Allegheny Pennsylvania Indemnification Agreement for a Trust is a legal document that outlines the terms and conditions in which a trustee is indemnified against any liability or losses incurred during the administration of a trust. This agreement is essential in providing protection and assurance to trustees when carrying out their fiduciary duties. The Allegheny Pennsylvania Indemnification Agreement for a Trust aims to ensure that trustees are not personally held liable for any actions they take on behalf of the trust unless it is proven that they have acted in bad faith or violated their duties. It is designed to safeguard trustees against potential claims, lawsuits, and financial loss that may arise from their service. Key terms and components included in the Allegheny Pennsylvania Indemnification Agreement for a Trust may consist of: 1. Indemnification Provision: This clause states that the trust will indemnify the trustee for any losses, expenses, or liabilities arising from their actions as long as they acted in good faith and within the scope of their authority. 2. Limitations on Indemnification: The agreement may set limitations on the trustee's indemnification, such as excluding indemnification for intentional misconduct, fraudulent acts, or willful negligence. 3. Advancement of Expenses: This provision addresses the trustee's right to receive timely reimbursement for legal fees, court costs, and any other expenses incurred while defending against claims made against them. 4. Notice and Defense: This section outlines the process for the trustee to notify the trust of any claims or potential claims and their right to participate actively in the defense against such claims. 5. Standard of Care: The document may define the standard of care expected from the trustee, which could be based on the Prudent Investor Rule or any other legally recognized standard. It is important to note that there could be different types or variations of the Allegheny Pennsylvania Indemnification Agreement for a Trust. These may include: 1. Permanent Indemnification Agreement: This type establishes a broad and ongoing indemnification provision that applies to all current and future trustees, protecting them throughout their entire tenure. 2. Limited Indemnification Agreement: Unlike the permanent agreement, this type of agreement may specify limitations regarding the duration or extent of indemnification provided to the trustee. 3. Customized Indemnification Agreement: Some trusts may choose to create customized indemnification agreements that address specific circumstances, risks, or requirements unique to that particular trust. The Allegheny Pennsylvania Indemnification Agreement for a Trust plays a crucial role in providing legal protection and peace of mind to trustees serving their fiduciary duties. It ensures that individuals who take on the responsibility of managing trusts are shielded from personal liability for their actions, promoting effective trust administration and encouraging qualified individuals to serve as trustees.

