Miami-Dade Florida Partnership Agreement for LLC is a legally binding document that outlines the terms and conditions agreed upon by two or more entrepreneurs or business entities in the Miami-Dade County, Florida, to form a limited liability company (LLC) and govern their partnership. This agreement sets forth the rights, duties, and responsibilities of each partner involved, as well as the rules for decision-making, profit sharing, and dispute resolution mechanisms. Keywords: Miami-Dade Florida, Partnership Agreement, LLC, limited liability company, entrepreneurs, business entities, terms and conditions, rights, duties, responsibilities, decision-making, profit sharing, dispute resolution. There are various types of Miami-Dade Florida Partnership Agreements for LLC: 1. General Partnership Agreement: This type of agreement is formed when two or more partners come together to form an LLC and have equal share in the profits, losses, and management of the company. In this agreement, partners have unlimited liability, meaning that their personal assets can be used to settle business obligations. 2. Limited Partnership Agreement: This agreement involves two types of partners: general partners and limited partners. General partners have unlimited liability and manage the day-to-day operations, while limited partners contribute capital but have limited liability and no involvement in the management decisions. 3. Limited Liability Partnership (LLP) Agreement: This agreement is commonly chosen by professionals such as lawyers, doctors, or architects. With an LLP, partners have limited personal liability for the actions of other partners and are protected from the partnership's debts and obligations. 4. Limited Liability Limited Partnership (LL LP) Agreement: This type of partnership combines the features of an LLP and a limited partnership. It allows for limited personal liability for all partners, including general partners. Regardless of the specific type, a Miami-Dade Florida Partnership Agreement for LLC serves to ensure clear communication, reduce misunderstandings, and establish a solid foundation for the partnership's operations and success. It is essential to consult legal professionals when drafting or entering into a partnership agreement to ensure compliance with Florida state laws and regulations.

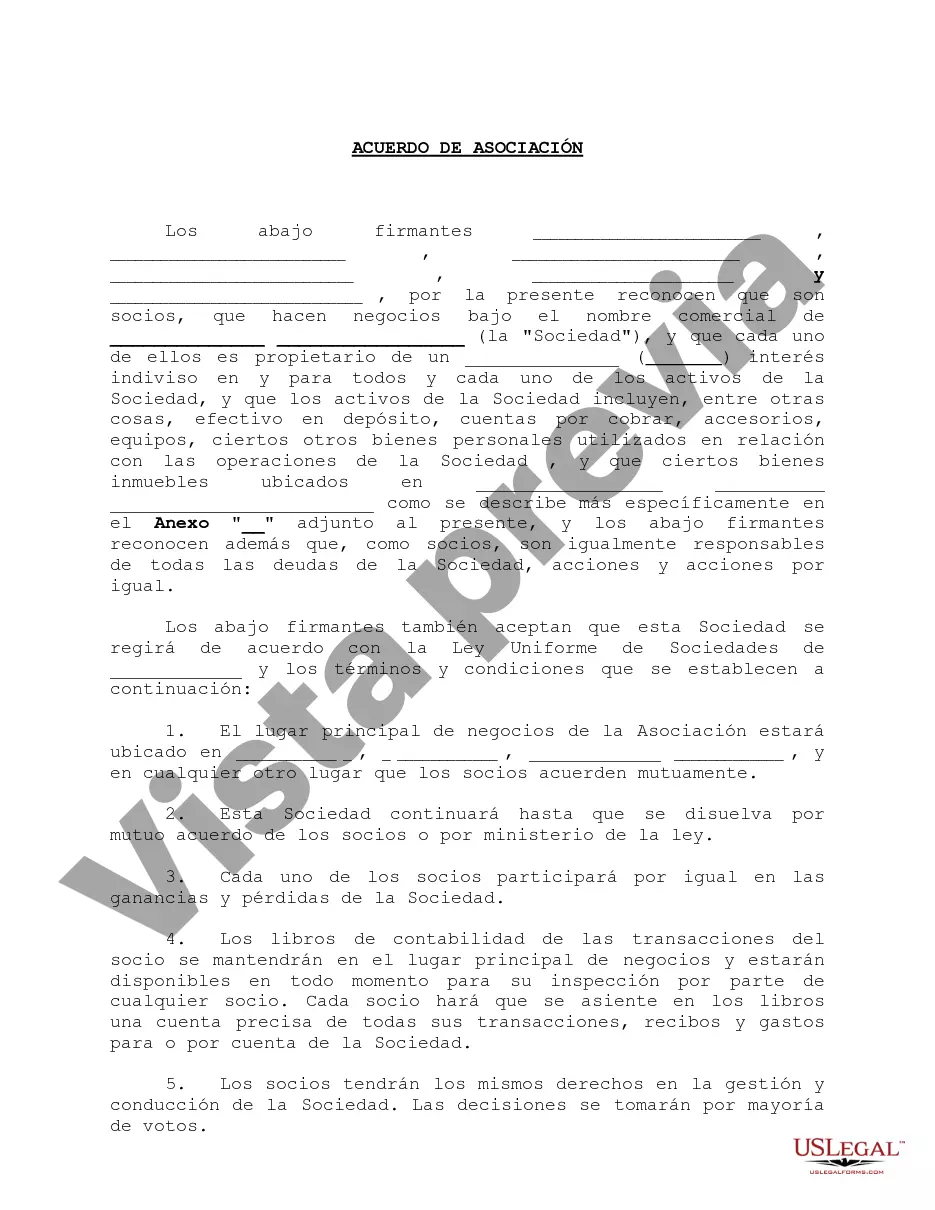

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Miami-Dade Florida Acuerdo de asociación para LLC - Partnership Agreement for LLC

Category:

State:

Multi-State

County:

Miami-Dade

Control #:

US-0766-WG-2

Format:

Word

Instant download

Description

This form is an agreement between partners where each partner has an agreed percentage of ownership in return for an investment of a certain amount of money, assets and/or effort.

