Houston, Texas is a vibrant city known for its diverse cultural heritage, thriving economy, and excellent quality of life. Located in the southeastern part of the state, Houston is the most populous city in Texas and the fourth-largest in the United States. It serves as a major center for industries such as energy, healthcare, aerospace, and manufacturing. In relation to the legal field, a Houston Texas Qualifying Subchapter-S Revocable Trust Agreement refers to a specific type of trust agreement established under the guidelines of Subchapter S of the Internal Revenue Code. This type of trust is designed to preserve and transfer assets while providing certain tax advantages to the beneficiaries. A Qualifying Subchapter-S Revocable Trust Agreement in Houston, Texas enables individuals or entities to create a trust structure that qualifies for Subchapter S tax treatment. This means that the trust's income, losses, deductions, and credits can flow directly to the trust beneficiaries without being subject to separate taxation at the trust level. Instead, the beneficiaries report these items on their personal tax returns, potentially reducing their overall tax liability. It is important to note that these tax advantages are subject to certain eligibility requirements and restrictions. Different types of Houston Texas Qualifying Subchapter-S Revocable Trust Agreements may include: 1. Family Revocable Trust: This trust agreement is commonly used for estate planning purposes within a family, allowing for the smooth transfer of assets and wealth from one generation to the next while potentially minimizing tax consequences. 2. Irrevocable Life Insurance Trust (IIT): An IIT is a type of trust agreement that holds life insurance policies outside an individual's estate, thereby shielding the proceeds from estate taxes upon their passing. By qualifying under Subchapter S, beneficiaries may receive the insurance policy's death benefits tax-free. 3. Charitable Remainder Trust (CRT): A CRT is a trust agreement where assets are placed to generate income for a specified period, with the remainder going to a charitable organization. A Qualifying Subchapter-S Revocable Trust Agreement for a CRT provides tax benefits to both the donor and the charitable beneficiaries. In summary, a Houston Texas Qualifying Subchapter-S Revocable Trust Agreement allows individuals or entities in Houston, Texas to establish trusts that qualify for Subchapter S tax treatment. These agreements offer tax advantages and can be tailored to various purposes, such as estate planning, life insurance management, or charitable giving. It is recommended to seek legal advice from professionals experienced in trust law to determine the most suitable type of trust agreement for individual circumstances.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Acuerdo de Fideicomiso Revocable Subcapítulo-S Calificado - Qualifying Subchapter-S Revocable Trust Agreement

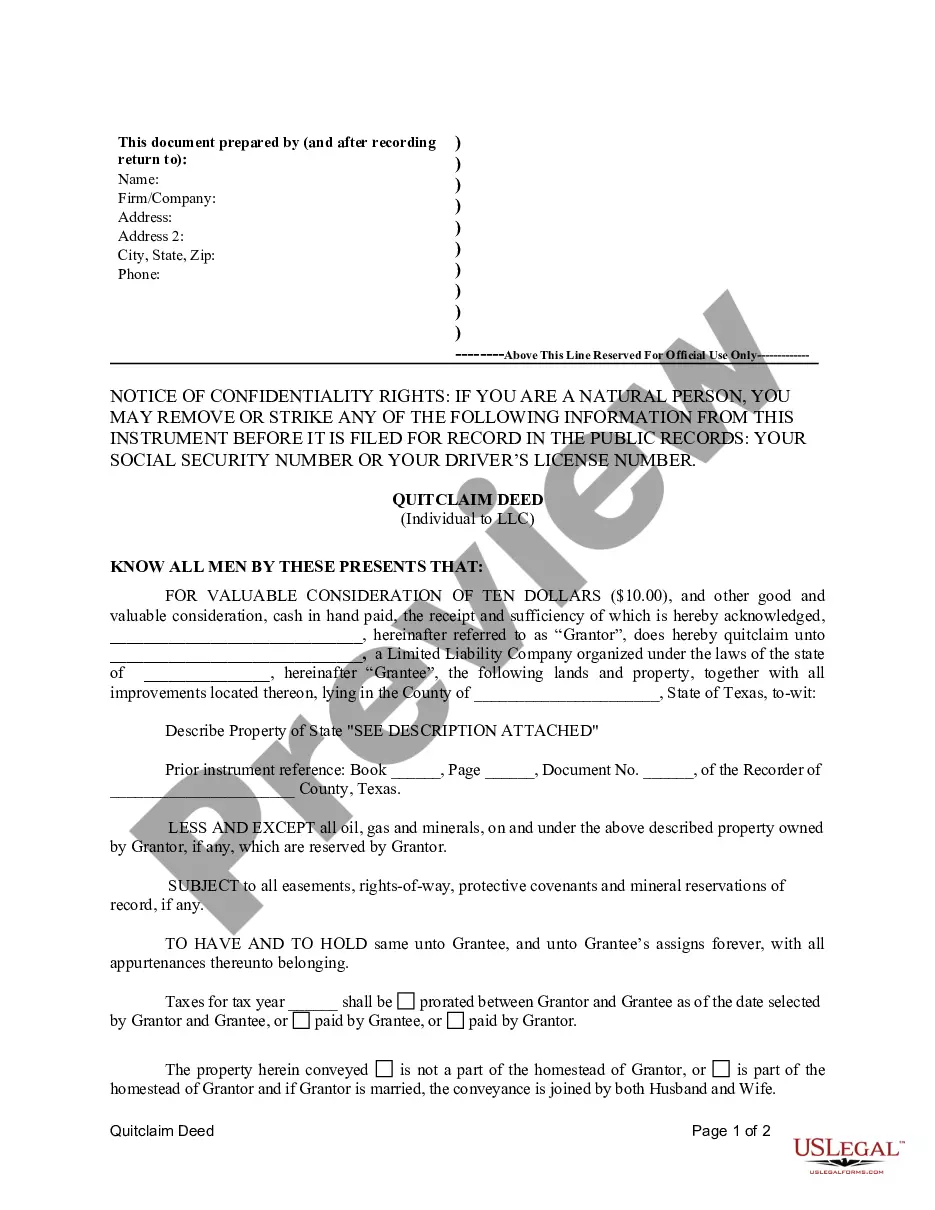

Description

How to fill out Houston Texas Acuerdo De Fideicomiso Revocable Subcapítulo-S Calificado?

A document routine always goes along with any legal activity you make. Opening a business, applying or accepting a job offer, transferring property, and lots of other life situations demand you prepare official documentation that varies throughout the country. That's why having it all collected in one place is so beneficial.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and download a document for any personal or business purpose utilized in your county, including the Houston Qualifying Subchapter-S Revocable Trust Agreement.

Locating templates on the platform is extremely simple. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. After that, the Houston Qualifying Subchapter-S Revocable Trust Agreement will be accessible for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to obtain the Houston Qualifying Subchapter-S Revocable Trust Agreement:

- Make sure you have opened the proper page with your regional form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form corresponds to your requirements.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to proceed.

- Opt for file format and save the Houston Qualifying Subchapter-S Revocable Trust Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most trustworthy way to obtain legal documents. All the samples available in our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs effectively with the US Legal Forms!