Cook Illinois Irrevocable Trust is a type of trust that falls under the category of a Qualifying Subchapter-S Trust (SST). This trust is specifically created in accordance with the tax regulations outlined in Subchapter S of the Internal Revenue Code. The Cook Illinois Irrevocable Trust takes advantage of the benefits and tax treatment available to trusts that are classified as Costs. As an Irrevocable Trust, it is important to note that once this trust is established, its terms and provisions cannot be altered or revoked by the granter. This means that the assets and property transferred into the trust become separate from the granter's personal estate and are managed by a trustee, who has the duty to administer the trust in accordance with the trust document and the law. The Cook Illinois Irrevocable Trust is designed to provide specific tax advantages to the beneficiaries. By electing to be classified as an SST, the trust can be an eligible shareholder in an S corporation without negatively impacting its tax treatment. This means that the trust and its beneficiaries can potentially enjoy various tax benefits, such as pass-through of income, deductions, and credits from the S corporation to the trust and ultimately to the beneficiaries. While there may not be different types of Cook Illinois Irrevocable Trusts that are specifically categorized as Costs by name, it is worth noting that there may be variations in specific terms and provisions based on the granter's preferences and objectives. Some trusts may have additional restrictions or conditions tailored to the unique circumstances of the granter and the intended beneficiaries. In summary, a Cook Illinois Irrevocable Trust is a specific type of Qualifying Subchapter-S Trust that allows for the tax-efficient administration and distribution of assets and income from an S corporation to its designated beneficiaries. By leveraging the benefits of being an SST, this trust ensures that taxable income is passed through to the beneficiaries, thus potentially reducing overall tax liabilities.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Fideicomiso irrevocable que es un fideicomiso calificado del Subcapítulo S - Irrevocable Trust which is a Qualifying Subchapter-S Trust

Description

How to fill out Cook Illinois Fideicomiso Irrevocable Que Es Un Fideicomiso Calificado Del Subcapítulo S?

