Houston Texas Partnership Agreement for Corporation is a legally binding contract that establishes the terms and conditions between two or more corporations entering into a partnership in the city of Houston, Texas. This agreement outlines the roles, rights, and responsibilities of each corporation involved, ensuring a transparent and mutually beneficial business relationship. Keywords: Houston Texas, Partnership Agreement, Corporation, legally binding, terms and conditions, corporations, partnership, roles, rights, responsibilities, transparent, mutually beneficial, business relationship. Different types of Houston Texas Partnership Agreement for Corporation include: 1. General Partnership Agreement: This type of agreement establishes a partnership where all corporations involved have equal control, liability, and responsibilities. Decisions, profits, and losses are shared equally among the partners. 2. Limited Partnership Agreement: In this agreement, there are two types of partners: general partners and limited partners. General partners have active involvement in the partnership's operations and are personally liable for any debts or obligations. Limited partners, on the other hand, invest capital but have limited liability and minimal involvement in the day-to-day operations. 3. Limited Liability Partnership Agreement: This agreement provides liability protection to partners to a certain extent. Each corporation involved is not personally liable for the actions, debts, or negligence of other partners. This type of agreement is often preferred by professionals, such as lawyers, accountants, or architects. 4. Joint Venture Agreement: A joint venture agreement is similar to a partnership agreement but is predicated on a specific project or goal. Corporations join forces for a limited duration or purpose, sharing resources, risks, and profits. This type of agreement allows corporations to collaborate on opportunities while maintaining separate legal entities. No matter the type, a Houston Texas Partnership Agreement for Corporation is crucial to clearly define the terms and conditions of the partnership, including capital contributions, profit-sharing mechanisms, decision-making processes, dispute resolutions, and termination clauses. It helps establish a solid foundation for a successful and legally compliant business partnership in the city of Houston, Texas.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Acuerdo de Sociedad para Corporación - Partnership Agreement for Corporation

Description

How to fill out Acuerdo De Sociedad Para Corporación?

