The Maricopa Arizona Partnership Agreement for Profit Sharing is a legal document that outlines the terms and conditions between two or more parties engaged in a business partnership in Maricopa, Arizona. This agreement is specifically designed for profit sharing purposes, ensuring that the profits generated by the partnership are fairly distributed among the partners. In this agreement, the partners determine the share of profits each one is entitled to based on their contribution to the partnership. The profit allocation can be determined in various ways, including a predetermined percentage, a ratio based on capital investment, or a combination of both. This ensures transparency and equity in the division of profits, avoiding any potential conflicts or disagreements among the partners. Furthermore, the Maricopa Arizona Partnership Agreement for Profit Sharing outlines the rights and responsibilities of each partner within the partnership. It includes details on the decision-making process, governance structure, and individual partner's authority to bind the partnership. This agreement also addresses matters concerning the addition or withdrawal of partners, dispute resolution mechanisms, and any necessary restrictions or limitations on partner activities. Types of Maricopa Arizona Partnership Agreement for Profit Sharing: 1. General Partnership Agreement for Profit Sharing: This type of partnership agreement is suitable for businesses where all partners are actively involved, sharing equally in the management and decision-making process. Profits and losses are distributed proportionally among the partners, based on their agreed upon share. 2. Limited Partnership Agreement for Profit Sharing: Ideal for businesses with both general partners who actively manage the business and limited partners who provide capital but have no role in day-to-day operations. In this agreement, profits are distributed based on the terms established by the partners in a written agreement. 3. Limited Liability Partnership Agreement for Profit Sharing: This agreement is specifically designed for professional service firms, where partners have limited personal liability for the actions of other partners. Profit sharing is determined either equally among partners or based on a predetermined formula outlined in the agreement. 4. Joint Venture Partnership Agreement for Profit Sharing: This agreement is suitable for two or more businesses that come together for a specific project or purpose. Profit sharing can be based on the contribution of resources, skills, or other agreed-upon criteria for the project, ensuring a fair distribution of profits among the joint venture partners. In conclusion, the Maricopa Arizona Partnership Agreement for Profit Sharing is a crucial legal document for businesses in Maricopa, Arizona, that outlines the terms and conditions surrounding profit distribution among partners. Whether it is a general partnership, limited partnership, limited liability partnership, or joint venture partnership, this agreement ensures transparency and fairness in the division of profits and lays the foundation for a successful and harmonious partnership.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Maricopa Arizona Acuerdo de Asociación para el Reparto de Utilidades - Partnership Agreement for Profit Sharing

Description

How to fill out Maricopa Arizona Acuerdo De Asociación Para El Reparto De Utilidades?

Creating legal forms is a must in today's world. However, you don't always need to seek professional help to draft some of them from scratch, including Maricopa Partnership Agreement for Profit Sharing, with a service like US Legal Forms.

US Legal Forms has over 85,000 forms to select from in various categories varying from living wills to real estate papers to divorce papers. All forms are organized according to their valid state, making the searching experience less overwhelming. You can also find information resources and guides on the website to make any activities related to paperwork execution straightforward.

Here's how you can find and download Maricopa Partnership Agreement for Profit Sharing.

