Wayne Michigan Partnership Agreement for Profit Sharing is a legal document that outlines the terms and conditions for distributing profits among partners within a partnership in Wayne, Michigan. This agreement establishes the framework for profit distribution, ensuring transparency and fair allocation of earnings based on the partnership's respective contributions. The Wayne Michigan Partnership Agreement for Profit Sharing encompasses several key elements, including the percentage or proportion of profits assigned to each partner, the frequency of profit distribution (monthly, quarterly, or annually), and the method of calculation. It also addresses potential scenarios such as losses or liquidation, ensuring that partners understand their rights and obligations in these circumstances. There are various types of Wayne Michigan Partnership Agreement for Profit Sharing, each catering to different partnership structures and arrangements. Some common types include: 1. General Partnership Agreement: This agreement is formed when two or more partners come together to conduct business with equal rights and responsibilities. Profit sharing in a general partnership is typically based on the partners' capital contributions or agreed-upon terms. 2. Limited Partnership Agreement: In a limited partnership, there are two types of partners: general partners and limited partners. General partners have unlimited liability and participate actively in the partnership, while limited partners contribute capital but have limited liability and do not engage in day-to-day operations. Profit sharing in a limited partnership is often based on the agreed-upon terms between the partners. 3. Limited Liability Partnership Agreement: In this type of partnership, all partners have limited liability, protecting their personal assets from the partnership's debts. Profit sharing among partners in a limited liability partnership may be based on various factors, such as the partners' capital contributions, efforts, or a predetermined distribution formula. Irrespective of the type of Wayne Michigan Partnership Agreement for Profit Sharing, it is crucial to consult with a legal professional well-versed in partnership laws to ensure compliance with local regulations and to customize the agreement according to the specific needs and goals of the partnership.

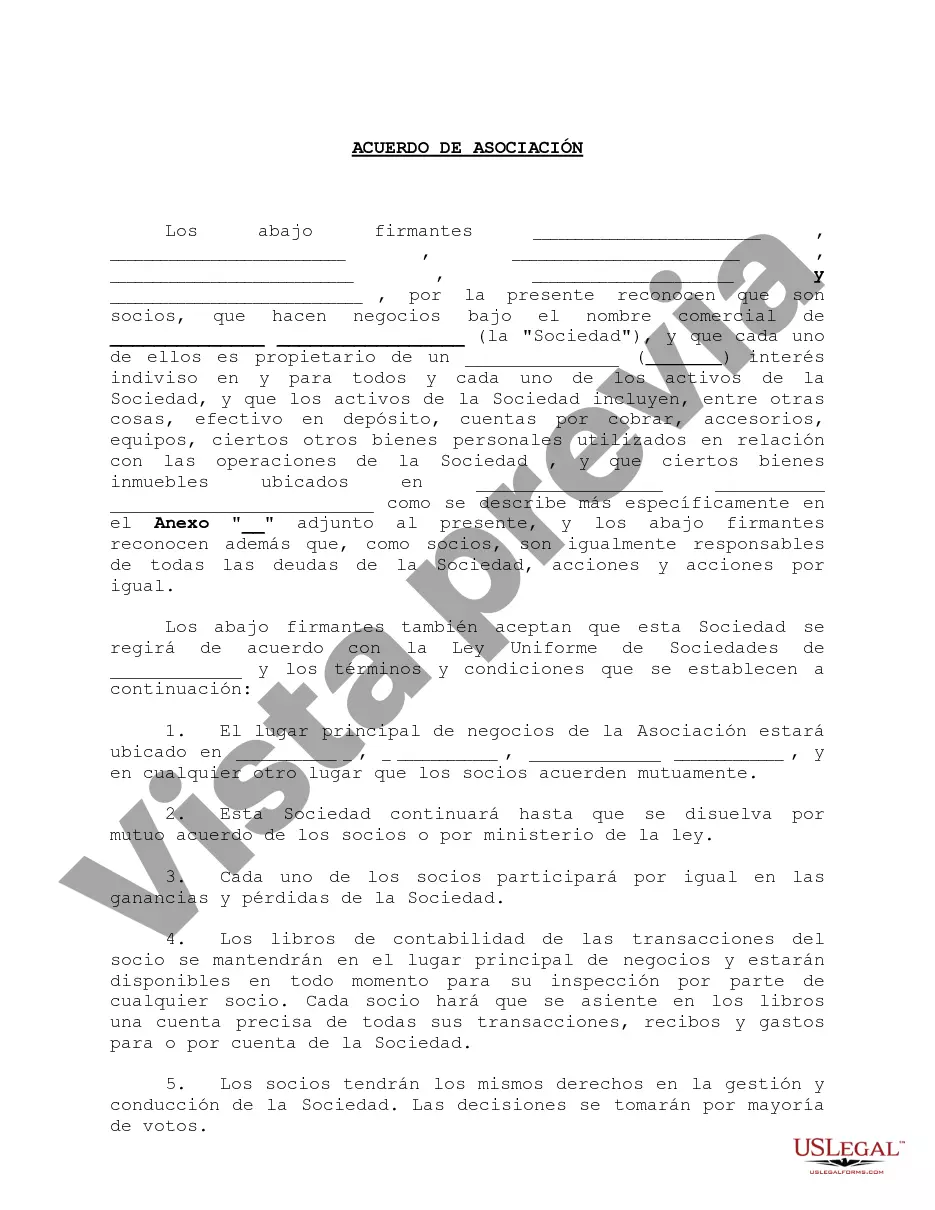

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Wayne Michigan Acuerdo de Asociación para el Reparto de Utilidades - Partnership Agreement for Profit Sharing

Description

How to fill out Wayne Michigan Acuerdo De Asociación Para El Reparto De Utilidades?

Draftwing forms, like Wayne Partnership Agreement for Profit Sharing, to manage your legal affairs is a challenging and time-consumming task. A lot of cases require an attorney’s participation, which also makes this task expensive. Nevertheless, you can consider your legal matters into your own hands and take care of them yourself. US Legal Forms is here to save the day. Our website comes with over 85,000 legal forms created for various scenarios and life circumstances. We make sure each document is compliant with the regulations of each state, so you don’t have to be concerned about potential legal pitfalls associated with compliance.

If you're already familiar with our services and have a subscription with US, you know how easy it is to get the Wayne Partnership Agreement for Profit Sharing template. Go ahead and log in to your account, download the template, and customize it to your needs. Have you lost your document? No worries. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding flow of new users is fairly easy! Here’s what you need to do before downloading Wayne Partnership Agreement for Profit Sharing:

- Ensure that your template is specific to your state/county since the rules for creating legal documents may differ from one state another.

- Learn more about the form by previewing it or reading a quick description. If the Wayne Partnership Agreement for Profit Sharing isn’t something you were hoping to find, then use the header to find another one.

- Log in or create an account to start utilizing our service and download the document.

- Everything looks great on your end? Hit the Buy now button and choose the subscription option.

- Select the payment gateway and type in your payment details.

- Your form is good to go. You can go ahead and download it.

It’s an easy task to find and buy the needed template with US Legal Forms. Thousands of organizations and individuals are already taking advantage of our rich library. Sign up for it now if you want to check what other benefits you can get with US Legal Forms!