Travis Texas Severance Agreement between Employee and College is a legally binding document that outlines the terms and conditions under which an employee's employment is terminated and provides certain benefits and protections to the employee in exchange for their agreement to release the college from any potential legal claims. This agreement serves as a tool to facilitate an amicable separation between the employee and college, protecting both parties' interests and ensuring a smooth transition. The specifics of the agreement may vary depending on the circumstances and the nature of the employment relationship. There are different types of Travis Texas Severance Agreements between Employee and College, depending on various factors such as the employee's position within the college, length of service, and the reason for termination. Some common types of agreements include: 1. Standard Severance Agreement: This is a generic agreement used when an employee's employment is terminated due to factors like downsizing, restructuring, or redundancy. It typically includes provisions related to the employee's final compensation, benefits continuation, references, and confidentiality. 2. Voluntary Severance Agreement: This type of agreement is mutually agreed upon when an employee voluntarily decides to leave the college. The terms of separation, including severance benefits and post-employment obligations, are negotiated by both parties. 3. Layoff Severance Agreement: In cases where the college needs to downsize or eliminate certain positions due to financial constraints, a layoff severance agreement comes into play. It outlines the terms of separation and provides the employee with severance payments and benefits. 4. Non-compete Severance Agreement: If an employee holds a critical position within the college and has access to sensitive information, a non-compete severance agreement may be added. This agreement restricts the employee from joining or starting a similar business or working for a competitor for a specified period. The Travis Texas Severance Agreement between Employee and College includes several key elements crucial to safeguard the rights and interests of both parties. These may include details regarding severance pay, continuation of benefits, release of claims, non-disparagement clauses, non-disclosure agreements, and any post-employment obligations. It is essential for both the employee and college to review and understand the terms and conditions of the agreement thoroughly before signing. Seeking legal advice is highly recommended ensuring that the agreement reflects the best interests of all involved parties and is compliant with relevant employment laws.