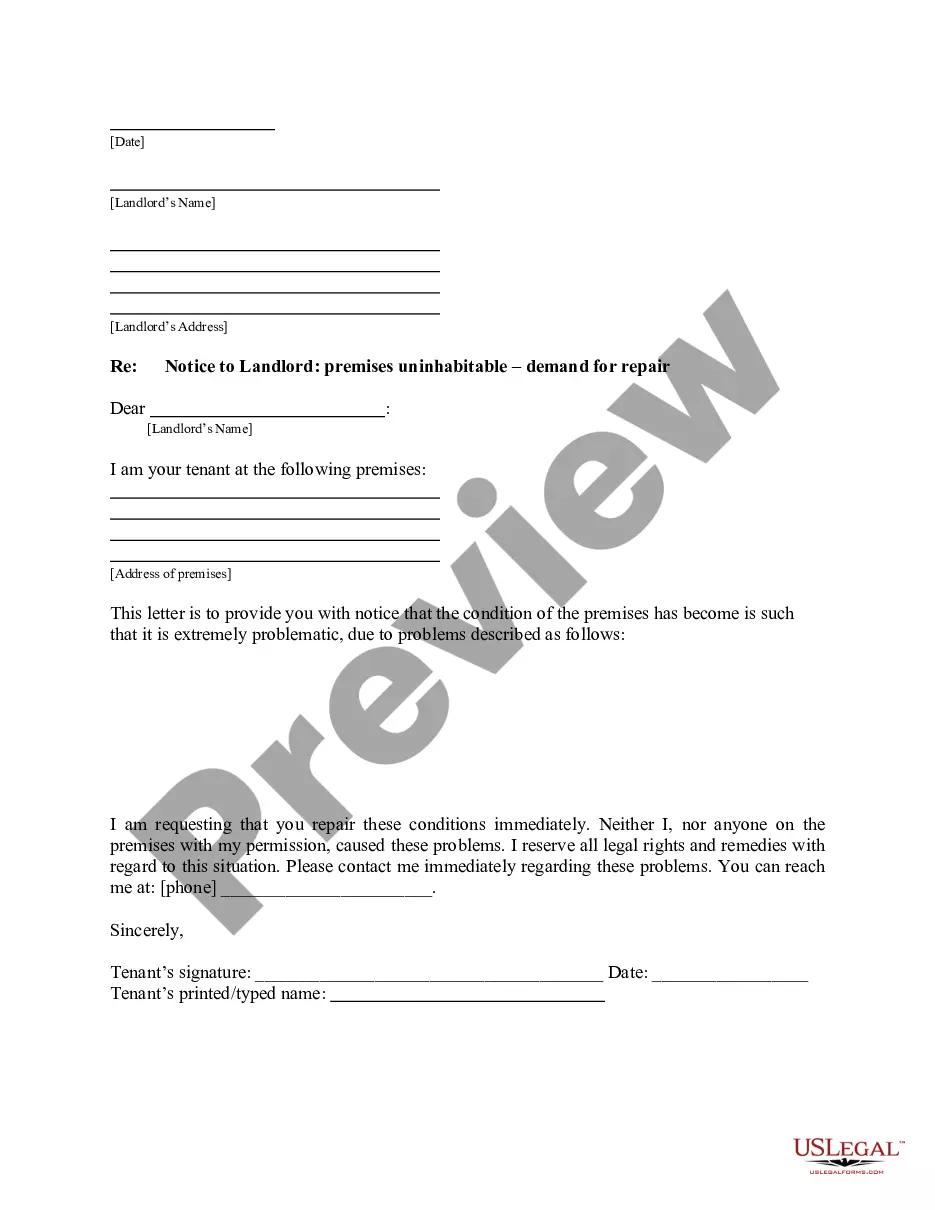

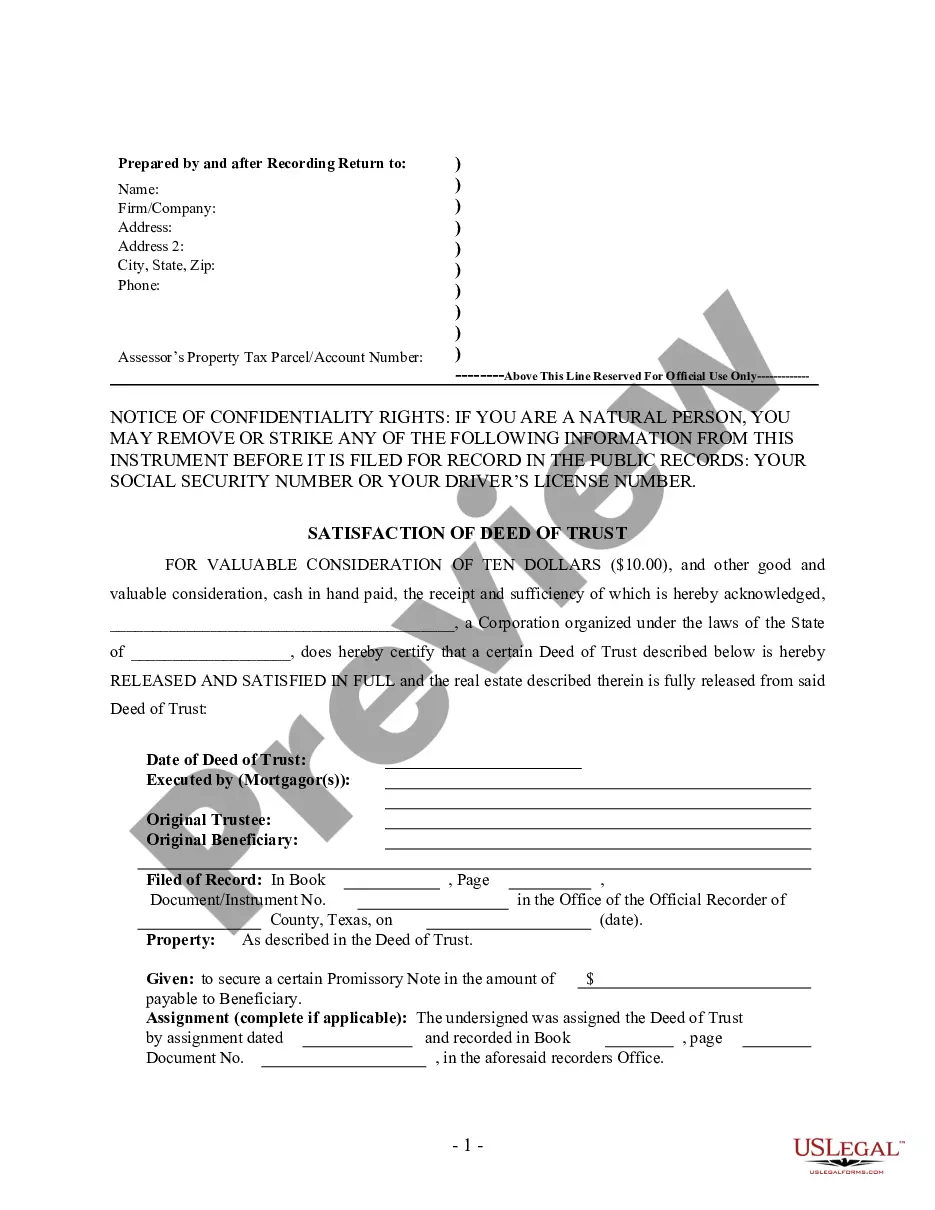

Draftwing forms, like Cook Irrevocable Trust which is a Qualifying Subchapter-S Trust, to manage your legal affairs is a tough and time-consumming process. A lot of situations require an attorney’s involvement, which also makes this task not really affordable. However, you can acquire your legal matters into your own hands and deal with them yourself. US Legal Forms is here to the rescue. Our website comes with over 85,000 legal documents created for different scenarios and life situations. We make sure each form is compliant with the regulations of each state, so you don’t have to be concerned about potential legal problems associated with compliance.

If you're already aware of our services and have a subscription with US, you know how easy it is to get the Cook Irrevocable Trust which is a Qualifying Subchapter-S Trust template. Go ahead and log in to your account, download the template, and customize it to your requirements. Have you lost your form? No worries. You can get it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new customers is fairly easy! Here’s what you need to do before getting Cook Irrevocable Trust which is a Qualifying Subchapter-S Trust:

- Ensure that your form is specific to your state/county since the regulations for writing legal documents may vary from one state another.

- Learn more about the form by previewing it or reading a quick intro. If the Cook Irrevocable Trust which is a Qualifying Subchapter-S Trust isn’t something you were looking for, then use the header to find another one.

- Log in or register an account to begin using our website and get the form.

- Everything looks good on your end? Click the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment information.

- Your template is good to go. You can go ahead and download it.

It’s an easy task to locate and purchase the appropriate document with US Legal Forms. Thousands of organizations and individuals are already benefiting from our extensive library. Subscribe to it now if you want to check what other perks you can get with US Legal Forms!