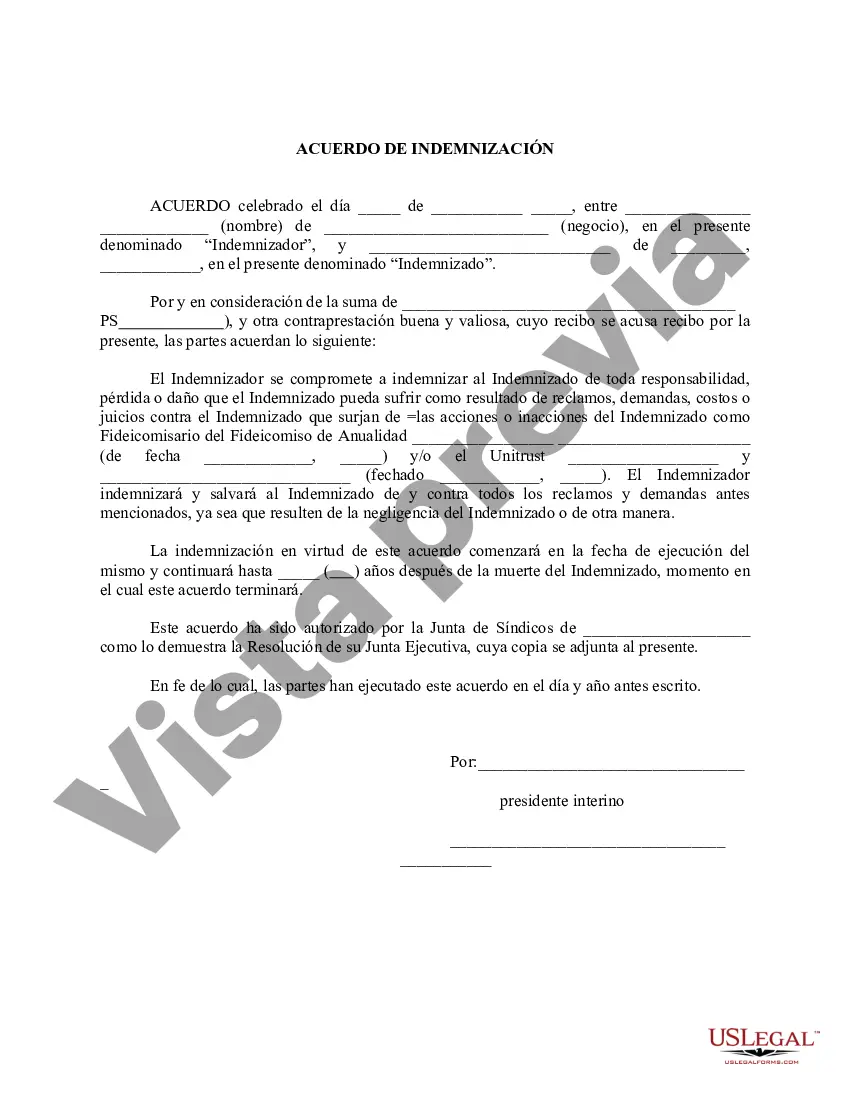

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Acuerdo de Indemnización por un Fideicomiso - Indemnification Agreement for a Trust

Description

How to fill out Allegheny Pennsylvania Acuerdo De Indemnización Por Un Fideicomiso?

Drafting documents for the business or individual needs is always a huge responsibility. When creating a contract, a public service request, or a power of attorney, it's important to consider all federal and state laws of the specific area. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to create Allegheny Indemnification Agreement for a Trust without professional help.

It's easy to avoid spending money on lawyers drafting your paperwork and create a legally valid Allegheny Indemnification Agreement for a Trust on your own, using the US Legal Forms online library. It is the greatest online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when choosing a sample for your county. Previously subscribed users only need to log in to their accounts to download the necessary form.

If you still don't have a subscription, adhere to the step-by-step instruction below to get the Allegheny Indemnification Agreement for a Trust:

