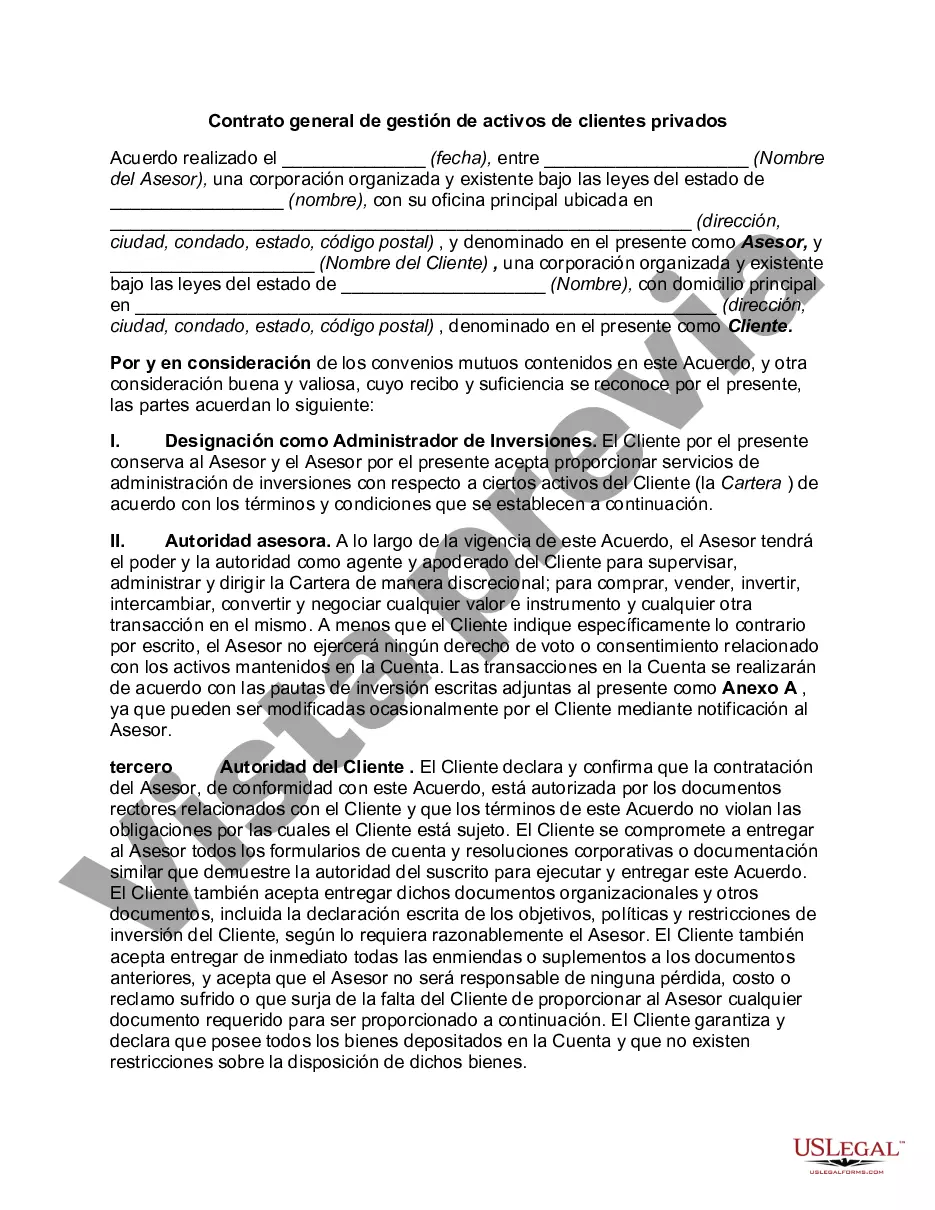

The Allegheny Pennsylvania Private Client General Asset Management Agreement is a comprehensive legal document that outlines the terms and conditions governing the professional relationship between a private client and their chosen asset management firm in Allegheny, Pennsylvania. This agreement ensures that all parties involved have a clear understanding of their roles, responsibilities, and the expected outcomes of the asset management services provided. In this agreement, clients entrust their assets, such as investment portfolios, real estate properties, and other valuable holdings, to their chosen asset management firm. The asset management firm, in turn, agrees to diligently manage and invest these assets in a manner that aligns with the client's financial goals, risk tolerance, and overall investment strategy. This agreement typically covers various aspects related to the asset management services provided, including but not limited to: 1. Objectives and Scope: The agreement defines the client's investment objectives, risk preferences, and financial goals. It also outlines the specific services and strategies that the asset management firm will employ to meet these objectives. 2. Account Management: The agreement specifies how the client's assets will be managed, monitored, and reported on a regular basis. It may include details on account performance reporting, investment reviews, and client meetings. 3. Delegation of Authority: The agreement grants the asset management firm the specific authority to make investment decisions on behalf of the client. This delegation of authority typically includes buying, selling, and holding various investments within the client's portfolio. 4. Fees and Compensation: The agreement outlines the fees, charges, and compensation structure associated with the asset management services. This may include management fees based on a percentage of assets under management, performance-based fees, or other agreed-upon remuneration methods. 5. Confidentiality and Privacy: The agreement highlights the importance of maintaining client confidentiality and outlines the procedures to protect the client's personal and financial information. 6. Termination and Dispute Resolution: The agreement includes provisions for termination, allowing either party to end the agreement under specific circumstances. It may also outline the process for resolving disputes, whether through mediation, arbitration, or legal action. It is important to note that the specific details of the Allegheny Pennsylvania Private Client General Asset Management Agreement may vary between different asset management firms. Some firms may have variations of this agreement tailored to specific client segments or asset classes, such as specialized agreements for high-net-worth individuals, institutions, or alternative investments. In conclusion, the Allegheny Pennsylvania Private Client General Asset Management Agreement is a crucial document that establishes the terms and conditions for a private client's engagement with an asset management firm in the Allegheny, Pennsylvania area. This agreement provides a framework for a collaborative and professional relationship, ensuring that the client's assets are managed in a manner that aligns with their financial goals and preferences.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Allegheny Pennsylvania Contrato general de gestión de activos de clientes privados - Private Client General Asset Management Agreement

