Oakland County, Michigan, Partnership Agreement for Business is a legal document that outlines the terms and conditions of a partnership between two or more businesses operating within the jurisdiction of Oakland County, Michigan. This agreement specifies the roles, responsibilities, and obligations of each partner involved in the joint business venture. Keywords relevant to this topic include "Oakland County," "partnership agreement," "business," and "Michigan." There are different types of partnership agreements that a business can enter into within Oakland County, Michigan. These types include: 1. General Partnership Agreement: This is the most common type of partnership agreement where all partners are equally responsible for the business's profits, losses, and liabilities. Each partner has a say in the decision-making process and shares both the risks and rewards. 2. Limited Partnership Agreement: This agreement consists of one or more general partners who have unlimited liability for the business's debts and obligations, while limited partners contribute capital but have limited involvement in the business operations and reduced liability. 3. Limited Liability Partnership (LLP) Agreement: An LLP partnership agreement provides partners with limited personal liability for the acts, debts, and obligations of the business. This agreement is often suitable for professional service businesses, such as law firms or accounting practices, where individual partners want to limit personal liability. 4. Joint Venture Agreement: A joint venture agreement is a partnership agreement entered into by two or more businesses for a specific project or limited duration. Each partner contributes resources or expertise, and the profits and losses are shared according to the agreed-upon terms. In an Oakland County, Michigan, Partnership Agreement for Business, various aspects should be detailed: 1. Partnership Name: The agreement should state the official name under which the partnership will operate in Oakland County. 2. Purpose of the Partnership: This section should clearly describe the nature of the partnership's business activities and goals within Oakland County. 3. Partner Contributions: The agreement should outline each partner's monetary or non-monetary contributions to the partnership, such as capital, assets, or intellectual property. 4. Profit Distribution: Details on how profits and losses will be allocated among partners, including profit-sharing ratios or specific methodologies for distribution. 5. Management and Decision-making: The agreement should define the decision-making process, responsibilities, and decision power of each partner, including the appointment of a managing partner or establishment of a management committee. 6. Duration of Partnership: This section specifies whether the partnership is for a specific period or will continue indefinitely. If time-limited, it should outline the provisions for extension or termination. 7. Dissolution and Exit Strategy: In case of dissolution, the agreement should define the process for winding up the partnership's affairs, distributing assets, and resolving liabilities. 8. Dispute Resolution: Provisions for how disputes will be resolved, including mediation, arbitration, or legal proceedings, should be included. Oakland County, Michigan, Partnership Agreement for Business plays a crucial role in establishing and maintaining successful partnerships within the county's business ecosystem. It provides a legal framework to ensure transparency, accountability, and mutual understanding among partners involved in joint business endeavors.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Oakland Michigan Acuerdo de Asociación para Negocios - Partnership Agreement for Business

Description

How to fill out Oakland Michigan Acuerdo De Asociación Para Negocios?

Drafting paperwork for the business or personal demands is always a huge responsibility. When drawing up a contract, a public service request, or a power of attorney, it's important to take into account all federal and state laws and regulations of the specific region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it burdensome and time-consuming to draft Oakland Partnership Agreement for Business without expert assistance.

It's easy to avoid wasting money on attorneys drafting your paperwork and create a legally valid Oakland Partnership Agreement for Business on your own, using the US Legal Forms online library. It is the largest online collection of state-specific legal templates that are professionally verified, so you can be certain of their validity when selecting a sample for your county. Previously subscribed users only need to log in to their accounts to save the needed document.

If you still don't have a subscription, follow the step-by-step guideline below to obtain the Oakland Partnership Agreement for Business:

- Look through the page you've opened and check if it has the sample you require.

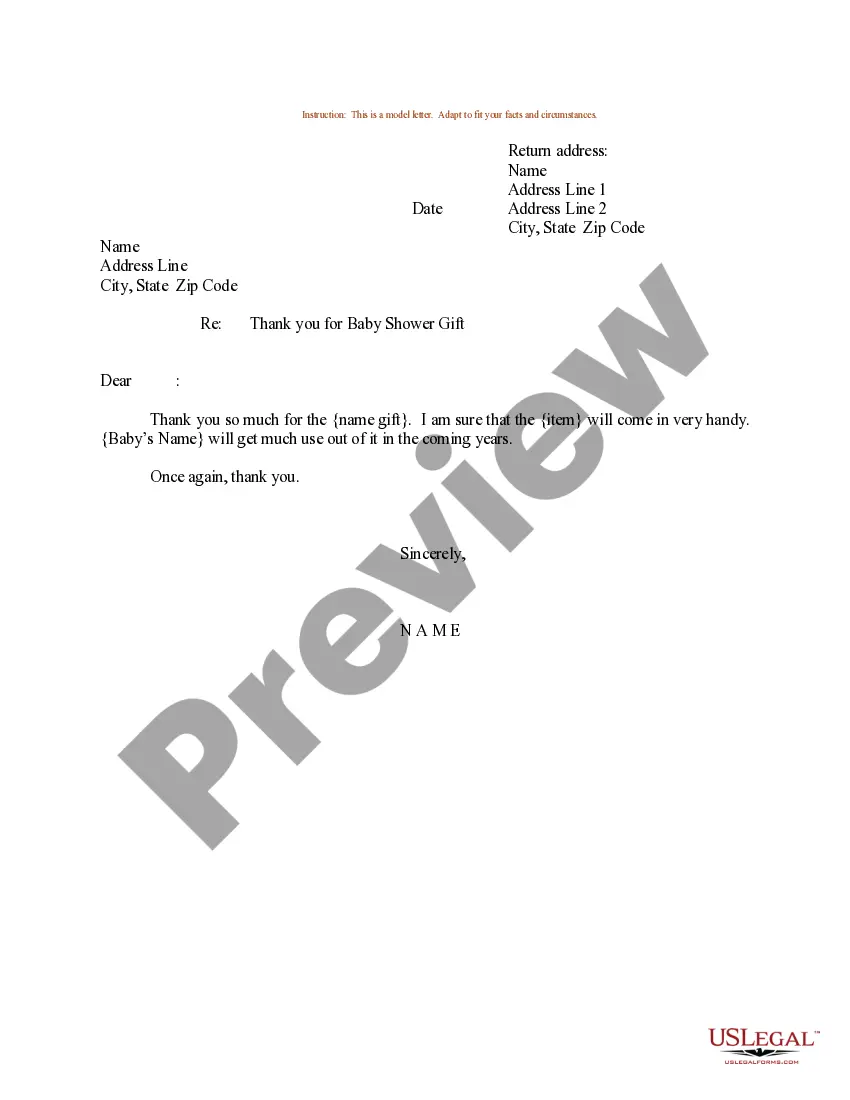

- To achieve this, use the form description and preview if these options are available.

- To locate the one that meets your needs, utilize the search tab in the page header.

- Recheck that the sample complies with juridical criteria and click Buy Now.

- Choose the subscription plan, then sign in or register for an account with the US Legal Forms.

- Utilize your credit card or PayPal account to pay for your subscription.

- Download the selected file in the preferred format, print it, or complete it electronically.

The exceptional thing about the US Legal Forms library is that all the paperwork you've ever obtained never gets lost - you can access it in your profile within the My Forms tab at any moment. Join the platform and easily obtain verified legal templates for any scenario with just a couple of clicks!