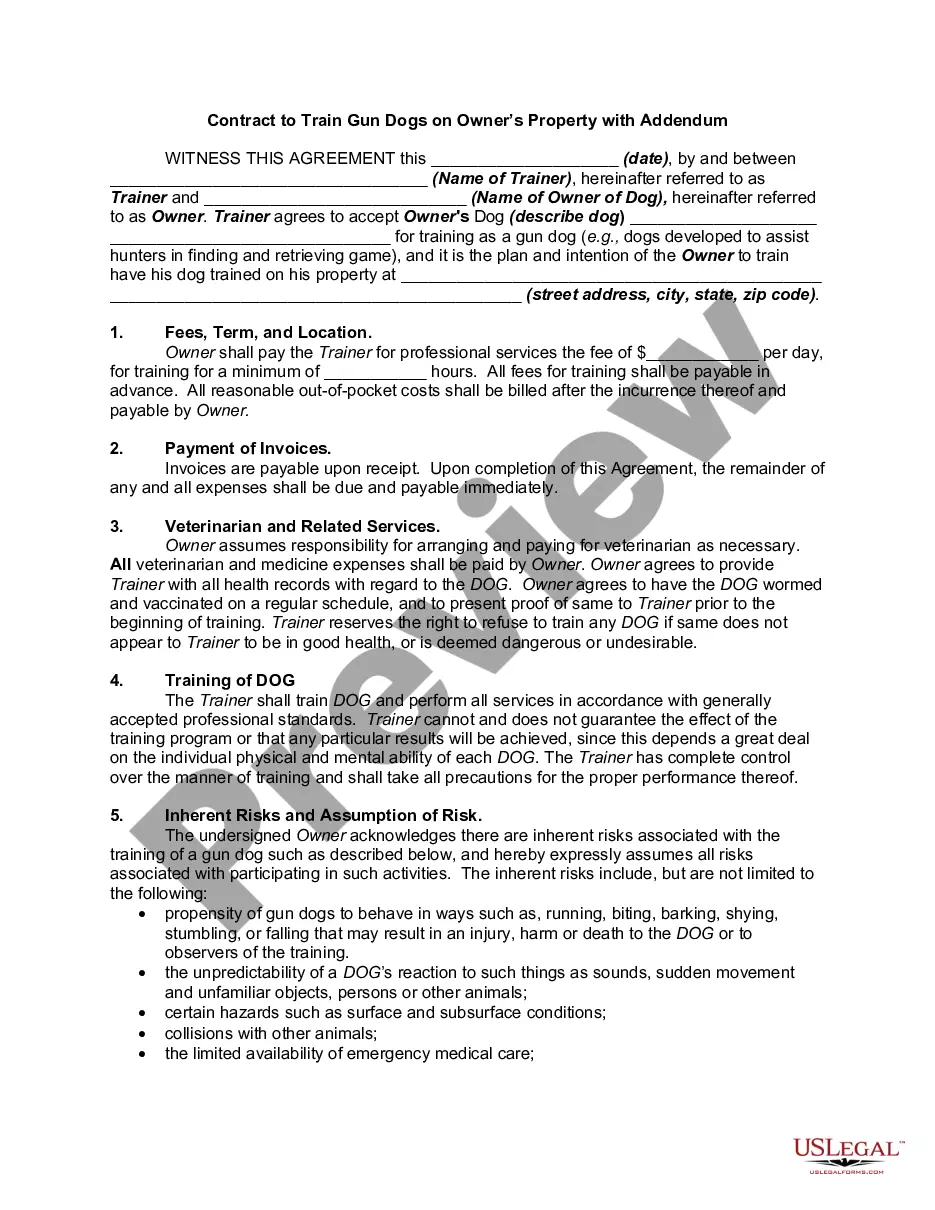

Dealing with legal forms is a necessity in today's world. However, you don't always need to seek professional help to draft some of them from the ground up, including Allegheny Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children, with a platform like US Legal Forms.

US Legal Forms has more than 85,000 forms to select from in different types varying from living wills to real estate paperwork to divorce papers. All forms are organized based on their valid state, making the searching experience less overwhelming. You can also find detailed resources and guides on the website to make any tasks associated with paperwork execution straightforward.

Here's how to locate and download Allegheny Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children.

- Go over the document's preview and outline (if available) to get a general idea of what you’ll get after downloading the form.

- Ensure that the template of your choice is specific to your state/county/area since state laws can affect the validity of some records.

- Examine the related forms or start the search over to find the right document.

- Hit Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a suitable payment gateway, and purchase Allegheny Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children.

- Choose to save the form template in any offered format.

- Visit the My Forms tab to re-download the document.

If you're already subscribed to US Legal Forms, you can find the appropriate Allegheny Revocable Trust for Lifetime Benefit of Trustor, Lifetime Benefit of Surviving Spouse after Trustor's Death with Trusts for Children, log in to your account, and download it. Needless to say, our platform can’t take the place of an attorney entirely. If you have to deal with an exceptionally complicated situation, we recommend using the services of an attorney to examine your form before executing and submitting it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Become one of them today and purchase your state-compliant paperwork effortlessly!