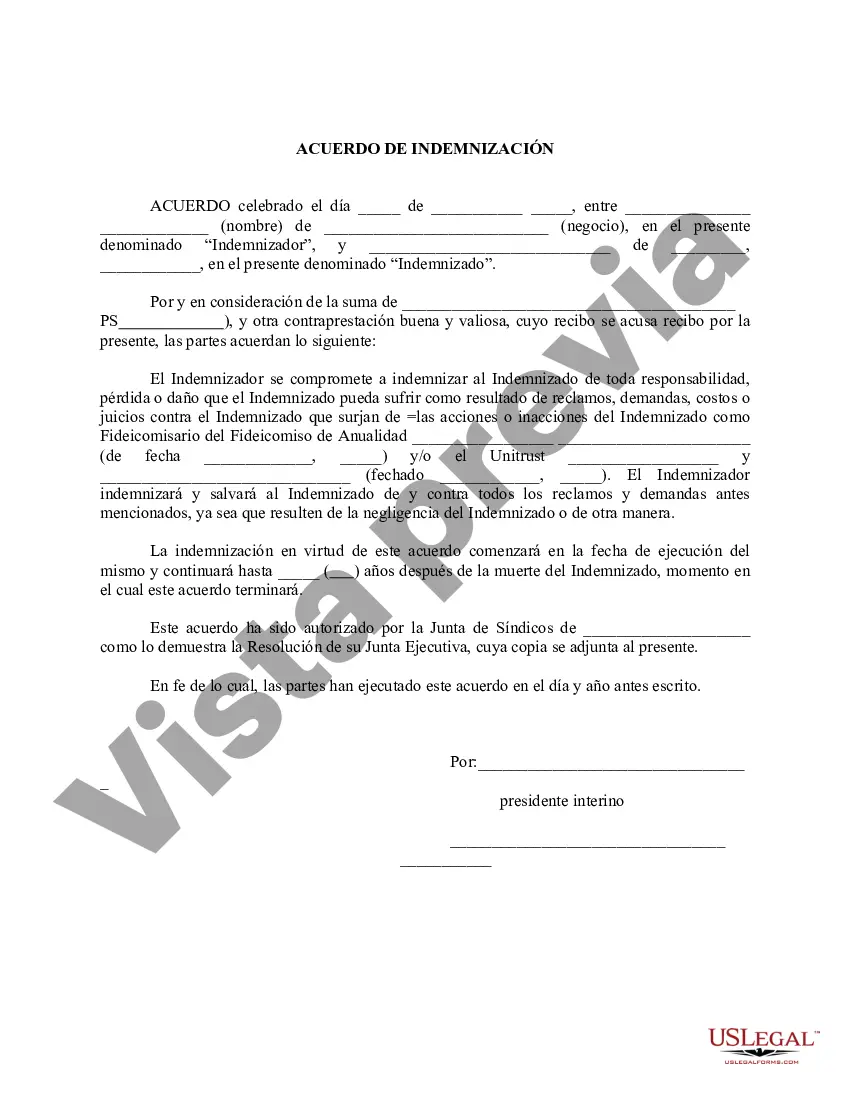

San Diego California Acuerdo de Indemnización por un Fideicomiso - Indemnification Agreement for a Trust

Description

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.

How to fill out Acuerdo De Indemnización Por Un Fideicomiso?

Legislation and policies in every domain differ across the nation.

If you are not a lawyer, it can be challenging to navigate through a range of standards when it comes to creating legal documents.

To prevent costly legal help while drafting the San Diego Indemnification Agreement for a Trust, you need an authenticated template suitable for your area.

This is the easiest and most cost-effective method to access contemporary templates for any legal purposes. Find them all with just a few clicks and maintain your documentation organized with US Legal Forms!

- Examine the webpage content to confirm you have located the accurate sample.

- Utilize the Preview option or read the form description if available.

- Seek another document if there are discrepancies with any of your needs.

- Press the Buy Now button to acquire the template once you identify the correct one.

- Select one of the subscription options and Log In or register for an account.

- Choose your preferred payment method for your subscription (credit card or PayPal).

- Select the format you wish to save the document in and click Download.

- Complete and sign the template on paper after printing it or do it all digitally.

Form popularity

FAQ

Es un contrato mediante el cual una persona fisica o moral, nacional o extranjera; afecta ciertos bienes o derechos para un fin licito y determinado, en beneficio propio o de un tercero, encomendando la realizacion de dicho fin a una institucion fiduciaria.

Los fideicomisos pueden ayudarte a administrar tus activos, pero tambien los puedes usar para asegurarte de que tu patrimonio se distribuya cuando ya no estes, de acuerdo con tus deseos, para entregar seguridad a tus seres queridos, permitiendo que ahorren dinero y tiempo en papeleo y tramites.

Tal como se menciono, el fideicomiso no es una persona fisica ni moral, es asi que, quienes tienen que contribuir, mediante el pago de los impuestos correspondientes, son las personas fisicas y, en su caso, las morales y no el fideicomiso.

¿Como realizar una Solicitud de Fideicomiso? Ingresa el monto que deseas solicitar. Selecciona el motivo de tu solicitud. Construccion, adquisicion, mejora o reparacion de vivienda.Verifica los datos y confirma la Operacion.Imprime o Guarda el comprobante de la Operacion en PDF.

Para su calculo se usa un promedio del salario integrado. Es decir que incluye vacaciones, utilidades y otras prestaciones. Es decir que vamos a sumar los 12 salarios del ano, mas bono vacacional, mas bono, mas y utilidades: Salarios al ano: Bs.

Un fideicomiso de inversion es un instrumento financiero que te ayudara con tu planeacion patrimonial, mediante el cual un tercero mantiene activos o dinero en resguardo y sera quien se encargue de las diligencias de otras dos partes que estan interesadas en que esos fondos sean bien utilizados.

El fideicomiso es un acto juridico por medio del cual una persona entrega a otra la titularidad de unos activos para que los administre y, al vencimiento de un plazo, transmita los resultados a un tercero. Es una herramienta juridica muy utilizada en los negocios y para preservar los patrimonios familiares.

¿Quienes lo presentan? Los fideicomisarios o fideicomitentes que efectuan operaciones a traves de fideicomisos que realicen actividades empresariales.

200bEl Fideicomiso es un acto juridico mediante el cual una o varias personas entregan bienes o derechos a una entidad fiduciaria para crear un patrimonio separado que sera administrado por esa entidad para beneficiar a otra persona o a la persona que entrega dichos bienes.

Salvo lo que se prevea en el fideicomiso, cuando por renuncia o remocion la institucion fiduciaria concluya el desempeno de su cargo, debera designarse a otra institucion fiduciaria que la substituya. Si no fuere posible esta substitucion, el fideicomiso se dara por extinguido.