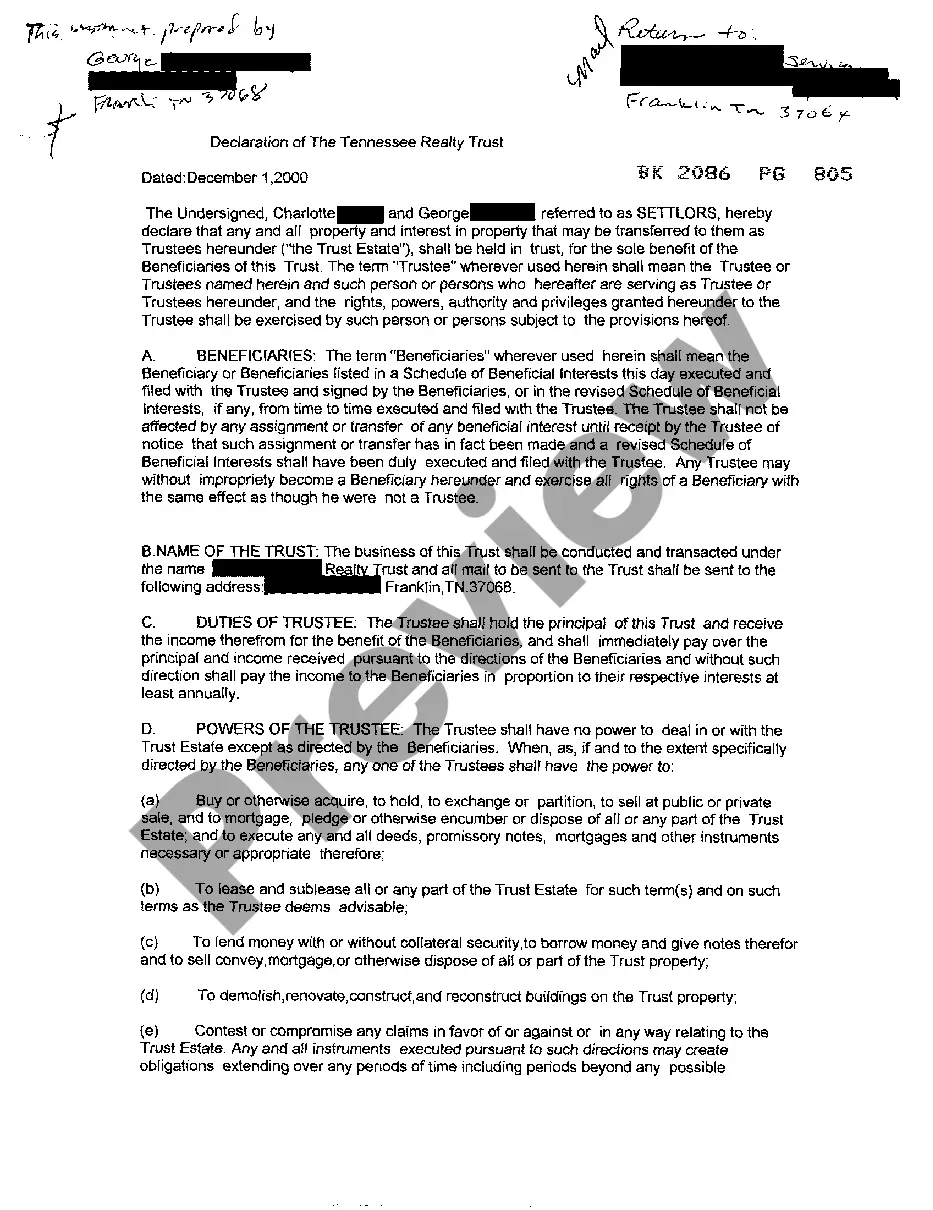

A San Diego California Qualifying Subchapter-S Revocable Trust Agreement is a legal document that establishes a trust in San Diego, California, which meets the requirements set forth by the Subchapter S of the Internal Revenue Code (IRC). This type of trust is commonly used for estate planning purposes, particularly to provide tax benefits for small family-owned businesses or closely-held corporations in San Diego. The Qualifying Subchapter-S Revocable Trust Agreement in San Diego allows for the creation of a trust that retains the flexibility of being revocable, meaning that the trust can be modified or terminated by the granter during their lifetime. In this agreement, the granter, typically the owner of a small business in San Diego, transfers assets into the trust, while retaining control over them. The trustee is responsible for managing these assets according to the terms and instructions outlined in the agreement. By qualifying as a Subchapter S trust, the trust income is treated similarly to that of an S corporation for tax purposes. This means that the trust itself doesn't pay income taxes; instead, the income generated by the trust is passed through to the beneficiaries or granter, who include it on their personal tax returns. This can result in significant tax advantages as income tax rates for individuals can be lower than those for trusts. It is important to note that there may be various types or variations of the San Diego California Qualifying Subchapter-S Revocable Trust Agreement, as every trust can be customized to meet the specific needs of the granter and their family. For instance, some trusts may be designed to provide asset protection, while others may focus on passing assets to future generations while minimizing estate taxes. Each trust agreement will have its own specific terms, provisions, and beneficiaries tailored to the granter's wishes. In summary, a San Diego California Qualifying Subchapter-S Revocable Trust Agreement is a legal document that creates a trust meeting the qualifications outlined by Subchapter S of the IRC. This type of trust offers tax benefits for small family-owned businesses or closely-held corporations in San Diego and can be customized to suit individual needs. By consulting with an experienced attorney or estate planner in San Diego, individuals can determine the most appropriate type of trust agreement for their specific circumstances and goals.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Acuerdo de Fideicomiso Revocable Subcapítulo-S Calificado - Qualifying Subchapter-S Revocable Trust Agreement

Description

How to fill out San Diego California Acuerdo De Fideicomiso Revocable Subcapítulo-S Calificado?

Preparing papers for the business or individual demands is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the particular area. Nevertheless, small counties and even cities also have legislative provisions that you need to consider. All these details make it burdensome and time-consuming to draft San Diego Qualifying Subchapter-S Revocable Trust Agreement without professional assistance.

