[Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] [Date] [Recipient's Name] [Recipient's Position] [Bank/Organization Name] [Address] [City, State, ZIP] Subject: San Antonio Texas Sample Letter regarding Revolving Note and Loan Agreement Dear [Recipient's Name], I am writing to you in reference to the revolving note and loan agreement related to my financial needs. As a resident of San Antonio, Texas, I have been actively seeking a reliable financial institution that understands the unique requirements of individuals residing in this vibrant city. San Antonio, often referred to as the "Alamo City," is the second-most populous city in Texas and home to a diverse population of over 1.5 million residents. It boasts a rich cultural heritage, with historic missions, Spanish influences, and a vibrant arts scene. With its booming economy, enhanced educational opportunities, and a wide range of employment prospects, San Antonio represents a prime location for many aspiring individuals. Considering the significant growth and potential for economic advancement in this region, it is essential for entities like yours to provide tailored financial solutions that meet the needs of individuals and businesses alike. The need for a revolving note and loan agreement is substantial as it offers flexibility and convenience for borrowers managing various financial obligations. In this context, I am pleased to come across your San Antonio Texas Sample Letter regarding Revolving Note and Loan Agreement. I am particularly interested in exploring the different types of revolving notes and loan agreements you offer to the residents of San Antonio, Texas. These may include: 1. Home Equity Lines of Credit (Helots): This type of revolving note and loan agreement allows homeowners to leverage the equity in their property to access funds for various purposes, such as home renovations, debt consolidation, or educational expenses. 2. Business Line of Credit: As San Antonio's economy thrives with a flourishing entrepreneurship culture, a business line of credit caters to the financial needs of local businesses, providing a readily available credit facility to address short-term cash flow requirements, inventory management, and business expansion initiatives. 3. Personal Lines of Credit: Tailored to the individual financial needs of San Antonio residents, personal lines of credit provide flexibility and quick access to funds, allowing borrowers to address unexpected expenses, consolidate debts, or invest in personal development opportunities, such as education or professional courses. After reviewing your San Antonio Texas Sample Letter regarding Revolving Note and Loan Agreement, I am particularly impressed with the transparent terms and competitive interest rates mentioned. However, before proceeding with any application, I kindly request additional information about the required documentation, eligibility criteria, and the process to initiate the application. I would greatly appreciate it if you could provide me with detailed information about the different types of revolving notes and loan agreements available in San Antonio, along with any other relevant terms, conditions, and benefits. Additionally, please advise if an appointment is necessary or if I can initiate the application process online or over the phone. Thank you for your attention to this matter. I look forward to receiving your response promptly. Should you require any further information or documentation, please do not hesitate to contact me at [Phone Number] or [Email Address]. Yours sincerely, [Your Name]

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Antonio Texas Modelo de carta sobre el pagaré renovable y el contrato de préstamo - Sample Letter regarding Revolving Note and Loan Agreement