Description

How to fill out Allegheny Pennsylvania Contrato General De Gestión De Activos De Clientes Privados?

Are you looking to quickly draft a legally-binding Allegheny Private Client General Asset Management Agreement or probably any other form to handle your personal or business affairs? You can go with two options: hire a professional to draft a valid paper for you or create it completely on your own. Thankfully, there's another option - US Legal Forms. It will help you receive professionally written legal papers without paying unreasonable fees for legal services.

US Legal Forms provides a rich collection of over 85,000 state-specific form templates, including Allegheny Private Client General Asset Management Agreement and form packages. We provide documents for a myriad of life circumstances: from divorce paperwork to real estate documents. We've been on the market for over 25 years and gained a rock-solid reputation among our clients. Here's how you can become one of them and get the needed document without extra hassles.

- To start with, double-check if the Allegheny Private Client General Asset Management Agreement is tailored to your state's or county's regulations.

- In case the document includes a desciption, make sure to check what it's intended for.

- Start the search again if the form isn’t what you were looking for by utilizing the search bar in the header.

- Choose the subscription that best suits your needs and proceed to the payment.

- Select the format you would like to get your document in and download it.

- Print it out, fill it out, and sign on the dotted line.

If you've already set up an account, you can simply log in to it, locate the Allegheny Private Client General Asset Management Agreement template, and download it. To re-download the form, just go to the My Forms tab.

It's easy to buy and download legal forms if you use our catalog. Moreover, the templates we offer are updated by law professionals, which gives you greater confidence when writing legal affairs. Try US Legal Forms now and see for yourself!

Form popularity

FAQ

Los activos de informacion son el resultado de la construccion de un inventario y clasificacion de los activos que posee la entidad de acuerdo con la Politica General de Seguridad y Privacidad de la informacion, la cual determina que activos posee la entidad, como deben ser utilizados, asi como los roles y

Activo de Informacion: Cualquier cosa que tiene informacion y valor para el ICBF. Puede encontrarse almacenados en diferentes medios como Discos Duros, USB, CD, Impresiones etc. Informacion: Datos relacionados que tienen significado para la organizacion3.

Se puede considerar como un activo de informacion a: Las herramientas o utilidades para el desarrollo y soporte de los sistemas de informacion. Personas que manejen datos, o un conocimiento especifico muy importante para la organizacion (Por ejemplo: secretos industriales, manejo de informacion critica, know how).

ACTIVO: Cualquier cosa que tiene valor para una organizacion1. ACTIVO DE INFORMACION: Es el elemento de informacion que se recibe o produce en el ejercicio de sus funciones.

El inventario de activos de informacion de la entidad deberia especificar para cada activo: Informacion basica del activo (nombre, observaciones, proceso, entre otras). El nivel de clasificacion de la informacion. Informacion relacionada con su ubicacion, tanto fisica como electronica.

Los activos son los recursos del Sistema de Seguridad de la Informacion ISO 27001, necesarios para que la empresa funciones y consiga los objetivos que se ha propuesto la alta direccion. Un proyecto de Seguridad tiene como principal objetivo de seguridad los activos que generan el dominio en estudio del proyecto.

Un inventario de activos se define como una lista de todos aquellos recursos (fisicos, software, documentos, servicios, personas, instalaciones, etc.) que tengan valor para la organizacion y necesiten por tanto ser protegidos de potenciales riesgos.

Algunos ejemplos de activos son bases de datos, archivos fisicos, sistemas de informacion, cableado y redes, dispositivos de almacenamiento e incluso las mismas personas que manejan datos o conocimiento especifico del negocio.

El inventario es el conjunto de mercancias o articulos que tiene la empresa para comerciar con aquellos, permitiendo la compra y venta o la fabricacion primero antes de venderlos, en un periodo economico determinados. Deben aparecer en el grupo de activos circulantes.

¿Como hacer un inventario de activos fijos de forma correcta? Primero comprender el alcance del proyecto. Asignar la responsabilidad de su proceso de gestion. Identifique los procedimientos basicos de gestion de activos fijos. Cuidado con las tendencias para el control de activos fijos.