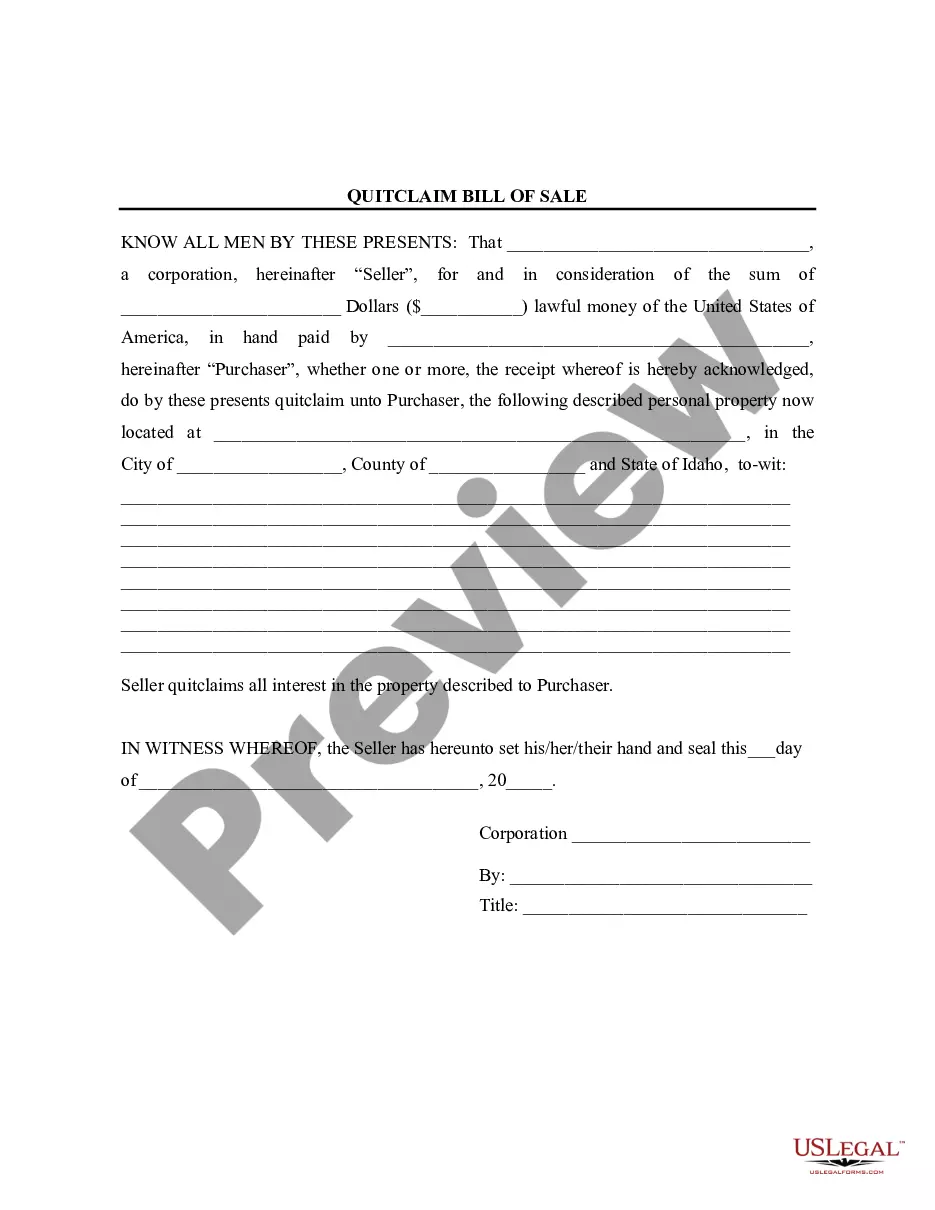

Drafting legal documents can be tedious. Furthermore, if you opt to hire a legal expert to create a business contract, documents for ownership transfer, pre-nuptial agreement, divorce documentation, or the Houston Partnership Agreement for Corporation, it might be quite expensive.

