Houston Texas Indemnification Agreement for a Trust is a legal contract that establishes a framework for protection and compensation in case a trustee or fiduciary is faced with legal claims or losses as a result of their actions or decisions. This agreement offers a level of security and peace of mind to trustees, enabling them to fulfill their duties without the fear of personal liability. In Houston, Texas, there are different types of Indemnification Agreements specifically designed for trusts depending on the circumstances and parties involved. Some common types include: 1. General Indemnification Agreement: This is a broad and all-encompassing agreement that provides protection to trustees against legal claims and losses arising from any action, omission, or decision made in their trust management capacity. It covers a wide range of scenarios, ensuring comprehensive indemnity for the trustee. 2. Limited Indemnification Agreement: This agreement outlines specific situations or actions where a trustee will be indemnified, limiting the scope of protection. Trustees may opt for this type of agreement if they want to define and mitigate potential risks arising from specific activities within their trust management role. 3. Third-Party Indemnification Agreement: This agreement involves a third party, often an individual or an entity, agreeing to indemnify the trustee of a trust in case of claims or losses arising from their acts or decisions. This third party provides an additional layer of protection, reducing the trustee's personal liability and ensuring a smoother trust management process. 4. Trustee-to-Trustee Indemnification Agreement: In situations where there are multiple trustees involved in the management of a trust, a trustee-to-trustee indemnification agreement can be established. This agreement ensures that each trustee indemnifies the others against claims or losses, fostering collaboration and shared responsibility among trustees. Houston Texas Indemnification Agreements for trusts are drafted by legal professionals and must comply with state laws and regulations. They provide trustees with the necessary protection to confidently carry out their fiduciary duties, ensuring that they can make decisions in the best interest of the trust and its beneficiaries without the fear of personal financial repercussions. It is important for all parties involved in the trust to consult with experienced attorneys to draft and review the agreement to ensure its effectiveness and applicability to their specific situation.

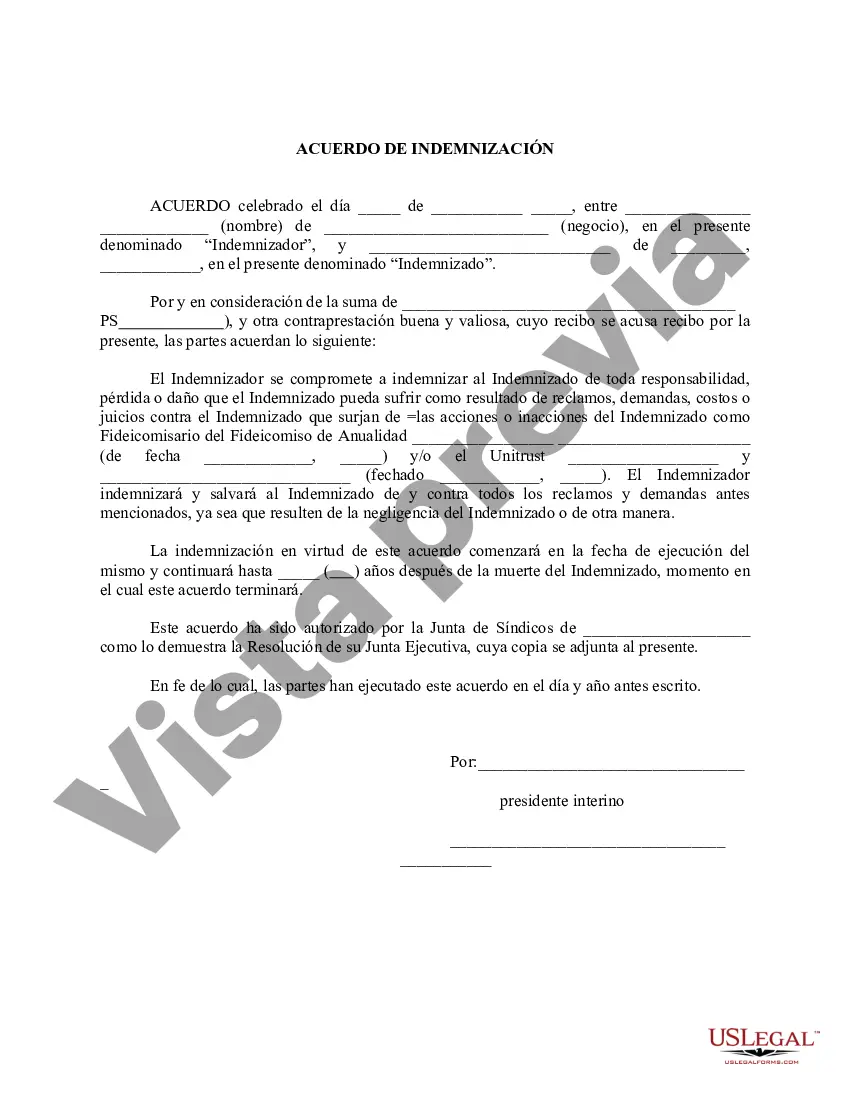

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Acuerdo de Indemnización por un Fideicomiso - Indemnification Agreement for a Trust

Description

How to fill out Houston Texas Acuerdo De Indemnización Por Un Fideicomiso?

Preparing legal paperwork can be difficult. In addition, if you decide to ask a legal professional to write a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce papers, or the Houston Indemnification Agreement for a Trust, it may cost you a lot of money. So what is the most reasonable way to save time and money and draft legitimate forms in total compliance with your state and local laws and regulations? US Legal Forms is a perfect solution, whether you're searching for templates for your personal or business needs.

US Legal Forms is the most extensive online library of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any scenario gathered all in one place. Therefore, if you need the current version of the Houston Indemnification Agreement for a Trust, you can easily locate it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample with the Download button. If you haven't subscribed yet, here's how you can get the Houston Indemnification Agreement for a Trust:

- Glance through the page and verify there is a sample for your region.

- Examine the form description and use the Preview option, if available, to ensure it's the template you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the needed sample and pick the best suitable subscription.

- Log in or sign up for an account to purchase your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your Houston Indemnification Agreement for a Trust and save it.

When done, you can print it out and complete it on paper or upload the samples to an online editor for a faster and more convenient fill-out. US Legal Forms enables you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!