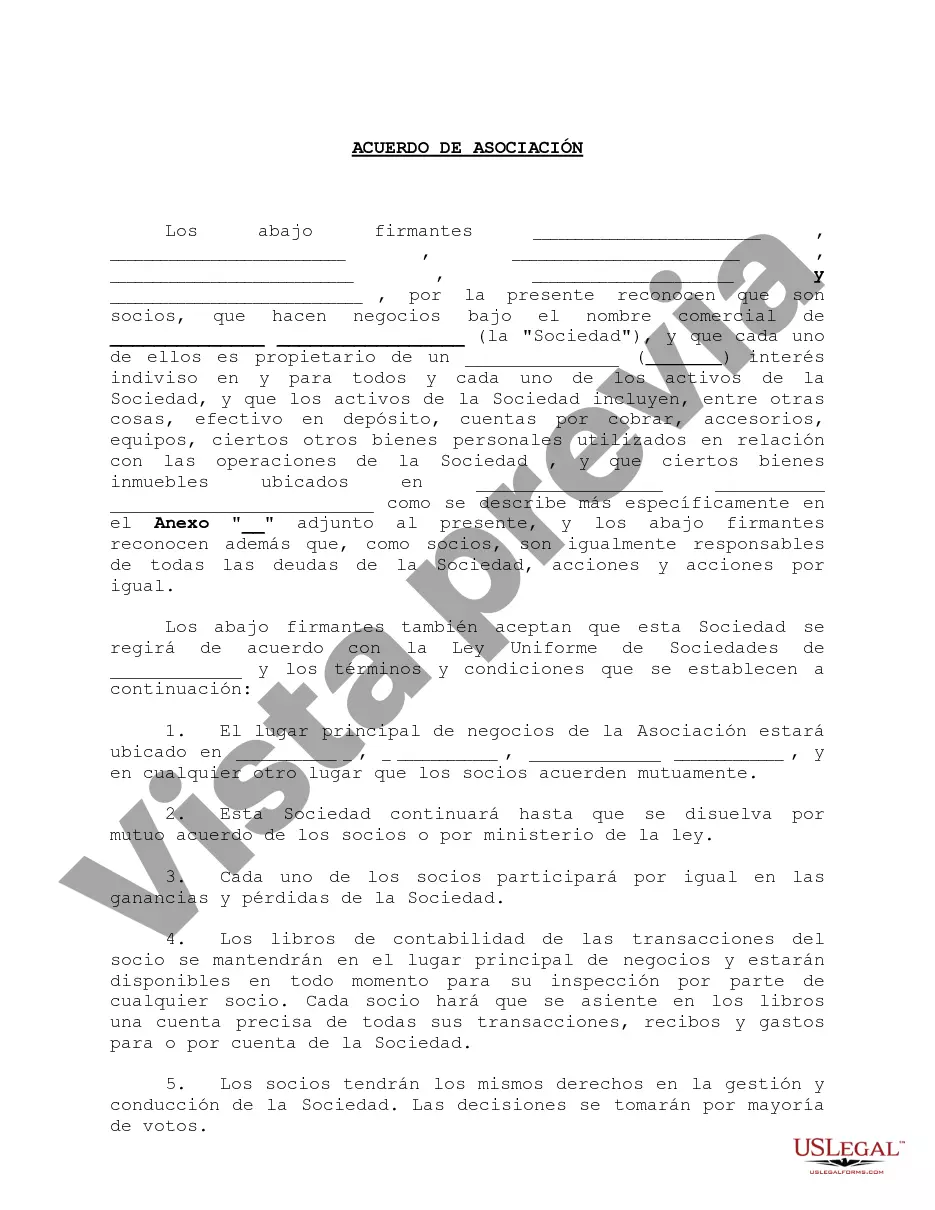

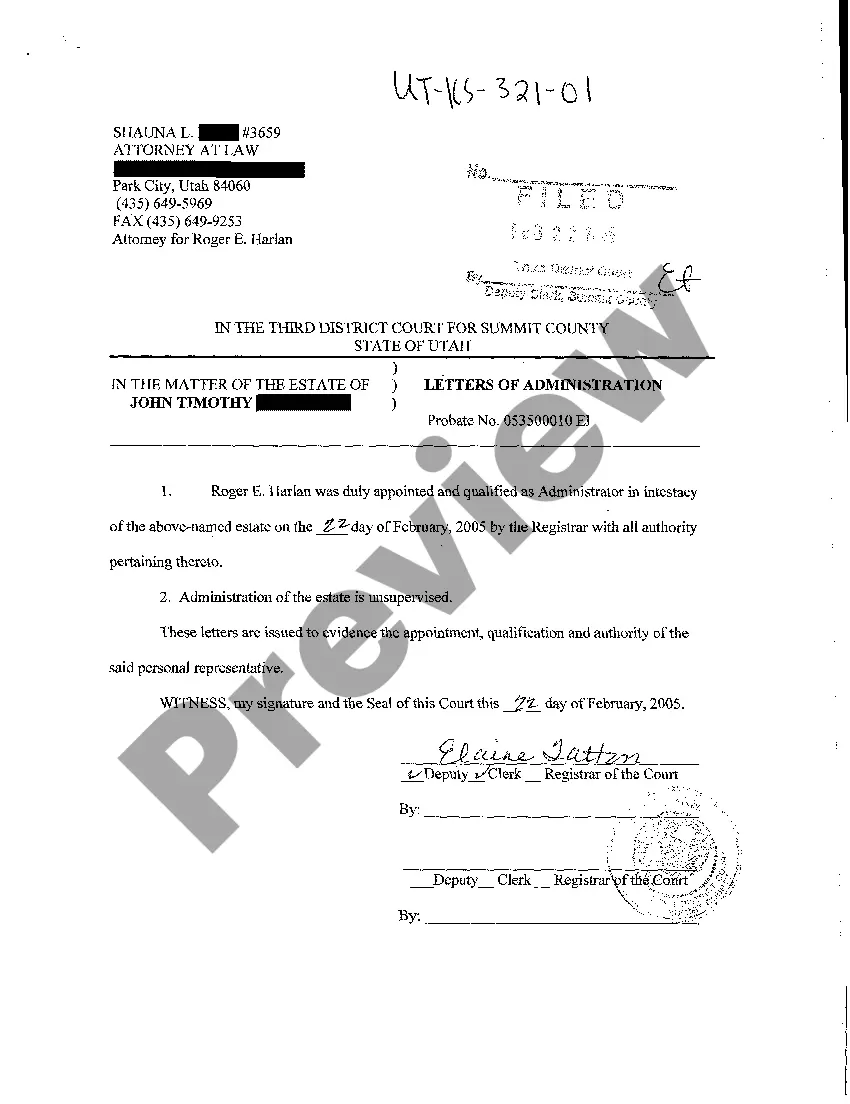

San Antonio Texas Partnership Agreement for Profit Sharing is a legally binding contract that outlines the terms and conditions under which two or more entities or individuals agree to collaborate and share profits in San Antonio, Texas. It is a strategic alliance designed to maximize financial gains and distribute them fairly among the partners involved. This partnership agreement aims to establish a mutually beneficial relationship for all parties involved in San Antonio, Texas. It outlines the rights, responsibilities, financial obligations, and profit distribution methods. This document serves as a guideline to ensure transparency, trust, and successful cooperation between the partners. Keywords: San Antonio, Texas, partnership agreement, profit sharing, legally binding, collaboration, financial gains, strategic alliance, distribute profits, mutually beneficial, rights, responsibilities, financial obligations, profit distribution, transparency, trust, cooperation. There are several types of San Antonio Texas Partnership Agreements for Profit Sharing, including: 1. General Partnership: This is the most common type of partnership agreement wherein all partners are equally responsible for the obligations, debts, and liabilities of the business. Profits and losses are shared equally or as per the agreed ratio. 2. Limited Partnership: In this type, there are two types of partners; general and limited partners. General partners manage the business and are personally liable for its obligations, while limited partners contribute capital but have limited liability. Profit sharing is determined based on the partnership agreement. 3. Limited Liability Partnership (LLP): LLP is a partnership where all partners have limited liability and are not personally responsible for the debts and obligations of the business. Profits and losses are shared as per the partnership agreement. 4. Joint Venture: Joint ventures are formed for a specific project or a limited period. Each partner contributes resources, expertise, and shares profits and losses based on the partnership agreement. 5. Silent Partnership: In this arrangement, one partner provides capital while remaining silent and not actively participating in the business. They share profits based on the agreed terms. 