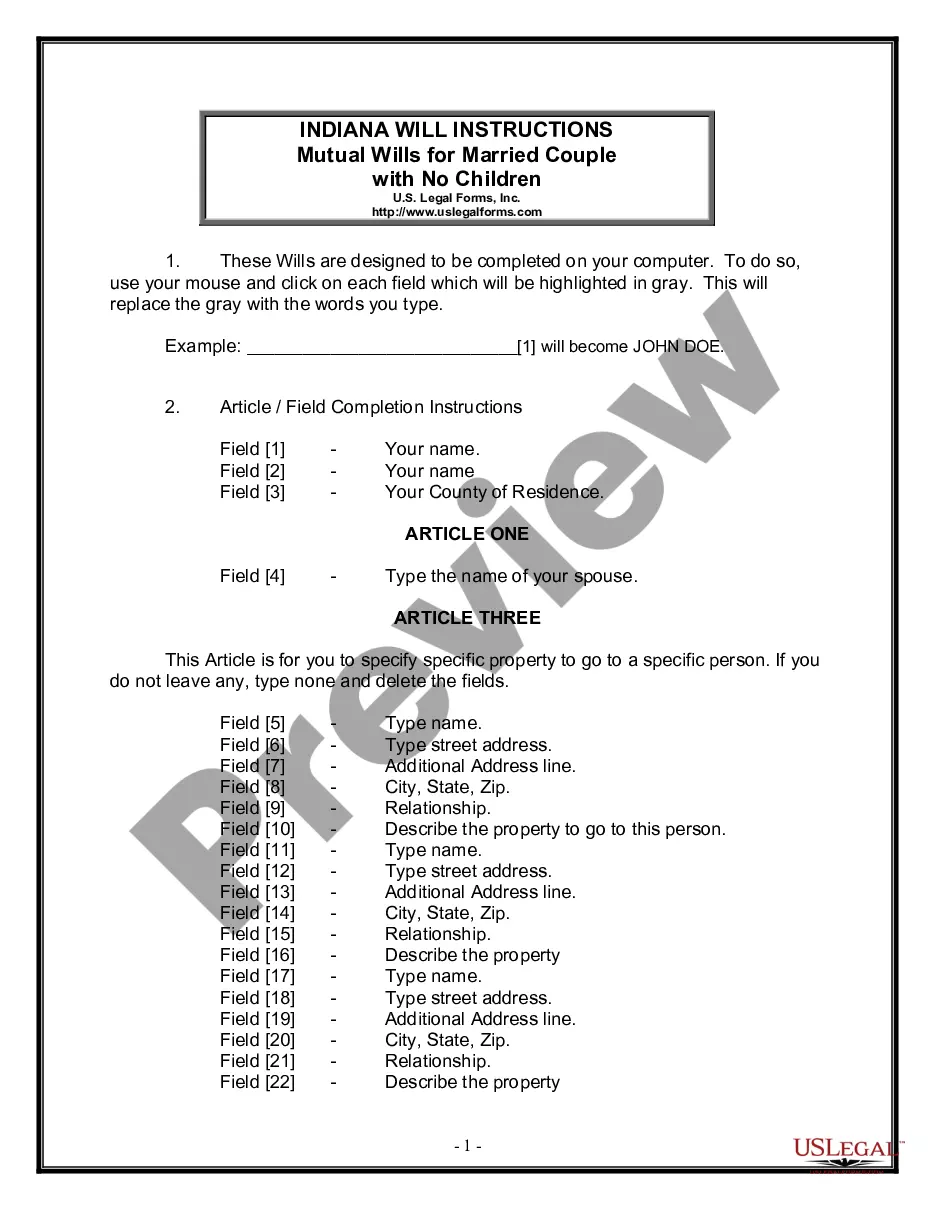

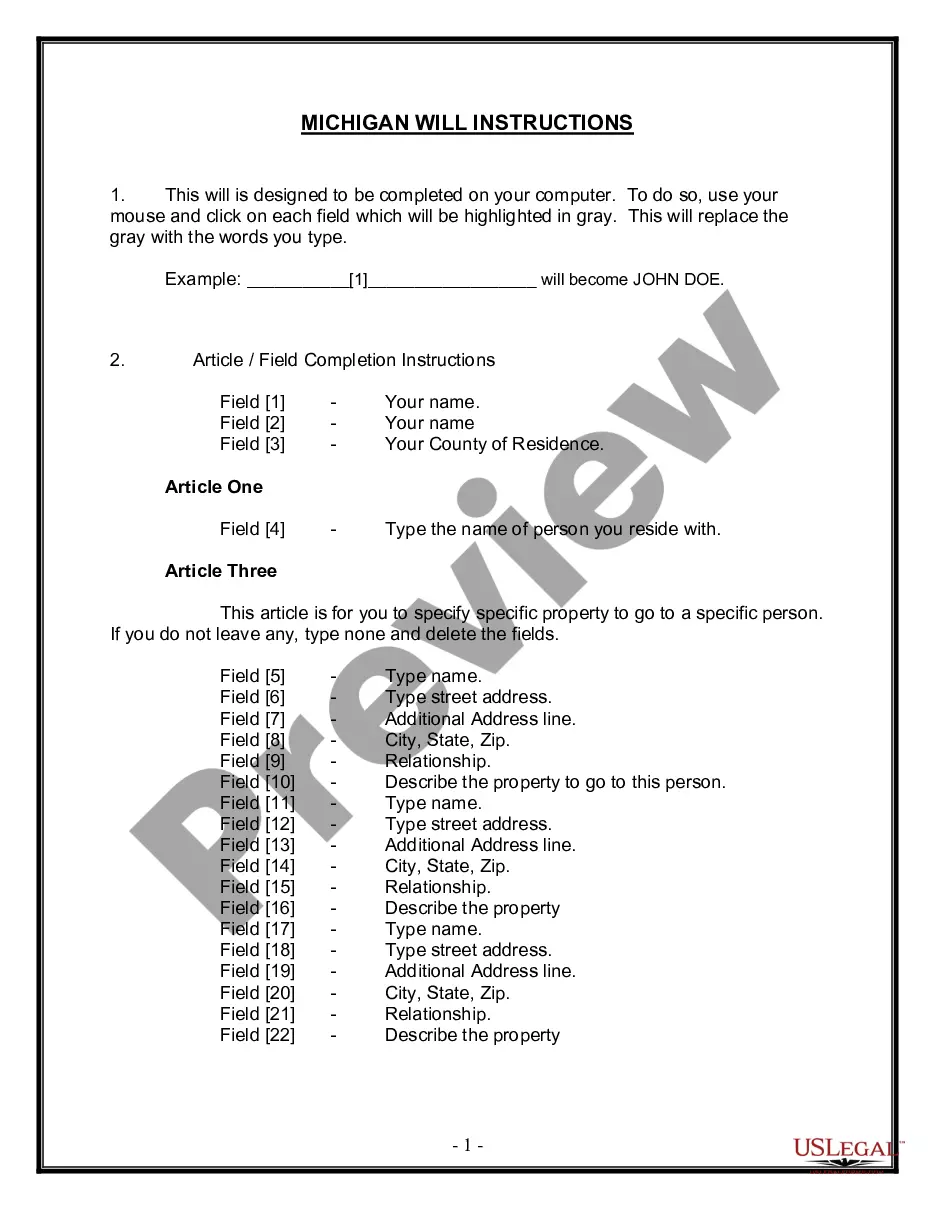

So what is the most effective way to conserve time and funds while generating valid documents that adhere to your state and local regulations? US Legal Forms is an ideal option, whether you're looking for templates for personal or commercial purposes.

