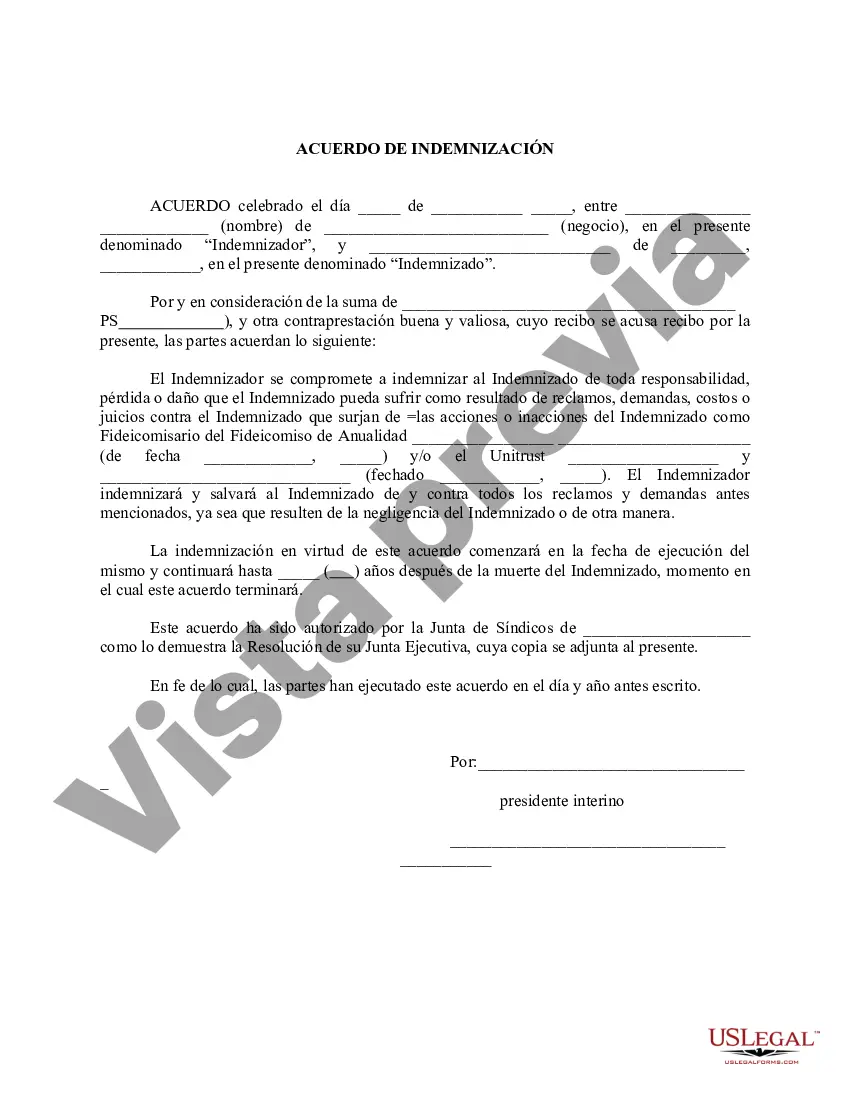

Description: The Harris Texas Indemnification Agreement for a Trust is a legal document that establishes the terms and conditions under which an individual or entity agrees to provide indemnification and protection to the trustee of a trust. This agreement is crucial in defining the responsibilities and liabilities of the indemnifying party and ensuring that the trust's assets are safeguarded. The primary purpose of the Harris Texas Indemnification Agreement for a Trust is to shield the trustee from financial loss, legal actions, and liabilities incurred while acting in their capacity as trustee. By entering into this agreement, the trustee can operate with confidence, knowing that they have the support and protection of the indemnifying party. Some relevant keywords in relation to Harris Texas Indemnification Agreement for a Trust include: 1. Trustee: Refers to the individual or entity entrusted with the administration and management of the trust's assets and affairs. 2. Indemnification: The act of compensating or protecting someone against financial loss or legal liabilities. 3. Agreement: A legally-binding document that outlines the terms and conditions agreed upon by involved parties. 4. Liability: Legal responsibility and obligation to compensate for harm or damage caused. 5. Trust Assets: The properties, investments, and financial resources held by the trust. Different types of Harris Texas Indemnification Agreement for a Trust include: 1. General Indemnification Agreement: This type of agreement provides broad indemnification coverage to the trustee, encompassing most liabilities and legal actions that may arise during their tenure. 2. Limited Indemnification Agreement: In contrast to a general agreement, a limited indemnification agreement restricts the scope of indemnification, specifying certain scenarios or limitations under which the trustee will receive protection. 3. Mutual Indemnification Agreement: This agreement involves reciprocal indemnification, where both the trustee and the indemnifying party agree to provide protection to each other against potential losses or liabilities. 4. Third-Party Indemnification Agreement: In certain cases, a trust may require a third-party indemnification agreement to protect the trustee from claims made by individuals or entities external to the trust. Regardless of the specific type, the Harris Texas Indemnification Agreement for a Trust serves as a crucial safeguard, ensuring that the interests of both the trustee and the trust's beneficiaries are protected. It provides clarity regarding liability and the extent of protection extended, allowing for smooth and secure trust administration.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Harris Texas Acuerdo de Indemnización por un Fideicomiso - Indemnification Agreement for a Trust

Description

How to fill out Harris Texas Acuerdo De Indemnización Por Un Fideicomiso?

Drafting paperwork for the business or individual demands is always a big responsibility. When drawing up an agreement, a public service request, or a power of attorney, it's essential to consider all federal and state laws and regulations of the particular region. However, small counties and even cities also have legislative procedures that you need to consider. All these aspects make it stressful and time-consuming to create Harris Indemnification Agreement for a Trust without expert assistance.

It's possible to avoid spending money on attorneys drafting your paperwork and create a legally valid Harris Indemnification Agreement for a Trust by yourself, using the US Legal Forms web library. It is the biggest online catalog of state-specific legal documents that are professionally verified, so you can be sure of their validity when picking a sample for your county. Previously subscribed users only need to log in to their accounts to download the required form.

In case you still don't have a subscription, adhere to the step-by-step guideline below to obtain the Harris Indemnification Agreement for a Trust:

- Examine the page you've opened and verify if it has the sample you require.

- To achieve this, use the form description and preview if these options are available.

- To locate the one that suits your requirements, utilize the search tab in the page header.

- Recheck that the template complies with juridical criteria and click Buy Now.

- Opt for the subscription plan, then log in or register for an account with the US Legal Forms.

- Use your credit card or PayPal account to pay for your subscription.

- Download the chosen file in the preferred format, print it, or fill it out electronically.

The great thing about the US Legal Forms library is that all the paperwork you've ever purchased never gets lost - you can get it in your profile within the My Forms tab at any moment. Join the platform and quickly obtain verified legal templates for any scenario with just a few clicks!