Phoenix Arizona Acuerdo de Fideicomiso Revocable Subcapítulo-S Calificado - Qualifying Subchapter-S Revocable Trust Agreement

Description

How to fill out Acuerdo De Fideicomiso Revocable Subcapítulo-S Calificado?

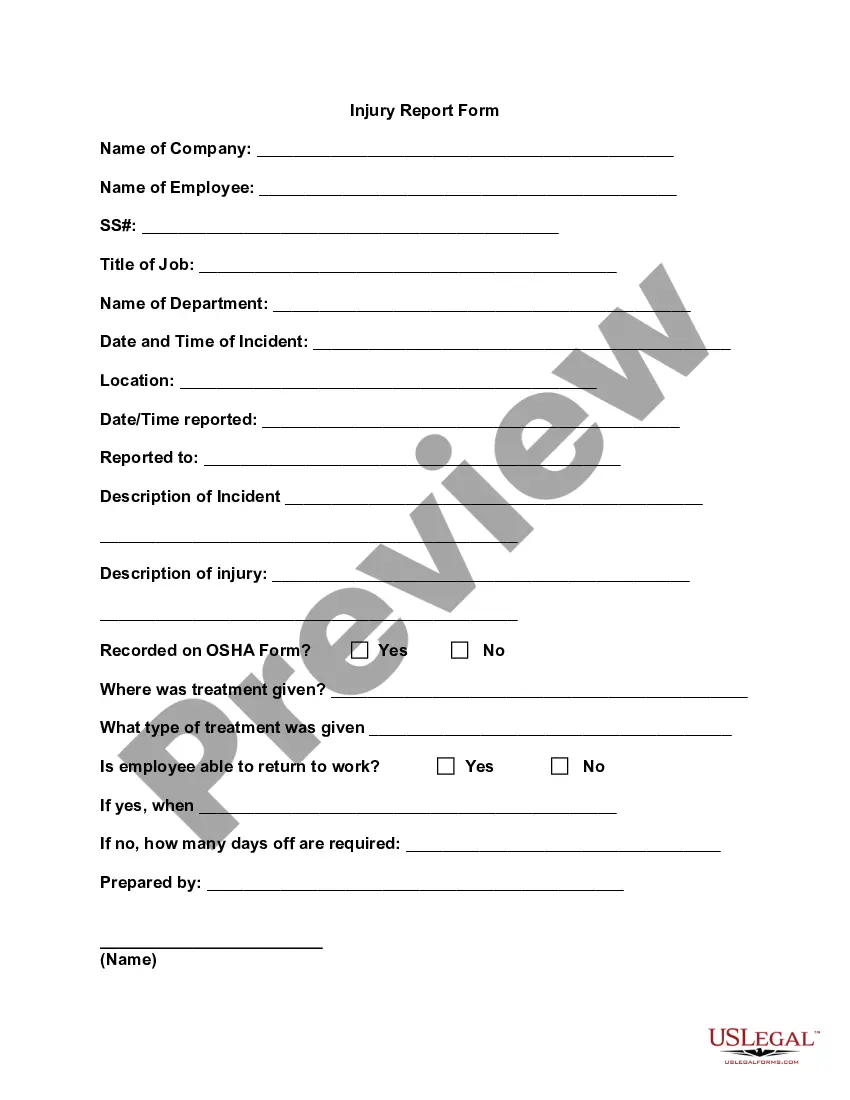

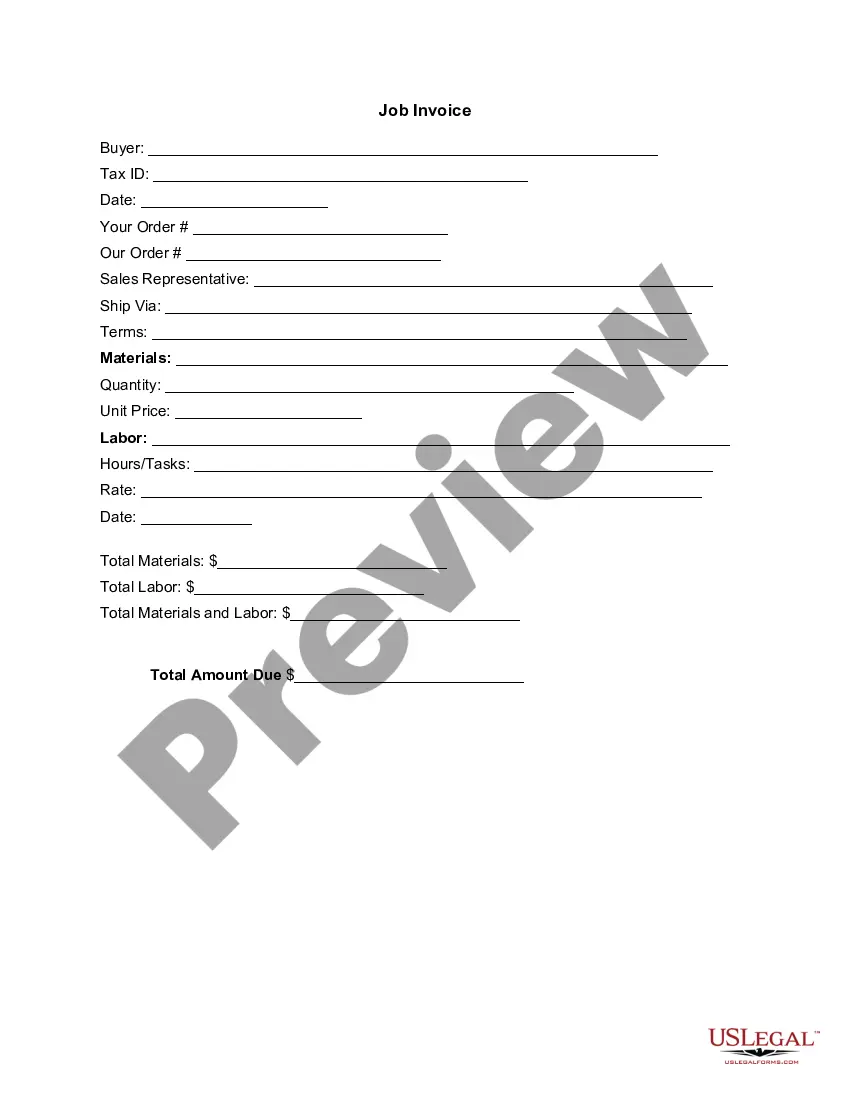

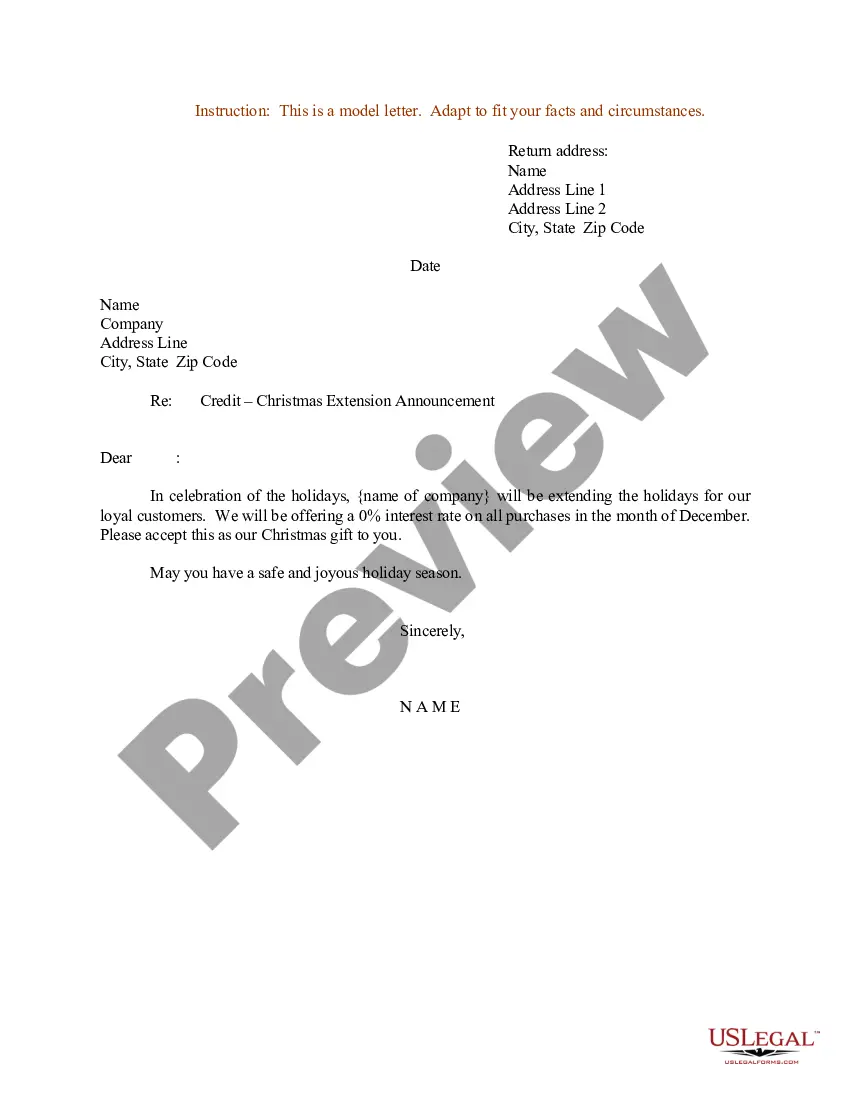

Are you seeking to swiftly compose a legally-enforceable Phoenix Qualifying Subchapter-S Revocable Trust Agreement or perhaps any other document to oversee your personal or corporate affairs.

You have two choices: employ a legal consultant to draft a legal document for you or construct it entirely by yourself. The positive aspect is, there's an alternative option - US Legal Forms. It will assist you in obtaining expertly crafted legal documents without incurring exorbitant costs for legal services.

If the document doesn’t match your expectations, start the search process again by using the search bar in the header.

Choose the plan that best suits your requirements and proceed to payment. Select the file format you prefer for your document and download it. Print it, fill it out, and sign on the designated line. If you have already created an account, you can conveniently Log In to it, find the Phoenix Qualifying Subchapter-S Revocable Trust Agreement template, and download it. To re-download the document, simply go to the My documents tab. It's easy to locate and download legal documents when you utilize our catalog. Moreover, the templates we offer are evaluated by legal experts, providing you with greater confidence when addressing legal matters. Experience US Legal Forms now and witness the difference!

