Cook Illinois is a renowned transportation company based in Illinois, known for its reliable and efficient services. To ensure smooth operations and outline the rights, responsibilities, and regulations governing the company, Cook Illinois utilizes an LLC Operating Agreement for S Corp. This agreement serves as a legally binding document between the company and its members or shareholders. The Cook Illinois LLC Operating Agreement for S Corp is specifically designed for limited liability companies (LCS) that have opted for S Corporation tax treatment. S Corporations enjoy certain taxation benefits, such as pass-through taxation, where profits and losses of the company are passed directly to the shareholders' personal tax returns. This comprehensive agreement covers various essential aspects related to the operation of the Cook Illinois LLC as an S Corp. It typically includes the following key components: 1. Corporate Structure: The operating agreement outlines the structure of the company, including the roles and responsibilities of members, managers, and officers. It defines the decision-making process and voting rights of shareholders in major company affairs. 2. Shareholder Rights and Obligations: The agreement clearly defines the rights and obligations of each shareholder, including their ownership percentages, capital contributions, and profit distribution. It also specifies restrictions on the transfer of shares and gives existing shareholders the first right of refusal in case of a share transfer. 3. Management and Operation: The operating agreement details how the company will be managed, be it by members or appointed managers. It outlines the decision-making procedures, annual meetings, and responsibilities of managers or officers. Additionally, it may include provisions for the appointment and removal of managers and officers. 4. Tax and Financial Matters: As an S Corp, Cook Illinois benefits from pass-through taxation. The agreement explains how the company's profits, losses, and tax liabilities will be passed on to individual shareholders. It also clarifies the accounting methods, financial reporting, and distribution of net profits. 5. Dissolution and Dispute Resolution: In the event that the Cook Illinois LLC needs to be dissolved or liquidated, the operating agreement outlines the procedures and distribution of assets. It may also include provisions for dispute resolution mechanisms, such as mediation or arbitration, to resolve conflicts among members or with third parties. While the Cook Illinois LLC Operating Agreement for S Corp generally covers the above-mentioned aspects, it is important to note that there may be variations or additional provisions based on the specific requirements of the company. Different types or versions of the agreement may exist, such as customized agreements for single-member LCS or agreements tailored for specific industries or unique shareholder arrangements. Overall, the Cook Illinois LLC Operating Agreement for S Corp ensures that the company functions smoothly, mitigates potential conflicts, protects the interests of shareholders, and maintains compliance with relevant laws and regulations.

