Title: Understanding the Oakland Michigan Partnership Agreement for LLP Introduction: The Oakland Michigan Partnership Agreement for Limited Liability Partnership (LLP) is a crucial legal document that governs the relationship between partners in a business venture operating as an LLP in Oakland County, Michigan. This agreement offers clarity and protects the interests of each partner involved. Keywords: Oakland Michigan, Partnership Agreement, LLP, Limited Liability Partnership, partners, business venture, relationship, legal document, Oakland County, interests. 1. Key Elements of the Oakland Michigan Partnership Agreement for LLP: — Formation and Purpose: Defines the purpose of the partnership and outlines the procedures for establishing the LLP in Oakland County, Michigan. — Partnership Contributions: Specifies the capital contributions, assets, and financial resources each partner brings into the LLP. — Profits and Losses: Describes how profits and losses are distributed among partners, outlining the ratio and method of allocation. — Management and Decision-making: Details the decision-making process, responsibilities, and authority of partners, including voting rights, roles, and obligations. — Partner Withdrawal or Retirement: Outlines the procedure for a partner's withdrawal, retirement, or transfer of ownership interest, including buyout provisions. — Dispute Resolution: Specifies the method for resolving conflicts, such as mediation, arbitration, or litigation, to minimize disputes among partners. — Dissolution and Winding Up: Outlines the steps to follow in case of LLP dissolution. This includes distribution of assets and payment of debts and obligations. Types of Oakland Michigan Partnership Agreements for LLP: 1. General Partnership Agreement for LLP: This agreement is suitable when partners in an LLP pool resources, share responsibilities and profits, and make joint decisions based on a mutual understanding and agreement. 2. Limited Partnership Agreement for LLP: In this agreement, there are two types of partners: general partners who manage the business and have unlimited liability, and limited partners who contribute capital but have limited liability and do not actively participate in management. 3. Silent Partnership Agreement for LLP: This agreement allows a partner to contribute capital and share in profits without actively participating in the LLP's management or decision-making process. Ensure to consult an experienced attorney familiar with Oakland County, Michigan, and its specific regulations to draft a comprehensive Oakland Michigan Partnership Agreement for LLP that aligns with the requirements and objectives of your business.

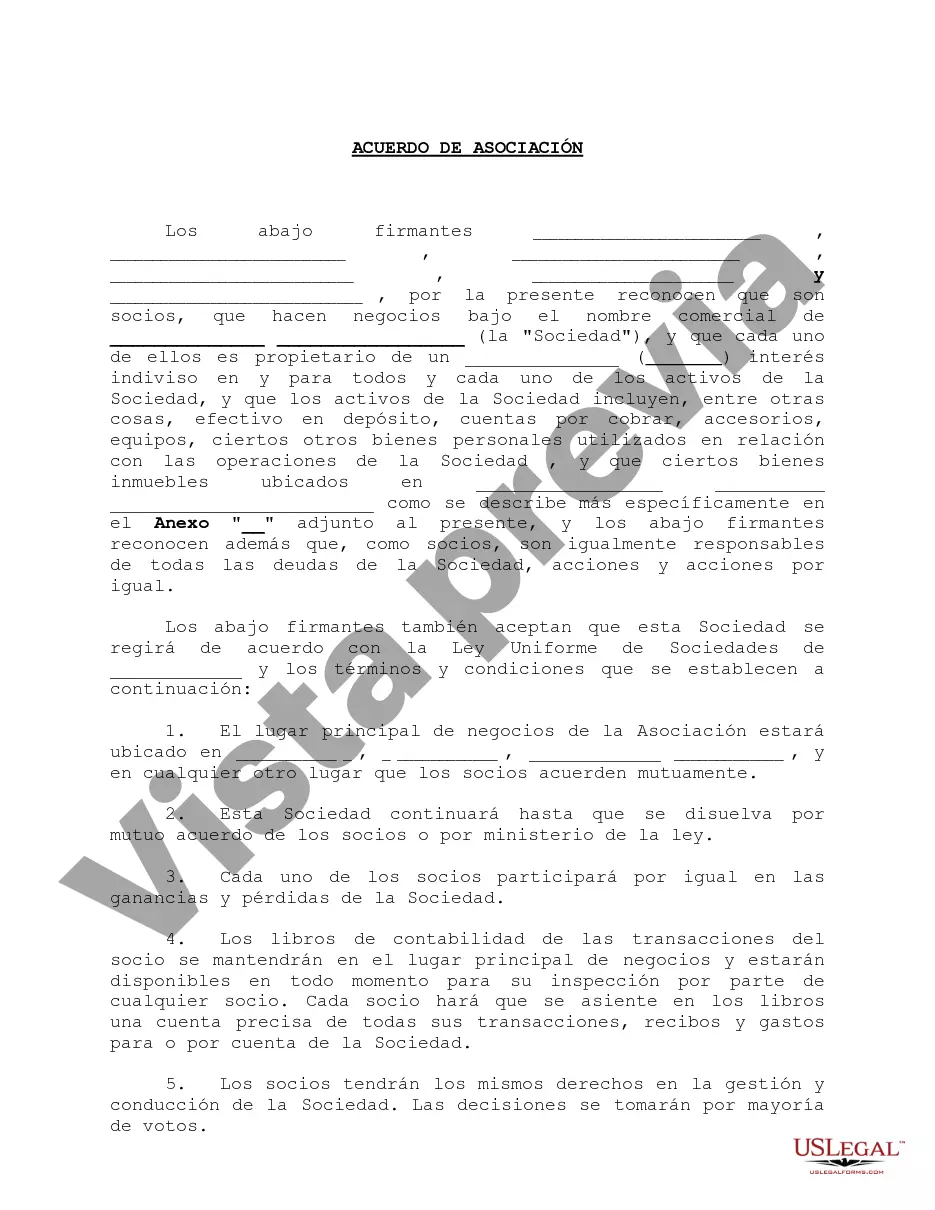

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Acuerdo de asociación para LLP - Partnership Agreement for LLP

Description

How to fill out Oakland Michigan Acuerdo De Asociación Para LLP?

How much time does it normally take you to draft a legal document? Because every state has its laws and regulations for every life situation, finding a Oakland Partnership Agreement for LLP meeting all local requirements can be stressful, and ordering it from a professional lawyer is often pricey. Many web services offer the most common state-specific templates for download, but using the US Legal Forms library is most beneficial.

US Legal Forms is the most extensive web collection of templates, collected by states and areas of use. In addition to the Oakland Partnership Agreement for LLP, here you can find any specific form to run your business or individual deeds, complying with your county requirements. Experts check all samples for their validity, so you can be certain to prepare your documentation correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, pick the needed form, and download it. You can get the document in your profile anytime in the future. Otherwise, if you are new to the website, there will be some extra actions to complete before you get your Oakland Partnership Agreement for LLP:

- Examine the content of the page you’re on.

- Read the description of the sample or Preview it (if available).

- Look for another form using the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Select the subscription plan that suits you most.

- Create an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Change the file format if needed.

- Click Download to save the Oakland Partnership Agreement for LLP.

- Print the sample or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can find all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!