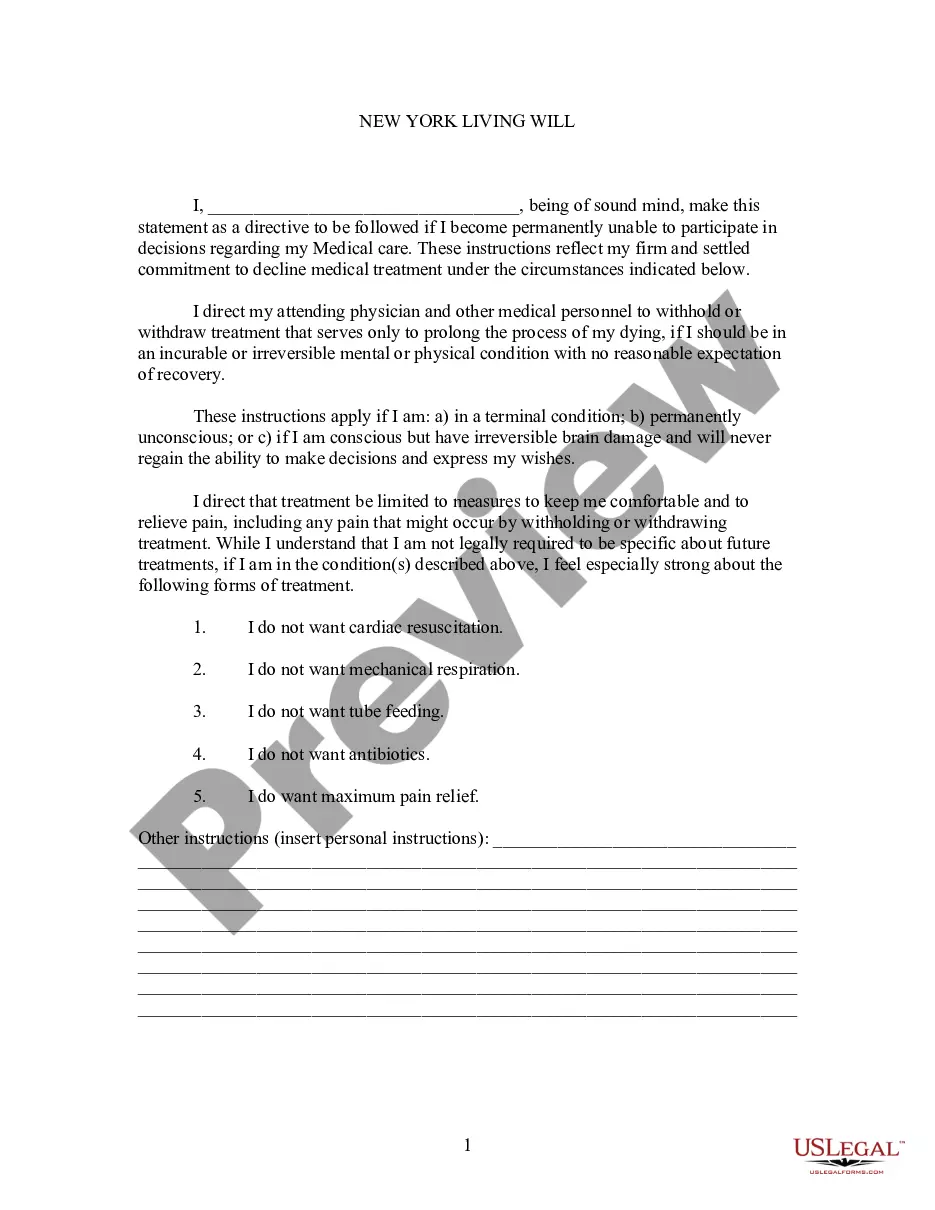

It's easy to avoid spending money on attorneys drafting your paperwork and create a legally valid San Diego Qualifying Subchapter-S Revocable Trust Agreement on your own, using the US Legal Forms online library. It is the biggest online catalog of state-specific legal documents that are professionally cheched, so you can be certain of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the required form.

If you still don't have a subscription, adhere to the step-by-step instruction below to obtain the San Diego Qualifying Subchapter-S Revocable Trust Agreement:

- Look through the page you've opened and verify if it has the document you need.

- To do so, use the form description and preview if these options are available.

- To find the one that suits your requirements, use the search tab in the page header.

- Double-check that the sample complies with juridical standards and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal forms for any use case with just a few clicks!

Form popularity

FAQ

Determinar cual es la finalidad que se desea realizar y seleccionar los bienes de los que desea disponer para lograrlo. Seleccionar quien sera el beneficiario. Elegir una institucion financiera para que se encargue de la administracion y pactar con la misma las condiciones de la administracion.

Es nulo el fideicomiso que se constituye a favor del fiduciario, salvo lo dispuesto en el parrafo siguiente, y en las demas disposiciones legales aplicables....El fideicomiso se extingue: Por la realizacion del fin para el cual fue constituido; Por hacerse este imposible;

En general, un fideicomiso es irrevocable porque el otorgante lo declara asi desde el principio o porque el fideicomitente de un fideicomiso revocable ha fallecido y ya no tiene facultad para modificar o revocar el fideicomiso.

