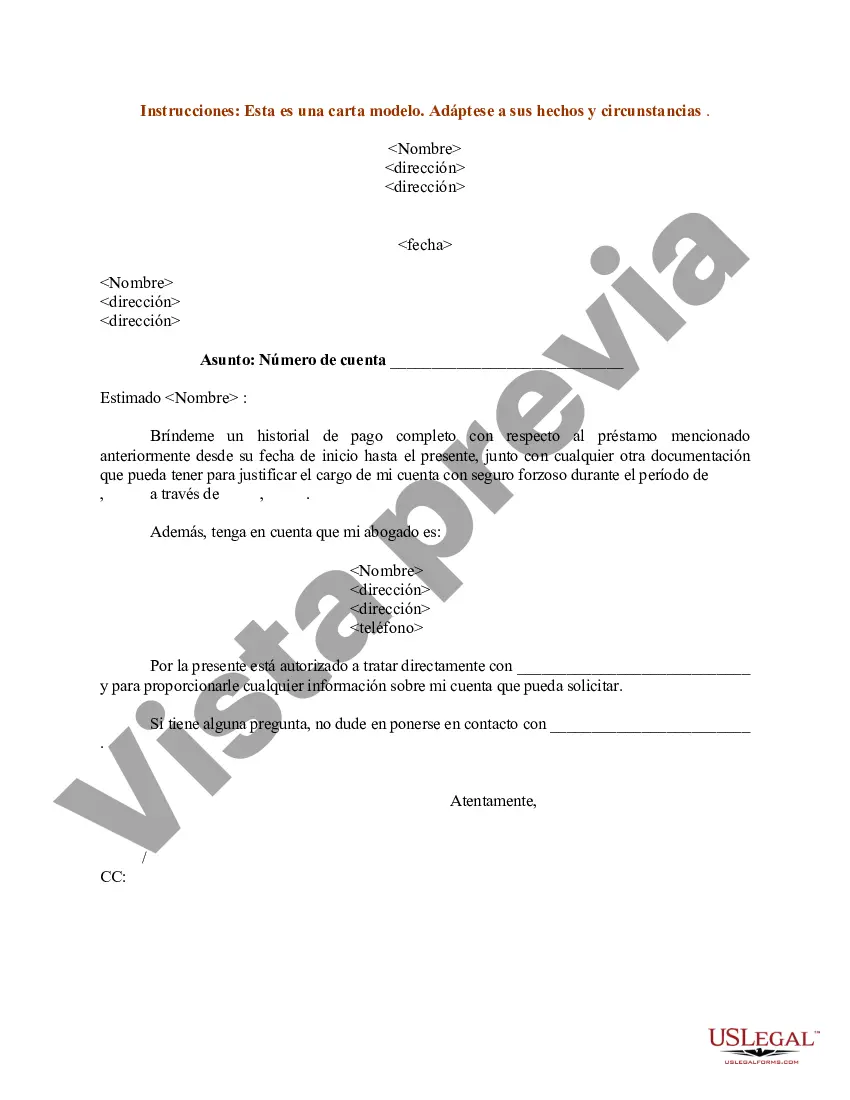

Title: Comprehensive Guide to Understanding Cuyahoga, Ohio — Sample Letter with Request for Loan Payment History Keywords: Cuyahoga, Ohio, loan payment, history, sample letter, types Introduction: Cuyahoga County, located in the state of Ohio, is a vibrant and diverse region famous for its rich history and thriving communities. With a population of over 1.2 million, Cuyahoga County boasts a strong economy, excellent educational institutions, and a range of recreational and cultural attractions. This article focuses on providing a detailed description of the Cuyahoga, Ohio sample letter with a specific emphasis on requesting loan payment history. 1. Background on Cuyahoga, Ohio: Cuyahoga County, named after the Cuyahoga River flowing through the region, encompasses several cities, including Cleveland — the county seat. This region has a significant industrial heritage, primarily renowned for its manufacturing and innovation sectors. With a diverse population and various economic opportunities, Cuyahoga County remains a hub of growth and development. 2. The Importance of Maintaining Loan Payment History Records: Loan payment history is crucial for individuals, banks, and financial institutions. It helps track the borrower's creditworthiness, evaluating the ability to repay debts promptly. Reliable and accurate loan payment history reports are crucial in accessing future loans, mortgages, or credit facilities. 3. The Role of a Sample Request Letter for Loan Payment History: A sample request letter for loan payment history is a written communication used to request a detailed record of loan payment transactions. By utilizing this document, borrowers can verify their repayment history, review any missed or late payments, reconcile their loan balance, and ensure the completeness and correctness of their records. 4. Components of a Cuyahoga, Ohio Sample Letter with Request for Loan Payment History: — Date: The letter should be dated to establish a timeline of the request. — Contact Information: Clearly provide the borrower's name, address, phone number, and email address. — Loan Details: List the loan type, loan number, and the name of the lending institution. — Request for Loan Payment History: Clearly state the purpose of the letter, i.e., the need to obtain a detailed payment history. — Supporting Documents: Mention any additional documents necessary to process the request, such as authorization forms, identification proof, or any other specifics required by the lender. — Closing and Signature: Sign off with a formal closing remark (e.g., "Sincerely" or "Best regards") followed by the borrower's signature. Types of Cuyahoga, Ohio Sample Letters with Request for Loan Payment History: 1. Personal Loan Payment History Request: For individuals seeking their personal loan payment history from a specific lending institution. 