- US Legal Forms offers an extensive assortment of over 85,000 state-specific document templates, including the Phoenix Qualifying Subchapter-S Revocable Trust Agreement and document bundles.

- We provide documents for a diverse range of life situations: from divorce papers to real estate document templates.

- We have been established for more than 25 years and have built a strong reputation among our clients.

- Here’s how you can join them and obtain the required template without additional hassles.

- First, make sure to thoroughly check if the Phoenix Qualifying Subchapter-S Revocable Trust Agreement complies with your state's or county's laws.

- If the form contains a description, ensure to confirm its intended purpose.

Form popularity

FAQ

Un testamento esta sujeto a una posible sucesion, un proceso judicial prolongado que es costoso y publico. Un fideicomiso no requiere revision ni aprobacion judicial, por lo que puede ahorrar dinero, tiempo y privacidad.

Un fideicomiso irrevocable tiene un otorgante, un fideicomisario y un beneficiario o beneficiarios. Una vez que el otorgante coloca un activo en un fideicomiso irrevocable, es un regalo para el fideicomiso y el otorgante no puede revocarlo.

REQUISITOS FIDEICOMISO CIVIL Escritura de la propiedad. Certificado de libertad y tradicion. Paz y salvo de impuestos de valorizacion. Si pertenece al regimen de Propiedad Horizontal, se necesita el paz y salvo de administracion. La solicitud especificando el plazo o condicion, y el beneficiario.