La extincion del Fideicomiso, procede por las siguientes razones: 1. - Cumplimiento de los fines para los cuales fue constituido; 2. - Hacerse imposible su cumplimiento; 3. - Renuncia o muerte del Beneficiario sin tener sustituto; 4.

Cuando se ha comprobado que el fideicomitente constituyo el fideicomiso sobre la base de haber comprado los bienes, a enajenar, a la sociedad fiduciaria, bajo pacto de retroventa. Por la destruccion de la cosa. Cuando se comprueba que los bienes administrados se han destruido por completo, se extingue el fideicomiso.

El fideicomiso es un acto juridico por medio del cual una persona entrega a otra la titularidad de unos activos para que los administre y, al vencimiento de un plazo, transmita los resultados a un tercero. Es una herramienta juridica muy utilizada en los negocios y para preservar los patrimonios familiares.

Fideicomiso Revocable Un Fideicomiso que puede ser cambiado. Fideicomiso Irrevocable Un Fideicomiso que no puede ser cambiado.

Es un termino legal que se refiere a cualquier persona con propiedad, autoridad, posicion de confianza o responsabilidad sobre los bienes de otra persona. En consecuencia, este es una persona a quien se le permite realizar tareas de administracion sobre unos bienes sin lucrarse de ellos.

UN FIDEICOMISO ES: Una operacion mercantil mediante la cual una persona -fisica o moral- llamada fideicomitente, destina ciertos bienes a la realizacion de un fin licito determinado, encomendando esta a una Institucion de Credito (Art. 381 de la Ley General de Titulos y Operaciones de Credito).

Lo que le haria revocable es la posibilidad de que mientras A (el fideicomitente) viva, pueda modificar dicha disposicion. Los fideicomisos irrevocables, al contrario que los revocables, no pueden ser modificados una vez se haya inscrito la disposicion testamentaria o se haya perfeccionado el contrato.