San Antonio Texas LLC Operating Agreement for Married Couple is a legal document that outlines the rights, responsibilities, and obligations of a married couple who own and operate a limited liability company (LLC) in San Antonio, Texas. This agreement serves as a guide and establishes the framework for managing the operations and decision-making processes of the LLC. Keywords: San Antonio Texas, LLC Operating Agreement, Married Couple, limited liability company, legal document, rights, responsibilities, obligations, operations, decision-making processes. There are several types of San Antonio Texas LLC Operating Agreements for Married Couples, including: 1. Single-Member LLC Operating Agreement: This type of agreement is suitable for married couples who intend to operate their LLC as a single-member entity. It outlines the management responsibilities, profit and loss distribution, and decision-making authority of the solitary member. 2. Member-Managed LLC Operating Agreement: In this agreement, the married couple as members collectively manage the day-to-day operations, decision-making, and governance of the LLC. It details the roles and responsibilities of each member, including voting rights, capital contributions, and profit and loss distributions. 3. Manager-Managed LLC Operating Agreement: This type of agreement is relevant when the married couple designates a manager or managers to handle the LLC's operations instead of managing it jointly. The agreement outlines the powers, responsibilities, and compensation of the appointed manager(s) while the couple retains ownership. 4. Capital Contribution Agreement: This agreement specifies each spouse's capital contributions to the LLC, including cash, assets, or services. It outlines the transfer of property, valuation methods, and the ownership percentage allocated to each spouse in accordance with their contributions. 5. Buy-Sell Agreement: A buy-sell agreement is crucial for married couples who wish to establish predetermined terms and conditions for the future sale or transfer of ownership interests in the LLC. It addresses situations such as divorce, death, or retirement, ensuring a smooth transition while protecting the interests of each spouse. Regardless of the type of San Antonio Texas LLC Operating Agreement for Married Couple, it is essential to consult with an experienced attorney specializing in business and family law to ensure compliance with applicable state laws and to tailor the agreement to the unique needs and circumstances of the married couple.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Acuerdo de operación de LLC para pareja casada - LLC Operating Agreement for Married Couple

Description

How to fill out San Antonio Texas Acuerdo De Operación De LLC Para Pareja Casada?