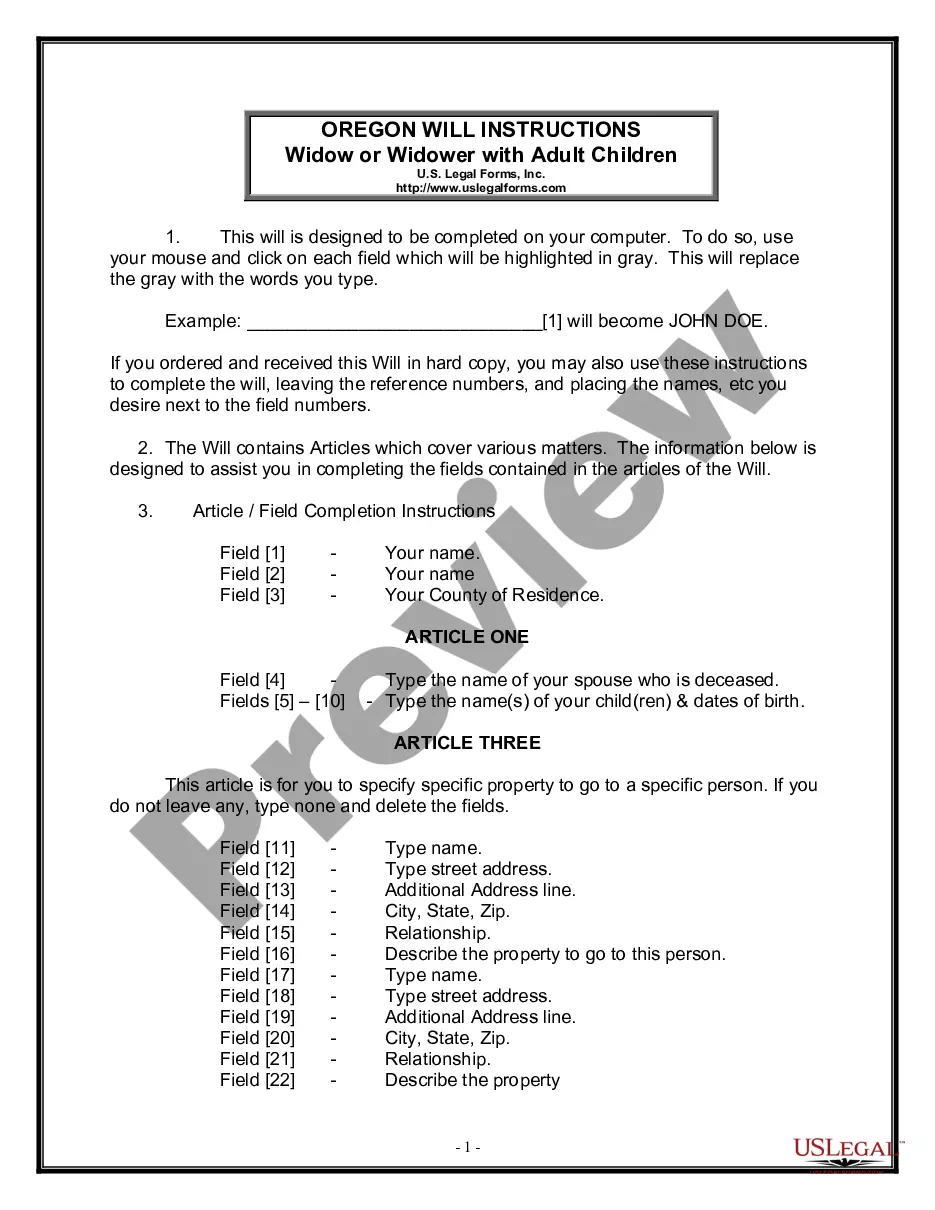

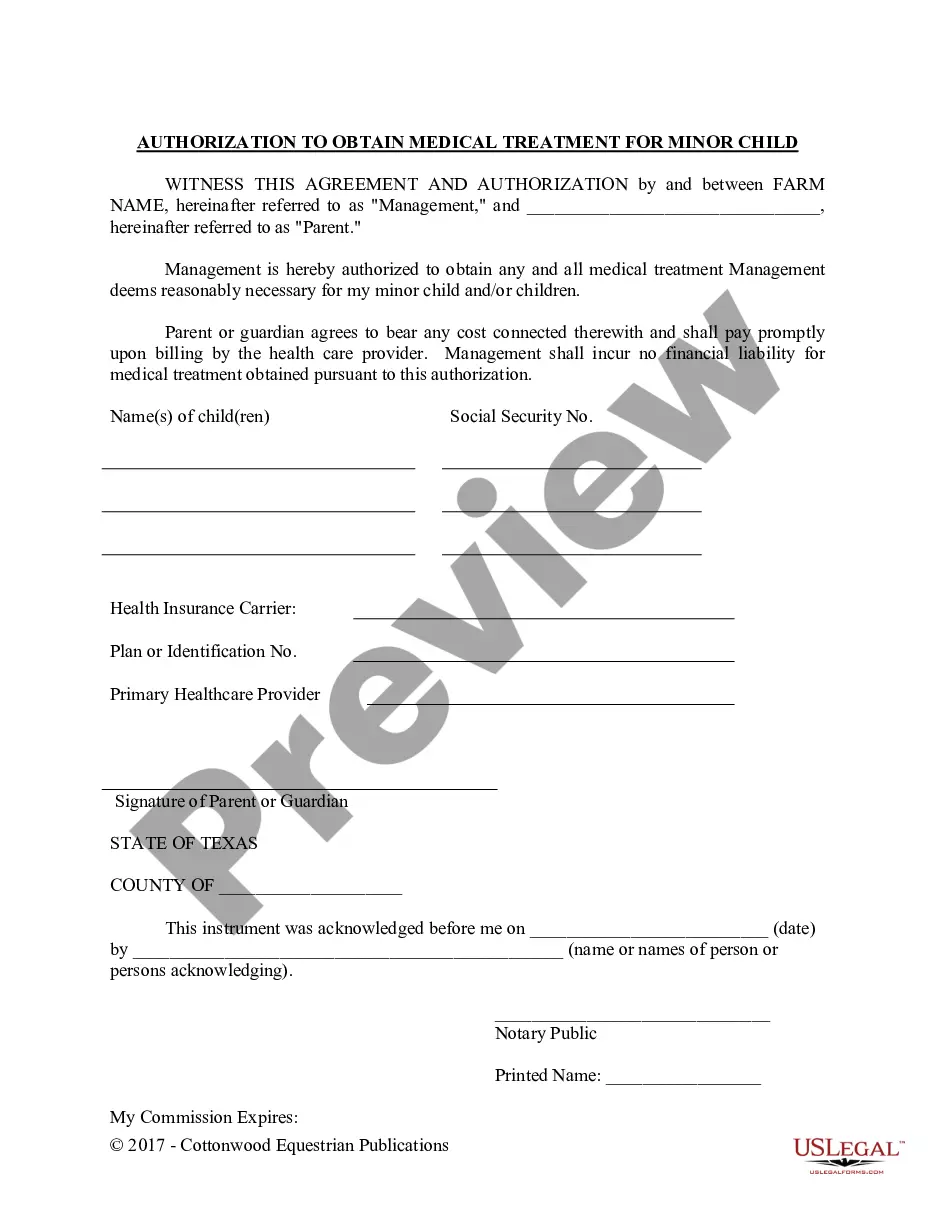

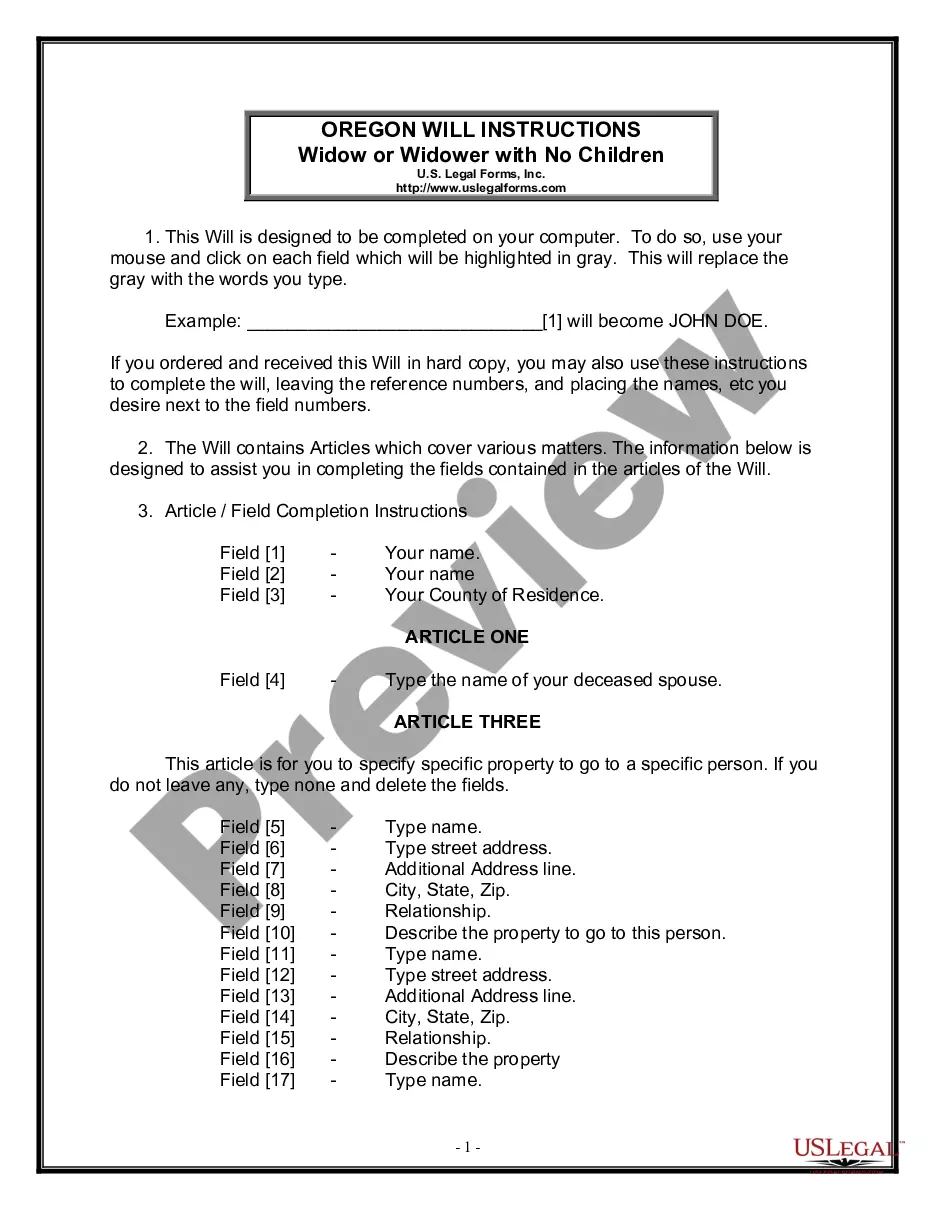

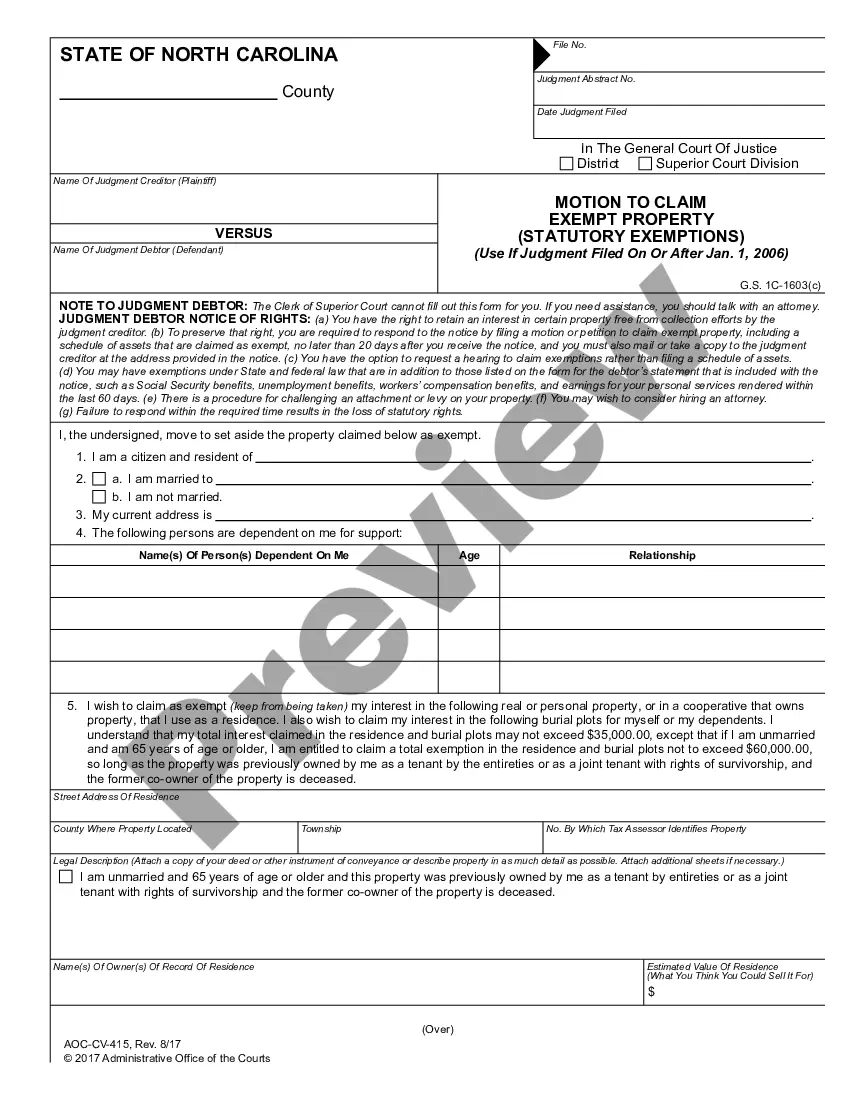

- Look through the page you've opened and verify if it has the sample you require.

- To achieve this, use the form description and preview if these options are presented.

- To locate the one that suits your needs, utilize the search tab in the page header.

- Double-check that the template complies with juridical standards and click Buy Now.

- Pick the subscription plan, then sign in or create an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen document in the preferred format, print it, or complete it electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever acquired never gets lost - you can access it in your profile within the My Forms tab at any time. Join the platform and quickly obtain verified legal templates for any scenario with just a couple of clicks!