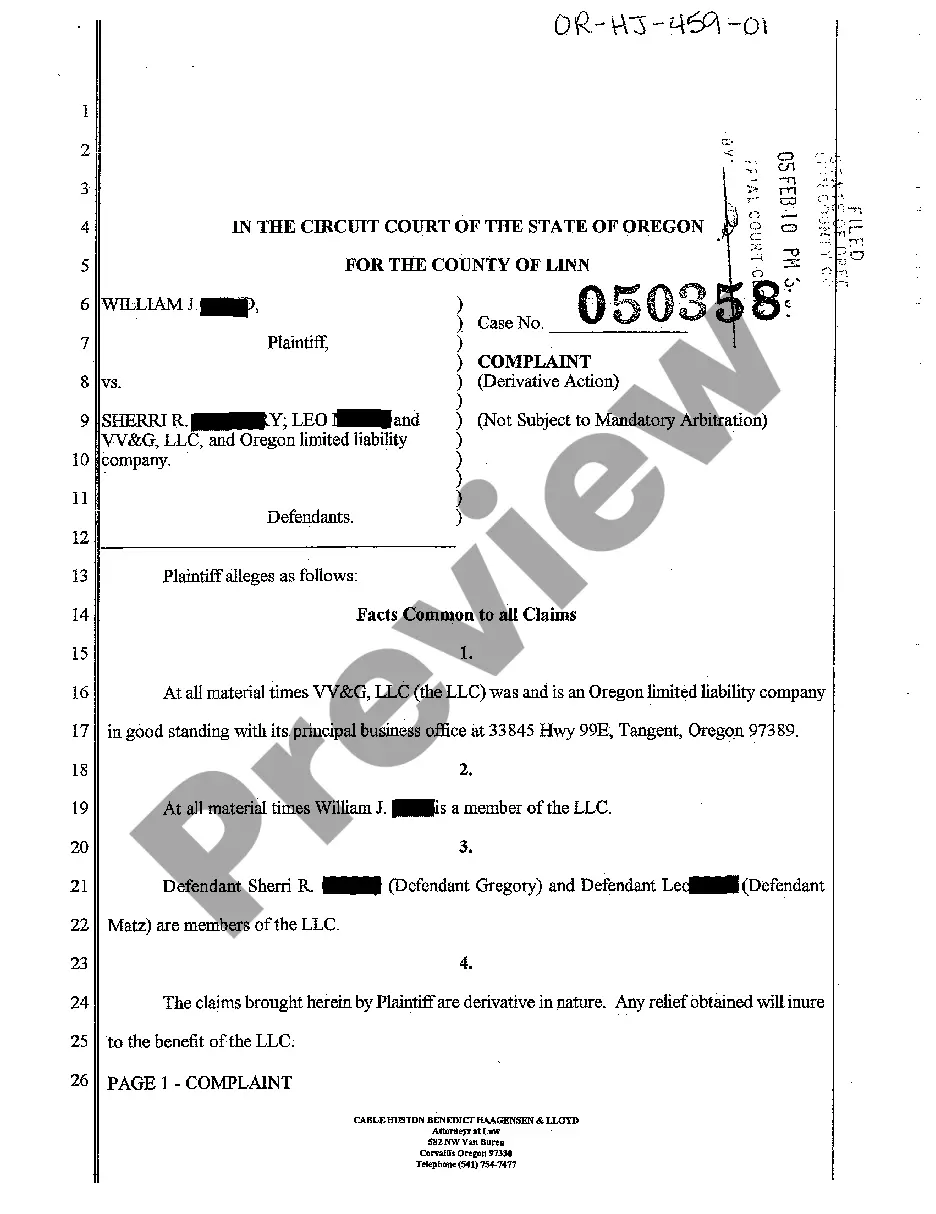

Miami-Dade Florida Partnership Agreement for LLC is a legally binding document that outlines the terms and conditions agreed upon by two or more entrepreneurs or business entities in the Miami-Dade County, Florida, to form a limited liability company (LLC) and govern their partnership. This agreement sets forth the rights, duties, and responsibilities of each partner involved, as well as the rules for decision-making, profit sharing, and dispute resolution mechanisms. Keywords: Miami-Dade Florida, Partnership Agreement, LLC, limited liability company, entrepreneurs, business entities, terms and conditions, rights, duties, responsibilities, decision-making, profit sharing, dispute resolution. There are various types of Miami-Dade Florida Partnership Agreements for LLC: 1. General Partnership Agreement: This type of agreement is formed when two or more partners come together to form an LLC and have equal share in the profits, losses, and management of the company. In this agreement, partners have unlimited liability, meaning that their personal assets can be used to settle business obligations. 2. Limited Partnership Agreement: This agreement involves two types of partners: general partners and limited partners. General partners have unlimited liability and manage the day-to-day operations, while limited partners contribute capital but have limited liability and no involvement in the management decisions. 3. Limited Liability Partnership (LLP) Agreement: This agreement is commonly chosen by professionals such as lawyers, doctors, or architects. With an LLP, partners have limited personal liability for the actions of other partners and are protected from the partnership's debts and obligations. 4. Limited Liability Limited Partnership (LL LP) Agreement: This type of partnership combines the features of an LLP and a limited partnership. It allows for limited personal liability for all partners, including general partners. Regardless of the specific type, a Miami-Dade Florida Partnership Agreement for LLC serves to ensure clear communication, reduce misunderstandings, and establish a solid foundation for the partnership's operations and success. It is essential to consult legal professionals when drafting or entering into a partnership agreement to ensure compliance with Florida state laws and regulations.

Free preview