Lima, Arizona Irrevocable Trust: A Detailed Explanation of Qualifying Subchapter-S Trusts Keywords: Lima Arizona, Irrevocable Trust, Qualifying Subchapter-S Trust, types Description: A Lima Arizona Irrevocable Trust, which is classified as a Qualifying Subchapter-S Trust, refers to a type of trust established in accordance with the guidelines outlined in Subchapter S of the Internal Revenue Code (IRC). This type of trust structure offers numerous advantages for individuals and businesses seeking to minimize taxes, protect assets, and ensure a smooth transition of wealth. A Qualifying Subchapter-S Trust offers the opportunity to elect the Subchapter S tax treatment, typically utilized by small businesses and family-owned enterprises. The Subchapter S election allows the trust to bypass double taxation that typically occurs in a standard corporation as profits pass through to the trust beneficiaries' individual tax returns. There are several key types of Lima Arizona Irrevocable Trusts classified as Qualifying Subchapter-S Trusts: 1. Business Trust: Primarily established by entrepreneurs who wish to protect their company's assets, maintain control, and facilitate efficient succession planning. It offers liability protection while enjoying the benefits of Subchapter S taxation. 2. Insurance Trust: Commonly utilized to hold and manage life insurance policies for estate planning purposes, these trusts help beneficiaries avoid estate tax liabilities upon the insured person's passing. In this case, the trust is designated as the policy owner and beneficiary. 3. Charitable Remainder Trust: Created with the dual purpose of providing financial benefits to the trust beneficiaries while supporting charitable causes. Under the Subchapter S election, this trust structure allows the trust to pass income through to the beneficiaries, who are then responsible for the applicable taxes. 4. Asset Protection Trust: Designed to protect assets from potential creditors, this type of trust ensures that the assets held within the trust are safeguarded while enjoying the tax advantages offered by Subchapter S election. 5. Qualified Terminable Interest Property (TIP) Trust: Often used in estate planning, a TIP trust allows the granter to provide income to a surviving spouse while ensuring that the remaining assets ultimately pass to the predetermined beneficiaries. It is essential to consult with legal and tax professionals specializing in trusts to determine the most suitable type of Lima Arizona Irrevocable Trust, which is a Qualifying Subchapter-S Trust, based on specific personal or business needs. Detailed consideration of individual circumstances and goals will help ensure the selection of the most advantageous trust structure.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Pima Arizona Fideicomiso irrevocable que es un fideicomiso calificado del Subcapítulo S - Irrevocable Trust which is a Qualifying Subchapter-S Trust

Description

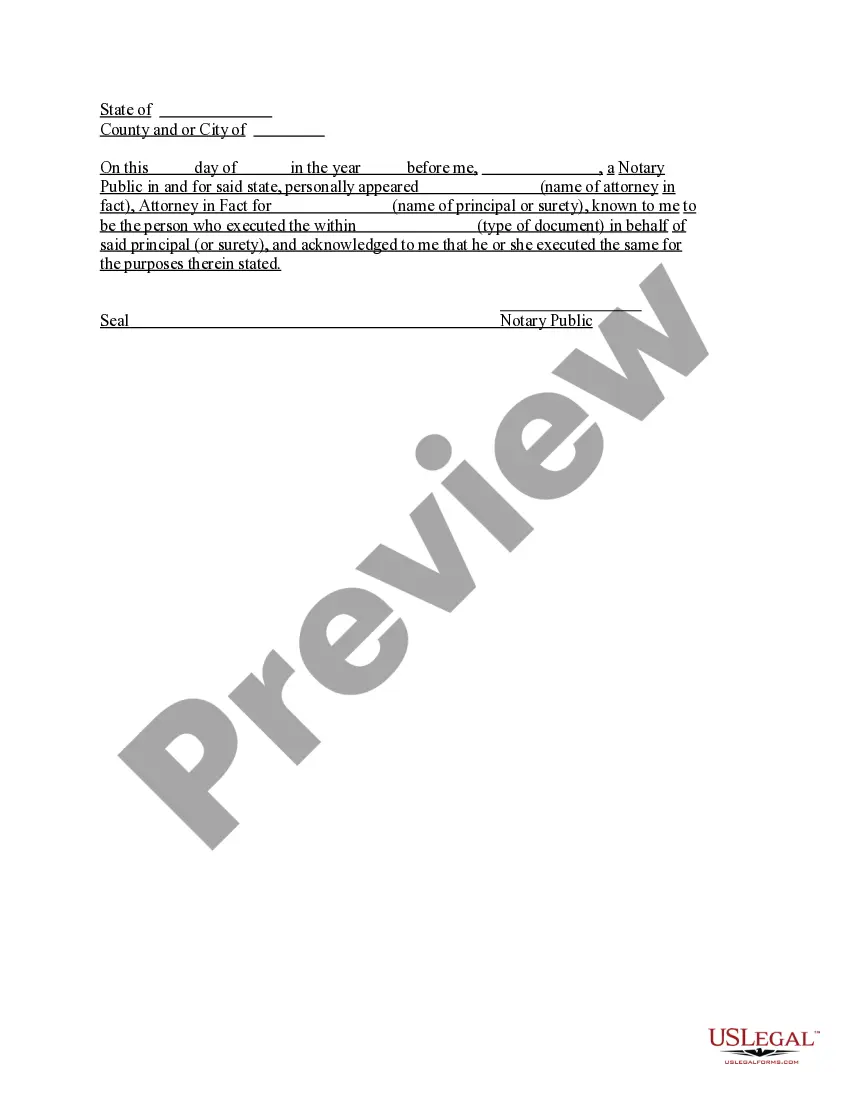

How to fill out Pima Arizona Fideicomiso Irrevocable Que Es Un Fideicomiso Calificado Del Subcapítulo S?

A document routine always accompanies any legal activity you make. Opening a business, applying or accepting a job offer, transferring ownership, and many other life situations require you prepare official paperwork that differs from state to state. That's why having it all accumulated in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and get a document for any individual or business purpose utilized in your county, including the Pima Irrevocable Trust which is a Qualifying Subchapter-S Trust.

Locating templates on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample using the search field, and click Download to save it on your device. Following that, the Pima Irrevocable Trust which is a Qualifying Subchapter-S Trust will be available for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, adhere to this quick guideline to obtain the Pima Irrevocable Trust which is a Qualifying Subchapter-S Trust:

- Make sure you have opened the proper page with your local form.

- Utilize the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Search for another document via the search tab in case the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Decide on the suitable subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Pima Irrevocable Trust which is a Qualifying Subchapter-S Trust on your device.

- Use it as needed: print it or fill it out electronically, sign it, and send where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!