Fairfax, Virginia Indemnification Agreement for a Trust: A Detailed Description An indemnification agreement forms a crucial component of establishing a trust in Fairfax, Virginia. It offers protection and assurance to trustees, safeguarding them against potential liabilities and legal risks involved in administering trust assets. This article will provide a comprehensive overview of the Fairfax Virginia indemnification agreement for a trust, highlighting its significance, key provisions, and any distinct types. In the context of trusts, an indemnification agreement refers to a legally binding document designed to protect trustees from personal financial loss resulting from their actions, omissions, errors, or decisions made in good faith while fulfilling their fiduciary duties. It acts as a shield against potential lawsuits, claims, or demands that may arise during the trust administration process. The Fairfax Virginia indemnification agreement for a trust typically includes provisions such as: 1. Scope of Indemnification: This section specifies the extent to which trustees will be indemnified, including legal expenses, judgments, settlements, and other related costs. It outlines the boundaries within which trustees can benefit from indemnity. 2. Standard of Conduct: The agreement defines the standard of conduct expected from trustees, emphasizing their obligation to act prudently, in good faith, and in the best interest of the beneficiaries. Compliance with the Virginia Uniform Trust Code and other applicable laws is generally required. 3. Misconduct Exclusions: Certain actions and behaviors may exclude trustees from indemnification. Willful misconduct, fraud, dishonest acts, and intentional or reckless violations of fiduciary duties are typically excluded from indemnity coverage. 4. Advancement of Expenses: The indemnification agreement may grant trustees the right to request advancement of expenses related to legal representation and defense in any proceeding or claim against them. This provision ensures that trustees have timely access to financial resources required to defend themselves. 5. Insurance: The agreement may require trustees to maintain adequate liability insurance coverage, protecting them from potential personal liabilities associated with the trust administration. Some distinct types of Fairfax Virginia indemnification agreements for a trust include: 1. General Indemnification Agreement: This type of agreement provides broad indemnity protection to trustees for actions taken in good faith and in accordance with their fiduciary duties. It is applicable in most trust administration scenarios. 2. Limited Indemnification Agreement: This agreement may contain narrower indemnity provisions, limiting the extent of protection offered to trustees. It is more commonly utilized when there are specific limitations on trust assets or unique circumstances involved in the trust administration. 3. Customized Indemnification Agreement: In certain cases, parties may opt to draft a tailored indemnification agreement that suits their specific requirements and risk profiles. This allows for greater flexibility in terms of defining indemnification provisions, subject to compliance with relevant laws and regulations. It is important to understand that the content of indemnification agreements may vary depending on individual circumstances, the complexity of the trust, and the goals of the trust settler. Seeking legal advice from a qualified attorney in Fairfax, Virginia, is highly recommended ensuring compliance with applicable laws and to tailor the indemnification agreement to specific needs. In conclusion, a Fairfax Virginia indemnification agreement for a trust is a crucial legal instrument that provides protection and peace of mind to trustees during the course of trust administration. By defining the scope of indemnification, setting standards of conduct, and addressing important provisions, this agreement helps safeguard trustees from potential personal liabilities and legal risks.

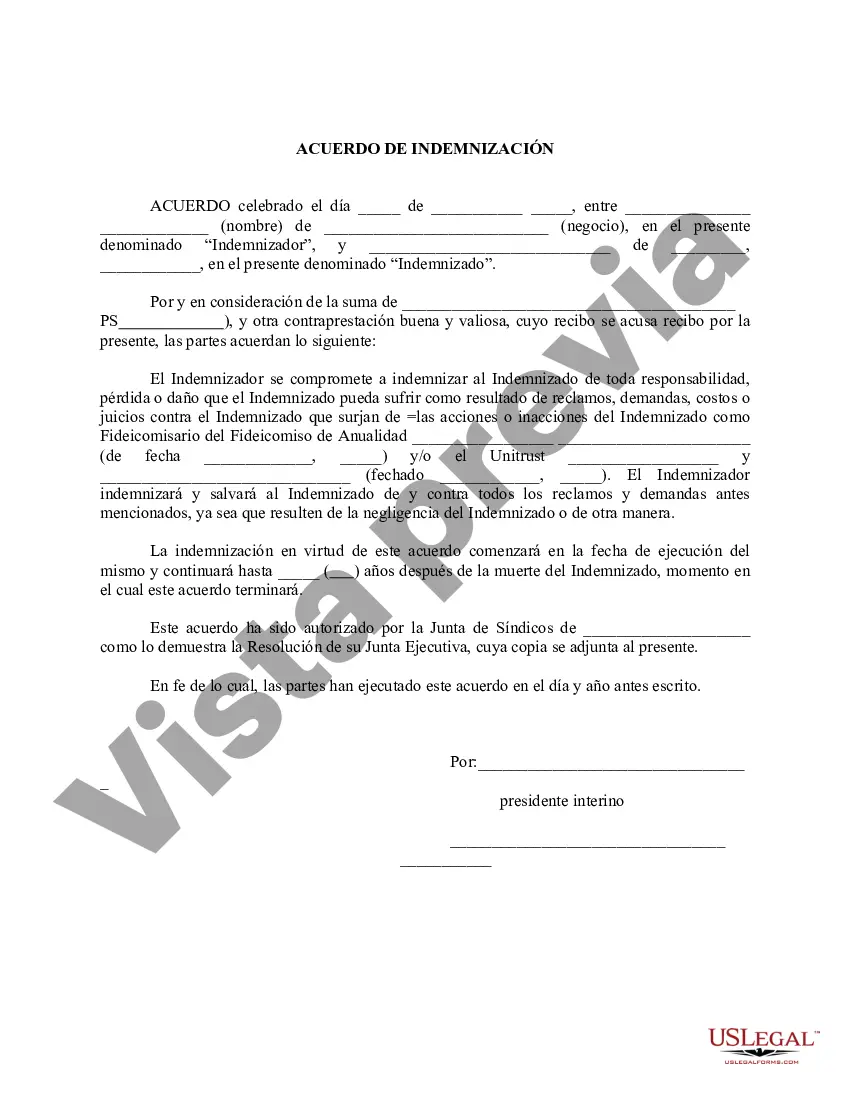

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Fairfax Virginia Acuerdo de Indemnización por un Fideicomiso - Indemnification Agreement for a Trust

Description

How to fill out Fairfax Virginia Acuerdo De Indemnización Por Un Fideicomiso?

Laws and regulations in every area vary from state to state. If you're not a lawyer, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid costly legal assistance when preparing the Fairfax Indemnification Agreement for a Trust, you need a verified template valid for your county. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions online collection of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business situations. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for subsequent use. Therefore, when you have an account with a valid subscription, you can just log in and re-download the Fairfax Indemnification Agreement for a Trust from the My Forms tab.

For new users, it's necessary to make a couple of more steps to obtain the Fairfax Indemnification Agreement for a Trust:

- Examine the page content to make sure you found the right sample.

- Take advantage of the Preview option or read the form description if available.

- Look for another doc if there are inconsistencies with any of your requirements.

- Use the Buy Now button to get the template once you find the appropriate one.

- Choose one of the subscription plans and log in or create an account.

- Choose how you prefer to pay for your subscription (with a credit card or PayPal).

- Pick the format you want to save the file in and click Download.

- Fill out and sign the template on paper after printing it or do it all electronically.

That's the simplest and most affordable way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!