A Chicago Illinois Irrevocable Trust, also known as a Qualifying Subchapter-S Trust, is a legal arrangement used for estate planning purposes. It provides individuals with a means to protect and distribute their assets according to their wishes, while offering potential tax advantages. This type of trust is specifically designed to qualify as a Subchapter S corporation shareholder, allowing it to receive shares of stock and enjoy certain tax benefits associated with this status. One significant benefit of establishing a Chicago Illinois Irrevocable Trust as a Qualifying Subchapter-S Trust is the potential to reduce the impact of estate taxes. In comparison to a traditional trust, the assets held within this trust are not considered part of the granter's estate, thereby minimizing the tax liability upon their passing. This arrangement can be particularly advantageous for individuals with sizable estates. Several subtypes of Chicago Illinois Irrevocable Trusts fall under the Qualifying Subchapter-S Trust category, each tailored to specific needs or circumstances. Some of these include: 1. Charitable Remainder Trust (CRT): This type of trust allows the granter to donate assets while still retaining an income stream from those assets. At the end of a specified period or upon the granter's passing, the remaining assets are transferred to a designated charitable organization. 2. Special Needs Trust: This trust is designed to provide financial support for individuals with special needs or disabilities. It allows for the management and distribution of assets in a way that ensures continued government benefits eligibility for the beneficiary. 3. Irrevocable Life Insurance Trust (IIT): Slits are commonly used to exclude life insurance proceeds from the taxable estate. This type of trust enables the granter's life insurance policy to be owned by the trust, bypassing estate taxes and offering potential liquidity to cover estate tax obligations. 4. Dynasty Trust: A Dynasty Trust is established to protect and provide financial support to multiple generations of a family. By holding assets within this trust, the granter can ensure their intended beneficiaries benefit from the assets' growth, while minimizing estate taxes. 5. Granter Retained Annuity Trust (GREAT): This trust allows the granter to transfer assets while retaining an annuity payment stream for a specified period. At the end of the term, the remaining assets are passed on to the designated beneficiaries, potentially reducing gift and estate tax liabilities. It is essential to consult with a qualified estate planning attorney or financial advisor to determine which type of Chicago Illinois Irrevocable Trust, including those classified as Qualifying Subchapter-S Trusts, best suits your unique needs and goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Fideicomiso irrevocable que es un fideicomiso calificado del Subcapítulo S - Irrevocable Trust which is a Qualifying Subchapter-S Trust

Description

How to fill out Chicago Illinois Fideicomiso Irrevocable Que Es Un Fideicomiso Calificado Del Subcapítulo S?

A document routine always goes along with any legal activity you make. Staring a company, applying or accepting a job offer, transferring ownership, and many other life scenarios require you prepare official documentation that differs throughout the country. That's why having it all collected in one place is so helpful.

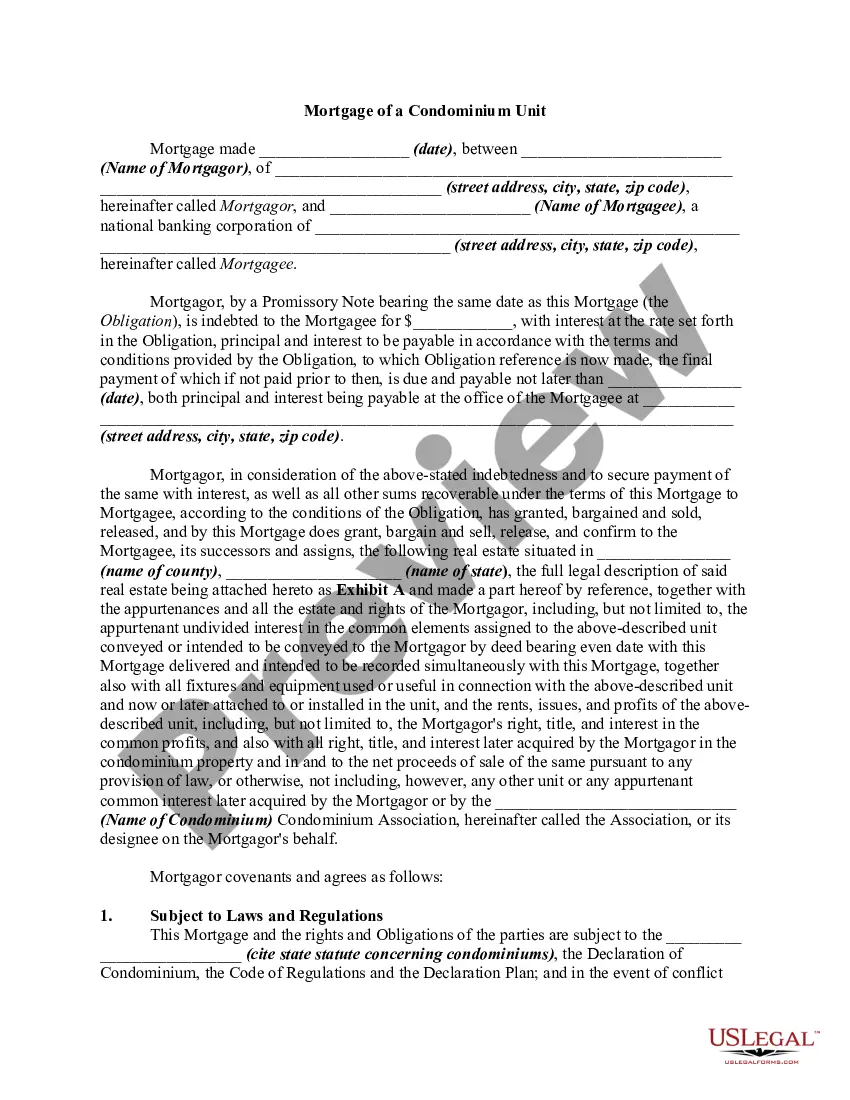

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. Here, you can easily find and get a document for any personal or business purpose utilized in your region, including the Chicago Irrevocable Trust which is a Qualifying Subchapter-S Trust.

Locating forms on the platform is remarkably simple. If you already have a subscription to our library, log in to your account, find the sample through the search bar, and click Download to save it on your device. Following that, the Chicago Irrevocable Trust which is a Qualifying Subchapter-S Trust will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guide to get the Chicago Irrevocable Trust which is a Qualifying Subchapter-S Trust:

- Ensure you have opened the right page with your localised form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form meets your requirements.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the suitable subscription plan, then log in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to proceed.

- Choose file format and save the Chicago Irrevocable Trust which is a Qualifying Subchapter-S Trust on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!