Franklin Ohio LLC Operating Agreement for S Corp is a legal document that outlines the specific operating procedures and guidelines for an S Corporation formed under the laws of Ohio. This agreement serves as a contract between the S Corporation and its members, detailing the rights and responsibilities of each party involved. The Franklin Ohio LLC Operating Agreement for S Corp includes various important provisions that govern the operation of the company. These provisions typically outline the management structure, profit and loss distribution, decision-making processes, voting rights, and other fundamental aspects related to the day-to-day operations of the S Corporation. There may be different types of Franklin Ohio LLC Operating Agreements for S Corp, depending on the unique needs and preferences of the company and its members. Some variations of the agreement include: 1. Standard Franklin Ohio LLC Operating Agreement for S Corp: This is the most commonly used type of agreement and includes standard provisions that apply to most S Corporations. It covers general topics such as company governance, member roles, financial matters, and dispute resolution procedures. 2. Customized Franklin Ohio LLC Operating Agreement for S Corp: In some cases, companies may opt for a more tailored agreement that caters to their specific requirements. This type of agreement allows greater flexibility in terms of adding or modifying provisions to suit the business's individual needs. 3. Single-Member Franklin Ohio LLC Operating Agreement for S Corp: If the S Corporation has only one member (owner), a single-member agreement is used. This agreement typically contains provisions specific to personal liability protection, management control, and tax treatment for single-member S Corporations. 4. Multi-Member Franklin Ohio LLC Operating Agreement for S Corp: When an S Corporation has multiple members, a multi-member agreement is utilized. This type of agreement includes provisions that govern the relationship between multiple owners, profit-sharing arrangements, voting rights, and decision-making procedures pertaining to the collective management of the company. It is important to note that the specific requirements and provisions within the Franklin Ohio LLC Operating Agreement for S Corp may vary depending on the nature of the business, the preferences of the members, and the relevant laws and regulations in Ohio. Consulting with an attorney or legal professional can ensure that the agreement is appropriately customized and in compliance with all applicable laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Franklin Ohio Acuerdo operativo de LLC para S Corp - LLC Operating Agreement for S Corp