Don't fret if the form doesn't fit your needs - search for the appropriate one in the header. Click Buy Now once you discover the necessary template and choose the most suitable subscription. Log In or create an account to complete your subscription payment. Process the payment using a credit card or through PayPal. Select your desired file format for the Houston Partnership Agreement for Corporation and download it. Once completed, you can print it and fill it out manually or upload the documents to an online editor for quicker and easier completion. US Legal Forms enables you to utilize all documents obtained multiple times - you can access your templates in the My documents section of your profile. Give it a try now!

- US Legal Forms boasts the largest online archive of state-specific legal documents, offering users the most recent and professionally confirmed templates for any situation compiled all in one location.

- As a result, if you're in need of the latest version of the Houston Partnership Agreement for Corporation, you can effortlessly find it on our site.

- Acquiring the paperwork requires very little time.

- Those with an account should ensure their subscription is active, Log In, and select the document using the Download button.

- If you haven't subscribed yet, here's how to obtain the Houston Partnership Agreement for Corporation.

- Browse the page and confirm there's a sample available for your area.

- Review the form description and utilize the Preview option, if applicable, to verify it's the template you require.

Form popularity

FAQ

Paso 1: Nombre de Tu Corporacion. Paso 2: Elije un Agente Registrado. Paso 3: Organiza una Reunion Empresarial. Paso 4: Presenta los Documentos de Formacion....Paso 5: Obtenga un EIN Para abrir una cuenta bancaria comercial para la empresa. Para propositos de impuestos Federales y Estatales. Contratar empleados para la empresa.

Es una entidad de negocios cuyos duenos son sus propios accionistas, quienes seleccionan una junta para supervisar las actividades de la organizacion. La corporacion es responsable por las acciones y las finanzas del negocio.

Una corporacion es una entidad juridica organizada de acuerdo con leyes estatales y fundamentalmente regulada por las mismas. Aunque existen diferencias entre las leyes aplicables en los distintos estados, la conformacion de una corporacion es basicamente la misma en todo el pais.

Beneficio: Una LLC puede ser utilizada para ayudar a reducir el valor de los activos en poder de un individuo debido a la aplicacion de descuentos por falta de control y falta de comerciabilidad y pasar riqueza adicional a las generaciones futuras.

Una corporacion es una buena opcion para una compania que va a obtener financiamiento de capital de riesgo o quiere establecer un plan de opciones sobre acciones para empleados. Pero una LLC es mas facil de mantener, mas flexible que una corporacion y puede convertirse facilmente en una corporacion.

La diferencia entre una LLC y una corporacion S es que el estatus de corporacion S permite que los propietarios de la empresa sean tratados (a efectos fiscales) como empleados de la misma. Esto puede reducir en gran medida la carga fiscal de un empresario en las circunstancias adecuadas.

Hay siete pasos basicos para crear una empresa en Texas. Elabore su plan comercial. Elija su ubicacion comercial. Financie su empresa. Decida la estructura comercial y registre el nombre de su empresa. Determine las responsabilidades fiscales de la empresa. Averigue cuales son las licencias y los permisos obligatorios.

Beneficios De Formar Una Corporacion Una corporacion tiene gran flexibilidad en las deducciones de impuestos. Ya que una corporacion es una entidad legal, puede proteger a los accionistas de ciertas obligaciones y riesgos legales. Una corporacion tiene existencia perpetua y puede vivir mas que los mismos accionistas.

Pasos para crear su negocio en Estados Unidos Escoja el estado en el que va a registrar su empresa.Escoja la estructura que mas le convenga.Elija un nombre para su compania.Aplique para los registros gubernamentales correspondientes.Obtenga los Numeros de Identificacion del Empleador para su nueva empresa.

Puedes crear tu propia corporacion en 5 pasos sencillos: Paso 1: Nombre de Tu Corporacion. Paso 2: Elije un Agente Registrado. Paso 3: Organiza una Reunion Empresarial. Paso 4: Presenta los Documentos de Formacion. Paso 5: Obten un EIN.