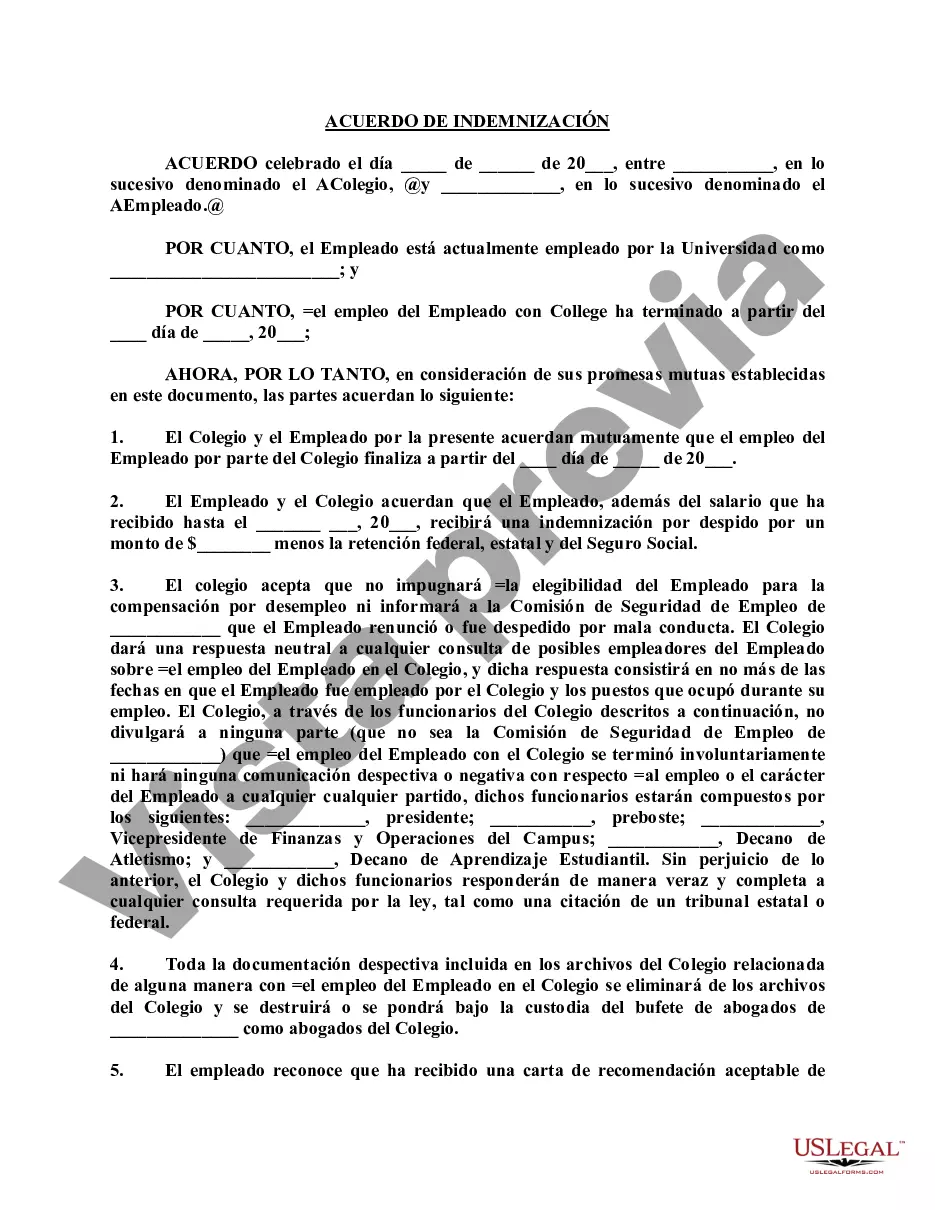

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Acuerdo de Cesantía entre Empleado y Colegio - Severance Agreement between Employee and College

Description

How to fill out Acuerdo De Cesantía Entre Empleado Y Colegio?

Drafting legal documents can be a cumbersome task.

Additionally, if you choose to hire an attorney to create a business agreement, documents for property title transfer, prenuptial contract, dissolution papers, or the Travis Severance Agreement between Employee and College, it could be very expensive.

Browse through the page and ensure there is a template available for your area.

- So what is the optimal method to conserve time and finances and create valid forms in complete accordance with your state and local statutes.

- US Legal Forms provides an excellent solution, whether you are looking for templates for personal or corporate purposes.

- US Legal Forms hosts the largest online repository of state-specific legal documents, offering users the latest and professionally vetted forms for various applications all in one location.

- Therefore, if you seek the most current version of the Travis Severance Agreement between Employee and College, you can easily find it on our platform.

- Acquiring the documents takes very little time.

- Users who already possess an account should confirm their subscription is active, Log In, and select the template via the Download button.

- If you have not yet subscribed, here is how to obtain the Travis Severance Agreement between Employee and College.

Form popularity

FAQ

Registrar en su Cuenta Individual un saldo insuficiente para financiar los pagos del seguro. Tener 12 cotizaciones registradas en el Fondo de Cesantia Solidario (FCS) en los 24 meses anteriores al despido. De estas cotizaciones, las 3 ultimas deben ser continuas y con un mismo empleador.

Las y los trabajadores independientes o por cuenta propia. Las personas menores de 18 anos. Las y los pensionados, excepto aquellas personas que estan pensionadas por invalidez parcial. Las y los trabajadores con contrato de aprendizaje.

Cesantias 2022: ¿como se calculan los intereses de esta prestacion social? Cesantias 12% dias trabajados / 360 = Intereses de cesantias. $ 2.250.000 12% 270 dias / 360 dias = $202.500.

Cesantias = Salario promedio dias trabajados / 360 dias.

¿A quienes no incluye el seguro de cesantia? A los trabajadores sujetos a contrato de aprendizaje, los menores de 18 anos de edad hasta que los cumplan y los pensionados, salvo que, en el caso de que la pension se hubiere otorgado por invalidez parcial. Tampoco rige para los trabajadores independientes.

Las cesantias corresponden a un salario mensual por cada ano trabajado, es decir que por cada 12 meses se paga un mes de salario, y de alli sale el 12, es decir, las cesantias corresponden a la doceava parte del salario anual (1/12), y 1/12 = 0.833%.

Las cesantias son un beneficio legal y prestacion, que una empresa o empleador debe pagar a sus trabajadores, a parte del salario ordinario. Este monto es equivalente a un mes de salario por cada ano trabajado del empleado.

El aporte anual del Estado es de 225.792 Unidades Tributarias Mensuales (UTM), depositadas en 12 cuotas en el Fondo de Cesantia Solidario, a traves de la Tesoreria General de la Republica.

Si una empresa no ha cumplido con las obligaciones legales del seguro de cesantia, no podra acceder a recursos fiscales de fomento productivo y tampoco a programas de capacitacion financiados por el Sence.

En estos casos, solo a el(la) empleador(a) le corresponde pagar un 4,11% de la remuneracion pactada en el contrato de trabajo, porcentaje que se divide en: 3% para el Seguro de Cesantia (2,2% para la Cuenta Individual de Cesantia y un 0,8% para el Fondo de Cesantia Solidario).