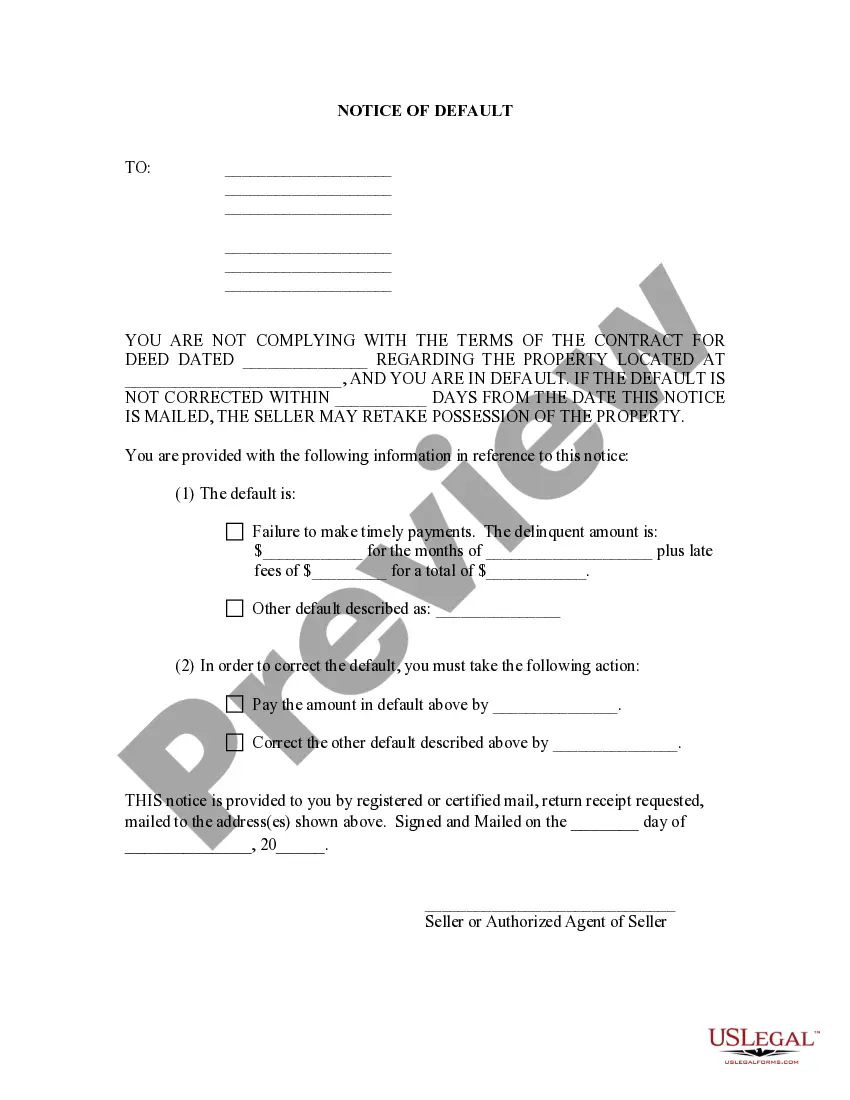

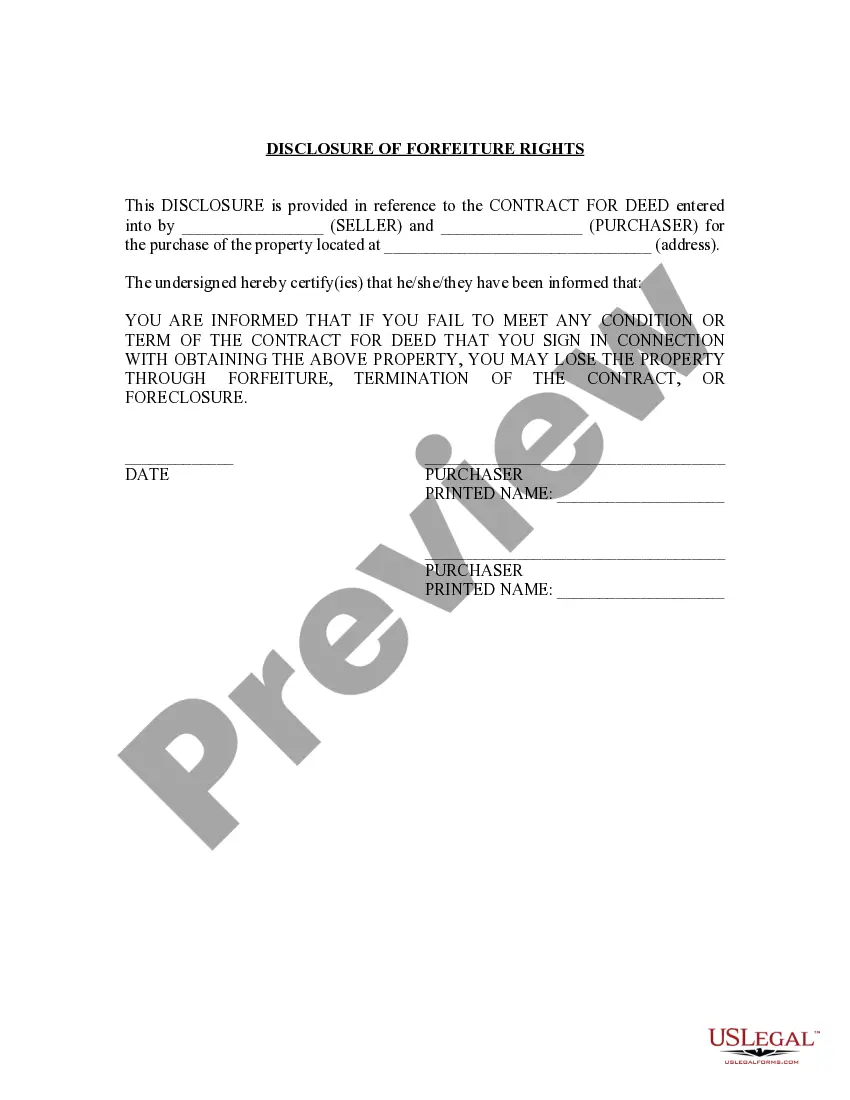

- Take a look at the document's preview and outline (if provided) to get a basic idea of what you’ll get after downloading the form.

- Ensure that the template of your choice is adapted to your state/county/area since state laws can impact the legality of some records.

- Examine the similar document templates or start the search over to locate the appropriate file.

- Click Buy now and register your account. If you already have an existing one, select to log in.

- Pick the option, then a needed payment gateway, and buy Maricopa Partnership Agreement for Profit Sharing.

- Select to save the form template in any available file format.

- Go to the My Forms tab to re-download the file.

If you're already subscribed to US Legal Forms, you can locate the needed Maricopa Partnership Agreement for Profit Sharing, log in to your account, and download it. Of course, our platform can’t take the place of an attorney entirely. If you need to deal with an extremely difficult situation, we recommend getting a lawyer to review your document before signing and filing it.

With more than 25 years on the market, US Legal Forms proved to be a go-to platform for various legal forms for millions of users. Join them today and get your state-compliant paperwork with ease!