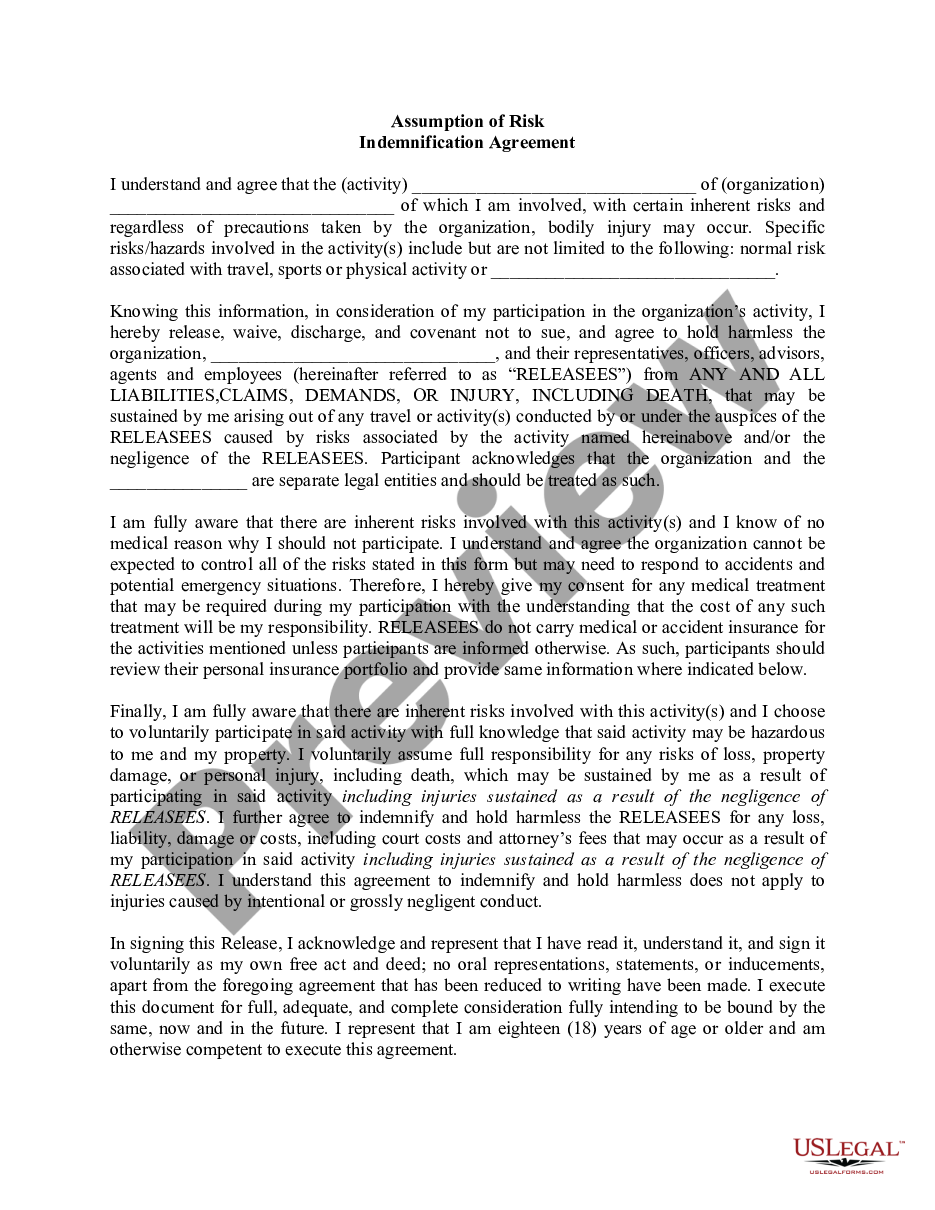

Description

How to fill out San Antonio Texas Modelo De Carta Sobre El Pagaré Renovable Y El Contrato De Préstamo?

How much time does it usually take you to draw up a legal document? Because every state has its laws and regulations for every life sphere, finding a San Antonio Sample Letter regarding Revolving Note and Loan Agreement suiting all local requirements can be stressful, and ordering it from a professional lawyer is often expensive. Many web services offer the most popular state-specific documents for download, but using the US Legal Forms library is most advantegeous.

US Legal Forms is the most comprehensive web catalog of templates, collected by states and areas of use. In addition to the San Antonio Sample Letter regarding Revolving Note and Loan Agreement, here you can find any specific form to run your business or personal affairs, complying with your county requirements. Professionals check all samples for their actuality, so you can be sure to prepare your paperwork correctly.

Using the service is remarkably simple. If you already have an account on the platform and your subscription is valid, you only need to log in, opt for the required sample, and download it. You can pick the document in your profile anytime later on. Otherwise, if you are new to the platform, there will be some extra actions to complete before you get your San Antonio Sample Letter regarding Revolving Note and Loan Agreement:

- Examine the content of the page you’re on.

- Read the description of the template or Preview it (if available).

- Search for another form utilizing the related option in the header.

- Click Buy Now when you’re certain in the chosen document.

- Decide on the subscription plan that suits you most.

- Sign up for an account on the platform or log in to proceed to payment options.

- Pay via PalPal or with your credit card.

- Switch the file format if needed.

- Click Download to save the San Antonio Sample Letter regarding Revolving Note and Loan Agreement.

- Print the doc or use any preferred online editor to complete it electronically.

No matter how many times you need to use the purchased template, you can locate all the samples you’ve ever saved in your profile by opening the My Forms tab. Give it a try!