The Hennepin Minnesota Partnership Agreement for Profit Sharing is a legal document that outlines the terms and conditions of profit distribution among partners in a business venture located in Hennepin County, Minnesota. This agreement is crucial in defining the rights, responsibilities, and financial arrangements between the partners involved. The following are some relevant details and keywords associated with different types of Hennepin Minnesota Partnership Agreement for Profit Sharing: 1. General Partnership Agreement: The general partnership agreement is established when two or more individuals decide to form a business venture, pooling their resources, skills, and expertise. This type of agreement ensures that profits and losses are shared proportionately among partners and stipulates the terms of the partnership's management, decision-making process, and exit strategies. 2. Limited Partnership Agreement: In a limited partnership agreement, there are two types of partners: general partners and limited partners. General partners assume full liability and actively manage the business. Limited partners, on the other hand, have limited liability and are not involved in the day-to-day operations. Profit sharing in this agreement is often based on a predetermined ratio agreed upon by the partners. 3. Limited Liability Partnership (LLP) Agreement: LAPS are suitable for professional firms such as law or accounting practices in Hennepin County. This agreement protects individual partners from being personally liable for each other's misconduct or negligence. Profit sharing can be determined based on various factors such as the amount of capital contributed or the level of involvement in business activities. 4. Joint Venture Agreement: A joint venture agreement is a partnership between two or more businesses for a specific project or period. This type of agreement allows companies to combine their resources and expertise while sharing the risks and rewards. Profit distribution can be allocated based on the contribution, effort, or pre-negotiated terms mentioned in the agreement. 5. Franchise Partnership Agreement: Franchise partnerships are formed when a franchisor grants a franchisee the rights to operate a business under their established brand. The profit-sharing terms in this agreement may include a percentage of the franchisee's gross sales or a fixed fee structure. This agreement also outlines the obligations, territory restrictions, and branding guidelines in Hennepin County. In summary, the Hennepin Minnesota Partnership Agreement for Profit Sharing defines the profit-sharing arrangements between partners in a business venture. It ensures clarity, transparency, and fairness in the distribution of profits while outlining the roles, responsibilities, and potential liabilities of each partner.

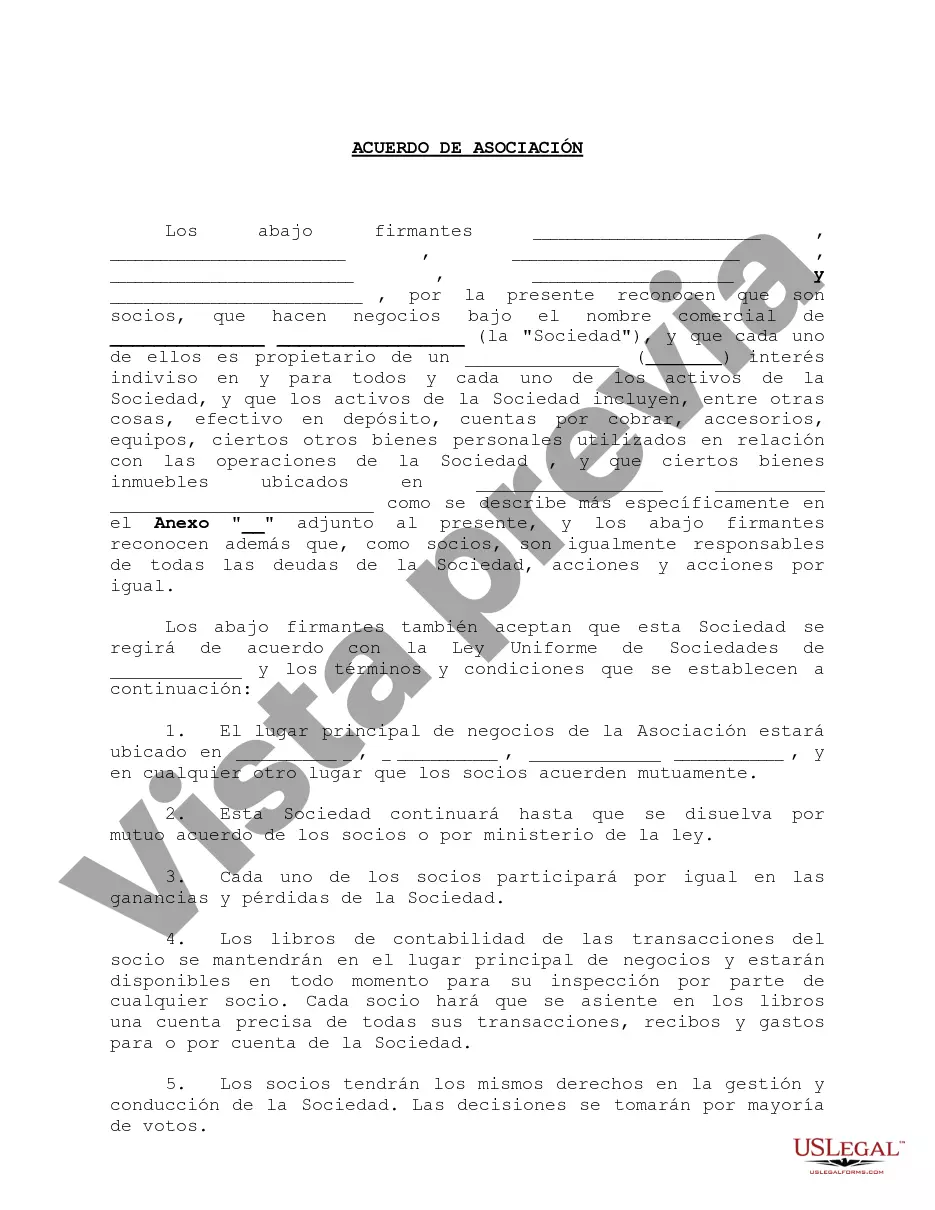

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Hennepin Minnesota Acuerdo de Asociación para el Reparto de Utilidades - Partnership Agreement for Profit Sharing

Description

How to fill out Hennepin Minnesota Acuerdo De Asociación Para El Reparto De Utilidades?

Laws and regulations in every sphere vary from state to state. If you're not an attorney, it's easy to get lost in various norms when it comes to drafting legal documents. To avoid costly legal assistance when preparing the Hennepin Partnership Agreement for Profit Sharing, you need a verified template valid for your county. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web catalog of more than 85,000 state-specific legal templates. It's an excellent solution for specialists and individuals searching for do-it-yourself templates for different life and business occasions. All the forms can be used multiple times: once you pick a sample, it remains accessible in your profile for subsequent use. Thus, when you have an account with a valid subscription, you can simply log in and re-download the Hennepin Partnership Agreement for Profit Sharing from the My Forms tab.

For new users, it's necessary to make a few more steps to get the Hennepin Partnership Agreement for Profit Sharing:

- Examine the page content to make sure you found the appropriate sample.

- Use the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your criteria.

- Utilize the Buy Now button to obtain the document when you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the easiest and most affordable way to get up-to-date templates for any legal scenarios. Find them all in clicks and keep your documentation in order with the US Legal Forms!