A Phoenix Arizona partnership agreement for profit sharing is a legal document that outlines the terms and conditions under which partners in a business venture agree to share profits. This agreement provides a framework for how profits will be distributed among partners and serves as a basis for setting expectations, avoiding disputes, and ensuring fairness in profit allocation. In Phoenix, Arizona, there are different types of partnership agreements for profit sharing, each catering to specific business needs and entities: 1. General Partnership Agreement: This is the most common form of partnership, where all partners have equal rights and responsibilities in managing the business and sharing profits. The partnership agreement outlines the percentage of profit each partner will receive based on their capital contributions or a predetermined agreement. 2. Limited Partnership Agreement: In a limited partnership, there are both general partners who have unlimited liability and participate in the day-to-day operations, as well as limited partners who only contribute capital and share in the profits accordingly. The profit sharing terms are typically defined in the partnership agreement. 3. Limited Liability Partnership (LLP) Agreement: Laps offer limited liability protection to partners while allowing them to actively participate in managing the business. Profit sharing terms are agreed upon in the LLP agreement, typically based on the partner's contribution or as per an agreed-upon formula. 4. Joint Venture Agreement: A joint venture is formed when two or more parties agree to collaborate on a specific project or business venture. The partners share profits based on the terms agreed upon in the joint venture agreement, which may consider capital investment, effort, or any other agreed-upon criteria. 5. Nonprofit Partnership Agreement: Nonprofit organizations may form partnerships to collaborate on achieving shared goals. The profit sharing aspect in nonprofit partnerships typically revolves around surplus funds or assets generated by the partnership, which are reinvested for furthering their mission rather than being distributed to the partners. In any of these partnership agreements, the profit sharing terms are crucial. They may be based on the partners' capital contribution, active involvement, or a combination of factors. The agreement should also address contingencies, such as how profits will be divided in the event of a partner's departure or dissolution of the partnership. Partnerships in Phoenix, Arizona, should consult legal professionals to tailor their partnership agreement for profit sharing to ensure compliance with local laws and regulations. It is important to include relevant clauses regarding profit allocation, partner rights, dispute resolution, and other important aspects to safeguard the interests of all involved parties.

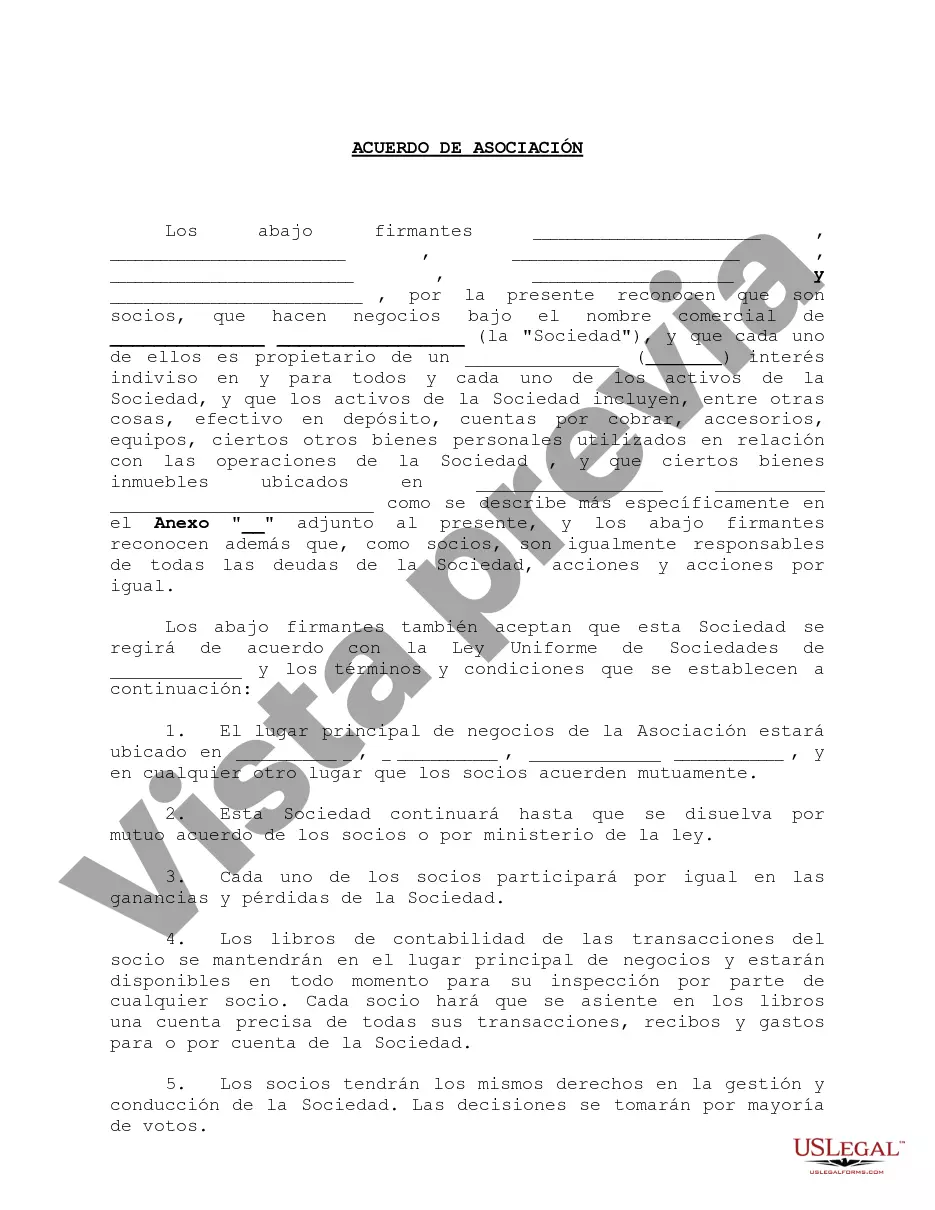

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Phoenix Arizona Acuerdo de Asociación para el Reparto de Utilidades - Partnership Agreement for Profit Sharing

Description

How to fill out Phoenix Arizona Acuerdo De Asociación Para El Reparto De Utilidades?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring ownership, and lots of other life scenarios require you prepare formal documentation that varies from state to state. That's why having it all collected in one place is so beneficial.

US Legal Forms is the most extensive online library of up-to-date federal and state-specific legal forms. Here, you can easily find and download a document for any individual or business purpose utilized in your region, including the Phoenix Partnership Agreement for Profit Sharing.

Locating templates on the platform is extremely simple. If you already have a subscription to our library, log in to your account, find the sample through the search field, and click Download to save it on your device. Following that, the Phoenix Partnership Agreement for Profit Sharing will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guide to get the Phoenix Partnership Agreement for Profit Sharing:

- Ensure you have opened the correct page with your regional form.

- Make use of the Preview mode (if available) and browse through the template.

- Read the description (if any) to ensure the form meets your requirements.

- Look for another document via the search tab if the sample doesn't fit you.

- Click Buy Now when you find the required template.

- Decide on the appropriate subscription plan, then sign in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Phoenix Partnership Agreement for Profit Sharing on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal paperwork. All the templates provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!