6. Equity Partnership: Equity partners contribute capital and actively participate in the management and decision-making process. Profit sharing is typically based on the equity invested in the partnership. 7. Non-equity Partnership: Non-equity partners contribute skills, services, or assets to the partnership without any capital investment. Profit sharing is determined by other factors such as performance, effort, or agreed-upon terms. Keywords: General Partnership, Limited Partnership, Limited Liability Partnership (LLP), Joint Venture, Silent Partnership, Equity Partnership, Non-equity Partnership.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Acuerdo de Asociación para el Reparto de Utilidades - Partnership Agreement for Profit Sharing

Description

How to fill out San Antonio Texas Acuerdo De Asociación Para El Reparto De Utilidades?

A document routine always goes along with any legal activity you make. Creating a company, applying or accepting a job offer, transferring property, and lots of other life scenarios demand you prepare formal documentation that differs throughout the country. That's why having it all accumulated in one place is so helpful.

US Legal Forms is the largest online library of up-to-date federal and state-specific legal templates. On this platform, you can easily find and get a document for any personal or business objective utilized in your region, including the San Antonio Partnership Agreement for Profit Sharing.

Locating samples on the platform is extremely straightforward. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. Following that, the San Antonio Partnership Agreement for Profit Sharing will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, adhere to this simple guideline to get the San Antonio Partnership Agreement for Profit Sharing:

- Ensure you have opened the right page with your localised form.

- Make use of the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the form satisfies your requirements.

- Look for another document via the search option if the sample doesn't fit you.

- Click Buy Now when you locate the required template.

- Decide on the suitable subscription plan, then sign in or create an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and save the San Antonio Partnership Agreement for Profit Sharing on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and manage your legal affairs efficiently with the US Legal Forms!