Description

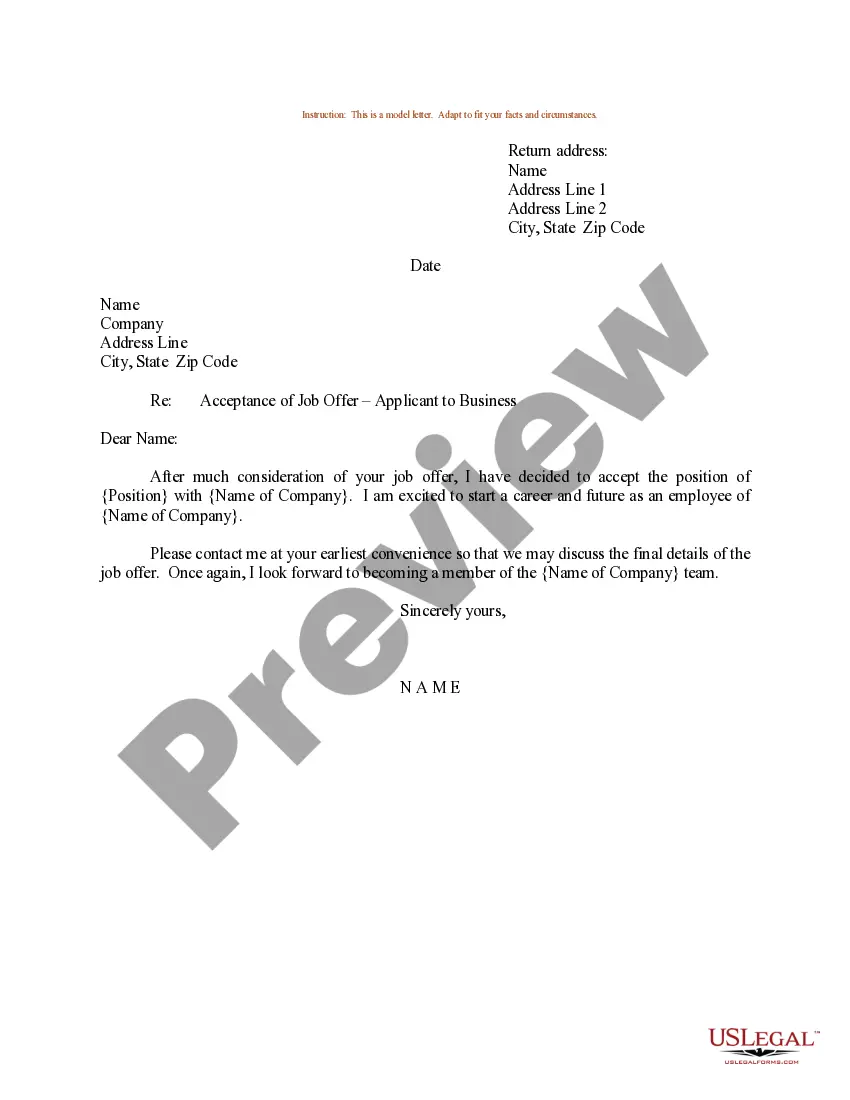

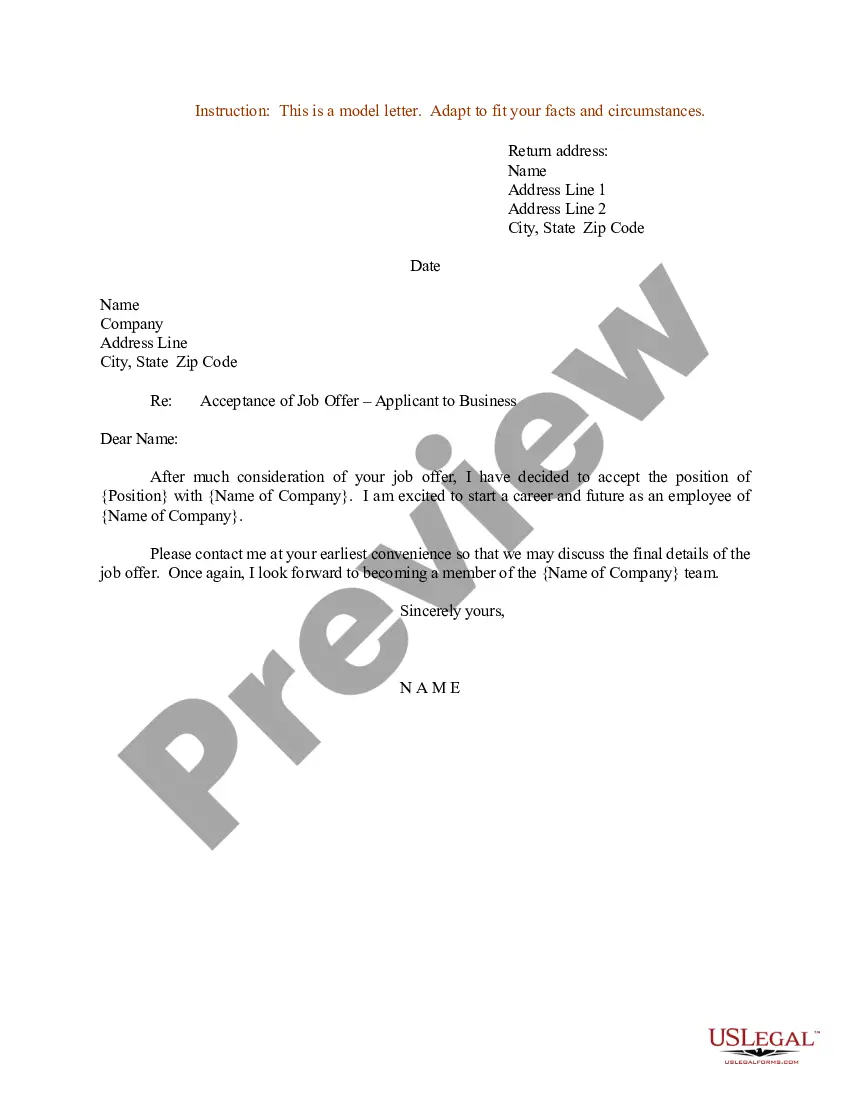

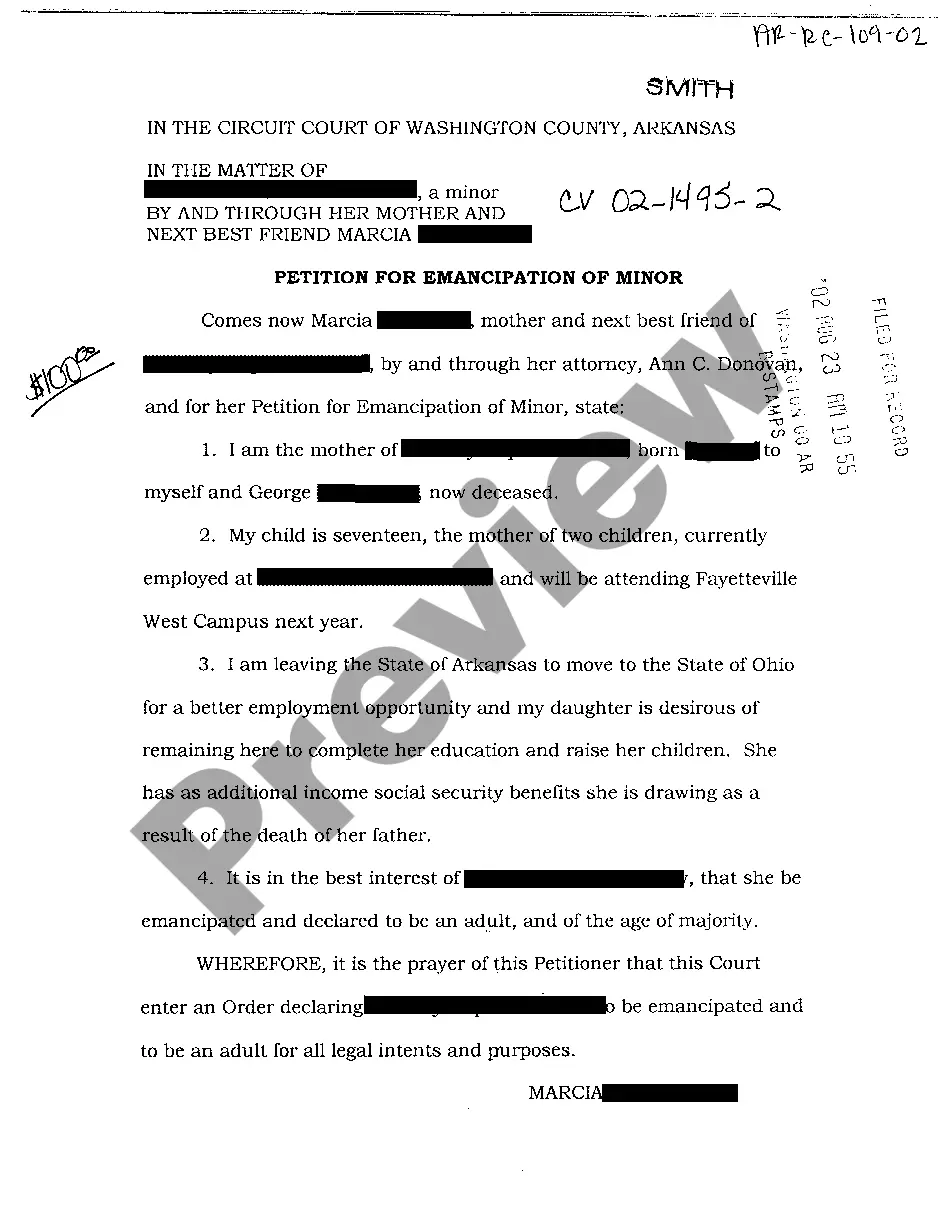

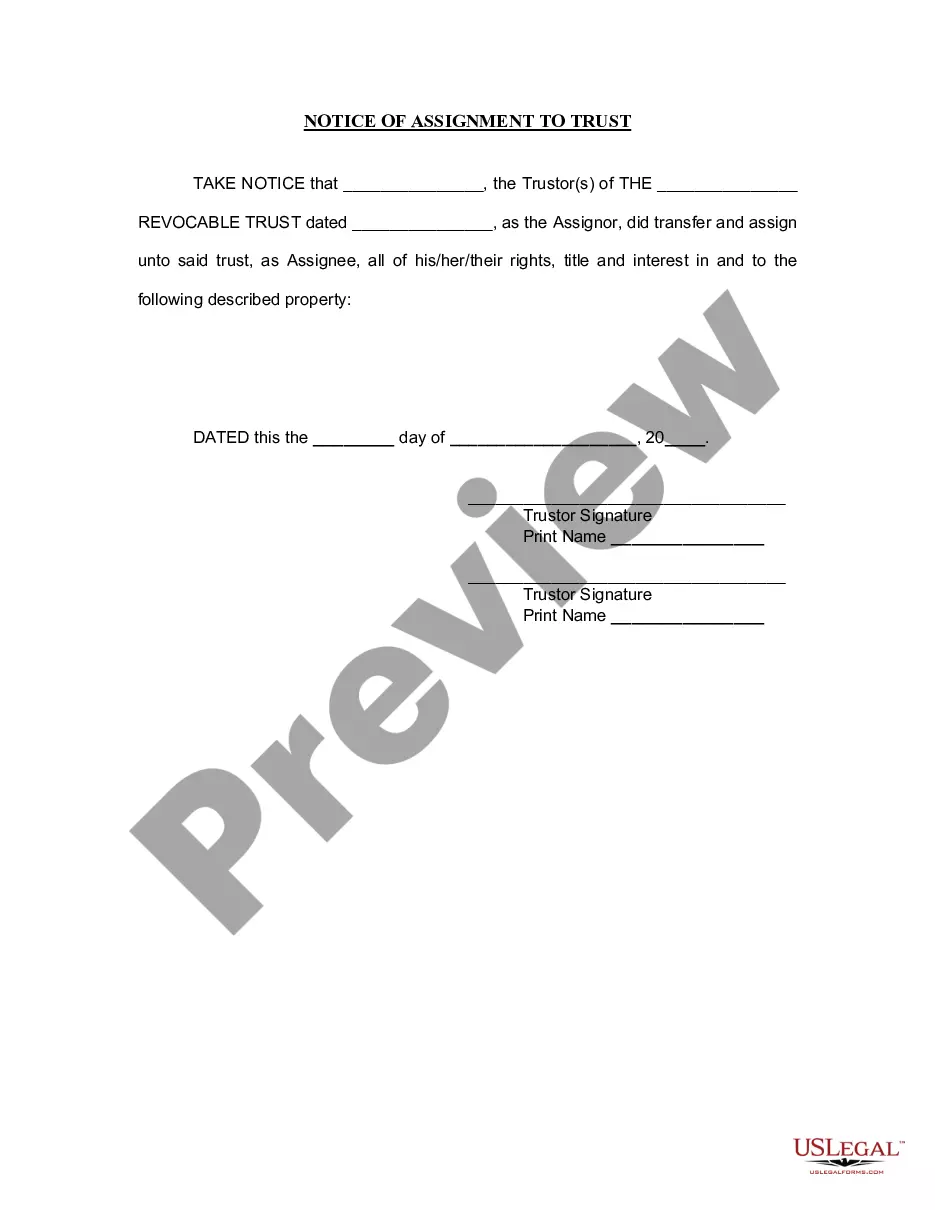

How to fill out Franklin Ohio Acuerdo Operativo De LLC Para S Corp?

Laws and regulations in every sphere differ from state to state. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Franklin LLC Operating Agreement for S Corp, you need a verified template valid for your county. That's when using the US Legal Forms platform is so beneficial.

US Legal Forms is a trusted by millions online library of more than 85,000 state-specific legal forms. It's a perfect solution for professionals and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used many times: once you purchase a sample, it remains available in your profile for future use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Franklin LLC Operating Agreement for S Corp from the My Forms tab.

For new users, it's necessary to make some more steps to get the Franklin LLC Operating Agreement for S Corp:

- Examine the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Click on the Buy Now button to obtain the document once you find the right one.

