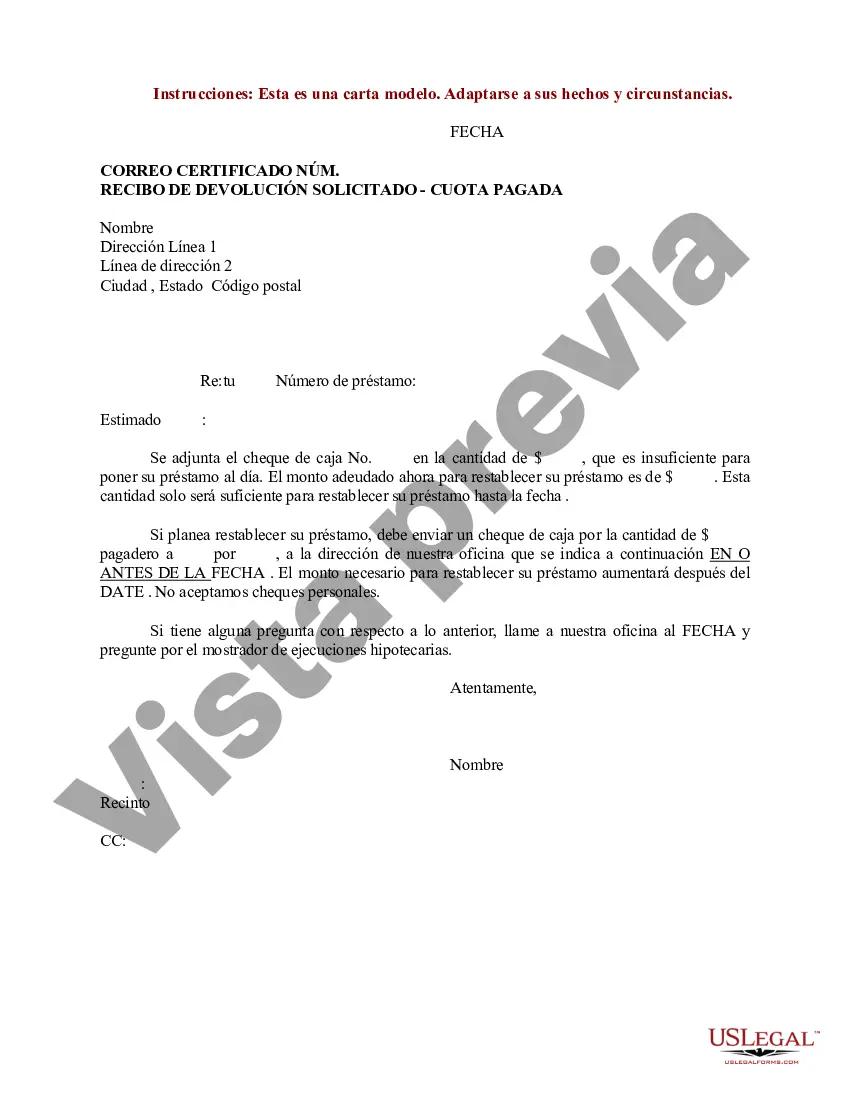

[Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date] [Loan Service's Name] [Loan Service's Address] [City, State, ZIP] Subject: Insufficient Amount to Reinstate Loan — Request for Additional Options Dear [Loan Service's Name], I hope this letter finds you well. I am writing to address the issue of an inadequate amount to reinstate my loan. As a resident of Houston, Texas, I am requesting your assistance in exploring viable options to resolve this matter promptly. Firstly, let me provide you with context about Houston, Texas. Located in the southeastern part of the state, Houston is the fourth-largest city in the United States and home to a diverse population of over 2.3 million people. It serves as a major economic hub, particularly in the energy, aerospace, and healthcare sectors. Despite its vibrant economy, many Houston residents face financial challenges, often requiring assistance to keep their homes, such as the issue I am currently encountering. Upon reviewing the reinstatement amount provided, I regret to inform you that the sum is insufficient to fully reinstate the loan and bring it back to good standing. I understand that there may have been unforeseen circumstances or miscalculations contributing to this shortfall. However, I am determined to resolve this issue promptly to avoid any further financial complications. I kindly request that you consider the following options to rectify the insufficient amount and ensure the loan reinstatement process can proceed effectively: 1. Review the Reinstatement Calculation: To identify any discrepancies or missed items in the reinstatement amount, I humbly urge you to review the calculation for inaccuracies. Any adjustments found will contribute to a better evaluation of the outstanding balance necessary to reinstate the loan successfully. 2. Explore Loan Modification: If it is evident that the current reinstatement amount cannot be met, I am open to discussing the possibility of a loan modification to ensure the loan remains sustainable for both parties involved. This alternative approach may involve extending the loan term, adjusting the interest rate, or modifying the repayment structure to better match my current financial capabilities. 3. Consider Temporary Payment Arrangement: Given the financial hardships faced by many individuals in Houston, Texas, offering a temporary payment arrangement could provide much-needed relief. This arrangement could include a reduced payment plan for a fixed period, allowing me to stabilize my finances and meet the reinstatement requirements in due course. 4. Seek Financial Counseling Assistance: I am committed to improving my financial situation and taking necessary steps to reinstate the loan successfully. As a part of this effort, I am open to attending financial counseling sessions through recommended resources in the Houston area. Such counseling can equip me with essential skills and tools to manage my finances more effectively in the future. I genuinely value the opportunity to resolve this matter promptly while maintaining the stability of my homeownership. I firmly believe that with your assistance, we can find a suitable solution that serves the interests of both parties. Furthermore, I kindly request your prompt attention to this matter and would appreciate your response within [state a timeline]. Should you require any additional information or documentation, please do not hesitate to contact me at [your phone number] or via email at [your email address]. Thank you for your understanding and cooperation. I look forward to hearing from you soon. Yours sincerely, [Your Name]

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Houston Texas Modelo de carta por monto insuficiente para restablecer el préstamo - Sample Letter for Insufficient Amount to Reinstate Loan

Description

How to fill out Houston Texas Modelo De Carta Por Monto Insuficiente Para Restablecer El Préstamo?

Preparing legal documentation can be cumbersome. Besides, if you decide to ask a lawyer to draft a commercial contract, papers for proprietorship transfer, pre-marital agreement, divorce paperwork, or the Houston Sample Letter for Insufficient Amount to Reinstate Loan, it may cost you a lot of money. So what is the best way to save time and money and draw up legitimate documents in total compliance with your state and local laws and regulations? US Legal Forms is an excellent solution, whether you're looking for templates for your personal or business needs.

US Legal Forms is biggest online collection of state-specific legal documents, providing users with the up-to-date and professionally verified templates for any use case collected all in one place. Therefore, if you need the latest version of the Houston Sample Letter for Insufficient Amount to Reinstate Loan, you can easily find it on our platform. Obtaining the papers takes a minimum of time. Those who already have an account should check their subscription to be valid, log in, and pick the sample by clicking on the Download button. If you haven't subscribed yet, here's how you can get the Houston Sample Letter for Insufficient Amount to Reinstate Loan:

- Look through the page and verify there is a sample for your area.

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't suit your requirements - look for the right one in the header.

- Click Buy Now when you find the needed sample and select the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the file format for your Houston Sample Letter for Insufficient Amount to Reinstate Loan and save it.

Once done, you can print it out and complete it on paper or upload the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever acquired many times - you can find your templates in the My Forms tab in your profile. Give it a try now!