A Chicago Illinois Indemnification Agreement for a Trust is a legally binding document that aims to protect trustees from any lawsuits or claims arising from their role as a trustee. This agreement plays a vital role in ensuring that trustees can carry out their duties without undue risk or liability. The purpose of an Indemnification Agreement is to provide trustees with financial protection and reimbursement for expenses associated with legal proceedings or claims made against them. By signing this agreement, trustees can feel secure knowing that they will be indemnified against any losses they may incur while acting in good faith and within the scope of their duties. Key provisions found in a typical Chicago Illinois Indemnification Agreement for a Trust include: 1. Indemnification Scope: This section outlines the circumstances under which trustees will be protected. It typically covers claims, suits, actions, or proceedings arising from the administration of the trust or any related matters. 2. Expense Reimbursement: The agreement clearly states that any reasonable costs, attorney fees, and expenses incurred by the trustees in defending against claims or lawsuits will be reimbursed by the trust. 3. Procedure for Indemnification: This section outlines the process for requesting indemnification, including providing notice to the trust and complying with any additional requirements or conditions set forth in the trust agreement or state laws. 4. Standard of Conduct: The agreement may include provisions that establish a standard of conduct for trustees, such as acting in good faith, with reasonable care and diligence, and in accordance with the trust's purposes and applicable laws. 5. Limitations: Certain limitations on indemnification may be included, specifying situations where indemnification is not available, such as if the trustee acted with willful misconduct or breached their fiduciary duties. Different types of Chicago Illinois Indemnification Agreements for a Trust may include: 1. Standard Indemnification Agreement: This is a comprehensive agreement that covers a broad range of circumstances in which trustees may face claims or lawsuits related to their role. 2. Limited Liability Indemnification Agreement: This type of agreement may provide more limited protection, safeguarding trustees against only specific types of claims or specified amounts. 3. Director and Officer Liability Indemnification Agreement: This particular agreement is designed for trustees who also serve as directors or officers of a corporation or organization related to the trust. It offers additional protection specific to these roles. In conclusion, a Chicago Illinois Indemnification Agreement for a Trust is an important legal tool that ensures trustees can perform their duties confidently and without fear of personal liability. Each agreement may vary in its scope and provisions, depending on the specific needs and circumstances of the trust and its beneficiaries.

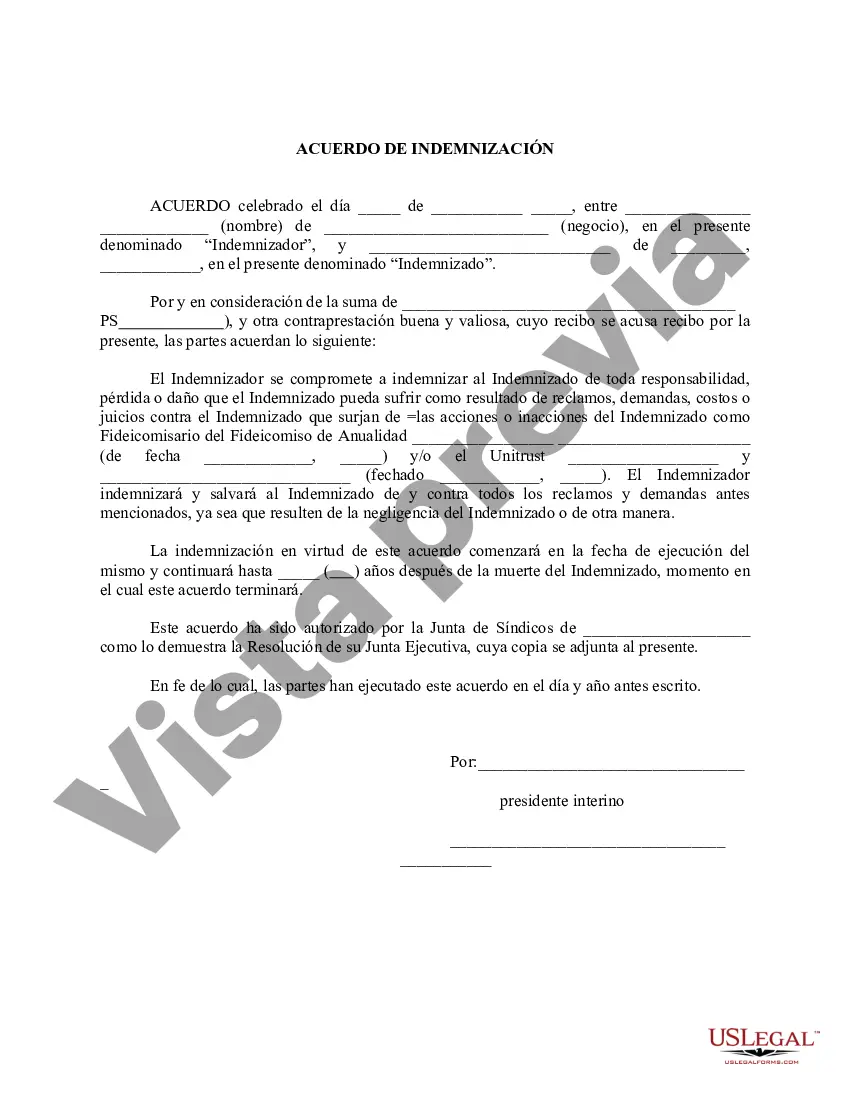

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Chicago Illinois Acuerdo de Indemnización por un Fideicomiso - Indemnification Agreement for a Trust

Description

How to fill out Chicago Illinois Acuerdo De Indemnización Por Un Fideicomiso?

If you need to find a reliable legal form provider to find the Chicago Indemnification Agreement for a Trust, look no further than US Legal Forms. No matter if you need to start your LLC business or manage your belongings distribution, we got you covered. You don't need to be well-versed in in law to locate and download the needed form.

- You can select from over 85,000 forms arranged by state/county and situation.

- The intuitive interface, number of learning materials, and dedicated support team make it easy to locate and execute various documents.

- US Legal Forms is a reliable service providing legal forms to millions of users since 1997.

Simply type to search or browse Chicago Indemnification Agreement for a Trust, either by a keyword or by the state/county the document is created for. After finding the needed form, you can log in and download it or save it in the My Forms tab.

Don't have an account? It's effortless to start! Simply find the Chicago Indemnification Agreement for a Trust template and check the form's preview and short introductory information (if available). If you're comfortable with the template’s legalese, go ahead and hit Buy now. Register an account and choose a subscription option. The template will be instantly ready for download once the payment is completed. Now you can execute the form.

Taking care of your legal affairs doesn’t have to be pricey or time-consuming. US Legal Forms is here to prove it. Our rich variety of legal forms makes this experience less costly and more reasonably priced. Set up your first business, organize your advance care planning, draft a real estate agreement, or execute the Chicago Indemnification Agreement for a Trust - all from the convenience of your home.

Sign up for US Legal Forms now!