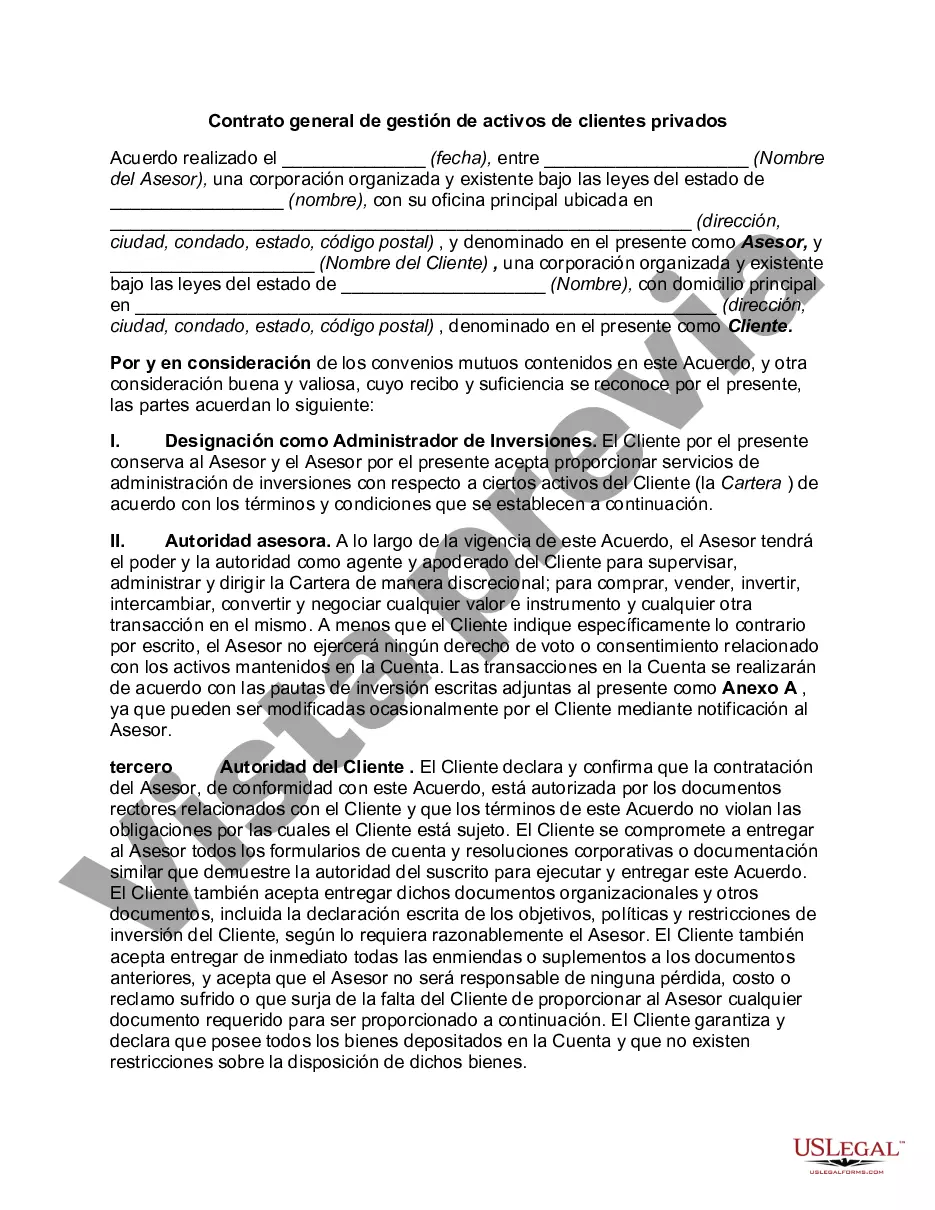

San Diego California Private Client General Asset Management Agreement is a legal contract designed to outline the terms and conditions for managing personal assets for high net worth individuals residing in San Diego, California. This agreement is typically entered into between the private client and a reputable asset management firm or a registered investment advisor. The primary objective of this agreement is to ensure that the client's assets are professionally managed, in line with their financial goals, risk tolerance, and investment preferences. Through this contract, the client grants the asset management firm the authority to make investment decisions on their behalf, safeguard their assets, and provide ongoing portfolio management services. Some common provisions found in San Diego California Private Client General Asset Management Agreements include: 1. Scope of Services: This section outlines the types of services the asset management firm will provide, such as investment selection, financial planning, cash management, custody of assets, and periodic reporting. 2. Investment Objectives: Clients can specify their investment objectives and overall financial goals in this section. It may include goals like capital preservation, income generation, growth, or a combination of these. 3. Investment Guidelines and Restrictions: The agreement will define the investment parameters and restrictions based on the client's risk tolerance, time horizon, and investment preferences. This ensures that the asset manager operates within the agreed-upon guidelines. 4. Fees and Compensation: The agreement discloses the fee structure, including any management fees, performance-based fees, or other charges related to the asset management services. It may also outline the compensation arrangements between the client and the asset management firm. 5. Termination and Amendment: This section covers the procedures for terminating the agreement or making any changes to its terms and conditions. It may specify the notice period required for termination and any associated costs. San Diego California Private Client General Asset Management Agreement may have different variations based on the specific needs and objectives of the client. These variations can include agreements tailored for individual clients, joint accounts, retirement accounts, trust accounts, or accounts with specialized investment strategies, such as socially responsible investing or impact investing. Each variation reflects the unique preferences and requirements of the clients involved. In summary, the San Diego California Private Client General Asset Management Agreement is a comprehensive legal document that governs the relationship between high net worth individuals and asset management firms. It establishes the framework for asset management services and ensures that the assets are managed professionally and efficiently in accordance with the client's goals, preferences, and risk tolerance.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.San Diego California Contrato general de gestión de activos de clientes privados - Private Client General Asset Management Agreement

Description

How to fill out San Diego California Contrato General De Gestión De Activos De Clientes Privados?