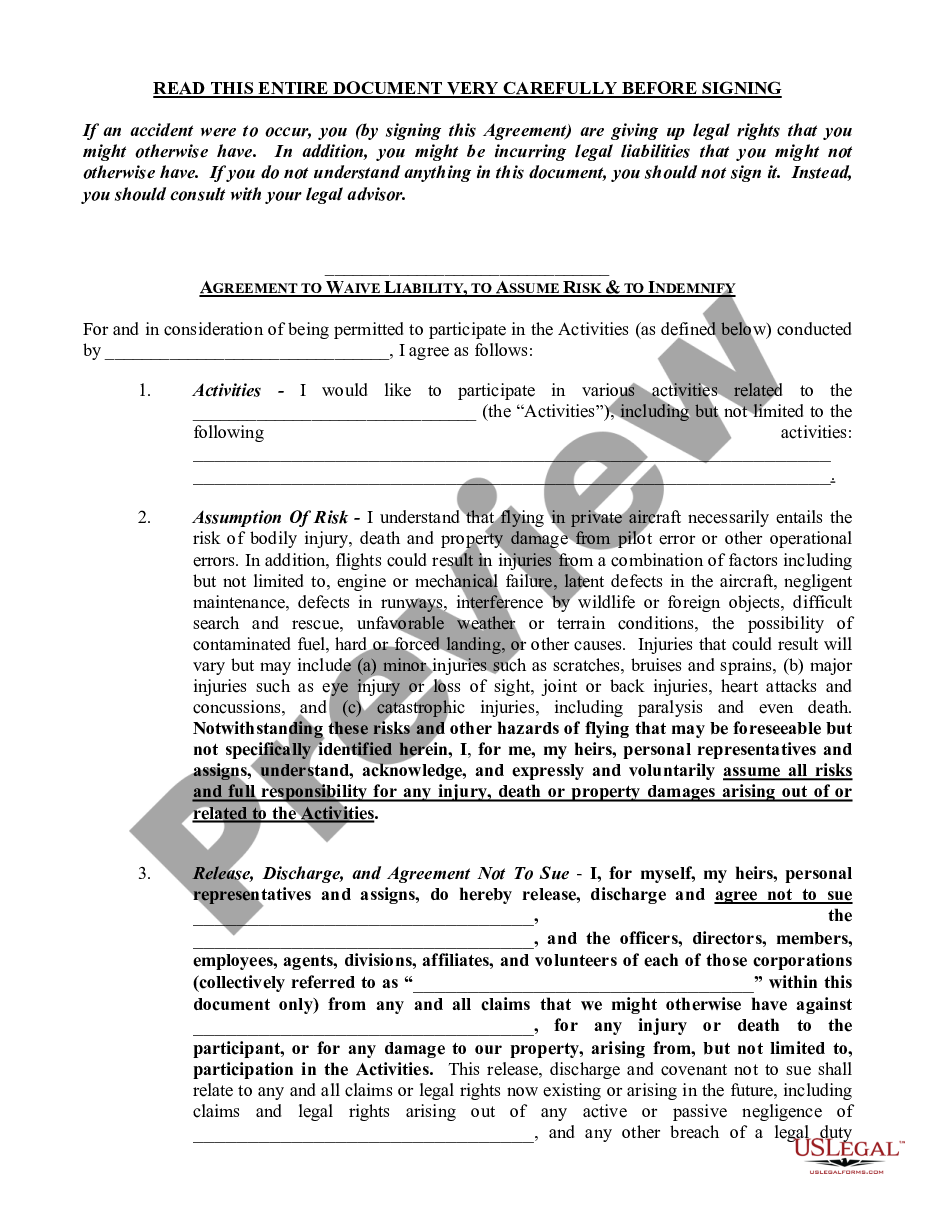

Whether you plan to start your company, enter into a contract, apply for your ID update, or resolve family-related legal concerns, you need to prepare specific documentation corresponding to your local laws and regulations. Locating the correct papers may take a lot of time and effort unless you use the US Legal Forms library.

The platform provides users with more than 85,000 expertly drafted and checked legal documents for any individual or business case. All files are collected by state and area of use, so opting for a copy like San Antonio LLC Operating Agreement for Married Couple is quick and simple.

The US Legal Forms library users only need to log in to their account and click the Download key next to the required form. If you are new to the service, it will take you a couple of additional steps to get the San Antonio LLC Operating Agreement for Married Couple. Follow the guide below:

- Make sure the sample fulfills your individual needs and state law regulations.

- Read the form description and check the Preview if there’s one on the page.

- Make use of the search tab specifying your state above to find another template.

- Click Buy Now to get the sample once you find the right one.

- Opt for the subscription plan that suits you most to proceed.

- Sign in to your account and pay the service with a credit card or PayPal.

- Download the San Antonio LLC Operating Agreement for Married Couple in the file format you require.

- Print the copy or complete it and sign it electronically via an online editor to save time.

Documents provided by our library are multi-usable. Having an active subscription, you can access all of your earlier acquired paperwork whenever you need in the My Forms tab of your profile. Stop wasting time on a constant search for up-to-date formal documents. Join the US Legal Forms platform and keep your paperwork in order with the most comprehensive online form library!

Form popularity

FAQ

Una compania de responsabilidad limitada (LLC) no paga impuestos a nivel empresarial. En cambio, los ingresos de la LLC se tributan a la declaracion de impuestos sobre la renta personal del miembro.

Veamos cuales son los principales beneficios de abrir una LLC en Estados Unidos para extranjeros. Registro rapido y simple.Protege el patrimonio de los emprendedores.Simplifica el pago de impuestos.Permite aplicar a una visa de inversionista.Dan acceso a nuevos mercados.

El proceso de transferencia implica la presentacion de un certificado de vigencia emitido por su antiguo estado con su nuevo estado y luego disolviendo la LLC en su antiguo estado. Disolver viejo LLC y formar una nueva LLC.

Pasos Para Pasar de Propietario Unico a una LLC Nombrar Tu LLC. Elegir un Agente Registrado de LLC. Presentar el Acta Constitutiva de Tu LLC. Crear un Acuerdo Operativo de LLC. Obtener un EIN.

No hay un limite maximo de miembros. La mayoria de los estados tambien permiten las LLC de un miembro unico, las que tienen un solo dueno.

Una compania de responsabilidad limitada (LLC) no paga impuestos a nivel empresarial.

El mayor beneficio de una LLC es la proteccion de responsabilidad personal que brinda. Esto significa que el propietario de una LLC no corre el riesgo de perder sus posesiones personales si la empresa quiebra o es demandada. Las empresas unipersonales y las sociedades generales no brindan esta proteccion.

El mayor beneficio de una LLC es la proteccion de responsabilidad personal que brinda. Esto significa que el propietario de una LLC no corre el riesgo de perder sus posesiones personales si la empresa quiebra o es demandada. Las empresas unipersonales y las sociedades generales no brindan esta proteccion.

Una Compania de Responsabilidad Limitada (LLC, por sus siglas en ingles) es una estructura de negocio permitido conforme a los estatutos estatales. Cada estado puede utilizar regulaciones diferentes y usted debe verificar con su estado si esta interesado en iniciar una Compania de Responsabilidad Limitada.

Se incurre en un costo de US$ 300 ( US$ 308 para la solicitud en linea) por la tarifa de presentacion al enviar el Certificado de formacion de una compania de responsabilidad limitada (Formulario 205) a la Secretaria de Estado de Texas.