The Clark Nevada LLC Operating Agreement for Rental Property is a legal document that outlines the specific terms and conditions of operating a Limited Liability Company (LLC) in Clark County, Nevada, for the purpose of engaging in rental property business activities. This agreement serves as a crucial tool for property owners, landlords, and investors to establish clear guidelines, roles, and responsibilities within the LLC structure. The operating agreement typically includes key provisions such as the formation and organization of the LLC, the members' contributions and ownership percentages, the procedures for managing and maintaining rental properties, as well as the distribution of profits and losses among members. Additionally, it outlines the decision-making process, voting rights, and procedures for resolving disputes or conflicts that may arise among members. While there is no specific variation named as "Clark Nevada LLC Operating Agreement for Rental Property," it's important to note that there may be customized operating agreements depending on the specific objectives and unique requirements of the LLC. Some potential variations include: 1. Single-Member LLC Operating Agreement: This agreement is tailored for LCS owned and operated by a single individual, providing detailed guidelines for the sole member's rights, responsibilities, decision-making authority, and profit allocation concerning rental property activities. 2. Multi-Member LLC Operating Agreement: This agreement caters to LCS owned and operated by multiple members, each having defined roles, contributions, and interests in the rental property business. It outlines the rules governing inter-member relationships, management structure, financial considerations, and dispute resolution mechanisms. 3. Member-Managed LLC Operating Agreement: This type of agreement is designed for LCS where all members directly participate in the management and decision-making process of the rental property business. It establishes guidelines for collaboration, voting procedures, and day-to-day operations. 4. Manager-Managed LLC Operating Agreement: In cases where one or more designated managers handle the rental property business on behalf of the LLC members, this agreement specifies the roles, responsibilities, authority, and compensation of the managers while still addressing the members' rights and oversight mechanisms. Regardless of the specific type, a well-drafted Clark Nevada LLC Operating Agreement for Rental Property plays a crucial role in establishing a solid foundation for a rental property business, ensuring transparency, clarity, and protection for all parties involved. It is always advisable to consult with a legal professional specializing in real estate and business law to ensure compliance with local regulations and to address specific needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Clark Nevada Acuerdo operativo de LLC para propiedad de alquiler - LLC Operating Agreement for Rental Property

Description

How to fill out Clark Nevada Acuerdo Operativo De LLC Para Propiedad De Alquiler?

Preparing legal paperwork can be cumbersome. Besides, if you decide to ask a lawyer to write a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Clark LLC Operating Agreement for Rental Property, it may cost you a lot of money. So what is the most reasonable way to save time and money and draw up legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is biggest online catalog of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case gathered all in one place. Therefore, if you need the current version of the Clark LLC Operating Agreement for Rental Property, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Clark LLC Operating Agreement for Rental Property:

- Look through the page and verify there is a sample for your region.

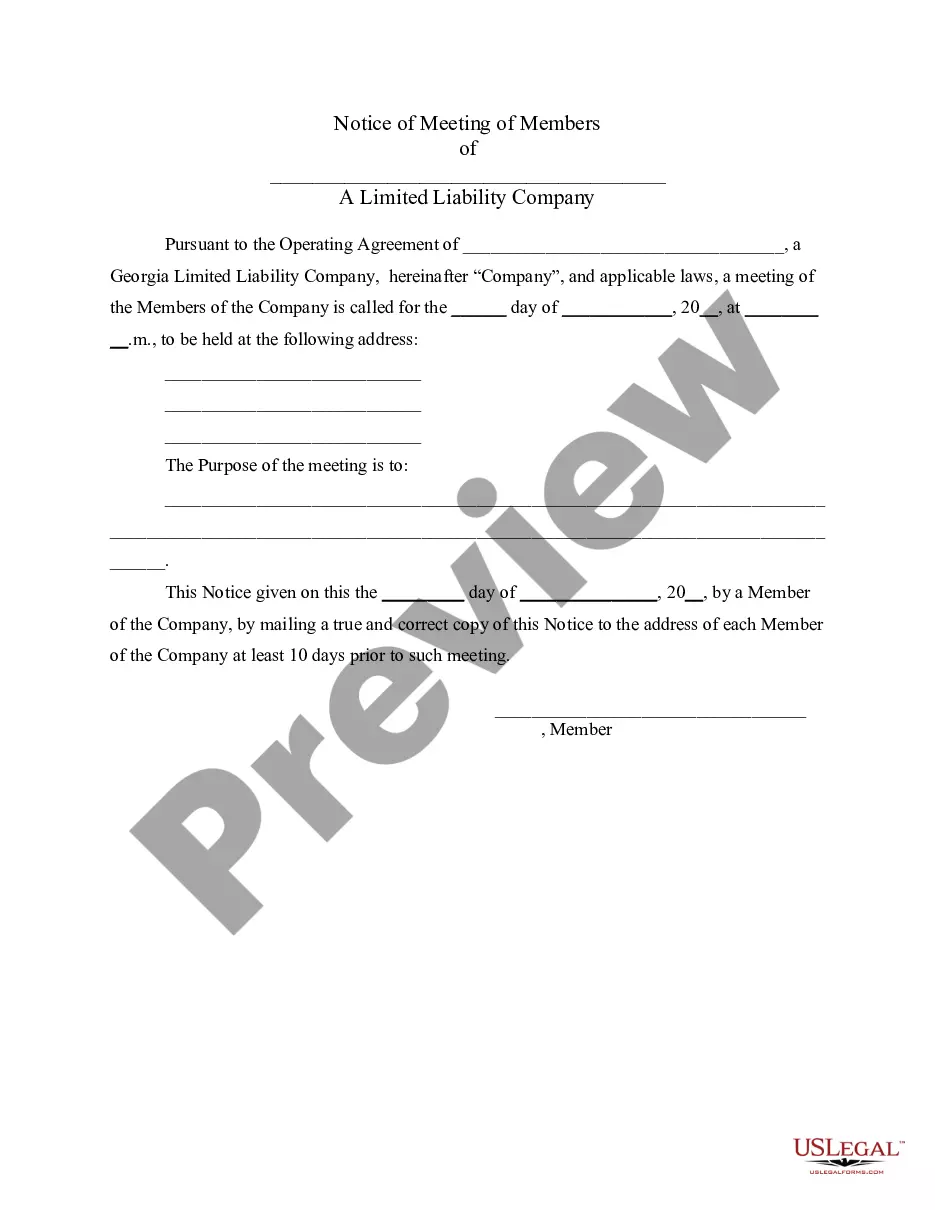

- Check the form description and use the Preview option, if available, to make sure it's the template you need.

- Don't worry if the form doesn't suit your requirements - search for the correct one in the header.

- Click Buy Now once you find the required sample and select the best suitable subscription.

- Log in or register for an account to purchase your subscription.

- Make a payment with a credit card or via PayPal.

- Choose the file format for your Clark LLC Operating Agreement for Rental Property and save it.

Once finished, you can print it out and complete it on paper or upload the template to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the documents ever acquired multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!