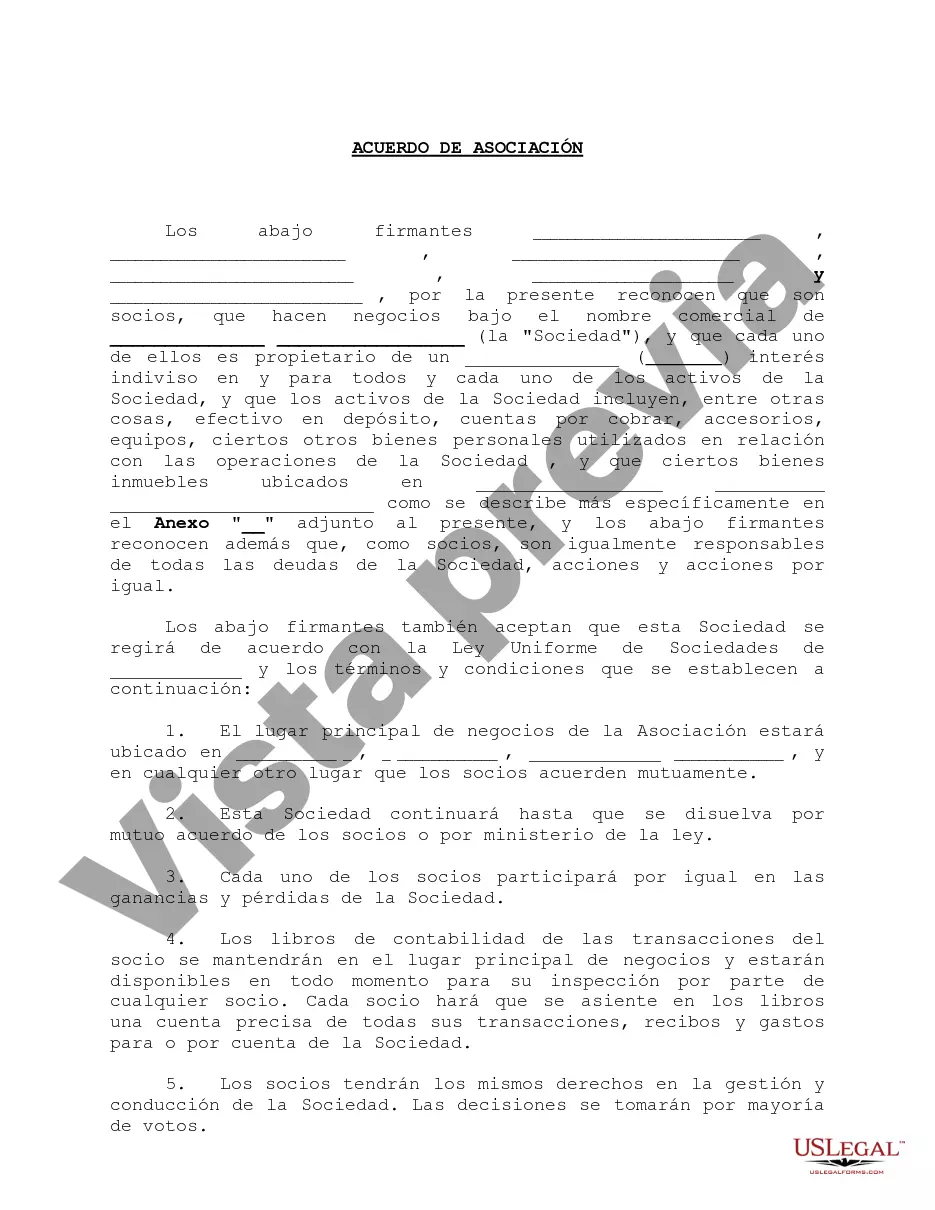

The Harris Texas Partnership Agreement for LLC is a legally binding document that outlines the terms, conditions, and regulations agreed upon by the partners of a limited liability company (LLC) in the Harris County area of Texas. This agreement is crucial for LCS intending to establish their operations in Harris County, as it sets the foundation for an effective and efficient business structure. The Harris Texas Partnership Agreement for LLC encompasses a wide range of essential components, including the roles and responsibilities of each partner, profit and loss distribution, capital contributions, decision-making processes, dispute resolution mechanisms, and the duration of the partnership. There are different types of partnership agreements available for LCS in Harris County, Texas, catering to various business needs and objectives. Some of these include: 1. General Partnership Agreement: This type of agreement establishes a partnership where all partners have equal decision-making power and assume full liability for the company's debts and obligations. 2. Limited Partnership Agreement: In this agreement, there are two types of partners: general partners and limited partners. General partners have control over the day-to-day operations and unlimited liability, while limited partners have limited liability but no involvement in management decisions. 3. Limited Liability Partnership Agreement: This partnership agreement provides limited liability protection to all partners, shielding them from personal liability for the company's debts or obligations resulting from the actions of other partners. 4. Family Limited Partnership Agreement: This agreement is specifically designed for family-run businesses. It allows family members to pool their resources and collaborate in managing the business while maintaining certain tax benefits and limited liability protection. Regardless of the type of partnership agreement, creating a Harris Texas Partnership Agreement for LLC is critically important for establishing a solid legal framework that governs the operation, management, and decision-making processes of an LLC in Harris County, Texas. It ensures clear communication, minimizes conflicts, and promotes the smooth functioning of the business while protecting the interests of all partners involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Acuerdo de asociación para LLC - Partnership Agreement for LLC

Description

How to fill out Harris Texas Acuerdo De Asociación Para LLC?

If you need to find a reliable legal paperwork supplier to find the Harris Partnership Agreement for LLC, look no further than US Legal Forms. No matter if you need to launch your LLC business or take care of your belongings distribution, we got you covered. You don't need to be knowledgeable about in law to locate and download the appropriate template.

- You can select from over 85,000 forms categorized by state/county and case.

- The intuitive interface, variety of supporting materials, and dedicated support make it simple to locate and execute different paperwork.

- US Legal Forms is a trusted service offering legal forms to millions of customers since 1997.

Simply type to search or browse Harris Partnership Agreement for LLC, either by a keyword or by the state/county the document is intended for. After locating needed template, you can log in and download it or retain it in the My Forms tab.

Don't have an account? It's effortless to start! Simply find the Harris Partnership Agreement for LLC template and take a look at the form's preview and description (if available). If you're confident about the template’s language, go ahead and hit Buy now. Register an account and select a subscription option. The template will be immediately available for download once the payment is completed. Now you can execute the form.

Handling your law-related matters doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our rich collection of legal forms makes these tasks less costly and more affordable. Create your first business, organize your advance care planning, create a real estate contract, or execute the Harris Partnership Agreement for LLC - all from the convenience of your sofa.

Join US Legal Forms now!