- Opt for one of the subscription plans and log in or create an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Fill out and sign the document in writing after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your documentation in order with the US Legal Forms!

Form popularity

FAQ

Un miembro de una corporacion S de Florida tiene que pagar el impuesto federal sobre el trabajo por cuenta propia solo sobre su salario; cualquier otra ganancia que obtenga a traves de la LLC no esta sujeta al impuesto sobre el trabajo por cuenta propia 15.3%.

Requisitos para abrir una LLC en Estados Unidos Nombre de la compania. Agente registrado. Acuerdo de operacion. Articulos de organizacion. Licencias y permisos comerciales (locales y federales) Formulario de declaracion de informacion. Declaracion de impuestos. EIN (Numero de Identificacion del Empleador)

Como iniciar una LLC en Virginia Paso 1: Decida un nombre para su LLC de Virginia. Paso 2: Asignar un agente registrado en Virginia. Paso 3: Presentar articulos de organizacion en Virginia. Paso 4: Cree su acuerdo operativo de Virginia LLC. Paso 5: Presentar un EIN de Virginia LLC. Costo de Virginia LLC.

There are no citizenship or residence requirements for ownership of a C Corporation or an LLC.

Una Compania de Responsabilidad Limitada (LLC, por sus siglas en ingles) es una estructura de negocio permitido conforme a los estatutos estatales. Cada estado puede utilizar regulaciones diferentes y usted debe verificar con su estado si esta interesado en iniciar una Compania de Responsabilidad Limitada.

Limited liability company (LLC) compania de responsabilidad limitada.

Para que la LLC declare impuestos como una empresa unipersonal, debes presentar el Anexo C. Los propietarios unicos pagan impuestos sobre las ganancias y perdidas comerciales de la empresa. Para declarar impuestos como una LLC/sociedad, presenta el Formulario 1065, Retorno de los ingresos de la sociedad.

Despues de averiguar los requerimientos sigue los siguientes pasos para registrar una LLC: Elige el nombre. Decide como se llamara la empresa e investiga si esta disponible.Consigue un agente registrado.Crea el acta constitutiva.Redacta el acuerdo operativo.Solicitar la calificacion foranea.Pago de cuotas.

A Limited Liability Company (LLC) is a business structure allowed by state statute. Each state may use different regulations, you should check with your state if you are interested in starting a Limited Liability Company. Owners of an LLC are called members.

Here are some ways you could legally name your LLC: ABC Limited Liability Company. ABC Limited Liability Co. ABC Limited.