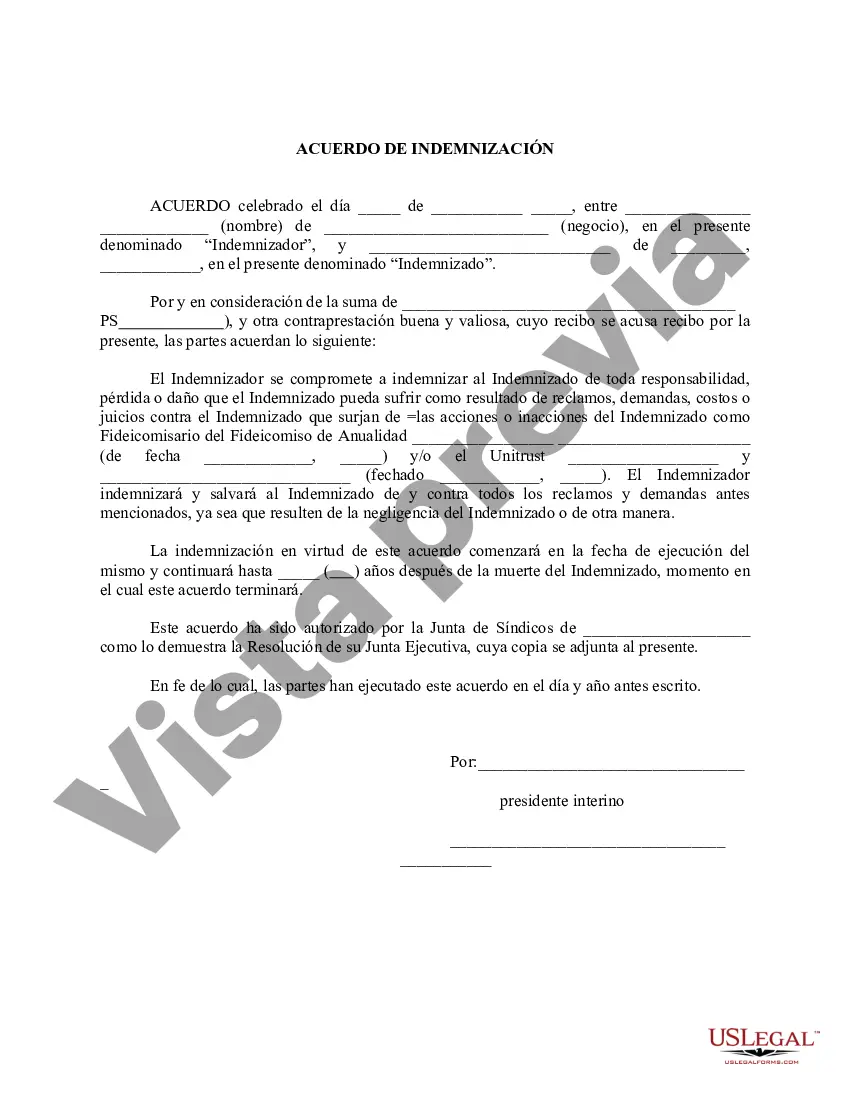

Travis Texas Indemnification Agreement for a Trust is a legally binding document that protects the trustees of a trust from personal liability arising from their actions or decisions made in the administration of the trust. This agreement serves as a safeguard, ensuring that trustees are not held personally responsible for any losses, debts, claims, or legal actions that may arise during the course of their duties. One type of Travis Texas Indemnification Agreement for a Trust is the Standard Indemnification Agreement. This agreement provides indemnification to trustees for any liabilities incurred while acting within the scope of their authority as trustees. It outlines the conditions and limitations under which trustees can seek indemnification, ensuring that the rights and responsibilities of all parties involved are clearly defined. Another type of Travis Texas Indemnification Agreement for a Trust is the Expanded Indemnification Agreement. This agreement offers a broader level of protection to trustees, covering not only liabilities arising from their actions as trustees but also liabilities arising from their status as beneficiaries or heirs of the trust. The expanded agreement provides trustees with enhanced security, minimizing personal risk and promoting trust management with confidence. When drafting a Travis Texas Indemnification Agreement for a Trust, it is crucial to include specific clauses that address key aspects of the agreement. These may include provisions on the limitations of indemnification, circumstances under which indemnification may be denied, the process for making indemnification claims, and any prerequisites for indemnification, such as providing notice or obtaining court approval. The agreement should also clearly define the scope of indemnification, specifying the types of liabilities covered, such as legal fees, damages, or settlements, and identify any exclusions or limitations on indemnification. It is essential to consult legal professionals or experienced trust attorneys to ensure the agreement complies with applicable laws and meets the specific needs and goals of the trust. Overall, a Travis Texas Indemnification Agreement for a Trust is a crucial document that protects trustees from personal liability, thereby promoting effective trust administration and preserving the integrity of the trust. It provides peace of mind to trustees, enabling them to fulfill their duties without fear of personal financial repercussions, ultimately benefiting both the trust and its beneficiaries.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Travis Texas Acuerdo de Indemnización por un Fideicomiso - Indemnification Agreement for a Trust

Description

How to fill out Travis Texas Acuerdo De Indemnización Por Un Fideicomiso?

Creating documents, like Travis Indemnification Agreement for a Trust, to manage your legal affairs is a challenging and time-consumming process. A lot of cases require an attorney’s participation, which also makes this task not really affordable. However, you can get your legal issues into your own hands and manage them yourself. US Legal Forms is here to the rescue. Our website comes with more than 85,000 legal documents intended for various scenarios and life circumstances. We ensure each form is compliant with the laws of each state, so you don’t have to worry about potential legal issues associated with compliance.

If you're already aware of our website and have a subscription with US, you know how easy it is to get the Travis Indemnification Agreement for a Trust form. Simply log in to your account, download the template, and personalize it to your requirements. Have you lost your form? Don’t worry. You can find it in the My Forms folder in your account - on desktop or mobile.

The onboarding process of new users is just as straightforward! Here’s what you need to do before downloading Travis Indemnification Agreement for a Trust:

- Make sure that your form is compliant with your state/county since the regulations for creating legal papers may vary from one state another.

- Find out more about the form by previewing it or going through a brief description. If the Travis Indemnification Agreement for a Trust isn’t something you were hoping to find, then use the header to find another one.

- Log in or create an account to begin using our website and download the form.

- Everything looks great on your end? Hit the Buy now button and select the subscription option.

- Select the payment gateway and enter your payment details.

- Your template is good to go. You can go ahead and download it.

It’s easy to locate and purchase the needed document with US Legal Forms. Thousands of businesses and individuals are already benefiting from our extensive collection. Sign up for it now if you want to check what other advantages you can get with US Legal Forms!