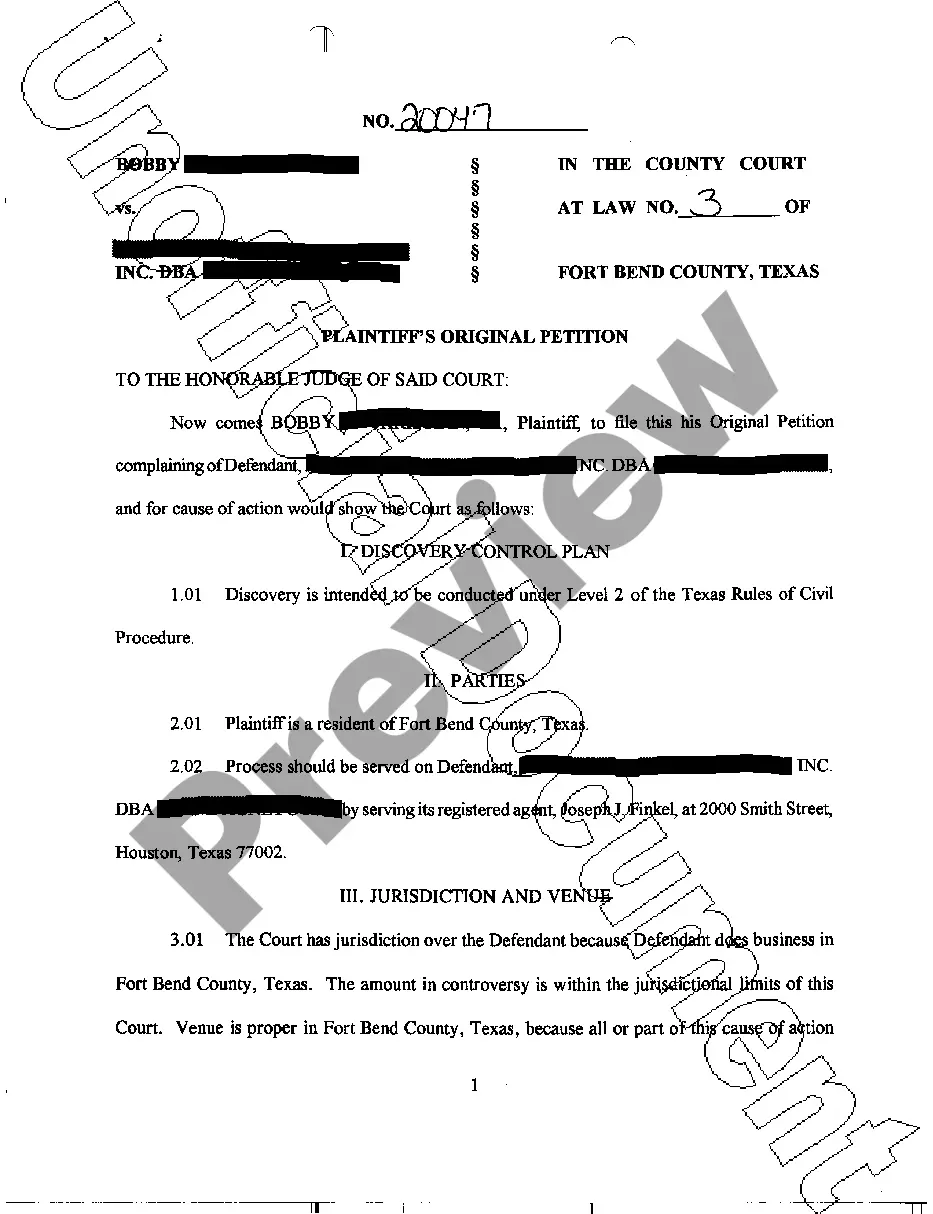

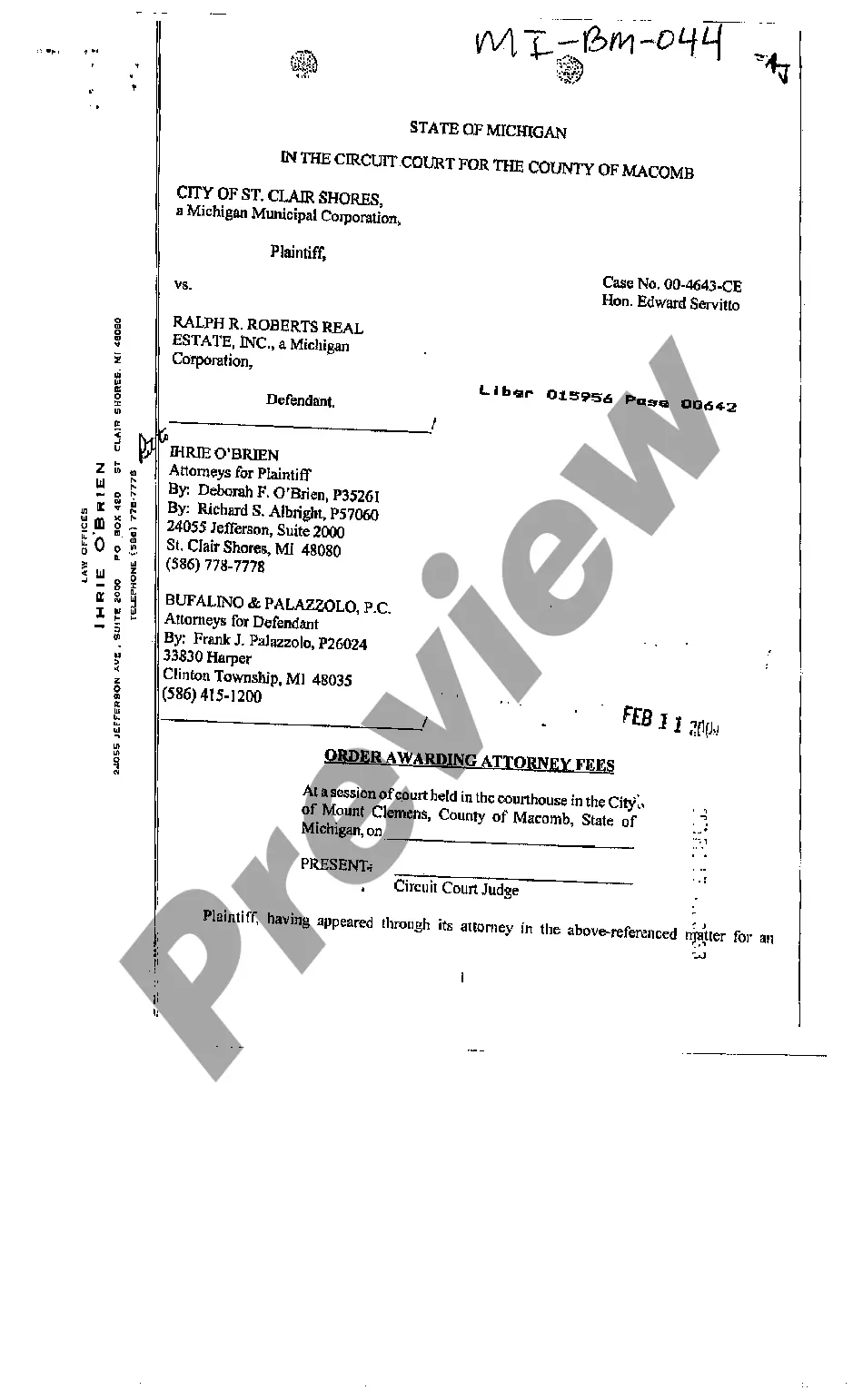

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cook Illinois Acuerdo operativo de LLC para S Corp - LLC Operating Agreement for S Corp

Description

How to fill out Cook Illinois Acuerdo Operativo De LLC Para S Corp?

A document routine always goes along with any legal activity you make. Opening a company, applying or accepting a job offer, transferring property, and many other life scenarios require you prepare official paperwork that varies throughout the country. That's why having it all collected in one place is so valuable.

US Legal Forms is the biggest online library of up-to-date federal and state-specific legal forms. On this platform, you can easily locate and get a document for any individual or business purpose utilized in your region, including the Cook LLC Operating Agreement for S Corp.

Locating templates on the platform is remarkably simple. If you already have a subscription to our service, log in to your account, find the sample using the search bar, and click Download to save it on your device. After that, the Cook LLC Operating Agreement for S Corp will be accessible for further use in the My Forms tab of your profile.

If you are using US Legal Forms for the first time, follow this simple guideline to obtain the Cook LLC Operating Agreement for S Corp:

- Ensure you have opened the correct page with your local form.

- Use the Preview mode (if available) and scroll through the template.

- Read the description (if any) to ensure the template corresponds to your needs.

- Search for another document via the search option if the sample doesn't fit you.

- Click Buy Now once you locate the necessary template.

- Select the suitable subscription plan, then log in or register for an account.

- Select the preferred payment method (with credit card or PayPal) to continue.

- Choose file format and save the Cook LLC Operating Agreement for S Corp on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the simplest and most trustworthy way to obtain legal documents. All the samples provided by our library are professionally drafted and checked for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs effectively with the US Legal Forms!

Form popularity

More info

Read it online for free. Find a business to sell your products through. Learn how to set up a website for your personal or business brand. Find the perfect gifts for businesspeople. Business Structure A Florida business entity must be classified as either a partnership or a corporation and must include the name of a limited liability company as a member. A corporation or partnership may not do business in Florida in the same name as any other entity. If you are forming a partnership, your member entities must be legally organized under the United States laws of Florida as a partnership, and you must meet these criteria. Florida does not recognize the creation of limited liability companies, so your member entities must be legally organized under the laws of the state they are legally located in or in a foreign country.

Disclaimer

The materials in this section are taken from public sources. We disclaim all representations or any warranties, express or implied, as to the accuracy, authenticity, reliability, accessibility, adequacy, or completeness of any data in this paragraph. Nevertheless, we make every effort to cite public sources deemed reliable and trustworthy.