Bexar Texas Indemnification Agreement for a Trust is a legally binding document designed to protect trustees from financial losses or liabilities that may arise while fulfilling their duties within a trust. This agreement ensures that trustees are safeguarded financially and encourages them to act in the best interest of the trust's beneficiaries. By indemnifying trustees, the agreement provides them with peace of mind and encourages them to carry out their responsibilities without fear of personal financial repercussions. Some key elements typically included in a Bexar Texas Indemnification Agreement for a Trust are: 1. Purpose: This section outlines the purpose of the agreement, emphasizing the intent to indemnify trustees against claims, damages, losses, or expenses incurred during trust administration. 2. Definitions: This part clarifies the meaning behind certain terms used throughout the agreement, ensuring a common understanding amongst the parties involved. 3. Indemnification Coverage: The agreement specifies the scope and extent of indemnification coverage provided to trustees. It may include legal fees, judgments, settlements, fines, or other expenses incurred as a result of legal proceedings or claims. 4. Standard of Conduct: This section establishes the standard of conduct expected from trustees, ensuring that indemnification is only applicable when trustees have acted in good faith and in the best interest of the trust and its beneficiaries. 5. Procedures: The agreement outlines the procedures for making an indemnification claim, including the submission of supporting documentation, notice requirements, and the approval process. 6. Limitations and Exceptions: Certain limitations or exceptions may be included to avoid indemnification in cases of fraud, willful misconduct, or acts committed outside the scope of the trustee's authority. While the specific types of Bexar Texas Indemnification Agreements for a Trust may vary depending on the specific needs and circumstances of the trust, there are generally no distinct types that are widely recognized. However, it is possible to tailor the agreement to best suit the requirements of different trusts, such as irrevocable trusts, living trusts, charitable trusts, or special needs trusts. It's important to consult with legal professionals and experienced trustees to design an indemnification agreement that aligns with the specific goals and structures of each trust.

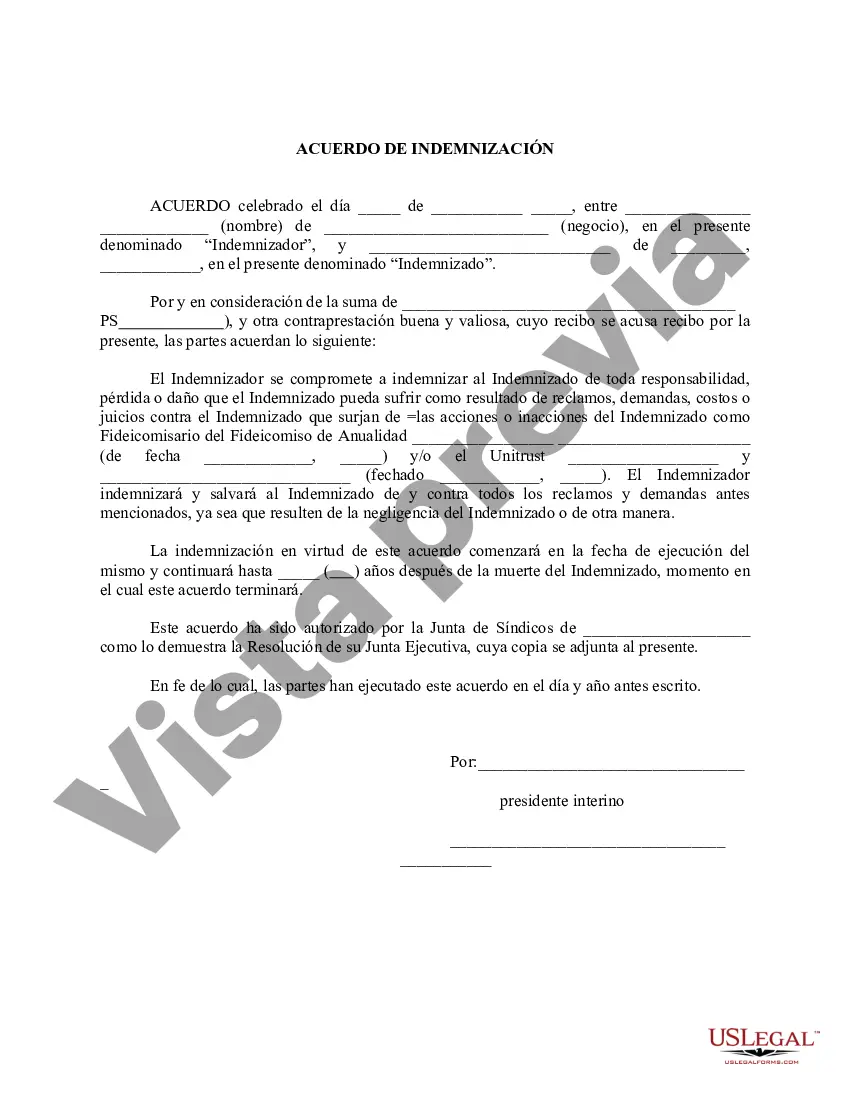

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Bexar Texas Acuerdo de Indemnización por un Fideicomiso - Indemnification Agreement for a Trust

Description

How to fill out Bexar Texas Acuerdo De Indemnización Por Un Fideicomiso?

Laws and regulations in every sphere differ around the country. If you're not an attorney, it's easy to get lost in a variety of norms when it comes to drafting legal documentation. To avoid expensive legal assistance when preparing the Bexar Indemnification Agreement for a Trust, you need a verified template valid for your region. That's when using the US Legal Forms platform is so advantageous.

US Legal Forms is a trusted by millions web collection of more than 85,000 state-specific legal templates. It's a great solution for professionals and individuals searching for do-it-yourself templates for different life and business scenarios. All the documents can be used many times: once you purchase a sample, it remains accessible in your profile for further use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Bexar Indemnification Agreement for a Trust from the My Forms tab.

For new users, it's necessary to make a few more steps to obtain the Bexar Indemnification Agreement for a Trust:

- Examine the page content to make sure you found the appropriate sample.

- Take advantage of the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your criteria.

- Click on the Buy Now button to get the template once you find the correct one.

- Opt for one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the document in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the easiest and most cost-effective way to get up-to-date templates for any legal purposes. Find them all in clicks and keep your documentation in order with the US Legal Forms!