2. Business Loan Payment History Request: For entrepreneurs or business owners who require a comprehensive record of their business loan repayment transactions. 3. Mortgage Loan Payment History Request: Geared towards homeowners or property owners seeking clarification or verification of their mortgage payment history. Conclusion: Cuyahoga, Ohio is a captivating region known for its cultural richness and economic vitality. Requesting loan payment history through a sample letter is an essential step towards maintaining accurate financial records and ensuring a secure financial future. By following the guidelines and utilizing the appropriate type of Cuyahoga, Ohio sample letter, borrowers can effectively obtain the necessary loan payment history information from their lenders.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Cuyahoga Ohio Ejemplo de carta con solicitud de historial de pago de préstamo - Sample Letter with Request for Loan Payment History

Description

How to fill out Cuyahoga Ohio Ejemplo De Carta Con Solicitud De Historial De Pago De Préstamo?

Laws and regulations in every sphere vary around the country. If you're not an attorney, it's easy to get lost in countless norms when it comes to drafting legal paperwork. To avoid expensive legal assistance when preparing the Cuyahoga Sample Letter with Request for Loan Payment History, you need a verified template valid for your region. That's when using the US Legal Forms platform is so helpful.

US Legal Forms is a trusted by millions web library of more than 85,000 state-specific legal forms. It's a perfect solution for specialists and individuals looking for do-it-yourself templates for various life and business scenarios. All the documents can be used multiple times: once you obtain a sample, it remains accessible in your profile for subsequent use. Therefore, if you have an account with a valid subscription, you can just log in and re-download the Cuyahoga Sample Letter with Request for Loan Payment History from the My Forms tab.

For new users, it's necessary to make a couple of more steps to get the Cuyahoga Sample Letter with Request for Loan Payment History:

- Analyze the page content to ensure you found the right sample.

- Utilize the Preview option or read the form description if available.

- Search for another doc if there are inconsistencies with any of your requirements.

- Utilize the Buy Now button to obtain the document once you find the correct one.

- Choose one of the subscription plans and log in or sign up for an account.

- Select how you prefer to pay for your subscription (with a credit card or PayPal).

- Select the format you want to save the document in and click Download.

- Complete and sign the document in writing after printing it or do it all electronically.

That's the simplest and most cost-effective way to get up-to-date templates for any legal scenarios. Locate them all in clicks and keep your paperwork in order with the US Legal Forms!