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

Un fideicomiso en vida revocable (conocido en ingles como un revocable living trust) es un documento legal que le da la autoridad para tomar decisiones sobre el dinero o los bienes de otra persona mantenidos en un fideicomiso.

Lo que le haria revocable es la posibilidad de que mientras A (el fideicomitente) viva, pueda modificar dicha disposicion. Los fideicomisos irrevocables, al contrario que los revocables, no pueden ser modificados una vez se haya inscrito la disposicion testamentaria o se haya perfeccionado el contrato.

¿Cuales Son Las Desventajas De Un Fideicomiso En Vida? No hay supervision judicial. Una de las ventajas del proceso de sucesion es que se cuenta con la proteccion de un tribunal.Es posible no financiar adecuadamente un fideicomiso en vida.Puede no ser tan bueno para patrimonios pequenos.

Fideicomiso Irrevocable El otorgante no puede cambiar el beneficiario o fideicomisario. Los activos ya no forman parte del patrimonio del otorgante. El otorgante ya no los posee. No incluido en la declaracion de impuestos del otorgante.

El fideicomiso es un acto juridico por medio del cual una persona entrega a otra la titularidad de unos activos para que los administre y, al vencimiento de un plazo, transmita los resultados a un tercero. Es una herramienta juridica muy utilizada en los negocios y para preservar los patrimonios familiares.