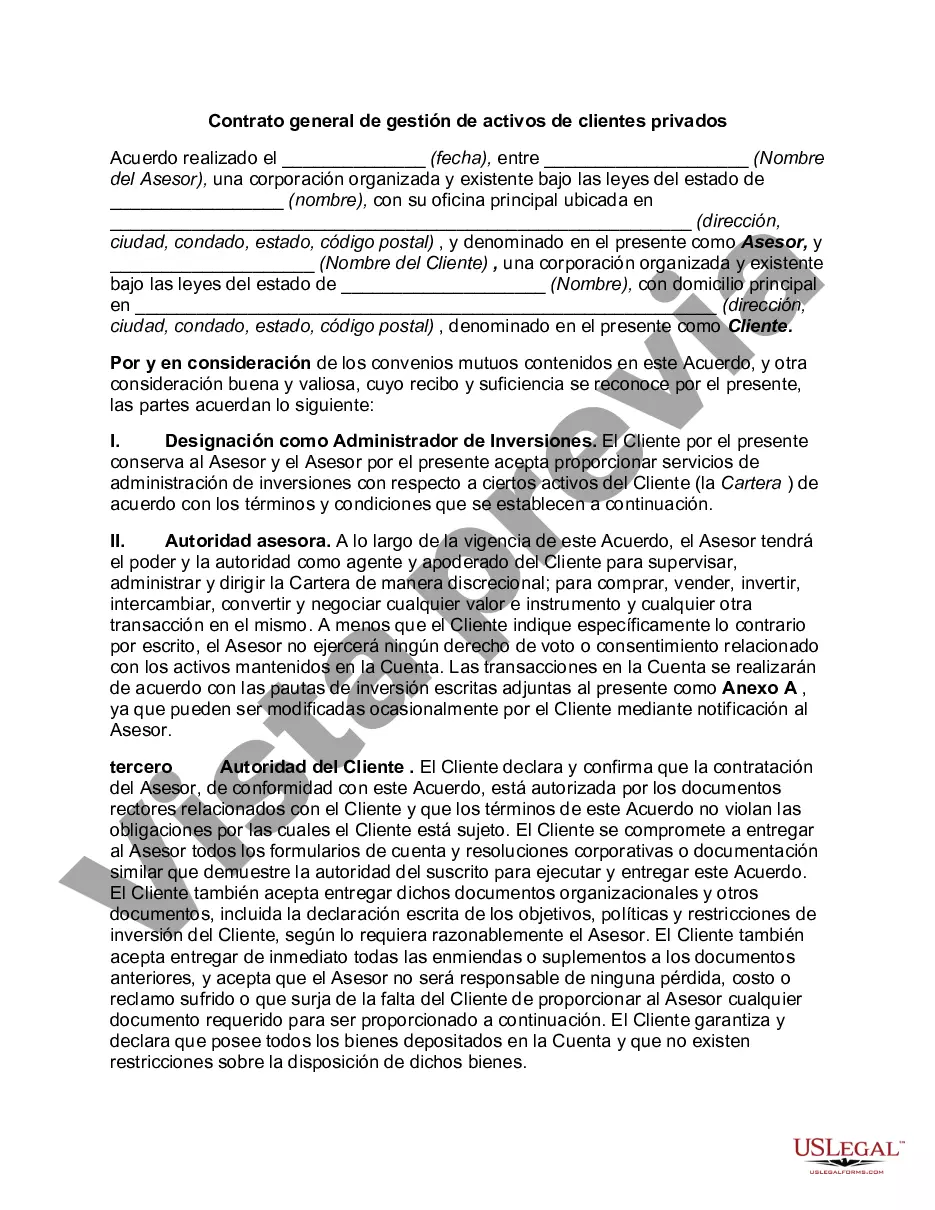

The Dallas Texas Private Client General Asset Management Agreement is a comprehensive contract outlining the terms and conditions between a private client and an asset management firm in Dallas, Texas. This agreement serves as the blueprint for managing the client's assets, with a focus on individual needs and objectives. It encompasses various specific types, including: 1. Wealth Management Agreement: This type of Private Client General Asset Management Agreement caters to high-net-worth individuals seeking comprehensive financial planning and investment management services. It covers areas such as portfolio diversification, risk management, estate planning, tax optimization, and philanthropic strategies. 2. Investment Advisory Agreement: This particular agreement is tailored for clients who require expert advice on their investment decisions. It includes provisions related to asset allocation, investment research, portfolio monitoring, and performance reporting. Investment advisors work closely with clients to develop strategies aligned with their financial goals and risk tolerance. 3. Family Office Agreement: Designed for ultra-high-net-worth families, the Family Office Agreement combines asset management services with various personalized offerings. It often includes family governance, generational wealth transfer, concierge services, reporting and analytics, and coordination of various professionals, such as attorneys and accountants. 4. Retirement Planning Agreement: This type of Private Client General Asset Management Agreement is customized for individuals or couples preparing for their retirement. It focuses on building a well-diversified portfolio, managing income sources, minimizing taxes, considering healthcare needs, and ensuring financial security during the retirement years. 5. Trust Management Agreement: This agreement is specifically tailored for clients who have established trusts as part of their estate planning. It involves the management and administration of the trust assets in accordance with the client's wishes, legal requirements, and the interests of the beneficiaries. Trust management encompasses investment oversight, distribution planning, tax management, and fiduciary responsibilities. In summary, the Dallas Texas Private Client General Asset Management Agreement is a versatile document that caters to the diverse needs of private clients in the region. It defines the scope of asset management services, clarifies the roles and responsibilities of both parties, and ensures the clients' financial goals are met through expert guidance and strategic planning.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Dallas Texas Contrato general de gestión de activos de clientes privados - Private Client General Asset Management Agreement

Description

How to fill out Dallas Texas Contrato General De Gestión De Activos De Clientes Privados?

A document routine always accompanies any legal activity you make. Creating a business, applying or accepting a job offer, transferring ownership, and lots of other life scenarios require you prepare official paperwork that differs from state to state. That's why having it all collected in one place is so helpful.

US Legal Forms is the most extensive online collection of up-to-date federal and state-specific legal forms. On this platform, you can easily find and download a document for any personal or business objective utilized in your region, including the Dallas Private Client General Asset Management Agreement.

Locating forms on the platform is remarkably straightforward. If you already have a subscription to our service, log in to your account, find the sample through the search field, and click Download to save it on your device. Afterward, the Dallas Private Client General Asset Management Agreement will be available for further use in the My Forms tab of your profile.

If you are dealing with US Legal Forms for the first time, follow this quick guideline to get the Dallas Private Client General Asset Management Agreement:

- Ensure you have opened the correct page with your regional form.

- Use the Preview mode (if available) and browse through the sample.

- Read the description (if any) to ensure the form meets your needs.

- Search for another document using the search tab if the sample doesn't fit you.

- Click Buy Now once you find the necessary template.

- Select the appropriate subscription plan, then sign in or register for an account.

- Choose the preferred payment method (with credit card or PayPal) to continue.

- Opt for file format and download the Dallas Private Client General Asset Management Agreement on your device.

- Use it as needed: print it or fill it out electronically, sign it, and file where requested.

This is the easiest and most reliable way to obtain legal documents. All the samples provided by our library are professionally drafted and verified for correspondence to local laws and regulations. Prepare your paperwork and run your legal affairs properly with the US Legal Forms!