Preparing legal documentation can be difficult. Besides, if you decide to ask a lawyer to draft a commercial contract, documents for proprietorship transfer, pre-marital agreement, divorce paperwork, or the San Diego Private Client General Asset Management Agreement, it may cost you a fortune. So what is the most reasonable way to save time and money and draft legitimate documents in total compliance with your state and local laws? US Legal Forms is a great solution, whether you're searching for templates for your individual or business needs.

US Legal Forms is biggest online library of state-specific legal documents, providing users with the up-to-date and professionally checked templates for any scenario accumulated all in one place. Consequently, if you need the recent version of the San Diego Private Client General Asset Management Agreement, you can easily locate it on our platform. Obtaining the papers requires a minimum of time. Those who already have an account should check their subscription to be valid, log in, and select the sample with the Download button. If you haven't subscribed yet, here's how you can get the San Diego Private Client General Asset Management Agreement:

- Look through the page and verify there is a sample for your region.

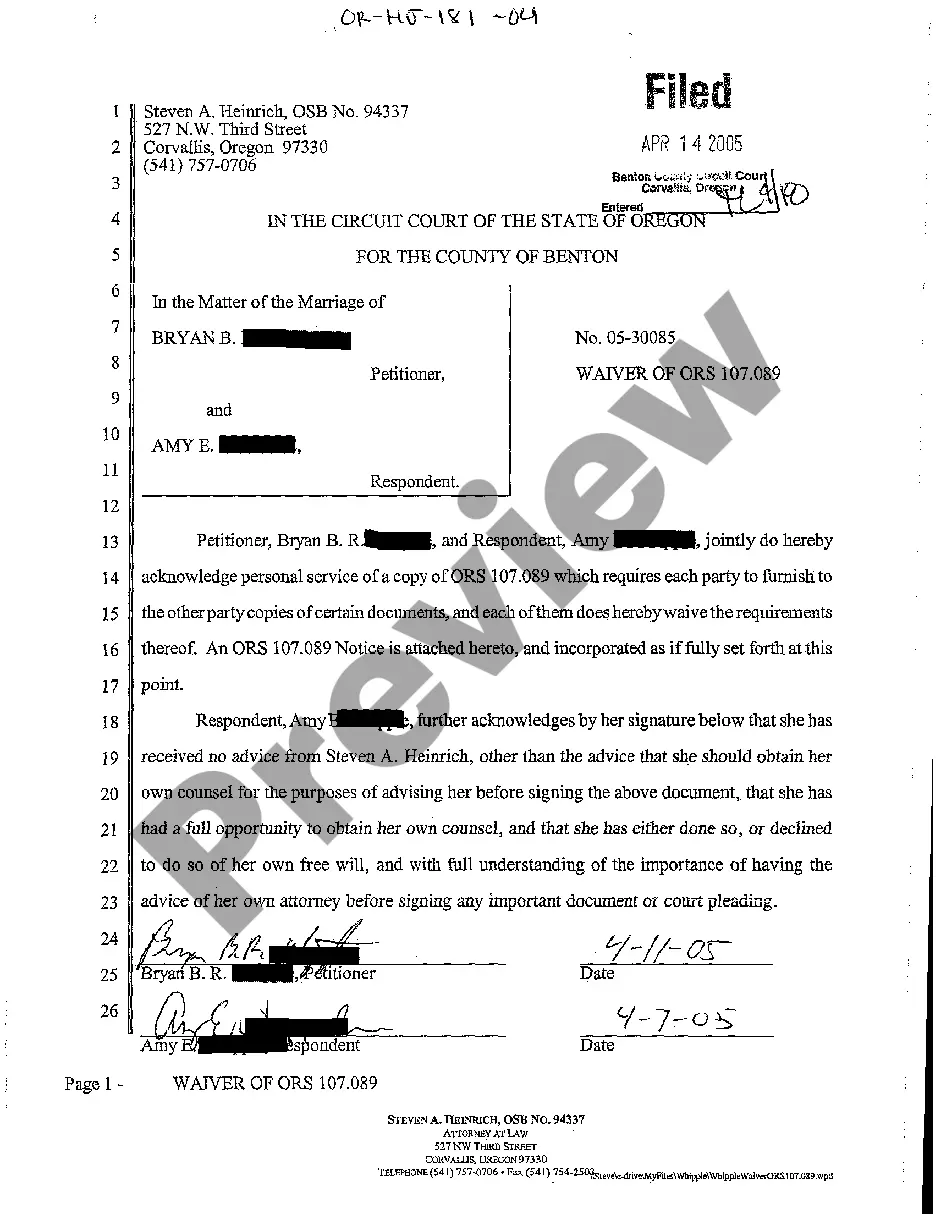

- Examine the form description and use the Preview option, if available, to make sure it's the sample you need.

- Don't worry if the form doesn't satisfy your requirements - search for the correct one in the header.

- Click Buy Now when you find the required sample and choose the best suitable subscription.

- Log in or sign up for an account to pay for your subscription.

- Make a transaction with a credit card or through PayPal.

- Opt for the document format for your San Diego Private Client General Asset Management Agreement and download it.

When finished, you can print it out and complete it on paper or import the template to an online editor for a faster and more practical fill-out. US Legal Forms allows you to use all the paperwork ever obtained multiple times - you can find your templates in the My Forms tab in your profile. Try it out now!